InterContinental Hotels Group

Summary

- InterContinental Hotels Group is one of the world’s leading hotel companies.

- It has nearly 6,000 open hotels in more than 100 countries and a further 1,800 hotels in development pipeline.

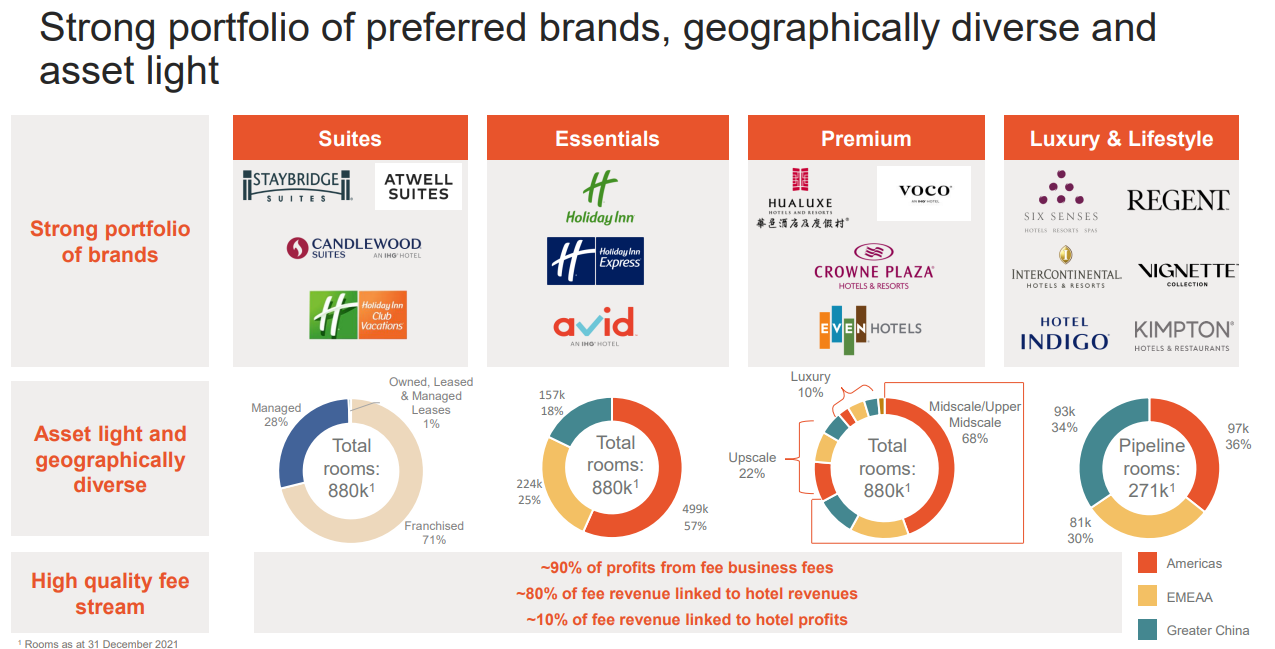

- The group has a portfolio of 17 brands in the Suites, Essentials, Premium and Luxury & Lifestyle categories.

Company Overview

InterContinental Hotels Group (NYSE:IHG, LSE:IHG) is a global hospitality company, with 17 hotel brands and one of the loyalty programmes. IHG has nearly 6,000 open hotels in more than 100 countries and a further 1,800 hotels in its development pipeline.

Recent Developments

IHG Hotels & Resorts signs InterContinental Tirana – a brand debut in Albania

27 JUNE 2022; IHG continues the expansion of its luxury & lifestyle growth in Europe with InterContinental Tirana set to open in 2025.1

IHG recently signed a Franchise Agreement with Mr. Ram Geci, Owner and President of Geci Group, one of Albania’s leading infrastructure companies, which also specialises in hospitality and tourism. The company has around 20 years’ experience in hospitality, having been a shareholder since 2004 and Sole Owner of Tirana International Hotel, Tirana, Albania, since 2011.

The new-build InterContinental Tirana hotel will have around 300 rooms and suites, a large conference centre with a ballroom and a capacity of up to 1,000 people for MICE (Meetings, Incentives, Conferences & Exhibitions) events and weddings. There will also be a luxury spa, and a rooftop restaurant and bar with panoramic views of the city. The hotel will be located within Tirana’s main Skanderbeg Square, close to key attractions such as the National Historical Museum, Castle of Tirana, Opera House, Art Gallery and the main institutions like the Albanian Parliament, Ministries, National Bank of Albania and Tirana Municipality. The property is just 15 minutes’ drive from Tirana International Airport.

HG Hotels & Resorts launches its premium voco brand in Japan with Osaka signing

22 JUNE 2022; HG Hotels & Resorts will launch its popular voco Hotels brand in Japan, following the signing of a management agreement with NTT Urban Development Corporation (that will be represented via its subsidiary UD Hospitality Management Corporation) that will see it open the flagship voco Osaka Central in 2023.2

The voco brand has seen phenomenal success since its global launch in 2018, and the signing of voco Osaka Central marks the 75th signing for IHG in just over three years, with 35 high quality properties already open around the world. As IHG experiences an unprecedented period of growth in Japan that’s recently seen it launch the Kimpton, Regent and Holiday Express brands into the market, it is now adding its lifestyle voco brand to its premium offering.

With a new brand comes a flagship opening, and the 191-room voco Osaka Central will bring a fresh and reliably different offering to Osaka’s accommodation landscape in 2023.

IHG Hotels & Resorts marks 6,000 hotels milestone with spectacular openings and partnerships to reward travellers

08 JUNE 2022; IHG Hotels & Resorts (IHG), one of the world's leading hotel companies, is celebrating 6,000 open hotels by unveiling the ‘6,000 Club’ and announcing partnerships with major sports and entertainment events.3

The 6,000 Club features a collection of stunning newly opened hotels from IHG’s iconic portfolio, showcasing the global reach of its 17 brands and the many ways its hotel teams delight owners and guests by delivering True Hospitality for Good, every day.

Financial Highlights

2022 First Quarter Results

- Q1 group RevPAR up 61% vs 2021 and attaining 82% of 2019’s level

- Average daily rate up 27% vs 2021 and in line with 2019

- Americas and EMEAA saw sequentially improved trading in February and March after a challenging January

- Greater China trading in March impacted by tightening of localised travel restrictions

- Gross system size growth of +4.9% YOY, +0.7% YTD; opened 6.6k rooms (45 hotels) in Q1, broadly similar to 2021

- Net system size growth of +3.4% YOY (adjusted for Holiday Inn and Crowne Plaza removals in 2021), +0.5% YTD

- Global system of 885k rooms (6,028 hotels); 68% across midscale segments, 32% across upscale and luxury

- Signed 16.6k rooms (120 hotels) in Q1, ~15% more than 2021 and 2020; global pipeline increased to 278k rooms

Americas

Q1 RevPAR was down 8% vs 2019 (up 58% vs 2021). US RevPAR was down 6% vs 2019. Across the region, occupancy was close to 60%, down 6%pts on 2019, whilst rate was up 1%. Holiday Inn Express and its Extended Stay brands exceeded 2019 levels of RevPAR. Demand was boosted by a strong Spring Break vacation period, with leisure rooms revenue 10% higher than 2019 for the quarter overall. Leisure demand is expected to remain strong in the coming quarters. Together with growth in corporate bookings and more group activity and events returning, this should support further progress in both occupancy and rate.4

Gross system size growth was +2.7% YOY, with 2.2k rooms (23 hotels) opened in the quarter. Net system size growth was 1.2% YOY on an adjusted basis (for the Holiday Inn and Crowne Plaza removals that occurred over the balance of 2021, driven by last year’s review of the estates of these two brands). 7.8k rooms (73 hotels) were added to the pipeline, representing a further sequential improvement in the signings pace and exceeding the Q1 signings back in 2019.

EMEAA

Q1 RevPAR was down 33% vs 2019 (up 122% vs 2021). Occupancy was approaching 50%, down 21%pts on 2019, whilst rate was down just 4%. Previous restrictions, particularly on international travel, were generally being lifted over the course of the quarter in all markets, though the timing of these still resulted in a broad spread of performance within the region: Q1 RevPAR was down just 7% vs 2019 in the Middle East and 15% in the UK, whilst it was still 38% lower in Australia, 45% in Continental Europe, 58% in South East Asia & Korea and 64% in Japan.

Gross system size growth was +5.7% YOY, with 3.5k rooms (17 hotels) opened in the quarter. Net system size growth was 4.2% YOY on an adjusted basis. There were 2.3k rooms (15 hotels) added to the pipeline, around half being conversions.

Greater China

Q1 RevPAR was down 42% vs 2019 (down 7% vs 2021). Occupancy was 36%, down 16%pts on 2019, whilst rate was down 17%. The Winter Olympics boosted performance around Beijing, though overall Tier 2-4 cities continued to outperform Tier 1 cities. However, in March, travel restrictions implemented following increased Covid-19 cases led to RevPAR weakening to a 53% decline vs 2019, with around a third of the estate temporarily closed or repurposed.

Gross system size growth was +11.3% YOY, with 0.9k rooms (5 hotels) opened in the quarter. Net system size growth was 9.9% YOY on an adjusted basis. There were 6.6k rooms (32 hotels) added to the pipeline.

In April, IHG entered into a new $1.35bn syndicated bank revolving credit facility (RCF). The previous $1.275bn syndicated facility and $75m bilateral facility have been cancelled. The covenant amendments to the previous facility announced in December 2020, which included a relaxation of covenants for the June 2022 and December 2022 and the $400m minimum liquidity covenant, are no longer in effect.

The new five-year RCF matures in April 2027. Two one-year extension options are at the lenders’ discretion. There are two financial covenants: interest cover and leverage ratio. Covenants are tested at half year and full year on a trailing 12-month basis. Interest cover requires a ratio of Covenant EBITDA to Covenant interest payable above 3.5:1. The leverage ratio requires Covenant net debt to Covenant EBITDA below 4.0:1. These covenants now include the impact of IFRS 16, Leases, which was previously excluded due to ‘frozen GAAP’ treatment in the previous agreement.

2021 Full Year Results

During the year ended 31 December 2021, total revenue increased by $513m (21.4%) to $2,907m including a $48m reduction in cost reimbursement revenue. Revenue from reportable segments increased by $398m (40.1%) to $1,390m, driven by improved trading conditions. Underlying revenue increased by $387m to $1,373m, with underlying fee revenue increasing by $314m. Owned, leased and managed lease revenue increased by $68m.5

Comparing to 2020, Group comparable RevPAR declined 34% in the first quarter, then grew 151% in the second quarter, 66% in the third quarter, 71% in the fourth quarter and 46% in the full year. When compared to the pre-pandemic levels of 2019, Group comparable RevPAR declined 51% in the first quarter, 36% in the second quarter, 21% in the third quarter, 17% in the fourth quarter and 30% in the full year.

Operating profit improved by $647m from a loss of $153m to a profit of $494m, including a $241m net reduction in operating exceptional items, a $91m improvement in the System Fund result, from a $102m deficit to an $11m deficit, and a $36m decrease in the charge for expected credit losses on corporate trade receivables. Operating profit from reportable segments increased by $315m (143.8%) to $534m, driven by improved demand and the delivery of sustainable fee business cost savings. Underlying operating profit increased $308m to $531m.

Fee margin increased by 15.5ppts to 49.6%, benefitting from the improvement in trading and focused cost management.

In the year to 31 December 2021, System Fund revenues increased $163m (21%) to $928m, primarily driven by the recovery in travel demand yielding higher assessment revenues. The System Fund income statement deficit reduced by $91m to $11m, primarily due to the rebound in travel demand and associated assessment income, partially offset by the reversal of temporary savings realised in 2020.

Net financial expenses decreased by $1m to $139m. Adjusted interest, as reconciled on page 223, and which excludes exceptional finance expenses, and adds back interest relating to the System Fund, increased by $12m to an expense of $142m. The increase in adjusted interest was primarily driven by increased average bond debt.

Financial expenses include $91m (2020: $69m excluding exceptional financial expenses) of total interest costs on public bonds, which are fixed rate debt. Interest expense on lease liabilities was $29m (2020: $37m).

The Group’s basic earnings per ordinary share is 145.4¢ (2020: basic loss per ordinary share: 142.9¢). Adjusted earnings per ordinary share increased by 115.7¢ to 147.0¢.

The Board is proposing a final dividend of 85.9¢ in respect of 2021, an amount equivalent to the withdrawn final payment in respect of 2019. No interim dividend was paid in respect of 2021.

Business Overview

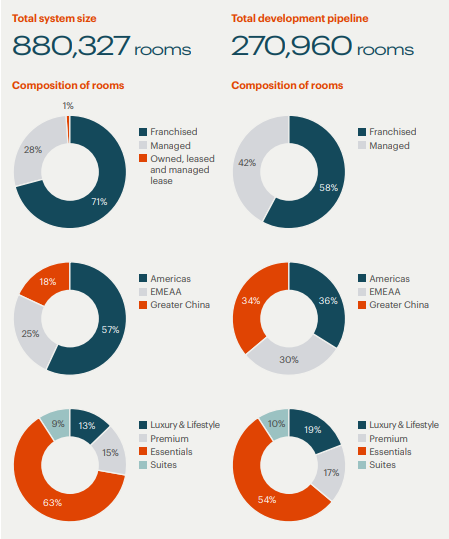

The company predominantly franchise its brands and manage hotels on behalf of third-party hotel owners and have a weighting to more resilient domestic non-urban markets.

The growth of its business relies on two fundamental growth drivers: revenue per available room (RevPAR) and increasing the number of rooms across its estate. RevPAR indicates the value guests ascribe to a given hotel, brand or market and grows when they stay more often or pay higher rates. Room supply reflects how attractive the hotel industry is as an investment from an owner’s perspective.

To drive growth, IHG has a portfolio of 17 brands across more than 100 countries in the Suites, Essentials, Premium and Luxury & Lifestyle categories. Supported by a leading loyalty programme and powerful technology, its brands meet clear guest needs and generate strong returns for its owners, which in turn attracts further hotel investment and grows its estate.

IHG is an asset-light business and its focus is on growing fee revenues and fee margins, which the company can do with limited capital requirements. This enables it to grow and invest in its business while generating high returns on invested capital and strong cash flow.

The company generally franchise or manage hotels, with the decision largely driven by market maturity, owner preference and, in certain cases, the particular brand. Hotels in the Essentials category tend to be franchised, while Luxury & Lifestyle hotels are predominantly managed.

The company's broad geographic spread and weighting towards essential business and domestic leisure travel has driven resilience relative to the wider industry during the pandemic. IHG is weighted towards non-urban markets which are less reliant on international inbound travel and less exposed to large group meetings and events. A combination of these factors, along with its enterprise capability, has allowed IHG to outperform the wider industry in RevPAR growth.

The company's asset-light business model requires a limited increase in IHG’s own operating expenditure to support its revenue growth, which delivers operating profit and fee margin growth.

For franchised hotels, the flow through of revenue to operating profit is higher than it is at managed hotels, given its well-invested scale platform where limited resources are required to support the addition of an incremental hotel. This is most evident in its Americas region, where fee margins are the highest, reflecting its scale and around 90% of its hotels operating under its franchised model.

Brands

- Six Senses Hotels Resorts Spas

- Regent Hotels & Resorts

- InterContinental Hotels & Resorts

- Vignette™ Collection

- Kimpton Hotels & Restaurants

- Hotel Indigo

- EVEN Hotels

- HUALUXE Hotels and Resorts

- Crowne Plaza Hotels & Resorts

- voco hotels

- Holiday Inn Hotels & Resorts

- Holiday Inn Express

- Holiday Inn Club Vacations

- avid hotels

- Staybridge Suites

- Atwell Suites

- Candlewood Suites

| Brands | Current | Pipeline | ||

| Hotels | Rooms | Hotels | Rooms | |

| Six Senses Hotels Resorts Spas | 21 | 1412 | 33 | 2424 |

| Regent Hotels & Resorts | 7 | 2190 | 8 | 1938 |

| InterContinental Hotels & Resorts | 207 | 69917 | 79 | 19730 |

| Vignette™ Collection | 2 | 539 | 6 | 884 |

| Kimpton Hotels & Restaurants | 75 | 13297 | 38 | 7723 |

| Hotel Indigo | 133 | 16717 | 119 | 19127 |

| EVEN Hotels | 21 | 2994 | 29 | 4907 |

| HUALUXE Hotels and Resorts | 17 | 4893 | 22 | 5762 |

| Crowne Plaza Hotels & Resorts | 406 | 111491 | 107 | 27856 |

| voco hotels | 35 | 8523 | 36 | 9701 |

| Holiday Inn Hotels & Resorts | 1192 | 215841 | 251 | 49206 |

| Holiday Inn Express | 3034 | 319407 | 658 | 83808 |

| Holiday Inn Club Vacations | 28 | 8822 | 0 | 0 |

| avid hotels | 52 | 4676 | 161 | 13956 |

| Staybridge Suites | 318 | 34559 | 158 | 17284 |

| Atwell Suites | 1 | 90 | 22 | 2181 |

| Candlewood Suites | 361 | 32024 | 107 | 8794 |

Industry Overview

The $360 billion hotel industry has compelling structural growth drivers, underpinned by factors including consumers’ inherent desire to travel, population growth, and an expanding middle class in emerging markets with increasing disposable incomes. While the pandemic suppressed demand during 2020 and 2021, demand has returned rapidly in domestic markets as government restrictions have lifted and vaccination rates increased. This demand has predominantly been in markets not exposed to cross-border trips and across essential business travel, though discretionary corporate travel and group events have begun to return.

Cost remains a significant barrier to building a scale position in the industry, whether that’s due to the investment required to build and maintain hotels, establish a strong loyalty programme or to market brands in a competitive marketplace. As such, the industry remains fragmented, with 54% of rooms affiliated with a global or regional chain.

Branded hotel penetration has steadily increased as a long-term trend and is expected to continue to grow as consumers look to trusted brands to meet their evolving expectations, particularly when it comes to state-of-the-art technology and the skills, scale and resources to provide more sustainable stays. Owners affiliated with a brand tend to generate higher returns

For the industry as a whole, it is not yet clear what impact there will be on demand from structural changes brought about by the pandemic, such as technology replacing elements of business travel. However, this may be offset by a greater use of hotels to facilitate a global shift to increasingly flexible working arrangements. In addition, there is scope for ‘bleisure’ demand, where flexible working creates potential for leisure demand to be combined with business stays.

It is likely that fluctuating Covid-19 restrictions will continue to create a volatile demand environment in the short term. However, the company anticipate the attractive industry fundamentals to be fully restored in the longer term. For example, STR forecast that US industry RevPAR will return to 2019 levels by the end of 2023.

References

- ^ https://www.ihgplc.com/en/news-and-media/news-releases/2022/ihg-hotels-and-resorts-signs-intercontinental-tirana-a-brand-debut-in-albania

- ^ https://www.ihgplc.com/en/news-and-media/news-releases/2022/ihg-hotels-and-resorts-launches-its-premium-voco-brand-in-japan-with-osaka-signing

- ^ https://www.ihgplc.com/en/news-and-media/news-releases/2022/ihg-hotels-and-resorts-marks-6000-hotels-milestone-with-spectacular-openings-and-partnerships

- ^ https://www.ihgplc.com/en/-/media/ihg/files/results/2022/q1-2022/q1-trading-update-30-march-2022-6-may-2022.pdf?la=en&hash=85FF8013CD0027CDDE035C2D7EC355BE

- ^ https://www.ihgplc.com/en/-/media/FBC3B4884AB449A4975A4302F38F1F7D.ashx