Franklin Resources Inc.

Summary

- Franklin Resources, Inc. one of the world’s largest investment managers.

- Franklin Resources, Inc. is a holding company with subsidiaries operating under Franklin Templeton.

- In 2022 Franklin Resources acquired BNY Alcentra Group Holdings.

- In 2020 Franklin Resources acquired Legg Mason for $4.5 billion in an all-cash deal

Franklin Resources, Inc. (NYSE:BEN, LSE: 0RT6) one of the world’s largest investment managers. Franklin Resources, Inc. is a holding company with subsidiaries operating under its Franklin Templeton. Franklin Resources assets under management (AUM) of $1,422.1 billion at March 31, 2023.

Recent Acquisition

On November 1, 2022, the company acquired BNY Alcentra Group Holdings, Inc. from The Bank of New York Mellon Corporation. Alcentra is a leading European credit and private debt manager, with global expertise in senior secured loans, high yield bonds, private credit, structured credit, special situations and multistrategy credit strategies. The company expect this acquisition to expand its alternative credit capabilities and presence in Europe, and continue to strengthen the breadth and scale of its alternative asset strategies.

On April 1, 2022, the company acquired all of the outstanding ownership interests in Lexington Partners L.P. a leading global manager of secondary private equity and co-investment funds, for cash consideration of $1.0 billion and additional payments totaling $750.0 million to be paid in cash over the next three years

Franklin Resources acquired Legg Mason for $4.5 billion in an all-cash deal on February 18, 2020.

Financial Highlights

First Quarter 2023 Results

January 30, 2023; Franklin Resources, Inc. announced net income of $165.6 million or $0.32 per diluted share for the quarter ended December 31, 2022, as compared to $232.7 million or $0.46 per diluted share for the previous quarter, and $453.2 million or $0.88 per diluted share for the quarter ended December 31, 2021. Operating income was $194.0 million for the quarter ended December 31, 2022, as compared to $348.5 million for the previous quarter and $557.7 million for the prior year.1

Adjusted net income was $262.4 million and adjusted diluted earnings per share was $0.51 for the quarter ended December 31, 2022, as compared to $394.4 million and $0.78 for the previous quarter, and $553.6 million and $1.08 for the quarter ended December 31, 2021. Adjusted operating income was $395.1 million for the quarter ended December 31, 2022, as compared to $494.1 million for the previous quarter and $685.9 million for the prior year.

Total assets under management (“AUM”) were $1,387.7 billion at December 31, 2022, up $90.3 billion or 7% during the quarter due to the positive impact of $48.8 billion of net market change, distributions, and other, an increase of $34.9 billion due to the acquisition of Alcentra Holdings, Inc. and $17.5 billion of cash management net inflows, offset in part by $10.9 billion of long-term net outflows.

Cash and cash equivalents and investments were $5.6 billion and, including the Company’s direct investments in consolidated investment products, were $6.6 billion at December 31, 2022. Total stockholders’ equity was $12.6 billion and the Company had 500.3 million shares of common stock outstanding at December 31, 2022. The Company repurchased 0.5 million shares of its common stock for a total cost of $14.2 million during the quarter ended December 31, 2022.

Fiscal Year 2022 Results

Net income for the year ended September 30, 2022 was $1,291.9 million or $2.53 per diluted share, as compared to $1,831.2 million or $3.57 per diluted share for the prior year. Preliminary adjusted net income2 was $1,855.6 million and adjusted diluted earnings per share2 was $3.63 for the year ended September 30, 2022, as compared to $1,915.2 million and $3.74 for the prior year.

AUM decreased $232.7 billion or 15% during fiscal year 2022 due to the negative impact of $269.0 billion of net market change, distributions and other, $27.8 billion of long-term net outflows and $0.8 billion of cash management net outflows, partially offset by acquisitions of $64.9 billion. Net market change, distributions and other primarily consists of $199.2 billion of market depreciation, $48.7 billion of long-term distributions and a $21.1 billion decrease from foreign exchange revaluation.

Company Overview

Franklin Resources, Inc. is a global investment management organization with subsidiaries operating as Franklin Templeton and serving clients in over 155 countries. Franklin Templeton’s mission is to help clients achieve better outcomes through investment management expertise, wealth management and technology solutions. Through its specialist investment managers, the company offers specialization on a global scale, bringing extensive capabilities in fixed income, equity, alternatives and multi-asset solutions. With offices in more than 30 countries and approximately 1,300 investment professionals, the California-based company has over 75 years of investment experience. Franklin Resources assets under management (AUM) of $1,422.1 billion at March 31, 2023

Major Acquisitions:

- the Templeton investment firm, known for its global investing strategies and value style of investing, in 1992

- the Franklin Mutual Series investment firm, known for its value-oriented equity funds, in 1996

- the Franklin Bissett investment firm, known for its Canadian fixed income funds and growth-oriented equity funds, in 2000

- the Fiduciary Trust International investment, trust and fiduciary services firm, in 2001

- the Benefit Street Partners U.S. alternative credit manager firm, in 2019

- the Athena Capital Advisors investment and wealth management firm, in March 2020

- The Pennsylvania Trust Company investment, trust and fiduciary services firm, in May 2020

- the Legg Mason global investment firm, including certain specialist investment managers, in July 2020

- the O’Shaughnessy Asset Management quantitative asset management firm, in December 2021, and the Lexington Partners global investment firm, known for its alternative asset capabilities, in April 2022.

Brands

The company offer its services and products under its various distinct brand names, including, but not limited to, Franklin®, Templeton®, Legg Mason®, Alcentra®, Benefit Street Partners®, Brandywine Global Investment Management®, Clarion Partners®, ClearBridge Investments®, Fiduciary Trust International™, Franklin Bissett®, Franklin Mutual Series®, K2®, Lexington Partners®, Martin Currie®, O’Shaughnessy® Asset Management, Royce® Investment Partners and Western Asset Management Company®.

Investment Brands2

- \Franklin Templeton Investments

- Brandywine Global

- ClearBridge Investments

- MARTIN CURRIE

- Royce Investment Partners

- CLARION PARTNERS

- WESTERN ASSET

- K2Advisors

- BENEFIT STREET

- Lexington Partners

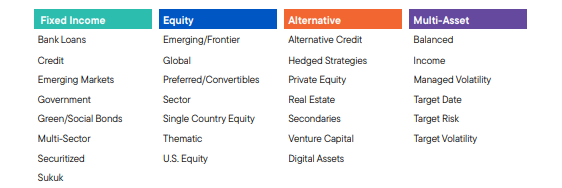

Services

The company offer a full range of investment capabilities across asset classes through its SIMs and investment teams

Global Offices

The company has team of over 9,000 people work in more than 30 countries.3

| Americas | Europe, Middle East, Africa | Asia Pacific |

| Atlanta | Amsterdam | Ahmedabad |

| Baltimore | Brussels | Bangalore |

| Boca Raton | Bucharest | Beijing |

| Bogota1 | Budapest | Chennai |

| Boston | Cape Town | Hong Kong |

| Buenos Aires | Douglas | Hyderabad |

| Calgary | Dubai | Kolkata |

| Coral Gables | Dublin | Kuala Lumpur |

| Dallas | Edinburgh | Melbourne |

| Ft. Lauderdale | Frankfurt | Mumbai |

| Houston | Geneva | New Delhi |

| Lincoln | Herzliya | Pune |

| Los Angeles | Istanbul | Seoul |

| Mexico | Leeds | Shanghai1 |

| Miami | London | Singapore |

| Montreal | Luxembourg | Sydney |

| Nassau | Madrid | Taipei |

| New York | Milan | Tokyo |

| Pasadena | Paris | Visakhapatnam |

| Philadelphia | Poznan | |

| Raleigh | Stockholm | |

| Rancho Cordova | Vienna | |

| Rio de Janeiro | Warsaw | |

| Rochester | Zurich | |

| Salt Lake City | ||

| San Mateo | ||

| San Ramon | ||

| Santiago | ||

| Sao Paulo | ||

| Short Hills | ||

| St. Petersburg | ||

| Stamford | ||

| Toronto | ||

| Washington D.C. | ||

| Wilmington |

Company History

The company was founded in 1947 in New York by Rupert H. Johnson4

| Year | Milestone |

| 1947 | Rupert H. Johnson Sr. founds Franklin Distributors, Inc. in New York City. |

| 1957 | The company launches its first mutual fund, the Franklin Custodian Funds, which were designed to hold securities for individual clients. |

| 1973 | Franklin Resources, Inc. becomes a publicly traded company and is listed on the New York Stock Exchange (NYSE) under the ticker symbol BEN. |

| 1979 | The company launches its flagship fund, the Franklin Income Fund, which became the first mutual fund to reach $1 billion in assets under management. |

| 1986 | Franklin Resources, Inc. acquires Templeton, Galbraith & Hansberger Ltd., a global investment management firm founded by Sir John Templeton in 1940. |

| 1992 | The company launches the Templeton Global Bond Fund, which quickly becomes one of the world's largest fixed-income mutual funds. |

| 2000 | Franklin Resources, Inc. acquires Bissett & Associates Investment Management, a Canadian investment management firm. |

| 2007 | The company launches Franklin Templeton Solutions, a business unit dedicated to providing multi-asset investment solutions. |

| 2013 | The company acquires K2 Advisors Holdings, LLC, an alternative investments specialist. |

| 2020 | Franklin Resources, Inc. announces a deal to acquire Legg Mason, Inc., an investment management company with $806 billion in assets under management. The deal was completed later that year. |