Grameenphone Ltd

Summary

- Grameenphone Ltd is the largest telecommunications company in Bangladesh. The company is founded by Iqbal Quadir and started its operation on March 26, 1997.

- Grameenphone launched its operation with a concept similar to Grameen Bank’s microcredit program. The ‘village phone’ concept was introduced to empower the rural women. The company later on attracted investment from Norway’s Telenor group.

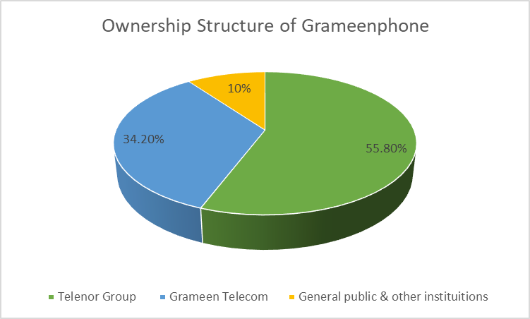

- Telenor Group holds a controlling 55.80% share of the company. Another 34.20% of the share is held by Grameen Telecom and the rest 10% of the share is owned by the general public.

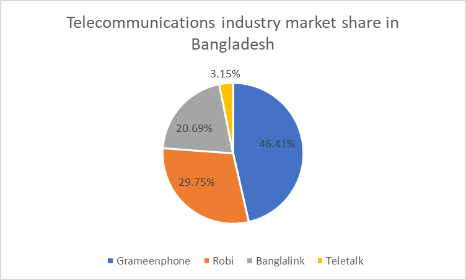

- The company holds more than 46% of market share in terms of subscribers in 2021.

- The operator is declared Significant Market Power (SMP) in 2019.

- Grameenphone has posted a profit after tax of BDT 37.19 billion in 2020, which was BDT 34.52 billion in 2019. Net profit margin of the company is 27% in the year 2020. Despite the restrictions due to pandemic, the company has been able to see a positive growth of 7.74% in the profits.

Company overview

Grameenphone Ltd (DSE:GP, CSE:GP) is the largest telecommunications company in Bangladesh, headquartered in GPHOUSE, Bashundhara, Baridhara, Dhaka-1229, Bangladesh. The company started its operation on March 26, 1997. It is listed in both Dhaka Stock Exchange (DSE) and Chattagram Stock Exchange (CSE). Earnings per share (EPS) of the company in 2020 is BDT 27.54 and Net Asset Value (NAV) per share in the same year is BDT 38.59. The company got listed in the exchanges on 16 November, 2009 and it currently belongs to ‘Category A’ in both the markets. Credit rating of the company by Credit Rating Information and Services Limited (CRISL) on 30 April, 2020 is ‘AAA’ for long-term, and ST-1 for short-term.

As of the year ended on December 31, 2020, the share holding of the company has been as following –

| Date | Sponsor/Director | Government | Institute | Foreign | Public | Total |

| Dec 31, 2020 | 90% | 0.00% | 4.49% | 3.38% | 2.13% | 100% |

| Jul 31, 2021 | 90% | 0.00% | 4.83% | 3.19% | 1.98% | 100% |

Grameenphone Ltd. is the leading telecommunications service provider that operates digital telecommunications network based on the GSM standard in 900 MHz, 1800 MHz, 2100 MHz frequency bands. The spectrum allowed to Grameenphone by Bangladesh Telecommunication Regulatory Commission (BTRC) and their expiry date is presented in the following table –

| Spectrum | Bandwidth (MHz) | Expiry |

| 900 MHz | 2×7.4 | 2026 |

| 1800 MHz | 2×7.2 + 2×7.4 | 2026 |

| 1800 MHz | 2×5 | 2033 |

| 2100 MHz | 2×10 | 2028 |

The company’s network covers 99.6% of the population in Bangladesh. Total subscribers of the company stand at 79.0 million in 2020 and total number of data users in the same year stand at 41.3 million. The company has a total of 16,547 sites across the country and among them 14,000 are 4G sites. Grameenphone has invested BDT 379.6 billion in infrastructure since its inception. In 2020, the company has invested 13.8 billion (excluding licenses & leases) to rollout 4G LTE sites, enhance capacity, expand network coverage, and build higher IT readiness.1

Company Ownership Structure

The ownership of the company belongs to two sponsors – Telenor Mobile Communications AS (TMC) (55.80%), Grameen Telecom (34.20%). The rest 10% of the shares belong to the general public. Telenor holds the controlling interest in the company by owning 753,407,724 shares. Grameen Telecom is the entrepreneur and initiator of the company, which holds 461,766,409 shares. Among other major investors, who share parts of the other 10%, Grameen Bank Borrower’s Investment Trust, Investment Corporation of Bangladesh, Government of Norway are the mentionable big institutional investors.

About Telenor Mobile Communications AS (TMC)

Telenor Mobile Communications AS (TMC) is a fully-owned subsidiary of Telenor ASA, which is a leading telecommunications company in Norway. Telenor ASA is listed on Oslo Stock Exchange. The company was found in 1855 and has expanded its operation in Scandinavia, Central and Eastern Europe, and Asia. The company was ranked as the world’s seventh largest mobile operator. It was listed as No.01 on Dow Jones Sustainability Index in 2008. The company has 188 million customers around the world, and annual sales is around USD 14 billion in 2020. The company employs 16,000 people worldwide. Telenor is operating across the world with high reputation and success rate. Telenor owns 55.80% of Grameenphone Ltd.

About Grameen Telecom

Grameen Telecom was established as a not-for profit company in Bangladesh by Professor Muhammad Yunus, the winner of Nobel Peace Prize 2006. The mandate of GTC is to provide easy access to GSM cellular services in rural Bangladesh. The company has started its operation on the same day as Grameenphone Ltd. – on March 26, 1997. More on Grameen Telecom is in the ‘History of Grameenphone’ section of this article.

History of Grameenphone

The story of Grameenphone is linked with Grameen Bank, a first of its kind microcredit organization in the world. The model of microcredit is innovated by Dr. Muhammad Yunus – a noble laureate for peace together with his established organization Grameen Bank in 2006. Inspired by the business model of Grameen Bank, the founder of Grameenphone Iqbal Quadir has initiated an effort to provide an income source to the rural entrepreneurs through mobile phone services. Quadir has raised some fund from New York based investor and philanthropist Jashua Mailman and worked three years to establish Grameenphone. The company got incorporated as a private limited company on October 10, 1996. Quadir obtained a license for cellular phone operation in Bangladesh from then Posts and Telecommunications Ministry on November 28, 1996. Grameenphone, together with Grameen Bank’s Grameen Telecom, has initiated Village Phone (VP) service. Under the scheme, the rural women could get a microcredit for purchasing their cell phone and got 50% discount on the airtime. The target women with this opportunity could even generate more income than men; thus, the dream of women empowerment comes to realization. Grameenphone later obtained support from Telenor of Norway.2

The story of Grameenphone is linked with Grameen Bank, a first of its kind microcredit organization in the world. The model of microcredit is innovated by Dr. Muhammad Yunus – a noble laureate for peace together with his established organization Grameen Bank in 2006. Inspired by the business model of Grameen Bank, the founder of Grameenphone Iqbal Quadir has initiated an effort to provide an income source to the rural entrepreneurs through mobile phone services. Quadir has raised some fund from New York based investor and philanthropist Jashua Mailman and worked three years to establish Grameenphone. The company got incorporated as a private limited company on October 10, 1996. Quadir obtained a license for cellular phone operation in Bangladesh from then Posts and Telecommunications Ministry on November 28, 1996. Grameenphone, together with Grameen Bank’s Grameen Telecom, has initiated Village Phone (VP) service. Under the scheme, the rural women could get a microcredit for purchasing their cell phone and got 50% discount on the airtime. The target women with this opportunity could even generate more income than men; thus, the dream of women empowerment comes to realization. Grameenphone later obtained support from Telenor of Norway.2

Grameenphone converted to a public limited company on June 25, 2007. It has got listed to the stock exchanges on November 16, 2009. The company was declared significant market power (SMP) by Bangladesh Telecommunications Regulatory Commission on February 10, 2019. The categorisation is done based on market share of a company. In this oligopoly market, if a company holds more than 40% market share, the regulatory authority imposes the SMP tag to protect other companies and keep the competition intact.

Industry Analysis

The government has set its vision to take the country towards a ‘Digital Bangladesh’, in which telecommunications industry has a major role to play. Total number of mobile subscribers stood at 174.6 million on May, 2021, which is about 99% of the population. Among the subscribers Grameenphone holds 80.7 million, Robi has 51.9 million, Banglalink achieved a number of 36.2 million, and Teletalk possesses the rest 5.6 million subscribers. The sector is contributing almost 1.8% to the total GDP. Most of the revenues are coming from Voice Calls and Internet Data services. Revenue from internet data usage is getting a boost recently owing to the introduction of 4G in 2018.3

Telecommunications market is an oligopoly market with numbered players – currently 4 only. Among the companies, Grameenphone holds the highest market share in terms of subscribers – about 46.41% followed by Robi, Banglalink, and Teletalk by 29.75%, 20.69% and 3.15%, respectively.

Many changes of corporate restructuring nature have taken place in this industry. In 2010, Bharti Airtel has acquired 70% stake in Warid Telecom of Bangladesh, which later was renamed to match the parent company name. Later on, Airtel and Robi Axiata merged in 2016 to form the second largest telecommunications operator in the country. Country’s first operator Citycell has quit the battle after a long history of struggle to survive. BTRC has cancelled its license for non-payment of dues in Q4, 2016.

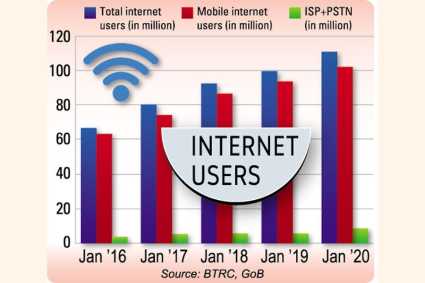

The industry is experiencing higher growth in internet subscribers. Number of subscribers are increasing at a smother pace. According to official source of BTRC, total mobile internet subscribers in Bangladesh has stood at 103.19 million, ISP + PSTN users at 9.5 million.

Competition analysis

According to researches, competitiveness factors in the industry are price & tariff, convenience, sales promotion, customer service care, value added service (VAS), and communication and coverage. All these factors are elaborated in the following figure (source: Nekmahmud & Rahman, 2018).4

With some statistics, the competitive positioning of Grameenphone in the market can be established. First comes the market share of the company, which is 46.41% in 2021. The company has been holding above 40% market share for more than a decade. The company has closed the year 2020 with 79.0 million subscribers, of which 41.3 million (52.2%) are internet users. Main strength of Grameenphone against its competitors is the network coverage across the country. About 99.9% population are under strong internet coverage of the company. According to customer surveys, internet coverage of Grameenphone is outstanding in the remote areas compared to its competitors. Call rate of the company is a little bit high for which the company has experienced a 2.8% decrease in revenue in earning from 2019. However, the company has successfully added 3.4% to its customer base. The company strives a transition from a commodity-based company to a platform-based digital technology company that is working toward IoT adaptation. In the national budget of 2020-21, the government has imposed an extra 5% supplementary duty (SD) on telecom sector. Grameenphone has rolled out smaller voice packs to absorb the SD and to relay an adaptive pressure only to the lower-income group.

Financial Performance

Grameenphone has posted a profit after tax of BDT 37.19 billion in 2020, which was BDT 34.52 billion in 2019. Net profit margin of the company is 27% in the year 2020. Despite the restrictions due to pandemic, the company has been able to see a positive growth of 7.74% in the profits. However, a closer inspection reveals that the company has actually lost some revenue in the year 2020 compared to the previous year. Then the profit growth is explained by reduction in the costs. The increase in profit has been due to reduction in finance expenses as well as in taxes. The company has incurred interest expenses in 2019 of BDT 0.8 million but has earned interest in 2020 of 1.2 million.

Net asset value (NAV) per share of the company in 2020 is BDT 38.59, which is a 35.88% increase from the previous year. Earnings per share of the company is BDT 27.54, a 7.75% increase than the previous year. Return on assets of the company is 25% in 2020, which is a 1%-point increase than the previous year. But the company has experienced a negative growth in the return on equity. ROI in 2019 was 92% and in 2020 it came down to 82%. The reason behind this decrease is an increase in total equity by 35.88% in 2020. Total non-current asset-base of the company has increased during the last one financial year. Equity of the company has also increased for an increase in the retained earnings. The company has increased lease liabilities, paid off some deferred tax liabilities and increased some employee benefits liabilities.

Cash and cash equivalent of the company at the end of financial year 2020 is BDT 2.6 billion, which was BDT 13.76 billion a year earlier. The cash position has decreased significantly due to a drastic decrease in the cash flow from operating activities. During the year, the company has received less from customers and paid more, comparative to the previous year.

Recent Developments

- On February 10, 2019, BTRC has declared Grameenphone a Significant Market Power (SMP) and imposed 4 restrictions. However, following a writ petition by Grameenphone, and for the pandemic, BTRC has reduced the number of restrictions to 2. Now, the company has to take prior approval from the authority before rolling out any packages. Also, it would need to take permission for the existing packages. And a customer can abandon Grameenphone in 60 days instead of existing 90 days under the mobile number portability facility.

- In April, 2019, BTRC claimed that Grameenphone owes an unpaid audit claim of BDT 12,580 crore (BDT 1.25 billion). After much negotiation and bids, Grameenphone paid BDT 100 crore (BDT 10 billion) to the authority on February

- ^ Annual Report 2020, p.20 https://www.grameenphone.com/about/investor-relations/ir-annual-report/annual-report-2020

- ^ https://web.archive.org/web/20010802042329/http://www.asiaweek.com/asiaweek/technology/article/0%2C8707%2C132167%2C00.html

- ^ http://www.eblsecurities.com/AM_Resources/AM_ResearchReports/SectorReport/Bangladesh%20Telecommunication%20Industry-A%20Comprehensive%20Review%202019.pdf

- ^ https://www.researchgate.net/publication/325122492_Measuring_the_Competitiveness_Factors_in_Telecommunication_Markets