GoviEx Uranium

Vancouver-based GoviEx Uranium Inc. (GVXXF) is a growing Africa-focused uranium company with a strong shareholder base, a robust project development pipeline, jurisdictional diversification, considerable exploration potential, and one of the largest resource bases among publicly listed peers, with combined National Instrument 43-101 Measured & Indicated resources of 131.7 Mlbs U308 plus Inferred resources of 76.9 Mlbs U308.1

Mineral Properties

Madaouela Uranium Project (Niger)

- Located ~10 km south of Arlit, and Areva's mining subsidiaries of Cominak and Somair, in north central Niger

- Deposits hosted within sandstones of the Tim Mersoi Basin

- Approved Mad 1 Mine Permit (Jan 2016), and ESIA (July 2015)

- Infrastructure includes: road access, labor, ground water and available grid power

- Integrated Development Plan (PFS) updated August 2015

- Probable mineral reserves are 60.54 Mlbs U3O8

- Uranium Recovery forecast at 93.7%

- Cash Operating Cost forecast at 24.49 USD/lb U3O8

- Startup Capital Expenditure of USD 359 million

- NPV post all taxes and royalties, and for 100% of the Madaouela Project at US$70/lb U3O8 and 8% discount rate of US$340 million

- Further recovery and cost optimization to be focus of future studies

| Classification | Tons (Mt) | Grade (kg/t eU3O8) | eU3O8 (t) | eU3O8 (Mlb) |

|---|---|---|---|---|

| Marianne/Marilyn | ||||

| Measured | 2.14 | 1.79 | 3,835 | 8.45 |

| Indicated | 14.72 | 1.43 | 21,000 | 46.30 |

| Inferred | 5.04 | 1.17 | 5,908 | 13.02 |

| Miriam | ||||

| Measured | 9.62 | 1.08 | 10,397 | 22.92 |

| Indicated | 2.68 | 0.79 | 2,112 | 4.66 |

| Inferred | 0.58 | 1.33 | 773 | 1.70 |

| MSNE | ||||

| Indicated | 5.05 | 1.61 | 8,111 | 17.88 |

| Inferred | 0.10 | 1.34 | 13 | 0.29 |

| Maryvonne | ||||

| Indicated | 1.23 | 1.79 | 2,195 | 4.84 |

| Inferred | 0.42 | 1.66 | 703 | 1.55 |

| MSCE | ||||

| Inferred | 0.72 | 1.81 | 1,308 | 2.88 |

| MSEE | ||||

| Inferred | 1.45 | 1.64 | 2,373 | 5.23 |

| La Banane | ||||

| Indicated | 1.5 | 1.64 | 2,589 | 5.71 |

| Inferred | 1.15 | 1.18 | 1,358 | 2.99 |

| TOTAL MEASURED | 11.76 | 1.21 | 14,232 | 31.37 |

| TOTAL INDICATED | 25.25 | 1.43 | 36,007 | 79.39 |

| TOTAL INFERRED | 9.46 | 1.33 | 12,554 | 27.66 |

The Madaouela Uranium Project is situated southeast of the mining town of Arlit, and the Marianne-Marilyn deposit is located approximately 9km from Arlit. The land surface of the tenement forms a rectangle of less than 250km2.

Topography

Topographic relief in the Madaouela tenements is minimal, a few tens of meters from high to low. Areas of drilling are at approximately 430m elevations. Over much of the areas drilled, relief is less than 15m from low ridges of sandstone outcrops to essentially flat sand covered plains.

Climate

Niger is landlocked and almost entirely located within the semi-desert belt of Western Africa. Its climate is characterized by very scarce rainfall, mostly concentrated during the summer months (July to September), and with very hot temperatures notably at the end of spring (April to June).

Infrastructure

The proximity of the town of Arlit and Akokan are an asset for Madaouela permits. The towns have over 160,000 people supporting local mining operations with airports, drilling companies, electricity, potable water and a hospital. Arlit is connected to the Southern part of Niger via the so-called "uranium-highway" through Agadez and Tahoua to Niamey, the Niger capital further south. A power line connects the town to the Sonichar coal-fired power station located North of Agadez. Access by plane is possible through an airstrip in Arlit and also Agadez.

History

The French Commissariat à l'Energie Atomique (CEA) discovered the Madaouela uranium mineralized areas in the early 1960's. They conducted drilling operations using drilling grids of 800 down to 100m, over vast areas of the permit. The discovery of the Marilyn deposit was then drilled locally at 50m. CEA sunk a 67m deep shaft and drove 330m of drifts within the mineralized formation. The simultaneous discovery of the Somaïr uranium deposits was responsible for the decision to stop all works at the Madaouela site.

PNC, the Japanese Pacific Reactor and Nuclear Fuel Development Corporation, took over the CEA tenement in 1980 in association with ONAREM, a Niger State-Owned Organization. PNC conducted additional uranium exploration work up to 1992 and produced a report on the feasibility of the Madaouela deposit in 1993, which was later updated (1999) by the Japan Nuclear Cycle Development Institute, the new company name for PNC. Very few drill holes (less than 20) were drilled by PNC in Madaouela I, and none on Marianne or Marilyn. The feasibility study was fully based on CEA drill holes. In 1999, the economic assumptions and data for the 1993 feasibility study were updated and concluded that underground mining could be cost-effective, provided the uranium price stabilized at the US$27-28/lb U308 level.

A Chinese company (CNUC) took over Madaouela and held the land from 2003 to 2006. They drilled a limited number of holes and departed, apparently because they could not access the original CEA data. Little exploration work seems to have been carried out until GoviEx Niger Holdings Ltd (GNH Ltd.) took over the property in 2007.

Regional Geology

The Madaouela property is located in the Tim Mersoi Basin. This basin covers most of the western part of the Republic of Niger with extensions in Algeria, Mali, Benin and Nigeria. In early Paleozoic, an open gulf developed to the south of the Central Saharan Massif and fed continental sediments to the developing basin. During the Mesozoic and Tertiary, the area was mainly continental, periodically invaded by marine transgressions diminishing in thickness to the south and passing laterally into continental series. Uplift movements beginning in the Middle Eocene gave the basin its present aspect.

Pre-Carboniferous sedimentation consists of Cambro-Ordovician sandstones and graptolite shales. These formations are of major interest because they host the major reduced uranium deposits in the Arlit area. The stratigraphic sequence begins by the grey-black Talak Visean argillites. It consists of black shale. This is overlaid by the Guezouman formation that includes a lower and an upper member. The lower member is composed of fine- to coarse-grained cross-bedded sandstone units with minor conglomerates (Teleflak). The upper member consists of fine sandstone, siltstone and shale units.

Geological Structures

West dipping units mark the structure of the Tim Mersoi basin. The deformation of the sedimentary body resulted from basement fault activities located between the Air Massif and the Azaoua lineament. Several large faults systems cut the sediments and have played a major role during the sedimentation.

The main structure is the Arlit fault. It has been active during the sedimentation, especially during Carboniferous time, and has been reactivated several times. All the major uranium deposits are located immediately to the east of the fault.

The Madaouela fault shows similar characters, with a large uplift of the North- western compartment (Quart-de-brie) that is situated across the GoviEx Madaouela tenements. In Anou Melou the Airlet and Madaouela fault converge and present GoviEx with a clear future exploration target.

Mineralization is always localized at the contact between the Guezouman sandstone and the underlying Talak argillite. The mineralization is located on the flank of the channel, following the reducing unit of the Talak, and always associated with coarse sandstone of the Guezouman.

In 2012 GoviEx geologists made a major scientific breakthrough and discovered the La Banane deposit as a result of its area exploration program. This discovery has had a major impact on the exploration philosophy in the Tim Mersoi basin as the La Banane deposit is situated in the Madaouela sequence of sandstones where previously it was not envisaged that uranium mineralization could significantly occur.

Deposit Type

Sandstone-hosted uranium deposits occur in permeable medium-coarse grained sandstone, usually deposited in continental fluvial or marginal marine sedimentary environments. The source of uranium is usually igneous or volcanic rocks either in close proximity to or inter-bedded with the sandstone units. The uranium mineralization typically precipitates from oxidizing fluids, under reducing conditions caused by a variety of reducing agents. The reducing agent for Madaouela is most likely in-situ organic material (lignite) or hydrocarbons transported along major fault. The main primary uranium minerals are uraninite and coffinite with minor secondary uranium minerals being noted in exposed (weathered) mineralization.

Sandstone deposits are an important source of uranium representing approximately 30% of the world's known uranium resources and accounting for over 18% of the African uranium deposits in 2007. This style of uranium deposit typically yields small to medium size individual deposits (10,000 to approximately 50,000t of U3O8) characterized by low to medium grade (0.05 to 0.5% U3O8), but deposits typically occur in clusters.

Mineralized Zones

The Marianne-Marilyn deposit is a nearly flat tabular body of mineralization that spans approximately 5km by 2km across in plan, and the deposit thickness varies from 0.2 to over 2m (average thickness of about 1m). The mineralization occurs at depths from about 30m on the east-end of Marilyn, to approximately 60m in depth in the middle of the Marianne-Marilyn deposit, up to 120m in depths on the west extensions of Marianne.

The MSNE deposit is approximately 4 km south of Marianne-Marilyn with Maryvonne deposit in between. The geology of these deposits is very similar to Marianne-Marilyn. Ore depth ranges from 100 m to 160 m across the deposits. Miriam deposit was discovered in 2011 and is located in the Southern portion of Madaouela I tenement. The ore is 20 to 30 m in thickness at Miriam and at a depth of 60 to 80 m

Adjacent Properties

There are currently two producing mines in the Arlit region that are on property positions immediately adjacent to the Madaouela Uranium Project. Both mines are subsidiaries of Areva and have operated uninterrupted since starting production:

- Somaïr: operates an open pit and an acid leaching plant since 1968 producing 1,500t uranium annually and have recently started a heap leaching operation; and

- Cominak: operates underground and has its own acid leaching plant to produce more than approximately 2,000 tpy uranium.

Exploration Drilling

Exploration is undertaken with mud-rotary drill rigs that drill 120mm diameter holes. Historical drill holes have been located where possible in the field, and re-drilled with this larger diameter drill bit, and re-logged. GoviEx is therefore relying of GoviEx data from historical drill holes, not historical data.

In uranium exploration, the usual technique consists in:

- Measuring the radioactivity in the drill holes using dedicated probes; and

- Transforming the radioactivity into uranium grade (equivalent uranium grade (eU or eU3O8)

Core drilling is therefore done with the rotary drill rig as conventional drilling to collect core from the mineralized horizons for assay comparisons with gamma probe eU308 determinations.

GoviEx exploration approach is complete surface mapping and sampling along traverse lines approximately 1.6 kilometres apart. Data collected during these traverses includes geological mapping and radioactivity measurement on regular spacing.

Once areas of exploration interest have been defined the Company commences with a wide spaced drilling program starting at 400mx 400m, and based on these results exploration drilling continues but on a decreasing spacing towards those required for resource classification.

Based on analysis Inferred material is where the drilling density of the deposit is 200m x 200m or lower, while Indicated material is defined a nominal drillhole spacing of 100m x 100m. GoviEx has reduced drillhole spacing to as low as 25m x 25m in large parts of Marianne- Marilyn and Miriam.

Mining Operations

Three primary mining targets are defined for future possible development : the Marilyn and Marianne deposits that are located adjacent to each other along a 6.5km NE-SW strike length, the MSNE and Maryvonne deposits and the Miriam deposit to the south of the Madaouela I license.

The Marilyn/Marianne deposits are shallow with depths below surface from 30m in the NE to 120m in the SW, while the MSNE/Maryvonne deposits are approximate 160m in depth. The deposits are generally flat lying (0-15° slope) with thicknesses varying from 1-3m. Tabular deposits such as these generally lend themselves to room and pillar type mining methods.

The mineralized material will be mined using low profile mining equipment capable achieving mining heights of 1.8 m. Panel development will be undertaken using 7 m wide drifts. A primary pattern of 17 m x 17 m pillars will be developed during the initial advance through the panel. On retreat from the extremities of the panel, each 15 m x 15 m pillar will be split by 7 m drifts to leave four 5 m x 5 m pillars.

The mineralized material is transported by LHD to the conveyor feeder that is located at the entrance to the panel, where initial crushing will occur. The crushed material is to be transported by conveyor to a coarse ore stockpile situated before the process plant. A panel mining fleet will consist of a single boom face drill, a ground support jumbo with fully automated rockbolt installation and a 3m3 bucket capacity LHD.

While the Miriam deposit is approximately 60 m to 80 m deep, but has a greater thickness up to 30m with local grades over 1% U308 thus containing the highest grade*thickness (GT) in four main seams (11, 21, 31 and 41) that coalesce locally in a redox front system. The mining of Miriam is planned to be by open pit operations inline with that under taken at Areva's Sominak mine.

Metallurgy

Mined ore is transferred to the run of mine ("ROM") stockpile. Feed preparation consists of primary crushing with the ore then routed to radiometric ore sorter ("ROS") where by the radiometric selection ore is pre-concentrated to provide a higher grade material. Following the ROS stage the ore is secondary crushed and mixed with water to produce a slurry for the Ablation stage, where two slurry streams are impacted together to form a high impact energy zone that separates fine heavier uranium minerals from the host rock. The combination of ROS and Ablation results in a 810tpd of feed for feed to the leaching circuit, with approximately 97% of the uranium that was contained in the initial 4020 tpd mined feed.

The two stage leaching circuit consists of primary and secondary agitated leach tanks in recirculation. In the first stage solution from the second stage belt filters is recirculated to leach the fresh feed after which the slurry is thickened with the thickener overflow routed to the uranium recovery circuit as pregnant leach solution ("PLS"). The thickener underflow is routed to the second stage leach, which uses fresh acid to further leach the milled solids. After the second stage the slurry is filtered and the filtered solids residue is washed with fresh solution and discarded to the tailings disposal system.

Leach tanks are agitated and aerated to allow the milled ore to react with sulfuric acid allowing dissolution of the contained uranium. The solution from leach (thickener overflow) is routed to uranium recovery. Uranium recovery from the neutralised PLS takes place through Solvent Extraction (“SX”).

SX is undertaken using a new process to recover both molybdenum and uranium from acidic solutions using CYANEX® 600 extractant. The overall circuit configuration would consist of two extraction steps, one stripping step for iron, two stripping steps for molybdenum, an ammonia washing step and two uranium stripping steps. A wash stage swill be used after the Uranium strip to prevent phosphoric acid transfer. Phosphoric acid will be recovered through an evaporation step in order to reduce reagent requirements. Additional uranium recovery will come from this step through a bleed stream that would feed back into the solvent extraction process.

As a result of the Cyanex 600 solvent the Madaouela Project will be able to produce molybdenum oxide and uranium oxide in a saleable form.

SRK completed a technical economic analysis for the project. The economic analysis results indicate an after-tax Net Profit Value ("NPV") of USD340 M at an 8% discount rate with an Internal Rate of Return ("IRR") of 21.9%. Payback will be in production Year 3.

The proposed base case envisions a 2.69 Mlb per year U3O8 yellowcake production rate, and an 93.7% ultimate recovery; generating an eighteen year mine life and a total production of 45.6 Mlb U3O8. The project economics are at a long-term uranium price of USD 70 /lb U3O8. Initial capital costs are estimated at USD 359 M, total LoM capital costs at USD 676 M, and cash operating costs of USD 24.49 /lb U3O8 excluding royalties, and USD 31.49 /lb U3O8 including royalties.

Mutanga Uranium Project (Zambia)

- Located ~200 km south of Lusaka, immediately north of Lake Kariba, at elevations of 500 metres – 960 metres

- Resource (September 2013) of10.3Mt @ 0.034% U3O8 (7.8Mlbs U3O8 contained) in the measured and indicated, and 65.2Mt @ 0.03% U3O8 (41.4Mlbs U3O8 contained) in the inferred category

- Mutanga, Dibwe and Dibwe East deposits defined to date

- Uranium deposits hosted within sandstones of the Escarpment Grit Formation of the Karoo Super Group

- 25 year mine license; based on open-pit mining + heap leach

- Considerable technical and environmental work completed to date

- Infrastructure includes: road access via 39 km gravel road, ground water and available grid power (~60 km away)

| Category | Tonnes | U3O8 (ppm) | U3O8 (Mlbs) |

|---|---|---|---|

| Indicated | 8.4 | 314 | 5.8 |

| Inferred | 65.20 | 287 | 41.4 |

The Mutanga Uranium Project consists of three main deposits; Mutanga, Dibwe and Dibwe East, which make up the bulk of the Mineral Resources described herein. There are also three minor deposits called Mutanga East, Mutanga Extension and Mutanga West. In addition several other mineral prospects have been identified.

The Mutanga Project area is situated in the Southern Province of Zambia about 200 km south of Lusaka immediately north of Lake Kariba, approximately 31 kilometres northwest of Siavonga. GoviEx acquired 100% of the Mutanga Project (“the Project”) in 2016 from Denison Mines Corp. (“Denison”). Denison had acquired 100% of the Project in 2007 through the acquisition of OmegaCorp Limited (“Omega”).

The Mutanga Project is currently comprised of two mining licenses (13880-HQ-LML and 13881-HQ-LML) encompassing 457.3 square kilometres. The mining licenses have a term of 25 years to April 2035.

Geological Setting

Regionally, the Karoo Supergroup is a thick succession of late Carboniferous to late Triassic terrestrial strata deposited across much of what is now southern Africa. The Karoo Supergroup comprises at least six regional depositional sequences, which reflect broadly synchronous episodes of basin subsidence and climate change, but vary considerably in detail from one sub-basin to another. Karoo strata typically overlie Precambrian crystalline basement rocks.

Three formations in the Lower Karoo Supergroup in the mid-Zambezi Valley of southern Zambia and four in the Upper Karoo Supergroup have been identified. The Late Carboniferous – Permian Lower Karoo Supergroup consists of the basal Siankondobo Sandstone Formation, overlain by the Gwembe Coal Formation, in turn overlain by the Madumabisa Mudstone Formation. The Triassic - Early Jurassic Upper Karoo Supergroup is sub-divided into the Escarpment Grit, overlain by the Interbedded Sandstone and Mudstone, the Red Sandstone and the Batoka Basalt Formation.

The Escarpment Grit sandstones are interpreted to be fluvial deposits, but they record a major change in fluvial style. Maps produced in the 1970s show southwesterly directed paleocurrents in the “Braided Facies” throughout most of the Mutanga region. The relatively small variance in paleocurrent direction, prevalence of trough cross-bedded sandstones, pebbly sandstones and conglomerates and lack of laterally extensive beds all support interpretation of the “Braided Facies” sandstones as braided stream deposits.

In the overlying “Meandering Facies” member, thick, upward-fining sandstone beds with cross-bedding and ripple lamination; locally capped by mudstones which can be traced laterally for hundreds of meters, are likely point-bar and flood plain deposits.

The uranium mineralisation identified to date appears to be restricted to the Escarpment Grit Formation (“EGF”). Dibwe East is predominantly composed of EGF. The surface geology is characterised by a few scattered sandstone outcrops. Two major units can be distinguished, the “Braided facies” member (EGFb-f) of the lower EGF and the “Meandering facies” member (EGBm-f) of the upper EGF in core, the two units appear to be transitional from one another. The “Braided Facies” is distinguished in outcrop as gritstones, very-coarse-grained to coarse grained sandstones and pebbly sandstones. Ripple lamination is common and mudstone beds are laterally continuous.

Mineralization appears to be later than at least some of the normal faults which cut the Escarpment Grit Formation. This is evident from the good correlation of the radiometric logging data between adjacent holes within the Mutanga mineral deposit separated by interpreted faulting.

The source of the uranium is believed to be the surrounding Proterozoic gneisses and plutonic basement rocks. Having been weathered from these rocks, the uranium was dissolved, transported in solution and precipitated under reducing conditions in siltstones and sandstones. Post lithification fluctuations in the groundwater table caused dissolution, mobilization and redeposition of uranium in reducing, often clay-rich zones and along fractures.

Exploration

In 2006 a detailed aeromagnetic and radiometric survey (Symons and Sigfrid, Report on the Interpretation of Aeromagnetic and Radiometric data 2006) was completed over the areas of interest which were revealed during an earlier pre-digital airborne survey. The 2006 survey has confirmed the position and tenor of the existing targets and identified additional, targets.

Prior to Omega/Denison involvement, AGIP and the Zambian geological survey undertook drilling across the Mutanga project area.

The drill program consisted of 14,794 metres of drilling (50 diamond holes for 6833 metres, 119 percussive (wagon drill) holes for 6998 metres and 83 percussive (shallow wagon drill) holes for 963 metres.

In 2006, 11 diamond drill holes were drilled by OmegaCorp to twin previous drilling at the Mutanga mineral deposit. Results confirmed the broad tenor of the historical U3O8 intercepts. Work was also carried out at Bungua, Mutanga and at Dibwe.

During 2007 to 2008 Denison completed work on the Mutanga mineral deposits, focussing on the Mutanga area and the Dibwe area in particular. The work included an appraisal of all available data (maps, plans, sections, limited geological interpretations and radiometrics and AGIP resource estimations). From this information Denison produced several databases covering Mutanga and other prospects.

After a two year delay due to suspension of exploration activities, a two phase drilling campaign resumed in April, 2011. Phase 1 drilling on Dibwe East and Mutanga West targets commenced in April and ended in July 2011 with 72 holes being drilled for a total of 7,564 m. The results for Phase 1 confirmed the continuity of uranium mineralization identified in 2008 drilling program at Dibwe East with a northeast-southwest strike length greater than 2.5 km. Results from the Mutanga West target still require further evaluation and are not considered material to the current Mutanga West resource.

Based on the encouraging results obtained with the Phase 1 drilling over the Dibwe East Zones 1 and 2 targets, a Phase 2 drilling program of 74 holes totalling 7,732 m was completed between August-October 2011. This drilling program discovered primary mineralization at depth and it also increased the strike length to 4.0 km.

Exploration for uranium typically involves identification and testing of sandstones within reduced sedimentary sequences. The primary method of collecting information is through extensive drilling (both RC and diamond drill coring) and the use of downhole geophysical probes. The downhole geophysical probes measure the electrical properties of the rock from which lithologic information can be derived and natural gamma radiation, from which an indirect estimate of uranium content can be made. The downhole geophysical probes measure conductivity, resistivity, self-potential, SPR, deviation and natural gamma. Geophysical probe data was collected from drilling over the property.

Metallurgical Test Work

Metallurgical test work (2012) has been completed by Mintek, South Africa on Dibwe East Deposit drill core samples. Denison supplied Mintek with 18 drill core samples, which were sourced from three different zones over Dibwe East. The test work included head sample characterization and preliminary bottle roll leach tests.

The average grade of samples was 586ppm U3O8. This is higher than the grades of the Mutanga (237 ppm U3O8) and Dibwe (247 ppm U3O8) mineral deposits.

Bottle roll leach tests (-25mm samples) yielded averaged uranium extractions of 85% which are comparable to results achieved for Mutanga (85%) and higher than for Dibwe (75%).

Leaching of fine milled material on six of the drill core samples achieved similar uranium extractions as for the - 25 mm samples. Therefore it appears that the uranium-bearing minerals of the Dibwe East samples are reasonably accessible to leaching at a crush size of -25 mm.

The average acid consumption of 10 kg/t for the Dibwe East samples is comparable to that of Dibwe (12 kg/t); both being higher than for Mutanga (2.3 kg/t).

Falea Uranium, Silver and Copper Project (Mali)

- Located within the Falea – North Guinea-Senegal Neoproterozoic Basin, ~80 km from Areva’s Saraya East uranium deposit

- Three licenses: Bala; Madini; Falea

- In addition, Falea contains 63Mlbs Cu and 21Moz Ag

- Only 5% of the 225 km2 land package has been explored

- Most known ore zones remain open for exploration

- Considerable technical and environmental work completed to date

- Forecast underground mining operation

- Process route includes recovery of copper and silver

- Road and air access, including a gravel airstrip on-site

| Category | Tonnes | U3O8 (MT) | Cu (%) | Ag (g/t) | U3O8 (Mlb) | Cu | Ag (Moz) |

|---|---|---|---|---|---|---|---|

| Indicated | 6.88 | 0.115 | 0.161 | 72.8 | 17.4 | 24.4 | 16.11 |

| Inferred | 8.78 | 0.069 | 0.200 | 17.3 | 13.4 | 38.7 | 4.9 |

The Falea uranium, silver and copper project is located in Mali, West Africa in the Prefecture of Kenieba, District of Kayes.

The Property is approximately 350 km west of Bamako, the capital of Mali, and approximately 240 km south of the city of Kayes. The nearest town is Kenieba, which is an 80 km drive north from the Property. The Project is located approximately 80 km to the east of AREVA's Saraya East uranium deposit in Senegal and approximately 13 km along trend from Merrex Gold Inc.’s Siribaya gold deposit.

GoviEx acquired the Property from Denison Mines Corp. (Denison) in June 2016. Denison acquired the Property following completion of the acquisition of 100% of Rockgate Capital Corp. (Rockgate) in January 2014.

The Property comprises three contiguous exploration permits, namely the Falea, Bala, and Madini Permits. The Mineral Resources occurring within the Bodi, Central, North, and East Zones are wholly contained within the Falea Permit.

The total surface area of the Falea Permit in terms of the Exploration Rights is approximately 7,500 ha. The Madini Permit adjoining to the east covers an area of 6,700 ha and the Bala Permit adjoining to the south covers an area of 12,500 ha.

Geology and Mineralization

Mineralization at the Property is hosted in the Neoproterozoic to Carboniferous sedimentary sequence of the Taoudeni Basin, a shallow interior sag basin with flat to very shallow dips. The Taoudeni Basin is located over a large portion of the West African Craton between the Reguibal Shield to the north and the Leo Shield to the south and encircles the Pan-African Belts to the west and east. The Taoudeni Basin is underlain by the Birimian greenstones which have been intruded by uranium-bearing Saraya granites.

The deposition of the Taoudeni Basin sedimentary sequence within the Project area was largely controlled by north-south and east-southeast trending structures. The orientation of the structural trends is coincident with the structural orientations within the Birimian greenstones. A dolerite sill ranging in thickness from a few metres to more than 160 m is present throughout most of the basin, intruding 65 m to 120 m above the Kania sandstone and forming prominent cliffs in the area.

Most of the mineralization at Falea occurs in the flat lying Kania sandstone, which is underlain and overlain by argillaceous units. The Kania sandstone is located near the bottom of the Taoudeni Basin sequence. The mineralization is interpreted as an unconformity type uranium deposit, since it is associated with the unconformity between the Kania sandstone and the underlying Birimian greenstones.

Four main mineralized areas have been identified, the North Zone, the Central Zone, the East Zone, and the Bodi Zone. The North, Central, and Bodi zones are further subdivided into the North Upper and North Deep, the Central Upper and Central Deep, and the Bodi Upper and Bodi Deep areas. The subdivisions of the Upper and Deep areas are based on their positions relative to the cross-cutting Road Fault.

Some of the highest grade uranium mineralization occurs in the Plateau Edge Structure (PES), a northwest trending zone of higher grade uranium-silver-copper mineralization which extends from the southeastern flank of the North Upper Zone, past the Road Fault, to the plateau edge and then parallel to it. Higher grade silver mineralization seems to be related to areas where northeast trending structures intersect the PES.

Exploration and Development History

Uranium, silver, and copper mineralization at Falea was first discovered by COGEMA in the 1970s at the Central Zone. Drilling by Rockgate began in the Central Zone and progressed northward, resulting in the discovery of the North Zone in late 2007 and the high-grade Plateau Edge Structure (PES) in late 2009.

The North Zone discovery was significant because it hosts higher uranium grades than Central Zone in addition to strong silver grades associated with native silver mineralization throughout much of the zone. The PES is a northwest-trending zone of thick, high-grade uranium-silver copper mineralization running along the northeastern margin of the North Zone. The zone hosts higher grades and thicknesses than North Zone proper and sits adjacent to the plateau edge.

From January to August 2011, 160 diamond drill holes totalling 45,691 m focused on resource definition in the North Zone and initial exploration drilling at Bala, south of Central Zone, East Zone, and Road Fault. The program resumed in October 2011 running through July 2012 and comprised 398 diamond drill holes totalling 88,350 m. Drilling continued to infill and step-out on the North Zone, and expanded north into the Bodi Zone. An additional 44 diamond drill holes were completed at the East Zone and 19 more at the Central Zone as part of an expanded resource definition program.

In October and November 2012, a total of 15,936 m was completed in 66 diamond drill holes located in the Bodi and North Zone areas. Almost all work to date has been completed on the Falea Permit.

Deposit Type

The Falea deposit is interpreted as an unconformity-associated uranium deposit, using a polymetallic egress model for the geological model. The unconformity at Falea is between the Birimian and overlying sedimentary sequences. The egress model was applied due to the presence of the Road Fault, which could have introduced fluids into the sandstones.

Unconformity-associated deposits are high-grade concentrations of uranium that are located at or near the unconformity between relatively undeformed quartz rich sandstone basins and underlying metamorphic basement rocks.

The compositional spectrum of unconformity-associated uranium deposits can be described in terms of monometallic (simple) and polymetallic (complex) end-members on the basis of associated metals. Polymetallic deposits are typically hosted by sandstone and conglomerate, situated within 25 m to 50 m of the basement unconformity. Polymetallic ores are characterized by anomalous concentrations of sulphide and arsenide minerals containing significant amounts of nickel, cobalt, lead, zinc, and molybdenum. Some deposits also contain elevated concentrations of gold, silver, selenium, and platinum-group elements.

Mineral Processing and Metallurgical Testing

In March 2010, Rockgate commissioned SGS South Africa (Pty) Ltd (SGS) to perform mineralogical characterization and deportment analysis of a composite sample from the Falea Project. The Summary and Discussions and Conclusions sections of the SGS report (SGS, 2010) focuses on the liberation characterization, flotation response and/or leaching efficiency in general of the sample, and how this could impact the mineral processing at Falea.

The grading analysis completed indicates that uranium, silver, sulphur, and base metals preferentially upgrade into the finer fractions. The silver displays no up- or downgrading in the 106 μm fraction.

The uranium-phases are dominantly U-silicates and U-oxides, both of which are readily leachable by acid leaching. Leach tests indicated approximately 90% dissolution of uranium after 48 hours, however, after six hours, the uranium dissolution was already at 86%.

The silver is present as native silver and silver-sulphide. Both minerals will dissolve in a cyanide solution, however, the silver-sulphide (acanthite) dissolves at a much slower rate than native silver. Only 77.56% of the silver was dissolved after 48 hours during the leach testwork. The leach kinetics may be improved by employing a stronger cyanide solution, however, the presence of chalcopyrite and pyrite may increase ferricyanide consumption. Due to the very fine-grained nature of the silver-phases, it is expected that finer grinding (to approximately 80% -65 μm) will improve silver recoveries.

Copper is present in low concentrations (approximately 0.16%). Copper is predominantly hosted by chalcopyrite and lesser chalcocite/covellite. A small amount of copper is also hosted in a silver-sulphide phase. Since chalcopyrite is not acid soluble, the acid leach recovery of copper is poor (approximately 17% after 48 hours), however, at a grind of 80% -75 μm, chalcopyrite is well liberated (>90% liberated and high middlings). Pyrite, the main sulphide mineral, exhibits similar degrees of liberation at this grind. Therefore, sulphide and copper recovery by flotation is expected to be high. Preliminary flotation tests indicated approximately 95% copper recovery with a mass pull of 11%, resulting in a copper grade of approximately 1.7%. Cleaning of this rougher concentrate to achieve the required saleable grades appears possible.

In March 2011, the Australian Nuclear Science and Technology Organisation (ANSTO) was appointed to complete the metallurgical testwork for the Falea Property. The following> summary of mineralogy and metallurgical testwork commissioned by Rockgate is taken from Rockgate’s 2013 Annual Information Form.

The Falea deposit is polymetallic, containing significant quantities of uranium, silver, and copper. The uranium is present as an oxide (U3O8) and is leachable with either acid or alkaline. The silver is present as either elemental or sulphide. The copper is present as both leachable and non-leachable (refractory) forms in varying proportions.

For the current flowsheet proposed the first step would be flotation of the ore and then an alkaline leach on both the flotation concentrate and the flotation tails.

Subsequent work indicated that the most suitable process would be Alkali leach, followed by Counter Current Decantation (CCD), Ion Exchange (IX) and Sodium Diuranite (SDU). The test work indicated an overall recovery of 90% uranium, including 99% recovery from the sulphide concentrate, using MgO as the precipitant. The precipitated uranium is recycled to the alkali circuit. Overall silver recovery of 88% has been achieved, including 97% silver recovery in the cyanide leach. Overall copper recovery of 73.5% has also been achieved, including 90% recovery from solvent extraction from the float concentrate.

African Energy -- Zambian Uranium Assets

On October 30, 2017, GoviEx announced the completion of its transaction to acquire the uranium mineral interests of African Energy Resources Ltd. in Zambia. The combination of African Energy’s Chirundu and Kiraba Valley tenements with GoviEx’s Mutanga Project unites these neighboring properties and significantly expands and improves the potential economies of scale. A Preliminary Economic Assessment based on the consolidated land holding is forthcoming.

The Chirundu and Kariba Valley properties include a mining license, a prospecting license, and a pending exploration license. The Chirundu mining license covers two uranium deposits – Gwabe and Njame – containing Joint Ore Reserves Committee (JORC) mineral resources of 7.4 Mlbs U3O8 in the Measured and Indicated categories, plus 3.8 Mlbs U3O8 in the Inferred category.

The Chirundu and Kariba Valley properties, combined with the Mutanga Project, represents a regional consolidation and will result in contiguous tenements of approximately 140 km in strike length, including three mining licences, containing combined Mineral Resources of 15.2 Mlb U3O8 in the Measured and Indicated categories and 45.2 Mlbs U3O8 in the Inferred category. Sections between the known deposits remain under-explored with a number of prospective drill targets that could further expand GoviEx’s NI 43-101 resource.

With the conclusion of the transaction, GoviEx has one of the largest combined uranium Mineral Resource bases amongst its peer group, with combined Measured and Indicated Resources of 131.7 Mlbs U3O8 and Inferred Resources of 76.9 Mlbs U3O8 estimated in accordance with NI 43-101.

Major Shareholders

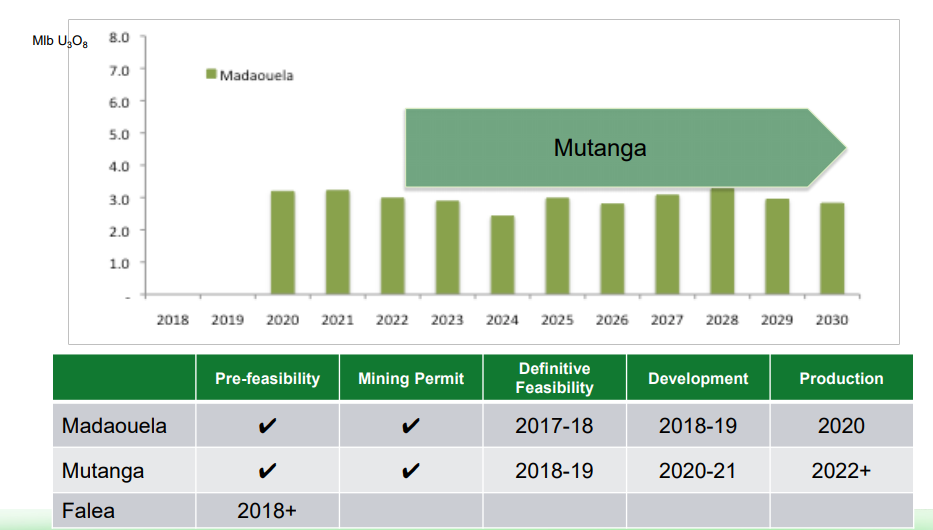

Proposed Development Strategy

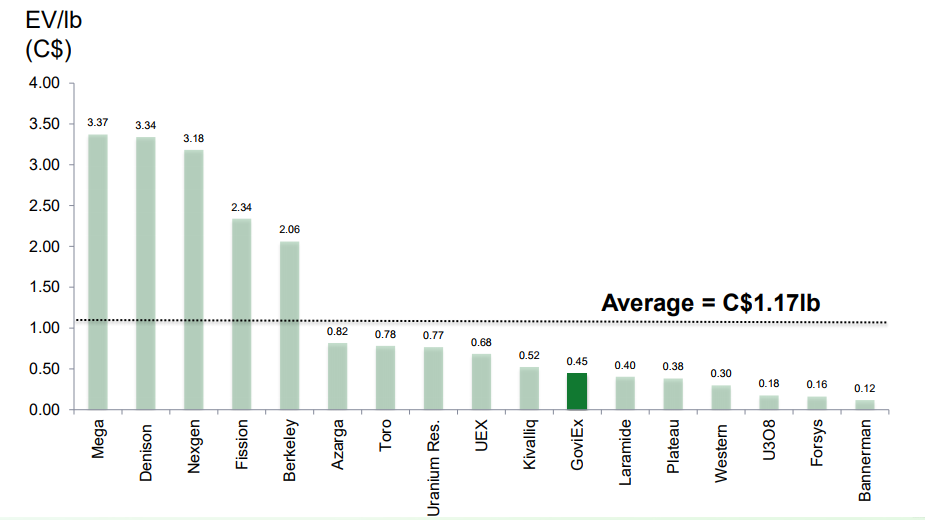

Developer Peer Group Comparison (Enterprise Value/lb.)

Management Team

Daniel Major (Chief Executive Officer)

- Career spans over 25 years in the mining industry.

- Solid track record initially with Rio Tinto at the Rössing Uranium Mine in Namibia.

- Formerly mining analyst with HSBC Plc as well as JP Morgan Chase & Co. based in in London.

- Chief Executive and later Non-Executive Chairman of Basic Element Mining and Resource Division in Russia.

- Leadership positions in several Canadian listed mining companies with exploration and producing assets in Canada, and South America.

- Mining engineer from the Camborne School of Mines in the UK.

Aminou Boukary (Country Manager, Niger)

- Over 10 years of experience in the Niger mining sector.

- Prior to joining GoviEx in 2007, was Country Administration Manager for the Exxon Mobil - Petronas JV from 2002 through 200.7

- Background includes complex logistics management, strategic planning, public relations, human resources management, organisational management, and professional translation.

- Holds degrees from Sophia Antipolis Technopole (DESS – MBA, Management/Marketing), Nice University (MA, English Studies) and University of Cambridge (Translation).

- Also holds various certificates in Health, Safety, Environment and Security Awareness.

Jerome Randabel (Chief Geologist)

- Geologist with over 20 years experience, with the last 13 years specialising in the exploration and development of uranium deposits.

- Worked on projects in Australia, Botswana, Kazakhstan, Kyrgyzstan and the US.

- Chief Mine Geologist at the Beverley Uranium Mine in Australia.

- Successfully completed numerous technical reviews of a number of projects in Bulgaria, Mongolia, Australia and Niger on behalf of various companies.

- Worked in senior technical positions for several mid to small cap companies as well as operating his own contract and consultancy service.

- Graduate of the University of Adelaide, South Australia, where he earned a Bachelor of Science with Honours in geology.

Rob Bowell (Technical Advisor)

- Geochemist with 27 years experience.

- Background in applied geology in tropical and deeply weathered terrain’s and mining consulting in the fields of due diligence, financial and technical audits, process chemistry, environmental geochemistry, environmental engineering and mineralogy.

- Specializes in the application of chemistry and mineralogy to solve engineering problems.

- Specialization in uranium, copper and REE deposits.

- Experience in North America, South America, Greenland, Africa and in Eastern Europe.

- Holds bachelors degree in chemistry and geology from University of Manchester, as well as PhD in Geochemistry from University of Southampton.

Investment Rationale

- Strong shareholder base.

- Experienced directors and management team.

- A growing Africa-focused uranium company with a defined project development pipeline and increased jurisdictional diversification.

- One of the largest combined uranium Mineral Resource bases amongst its peer group.

- Considerable exploration potential with several drill-ready targets defined at each property.

- Mining permits granted in Niger and Zambia – mining countries recognized for good infrastructure and mining history.

- Significant metallurgical test work and engineering studies completed on its development assets providing GoviEx with an opportunity to build a strong development pipeline.

Demand

- Uranium demand driven by nuclear energy growth forecast at 3% per annum average.

- China nuclear energy capacity from 30 GWe to 130 GWe by 2030, 240 GWe by 2050.

- India growing from 5 GWe in 2014, to 17 GWe in 2024 and 63 GWe in 2032.

- Japan restarts slow to begin, but still targeting approx. 20% of long-term power mix.

- Saudi Arabia planning 17 GWe of capacity by 2040 and small nuclear reactors for desalination.

Supply

- Uranium production to decline unless new mines developed.

- All-in breakeven cost for uranium mines estimated at US$40 and US$50/lb U3O8.

- Higher uranium price required to maintain current production and to incentivize new production.