Godrej Industries Ltd

Company Overview

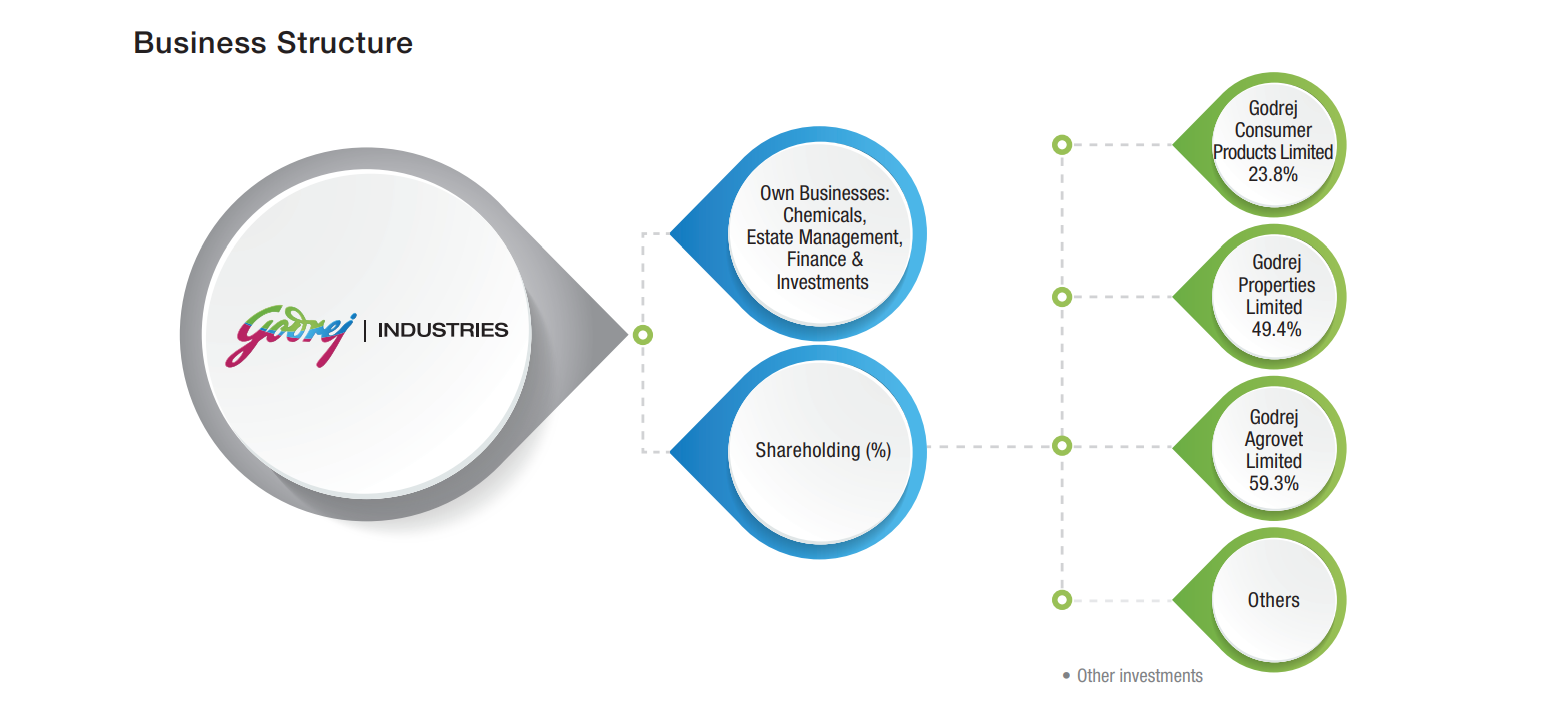

Godrej Industries (NSE: GODREJIND) is a holding company of the Godrej Group. Godrej Industries has significant interests in consumer goods, real estate, agriculture, chemicals and financial services through its subsidiary and associate companies

Established in 1897, the Godrej Group has its roots in India's Independence and Swadeshi movement. The company's founder, Ardeshir Godrej, lawyer-turned-serial entrepreneur failed with a few ventures, before he struck gold with a locks business.

Today, the company enjoy the patronage of 1.1 billion consumers globally across consumer goods, real estate, appliances, agriculture and many other businesses. In fact, its geographical footprint extends beyond Earth, with its engines now powering many of India's space missions.

With a revenue of over USD 4.1 billion Godrej Industries is growing fast, and have exciting, ambitious aspirations. The company's Vision for 2020 is to be 10 times the size the company were in 2010.

But for it, it is most important that besides its strong financial performance and innovative, much-loved products, the company remain a good company. Approximately 23 per cent of the promoter holding in the Godrej Group is held in trusts that invest in the environment, health and education. Godrej Industries is also bringing together its passion and purpose to make a difference through its Good & Green strategy of 'shared value' to create a more inclusive and greener India.

Godrej Industries Limited and Associate Companies (GILAC) is part of the Godrej Group. It comprises 5 major companies with interests in real estate, FMCG, agriculture, chemicals and gourmet retail.

Industry Overview

According to the Asian Development Bank, amidst the COVID19, India’s GDP growth is projected to slow to 4.0% in FY2021 before recovering sharply to 6.2% in FY2022, on the assumption of recovery from the pandemic in the second half of 2020. With the lockdown scenario, consumption and investments are expected to be severely impacted in the first quarter. The gross fixed capital formation is likely to decline with rising risk perception and uncertainty around the pandemic. RBI has cut the repo rate by 75 bps to 4.4% in March 2020 and further by 40 bps to 4.0% in May’20, which is the lowest ever and rolled out a range of measures to preserve financial stability and counter the economic impact of COVID19. 1

Indian real estate sector has been trying to get back on its foot and come to terms with multiple reforms and changes brought in by demonetization, RERA, GST, IBC, NBFC crisis and the subvention scheme ban. While it was a tough task for the sector to align itself with these new regulations, the measures have been instrumental to bring transparency, accountability and fiscal discipline over the last few years. Prior to COVID19, the real estate sector was expected to grow to USD 650 billion and contribute around 13% of India’s GDP by 2025 (from around 6-7% in 2017), according to ANAROCK Research.

While the pandemic outbreak could temporarily disrupt the sector. According to industry estimates, 90% of the workforce employed in real estate and construction sector is engaged in the core construction activities, while the rest 10% is involved in other ancillary activities. Since majority of the workers are immigrants, labour shortage could possibly pose a major challenge for the sector post COVID19 lockdown. However, there are certain green-shoots in this adverse situation. The recent liquidity crisis has worsened the situation for smaller players which were anyway finding it difficult to adhere to new norms laid by RERA leading to a new wave of consolidation. The consolidation phase is likely to get accelerated further with the COVID19 outbreak and many weak players may cease to exist. Larger established players with strong access to funding are expected to gain market share further. Also, the current situation is expected to open up a lot of business development opportunities for well capitalized developers.

For the Financial Year 2019-20, agriculture sector is expected to grow at 4.1% compared to low growth rate of 2.4% seen in the previous Financial Year, thanks to the strong Rabi season. Outbreak of COVID-19 has affected the agriculture sector in mid-March 2020, but, the impact was limited. Cumulative rainfall during the monsoon season was 110% of the Long Period Averages (LPA; highest in last 25 years), but was erratic and unevenly distributed both geographically and periodically. Therefore, the production of food-grains was adversely impacted during the Kharif season, however, sowing in the Rabi season was up by 10% due to good water reservoir levels and high soil moisture content. As a result, food grain production for the FY2019-20 is estimated at 295.67 million tonnes compared to previous year production of 285.21 million tonnes.

For FY2020-21, while the outbreak of COVID-19 has caused supply chain disruption and limited availability of labour, the impact on the agriculture sector is expected to be lower than other sectors. Further, agriculture sector is expected to recover faster, once economic activity picks up. Also, macro indicators for Indian agriculture sector are favourable with normal monsoon expectation, high reservoir levels, improved soil moistures and remunerative crop-prices. Indian Meteorological Department (IMD) in its recent monsoon forecast has predicted a normal south west monsoon for the year and rainfall is expected to be at 102% of the LPA (with a model error of +/- 4%). IMD highlights that ‘El Nino’ conditions will remain weak during the monsoon in the current year. This comes as a relief amid the ongoing health crisis, as normal monsoon should support agricultural growth in FY2020-21. Nevertheless, the spatial and temporal distribution of rains will remain crucial for timely sowing and harvesting.

Business Segments

Godrej Agrovet

Godrej Agrovet Limited is a diversified, Research & Development focused agri-business company, dedicated to improving the productivity of Indian farmers by innovating products and services that sustainably increase crop and livestock yields. The company hold leading market positions in the different businesses in which the company operate - Animal Feed, Crop Protection, Oil Palm, Dairy and Poultry and Processed Foods. 2

Godrej Industries is investing significantly in cutting-edge Research & Development to support its innovation pipeline. In 2015, the company set up the Nadir Godrej Centre for Animal Research and Development in Nashik, Maharashtra; a one-of-its-kind animal husbandry research centre in the private sector in India. The company's focus will be to leverage capabilities at this centre, to develop cost effective solutions to improve animal productivity.

The company's Animal Feed business is one of the largest organised players in the Compound Feed market in India, with annual sales of more than a million tonnes across cattle, poultry, aqua feed and specialty feed. All its feed offerings are formulated with a deep understanding of the nutritional requirements of different breeds.

The company's teams have worked closely with Indian farmers to develop over 61,700 hectares of smallholder Oil Palm Plantations to bridge the demand and supply of edible oil. Godrej Industries has plantations across Andhra Pradesh, Goa, Gujarat, Orissa, Tamil Nadu, Maharashtra and Chhattisgarh. In 2015, the company commissioned an oil palm mill in Mizoram as well. It is one of the largest private sector investments in the state.

In its Crop Protection business, the company meet the niche requirement of farmers through innovative agrochemical offerings. Godrej Industries has a strong market share in plant growth promoters, soil conditioners, and cotton herbicides. The company's portfolio offers a range of products that cover the entire life-cycle of a crop. A robust, pan-India distribution channel of over 6,000 distributors, helps ensure wide reach across the country.

Continuing the business growth story, the company acquired promoter holding in Astec Life Sciences Limited in 2015. Astec is a business to-business tech, bulk manufacturer of fungicides in India. It also has a contract manufacturing presence and counts multinational Agrochemical companies among its clients. It has established a successful track record in nurturing stable and long term relationships with highly reputed companies in U.S.A., Europe, West Asia, South East Asia and Latin America.

In line with its ambitions of expanding its presence in the "Animal Protein" space further, the company acquired controlling stake in Cream Line Dairy Products Limited - a leading Dairy player in South India. The company has significant presence in Andhra Pradesh, Telangana, Tamil Nadu, Karnataka and Maharashtra, under the "Jersey" Brand name. It also has a very interesting value-added product portfolio like Curd, Flavored Yogurt, and Ice Cream among others.

In 2004, the company entered into a joint venture with the Advanced Chemical Industries Limited (ACI) Group from Bangladesh, to manufacture and sell Compound Feed. The ACI-Godrej Agrovet joint venture ranks among the top three feed companies, across all categories in Bangladesh.

The company's poultry business, Godrej Tyson Foods, best known for two brands, Real Good Chicken and Yummiez, is a joint venture with Tyson Foods, one of the largest poultry processing companies in the world. Godrej Tyson Foods is the second largest player in the processed poultry segment in India.

Business

- Animal Feed

- Oil Palm

- Crop Protection

- Godrej Tyson Foods

- ACI Godrej Agrovet

- Creamline Dairy Products

- Astec LifeSciences

- Aqua Feed

- Godrej Maxximik

Agriculture sector in the Financial Year 2019-20 was expected to grow at 4.0% compared to the low growth rate of 2.4% seen in the previous Financial Year. Outbreak of COVID-19 impacted the sector in March 2020. However, the impact was limited, as agriculture forms part of essential commodities. During the year, while Kharif season was impacted by erratic and uneven distribution of rainfall (both geographically and periodically), Rabi season was better than the previous year due to good water reservoir levels and high soil moisture content.

GAVL recorded consolidated total income growth of 17.4% for the Financial Year 2019-20. Low output prices in the vegetable oil business during the peak season and high raw materials costs in the food businesses (dairy and poultry and processed products) lowered the profitability in the first nine months. Further, rumours of linking COVID-19 spread to poultry and poultry consumption was affected which led to lower volumes, prices and profitability of the animal feed business and the poultry business for the fourth quarter.

Animal Feeds

GAVL’s performance in the animal feed segment was strong as segment revenue and segment result grew by 20.1% and 19.6%, respectively in the Financial Year 2019-20. This is, despite, the business being severely impacted by the false rumour of linking coronavirus to consumption of egg and chicken which adversely impacted the demand for poultry feed in the fourth quarter. In terms of volume growth, for the first nine months the growth was around 7.9%, but 11.3% decline in the fourth quarter. This pulled down the annual growth rate to around 2.9%. Nevertheless, for full Financial Year, fish feed and layer feed posted strong volume growth and shrimp feed volumes also grew over the previous year

Crop Protection

GAVL’s crop protection business had two key launches in the current year. ‘Hitweed Maxx’ an inhouse developed cotton herbicide which is a onestop solution for controlling all major weeds on the cotton crop and ‘Hanabi’ an in-licensing arrangement product which is used for managing mites in tea plantation. In addition, GAVL also launched other products which will help in increasing the product portfolio. Standalone segment revenue grew by 3.3%, but segment result declined marginally by 3.9%. This was due to lower volumes compared to the previous year, especially of the higher margin specialty products. Also, placements in the month of March-2020 got severely impacted due to Covid-19, resulting in drop in volumes for the month.

Vegetable Palm

In the vegetable oil segment, while the Fresh fruit bunches arrival increased by 14.6% year-on-year in the Financial Year 2019-20, decline in Crude Palm Oil and Palm Kernel Oil prices during the peak season (June to September) impacted the profitability. Crude Palm Oil and Palm Kernel oil prices declined by 16% and 32%, respectively, during the first half of the year. As a result, segment revenues and segment results declined by 0.9% and 21.2%, respectively, in Financial Year 2019-20.

Creamline Dairy Products

In GAVL’s dairy subsidiary, Creamline Dairy Products Limited (CDPL) continued to launch new products to increase the share of value added products in its portfolio. This year, launches include new variants of thick shakes, butter milk, yogurts etc. CDPL also launched energy drink named ‘Jersey RECHARGE’ which is a nourishing milk protein drink targeting the youth. During the Financial Year 2019-20, milk procurement prices were very high throughout the year and despite taking price hikes, entire cost increase could not be passed on to end consumer

Godrej Tyson Foods Limited (GTFL)

GAVL operates in the poultry and processed food segment through its subsidiary GTFL in which GAVL increased its stake to 51% as on March 27, 2019. Therefore, this was the first year of full consolidation of the financials of GTFL. This year has been a difficult year for the poultry businesses, especially the live bird segment. During the first nine months, the live bird business was impacted by supply side glut which kept output prices low, while input prices of key raw materials remained very high. Fourth quarter performance was further impacted by rumours of coronavirus being spread through chicken consumption.

Godrej Maxximilk Private Limited

In the current year, Godrej Agrovet Limited increased its shareholding in Godrej Maxximilk Private Limited to 74.0%. The subsidiary is engaged in in-vitro production of high-quality cows that aid dairy farmers produce top-quality milk, thereby increasing their yield by a significant proportion.

ACI Godrej Agrovet Pvt Ltd, Bangladesh

In GAVL’s 50:50 joint venture with Advanced Chemical Industries Limited (ACI), Bangladesh named ACI Godrej Agrovet Private Limited, performance significantly improved over the previous year. This was on account of strong volume growth in all segments, i.e. cattle, poultry and aqua feed.

Godrej Chemicals

Godrej Industries (Chemicals) is one of the oldest businesses of the Godrej Group. Godrej Industries is proud to have pioneered the manufacturing of oleochemicals in India, back in 1963. Today, Godrej Industries is one of India’s leading oleochemicals players and manufacture and market over 100 chemicals for use in more than 24 applications. Godrej Industries is expanding its reach globally and its products are exported to over 80 countries in North and South America, Asia, Europe, Australia and Africa. The company's state-of-the-art manufacturing facilities are located in India at Valia in Gujarat and Ambernath in Maharashtra. 3

Over the last decade, Godrej Industries has diversified its product portfolio to include value added specialty products. Godrej Industries is constantly looking for new ways to collaborate and learn from partners across the globe. At the same time, Godrej Industries is also investing significantly in Research and Development to enhance its capabilities and grow its product portfolio. The company recently set up a Research and Development centre at Ambernath and a pilot plant at Valia to develop its new range of products. Godrej Industries has also formed a Technology Excellence Group to build on its technical capabilities and cross-pollinate best practices between its factories.

Business

- Fatty Alcohols

- Fatty Acids

- Surfactants

- Glycerine

- Oleo Derivatives &

- Specialty Chemicals

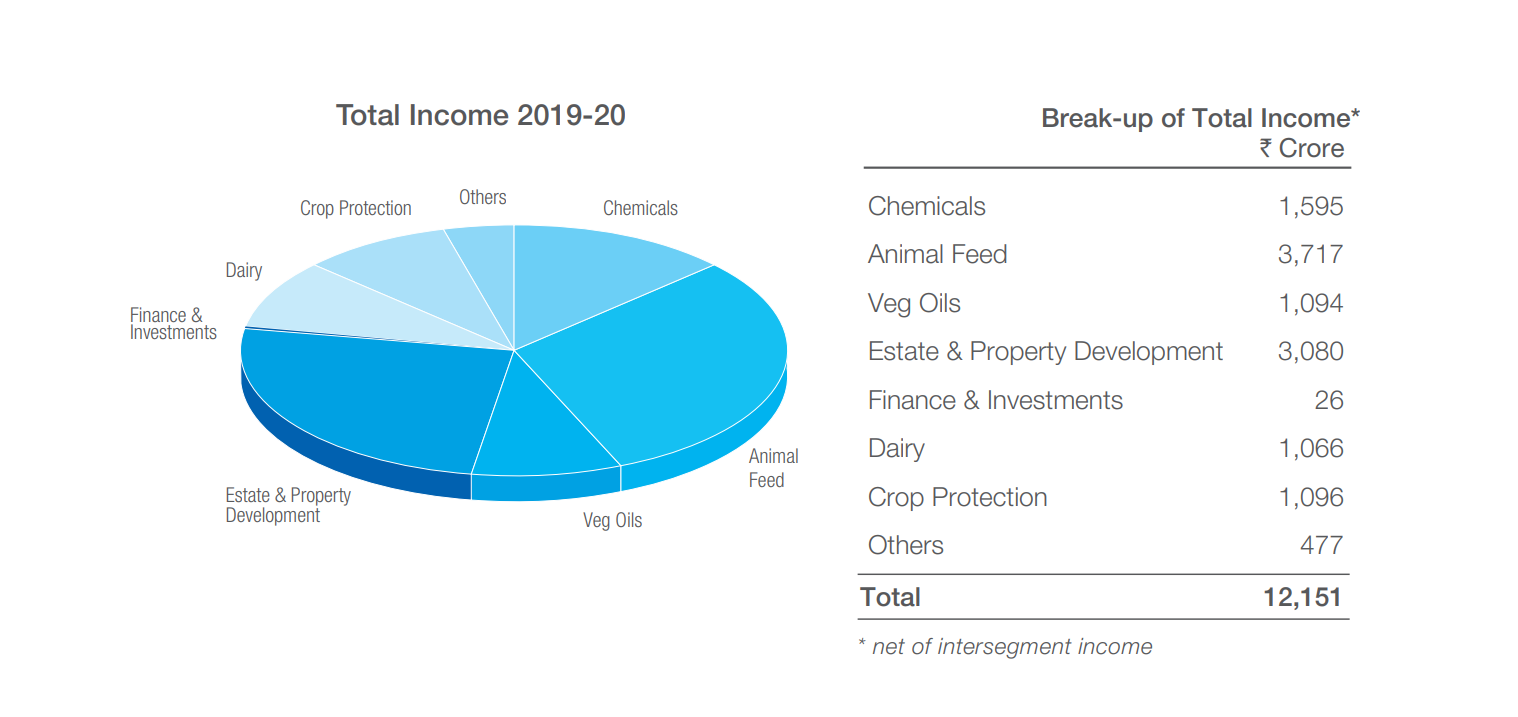

The Chemicals division in FY19-20 recorded a revenue and PBIT of Rs 1604 crore and Rs 140 crore respectively

Fatty Acids

The Fatty Acids portfolio, comprising stearic acid, oleic acid, as well as value-added fatty acids, accounted for about 42% of the turnover of the division. The division plans to enhance the sales of its value-added fatty acids in the domestic as well as export markets.

Fatty Alcohol

Fatty alcohol contributed 30% to turnover of this division. A good portion of the revenues for this category comes from exports. The division is also expanding the product basket by focusing on value-added fatty alcohol and also long chain alcohol.

Surfactants

Surfactants contributed 22% to the turnover of the division. The company's products have been approved by several multi-national companies and the company can now strongly participate in their global sourcing programs. Effective sourcing of raw material and increasing customer base are important for improving margins. This product portfolio has done reasonably well on both these counts. The division also has significant presence in Sodium Lauryl Ether Sulphate (SLES) and Alpha Olefin Sulfonate (AOS) market segments.

Glycerin

Glycerin accounted for 7% of the turnover of this division. Being largely a co-product, additional sales are mostly opportunistic, depending on market conditions. With the help of R&D, the division is now manufacturing value added glycerin products

Veg Oils

The veg oils business started direct sales of edible Oils under ‘Godrej Brand’ in bulk and consumer packs from September, 2015. The business clocked a revenue of ` 114 crore and has a reach of 8000+ retail outlets in Mumbai Metropolitan Region (MMR) and 2000+ retail outlets in Western Maharashtra and Goa. The products of this business have been well received in the market. While the Bulk Pack business has been stable, consumer pack business recorded a steady growth.

Godrej Consumer Products

Godrej Consumer Products (NSE:GODREJCP) is a part of the over 123-year-young Godrej Group. Godrej Consumer is fortunate to have a proud legacy built on the strong values of trust, integrity, and respect for others. As an emerging market company, Godrej Consumer has witnessed rapid growth and are pursuing its exciting and innovative aspirations

The company rank among the largest household insecticide and hair care players in the emerging markets. In household insecticides, Godrej Consumer is the leader in India and Indonesia and are expanding its footprint in Africa. Godrej Consumer is the leader in serving the hair care needs of women of African descent and are the number one player in hair colour products in India and sub-Saharan Africa, and among the leading players in Latin America. The company rank second in soap products in India, first in air freshener products in India and Indonesia, and lead in wet tissue product in Indonesia.

Brands

Delighting 1.15 billion consumers across Asia, Africa and Latin America 4

- Goodknight

- Godrejexpert

- Darlingafrica

- Saniter

- Inecto

- Godrejaer

- Godrejhit

- Hitexpert

- Megagrowth

- Godrejezee

- Godrejno1

- Cinthol

- Ilicit

- Issuecolor

- Godrej protekt

- Bblunt

- Godrejnupur

- Godrejprofessional

- Tcbnaturals

- Renewhair

- Justformehair

- Robystyling

- Pamelagrant

- Villeneuveproteccion

- Millefiori

- Africanpridehair

- stella-airfreshener

- Mitubabycare

- Nyubeauty

- Puresthygiene

- Goodnessme

Godrej Consumer Products (GCPL), an associate of the company, reported total sales of Rs 9,827 Crore during fiscal year 2019-20 on a consolidated basis as compared to Rs 10,221 Crore in the previous year. GCPL’s net profit for fiscal year 2019-20 decreased by 36% from Rs 2,342 Crore in the previous fiscal year to Rs 1,497 Crore in the current fiscal year 2019-20.

Godrej Housing Finance

Godrej Housing Finance (GHF) is the financial services arm of the Godrej Group. It aims to build a long term, sustainable, retail financial services business in India, deeply anchored around the Godrej Group’s 123-year legacy of trust and excellence.

With a keen focus on product innovation, a digital first approach, data-driven decision making and strong risk fundamentals, Godrej Housing Finance offers home loans, balance transfer and Loans Against Property to customers across Mumbai, NCR, Bangalore and Pune.

Services

- Home Loans

- Plot Loans

- Balance Transfer

- Loan Against Property

Godrej Properties

Godrej Properties brings the Godrej Group philosophy of innovation, sustainability, and excellence to the real estate industry. Each Godrej Properties development combines a 123–year legacy of excellence and trust with a commitment to cutting-edge design and technology. 5

In recent years, Godrej Properties has received over 250 awards and recognitions, including ‘The Most Trusted Real Estate Brand’ in 2019 from the Brand Trust Report, 'Real Estate Company of the Year' at the 9th Construction Week Awards 2019, ‘Equality and Diversity Champion’ 2019 at the APREA Property Leaders Awards, ‘The Economic Times Best Real Estate Brand 2018’ and the ‘Builder of the Year’ at the CNBC-Awaaz Real Estate Awards 2018.

With an estimated 10 million Indians moving into the urban areas annually, the country's urban landscape is likely to change dramatically in the coming decades. The company firmly believe that India must seize on the opportunity to urbanize in a sustainable manner. The company's group has always been at the forefront of the environmental sustainability movement. The CII-Godrej Green Building Center in Hyderabad, when it was completed in 2004, was the first LEED Platinum building outside of the United States and was the single highest rated LEED building in the world. In 2010, Godrej Properties committed that every single project the company develop will be a certified green building. Many of its projects have since received LEED Platinum certifications, which are globally recognized as the leading sustainability recognitions. The company's large township project, Godrej Garden City, in Ahmedabad was selected as one of only 2 projects in India and 16 worldwide by The Clinton Foundation to partner with them in the goal of achieving a climate positive development. In 2016, the company stood 2nd in Asia and 5th in the world in the GRESB (Global Real Estate Sustainability Benchmarking) study, which is an industry led sustainability and governance benchmarking platform.

In 2010, Godrej Properties became a publicly listed company through a successful IPO in which it raised USD 100 million. Godrej Properties also created a fund management subsidiary in 2016; Godrej Fund Management raised USD 275 million in the year's largest residential real estate focused fund raise in the country. Godrej Industries is one of India's only national developers with a strong presence across the country's leading real estate markets. In the financial year 2016, for the first time, Godrej Properties was India's largest publicly listed real estate developer by sales value having sold over INR 5,000 crore of real estate that year. In the same year, the company also delivered 0.56 million square meters (6 million square feet) of real estate in seven cities across India.

City covered

- Mumbai

- NCR

- Pune

- Bangalore

- Kolkata

- Ahmedabad

- Nagpur

- Mangalore

- Chennai

- Chandigarh

For the Financial Year under review GPL's total income stood at Rs 2915 Crore and net profit stood at Rs 267 Crore.

GPL added 10 new projects with 19 million sq. ft. saleable area potential in aggregate located across Bangalore, National Capital Region and Mumbai. One of the key achievements of GPL was acquisition of 26 acres land parcel in Central Delhi from the Railway Land Development Authority with a saleable potential of 3.3 million sq. ft. GPL added plotted development in Faridabad, making it the first deal in the city. The projects added are in line with GPL’s long term strategy of focusing on value accretive and risk efficient models. These new projects have further strengthened GPL’s project pipeline and will drive its performance in coming years.

GPL has achieved the highest ever sales in its history, making GPL India’s largest publicly listed developer by value of real estate sales. GPL achieved sales volume of 8.8 million square feet and booking value of Rs 5,915 Crore in FY 20. This is a growth of 11% from FY19 in booking value. That makes it fourth time in last five years that GPL has recorded a booking value in excess of Rs 5,000 Crore. GPL achieved sale volumes of more than 1 million sq. ft. and sale value of more than Rs 1000 Crore in all the four focus markets. GPL launched 17 new projects/phases in FY20. Most notable of these were Godrej South Estate, Delhi with booking value of Rs 510 Crore and Godrej Nurture, Bengaluru with booking value of Rs 316 Crore. These successful launches were complimented by Rs 3,048 Crore of sustenance sales in FY20 which is the highest ever reported by GPL and as a result significantly strengthened its relative market position in each of its four key growth markets.

On the operational front, GPL has successfully delivered 5.2 million sq. ft across its projects. GPL has now delivered almost 22 million sq. ft. of real estate in the last five years. Godrej 24 in Pune received its occupation certificate in the fourth quarter within 24 months of starting construction. This is the fastest ever project completion for GPL. GPL’s ramp up in project delivery demonstrates that GPL can operate at a large scale and keep pace with its accelerating sales. Customer Net Promoter Score achieved by GPL also improved significantly over last one year from 26% to 59%

Financial Highlights

Godrej Industries Q2 net profit falls 45% YoY; revenue declines 9% 6

November 11, 2020; Godrej Industries on November 11 posted a 44.8 percent year-on-year (YoY) fall in its Q2FY21 consolidated net profit to Rs 205.3 crore against Rs 372.2 crore in the corresponding quarter of the previous financial year.

Revenue for the said quarter reduced 9.2 percent YoY to Rs 2,386.3 crore against Rs 2,628.7 crore in Q2FY20.

EBITDA reduced 11.5 percent to Rs 133.7 crore against Rs 151.1 crore YoY while EBITDA margin came in at 5.6 percent against 5.7 percent YoY.

The company said, in the consumer segment, its consolidated sales grew 11 percent YoY while net profit grew by percent. The Consolidated EBITDA of the segment also grew 19 percent YoY.

The company said Household Insecticides grew 4 percent, partially impacted by supply issues due to regional lockdowns.

Soaps delivered a strong performance and grew 18 percent, driven by market share gains. The company said new launches in the health segment are scaling up well.

References

- ^ https://www.godrejindustries.com/public/uploads/reports/2019-20/GIL_Annual_Report_2020.pdf

- ^ https://www.godrejagrovet.com/about-us.aspx

- ^ https://www.godrejindustries.com/chemicals/about-us.aspx

- ^ https://www.godrejcp.com/brands/brands-with-purpose

- ^ https://www.godrejproperties.com/ourstory/about-us

- ^ https://www.moneycontrol.com/news/business/markets/godrej-industries-q2-net-profit-falls-45-yoy-revenue-declines-9-6102161.html