JPMorgan Chase & Co.

Summary

- JPMorgan Chase is a financial institution based in the United States that can be traced back to as early as 1799. The company has presence in more than 100 countries in the world and employs 293,723 employees as on December 31, 2022.

- In the fourth quarter of 2022, JPMorgan has reported net interest income of $20.19 billion which was $13.6 billion for the same quarter of 2021. Net income of the company during this quarter is $11.0 billion, up from $10.40 billion in the fourth quarter of 2021.

- JPMorgan Chase reported total net revenue of $128.7 billion, up 6% year-on-year. Reported net income of the company is $37.7 billion for 2022, down 22%.

- JPMorgan Chase conducts its business with four reportable segments - Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking and Asset & Wealth Management.

Brief Company Overview

JPMorgan Chase (NYSE:JPM) is a financial institution based in the United States with a history of over 200 years. JPMorgan Chase had $3.7 trillion in assets and $292 billion in stockholders’ equity as of December 31, 2022. It has presence in over 100+ countries in the world; and the company employs more than 250,000+ employees all around the world. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers, predominantly in the U.S., and many of the world’s prominent corporate, institutional and government clients globally.

JPMorgan Chase (NYSE:JPM) is a financial institution based in the United States with a history of over 200 years. JPMorgan Chase had $3.7 trillion in assets and $292 billion in stockholders’ equity as of December 31, 2022. It has presence in over 100+ countries in the world; and the company employs more than 250,000+ employees all around the world. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers, predominantly in the U.S., and many of the world’s prominent corporate, institutional and government clients globally.

JPMorgan Chase’s principal bank subsidiary is JPMorgan Chase Bank, National Association (“JPMorgan Chase Bank, N.A.”), a national banking association with U.S. branches in 48 states and Washington, D.C. as of December 31, 2022. JPMorgan Chase’s principal non-bank subsidiary is J.P. Morgan Securities LLC (“J.P. Morgan Securities”), a U.S. broker-dealer. The bank and non-bank subsidiaries of JPMorgan Chase operate nationally as well as through overseas branches and subsidiaries, representative offices and subsidiary foreign banks. The Firm’s principal operating subsidiary outside the U.S. is J.P. Morgan Securities plc, a U.K.-based subsidiary of JPMorgan Chase Bank, N.A.

JPMorgan Chase has four reportable segments - the firm’s consumer business is the Consumer & Community Banking (“CCB”) segment. The Firm’s wholesale business segments are the Corporate & Investment Bank (“CIB”), Commercial Banking (“CB”), and Asset & Wealth Management (“AWM”).

As of December 31, 2022, JPMorgan Chase had 293,723 employees globally, an increase of 22,698 employees from the prior year. The Firm’s employees are located in 63 countries, with over 60% of the Firm’s employees located in the U.S. James Dimon is the Chairman & CEO of JPMorgan Chase & Co. The company is listed on the New York Stock Exchange.

Recent Developments

- On January 20, 2023, JPMorgan Chase announced that J.P. Morgan Asset Management had received regulatory approval from the China Securities Regulatory Commission to complete its acquisition of China International Fund Management Co., Ltd.

- In January, 2023, J.P. Morgan Wealth Management Introduces QuickDeposit for Investments, enabling all clients to conveniently deposit checks into their investment accounts anytime from their phone. Now clients can click “Deposit Checks” on the Home or Pay & Transfer tabs in the Chase Mobile app, take a photo of the check and have their funds deposited in their investment account within 24 hours.1

- JPMorgan has been duped into purchasing a startup - a website for a college financial aid platform, for $175 million. JPMorgan shut down the website for a college financial aid platform it bought for $175 million after alleging the company’s founder created nearly 4 million fake customer accounts. It is preparing a lawsuit against the fintech startup entrepreneur.2

- JPMorgan declares dividend on its preferred stock on January 13, 2023, for its preferred stock series DD, EE, GG, JJ, KK, LL, and MM at different amount per share.3

- JPMorgan Chase has announced Alicia Boler Davis as a director of the company on January 17, 2023.4

- JPMorgan Chase & Co. has announced that on October 31, 2022 it will redeem all of the 293,375 outstanding shares of its Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series I (“Series I Preferred Stock”).5

Financial Highlights

Q4 2022 Highlights

In the fourth quarter of 2022, JPMorgan has reported net interest income of $20.19 billion which was $13.6 billion for the same quarter of 2021. Non-interest income reported are $14.35 billion and $15.66 billion, respectively for the periods. Thus, total revenue of the company has increased about 18% comparing these two quarters. Net income of the company during this quarter is $11.0 billion, up from $10.40 billion in the fourth quarter of 2021. Diluted earnings per share (EPS) of the company for the fourth quarter of 2022 is $3.57, up from $3.33. Return on equity (ROE) for both periods is 16%. Return on tangible common equity (ROTCE) for the periods are 20% and 19%, respectively, for Q4 of 2022 and Q4 of 2021.

At the end of fourth quarter of 2022, the company had $3,265 billion interest-earning assets, compared to $3,337 billion for the same period a year earlier. Total interest-bearing liability of the company for the periods was $2,498 billion and $2,526 billion, respectively. Dividend declared on common stock of the for the fourth quarter of 2022 is $2.97 billion, compared to $2.98 billion for the same quarter a year earlier.

Annual Performance Highlights

JPMorgan Chase reported total net revenue of $128.7 billion, up 6%, reflecting net interest income of $66.7 billion, up 28%, driven by higher rates and loan growth, partially offset by lower Markets net interest income. Net interest income excluding Markets was $62.4 billion, up 40%. Noninterest revenue reported is $62.0 billion, down 11%, driven by lower Investment Banking fees, $2.4 billion of net investment securities losses in Treasury and CIO, lower net production revenue in Home Lending and lower auto operating lease income, largely offset by higher CIB Markets revenue and a $914 million gain on the sale of Visa Class B common shares (“Visa B shares”) in Corporate. Reported net income of the company is $37.7 billion for 2022, down 22%.

Noninterest expense was $76.1 billion, up 7%, driven by higher structural expense and continued investments in the business, including compensation, technology and marketing, partially offset by lower volume- and revenue-related expense.

The provision for credit losses was $6.4 billion, reflecting a net addition of $3.5 billion to the allowance for credit losses, consisting of $2.3 billion in wholesale and $1.2 billion in consumer, driven by loan growth and deterioration in the Firm’s macroeconomic outlook, partially offset by a reduction in the allowance related to a decrease in uncertainty associated with borrower behavior as the effects of the pandemic gradually recede, and $2.9 billion of net charge-offs. The prior year provision was a net benefit of $9.3 billion, reflecting a net reduction to the allowance for credit losses of $12.1 billion.

On December 31, 2022, firm's nonperforming assets totaled $7.2 billion, a net decrease of $1.1 billion. Firmwide average loans were $1.1 trillion, up by 6%. Firmwide average deposits stood at $2.5 trillion, up 5% from the previous year. CET1 capital was $219 billion, and the Standardized and Advanced CET1 ratios were 13.2% and 13.6%, respectively.

As of December 31, 2022, the Firm had average eligible High Quality Liquid Assets (“HQLA”) of approximately $733 billion and unencumbered marketable securities with a fair value of approximately $694 billion, resulting in approximately $1.4 trillion of liquidity sources.

Return on common equity (ROE) for 2022 has been 14%, down from 19% a year earlier. Return on tangible common equity (ROTCE) is 18% and 23% for the years, respectively. Cash dividend declared from the years are $4.00 and $3.80, respectively.

On December 31, 2022, JPMorgan had $1 par value 200 million shares of preferred stock authorized and 2.74 million shares issued; $1 par value 9,000 million shares of common stock and 4,104.93 shares issued.

Net cash provided by operation of the company in 2022 is $107,119 million, compared to $78,084 million a year earlier. Net cash used in investing activities for 2022 is $137,819 million, as compared to $129,344 million in 2021. Owing to a big unfavorable change in the deposit, which was positive $293,764 million in 2021 and negative $136,895 million in 2022, net cash used in financing activities of the company is $126,257 million in 2022 and net cash provided by the same is $275,993 million in 2021.

Business Overview

JPMorgan Chase conducts its business with four reportable segments - Consumer & Community Banking, Corporate & Investment Bank, Commercial Banking and Asset & Wealth Management. In addition, there is a Corporate segment. The business segments are determined based on the products and services provided, or the type of customer served.

Consumer & Community Banking (CCB)

Consumer & Community Banking offers products and services to consumers and small businesses through bank branches, ATMs, digital (including mobile and online) and telephone banking. CCB is organized into Banking & Wealth Management (including Consumer Banking, J.P. Morgan Wealth Management and Business Banking), Home Lending (including Home Lending Production, Home Lending Servicing and Real Estate Portfolios) and Card Services & Auto. Banking & Wealth Management offers deposit, investment and lending products, cash management, payments and services. Home Lending includes mortgage origination and servicing activities, as well as portfolios consisting of residential mortgages and home equity loans. Card Services issues credit cards and offers travel services. Auto originates and services auto loans and leases.

Net revenue of this segment was $55.0 billion in 2022, an increase of 10% from the previous year; net income was $14.9 billion, down 29%, reflecting a net increase in the provision for credit losses compared with a net benefit in the prior year.

Corporate & Investment Bank (CIB)

This business segment consists of Banking and Markets & Securities Services and offers a broad suite of investment banking, market-making, prime brokerage, lending, and treasury and securities products and services to a global client base of corporations, investors, financial institutions, merchants, government and municipal entities. Banking offers a full range of investment banking products and services in all major capital markets, including advising on corporate strategy and structure, capital-raising in equity and debt markets, as well as loan origination and syndication. Banking also includes Payments, which provides payments services enabling clients to manage payments and receipts globally, and cross-border financing. Markets & Securities Services includes Markets, a global market-maker across products, including cash and derivative instruments, which also offers sophisticated risk management solutions, prime brokerage and research. Market & Securities Services also includes Securities Services, a global custodian which provides custody, fund accounting and administration, and securities lending products principally for asset managers, insurance companies and public and private investment funds.

Net revenue of this segment was $47.9 billion in 2022, an decrease of 7% from the previous year; net income was $15 billion, down 29%.

Commercial Banking (CB)

Commercial Banking provides comprehensive financial solutions, including lending, payments, investment banking and asset management products across three primary client segments: Middle Market Banking, Corporate Client Banking and Commercial Real Estate Banking. Other includes amounts not aligned with a primary client segment. Middle Market Banking covers small and midsized companies, local governments and nonprofit clients. Corporate Client Banking covers large corporations. Commercial Real Estate Banking covers investors, developers, and owners of multifamily, office, retail, industrial and affordable housing properties.

Net revenue from this segment was $11.5 billion, up 15%. Net interest income was $8.2 billion, up 35%, driven by deposit margin expansion on higher rates and growth in loans, predominantly offset by the impact of higher funding costs and lower deposits. Net income was $4.2 billion, down 20%, reflecting a net increase in the provision for credit losses compared with a net benefit in the prior year.

Asset & Wealth Management (AWM)

Asset management offers multi-asset investment management solutions across equities, fixed income, alternatives and money market funds to institutional and retail investors providing for a broad range of clients’ investment needs. A global private bank under this segment provides retirement products and services, brokerage, custody, estate planning, lending, deposits and investment management to high net worth clients.

Net revenue from this segment was $17.7 billion, up 5%. Net interest income was $5.2 billion, up 35%. Noninterest revenue was $12.5 billion, down 4%. Net income was $4.4 billion, down 8%.

Corporate

The Corporate segment consists of Treasury and Chief Investment Office (“CIO”) and Other Corporate. Treasury and CIO is predominantly responsible for measuring, monitoring, reporting and managing the Firm’s liquidity, funding, capital, structural interest rate and foreign exchange risks. Other Corporate includes staff functions and expense that is centrally managed as well as certain Firm initiatives and activities not aligned to a specific LOB. The major Other Corporate functions include Real Estate, Technology, Legal, Corporate Finance, Human Resources, Internal Audit, Risk Management, Compliance, Control Management, Corporate Responsibility and various Other Corporate groups.

Net revenue from this segment was $80 million, compared with a loss of $3.5 billion driven by higher net interest income due to higher rates, partially offset by lower noninterest revenue. Net loss was $743 million, compared with a net loss of $3.7 billion in the prior year.

Risks

The principal risk factors that could adversely affect JPMorgan Chase’s business are results of operations, financial condition, capital position, liquidity, competitive position or reputation.

- Post-script of the COVID-19 pandemic and its impact on the global economy.

- Regulatory risk is high for a company belonging to the financial services industry.

- Market risks - changes in interest rates and credit spreads.

- Credit risks of the financial institutions.

- Liquidity risks arising from unforeseen liquidity or capital requirements, the inability to sell assets, default by a significant market participant, unanticipated outflows of cash or collateral, or lack of market or customer confidence in JPMorgan Chase. Apart from that the dependence of JPMorgan Chase & Co. on the cash flows of its subsidiaries; the adverse effects that any downgrade in any of JPMorgan Chase’s credit ratings may have adverse effect on its liquidity and cost of funding; and potential negative impacts on JPMorgan Chase’s funding, investments and financial products, as well as litigation risks, are associated with the transition from U.S. dollar LIBOR and other benchmark rates.6

- Operational risks including changes to products, services and delivery platforms, attacks on cyber system, risks from third-party association, failure in judgement and modelling of its forecasts, unintentional noncompliance of regulatory measures etc.

- Reputation risks from failure to maintain good terms with the clients, customers, shareholders, regulators, and other stakeholders.

- Country risks, including potential impacts on JPMorgan Chase’s businesses from an outbreak or escalation of hostilities between countries or within a country or region.

- People risks include failure to attract and retain qualified workforce.

- Legal risks relating to litigation and regulatory and government investigations.

Company History

JPMorgan Chase & Co. can be traced back to 1799 in New York City. Around 1,200 predecessor institutions have come together to form what today is called JPMorgan Chase & Co. Many heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First National Bank of Chicago, National Bank of Detroit, The Bear Stearns Companies Inc., Robert Fleming Holdings, Cazenove Group and the business acquired in the Washington Mutual transaction.

| Year | Particulars |

| 1799 | The Manhattan Company, JPMorgan Chase's earliest predecessor institution, is chartered by the New York State legislature to supply "pure and wholesome" drinking water to the city's growing population. |

| 1807 | The Manhattan Company takes its first philanthropic endeavor to grants New York City’s volunteer fire companies free access to its network of water pipes to fight fires, contributing to the community’s public safety. |

| 1812 | The New York Manufacturing Company, the earliest predecessor in Manufacturers Hanover’s family tree, is created to produce tools and parts for the textile industry. The company’s charter permits it to conduct a banking operation, similar to The Manhattan Company's example, and it establishes Phenix Bank in 1817. |

| 1817 | The Bank of The Manhattan Company is a key lender for the construction of the Erie Canal, which opens in 1825 linking the Hudson River to the Great Lakes. |

| 1823 | New York City merchants organize the New York Chemical Manufacturing Company to produce chemicals, medicines, paints and dyes. |

| 1839 | The Bank of Commerce opens in New York City. This institution, which merges with the Guaranty Trust Company of New York in 1929, is the earliest predecessor on the J.P. Morgan family tree. |

| 1853 | The New York Clearing House is organized, with several JPMC predecessors as charter members, to systematize the daily settling of checks drawn on other local banks. |

| 1853 | Springfield Marine and Fire Insurance Company opens in 1851 to insure shipping vessels and goods, but it also provides a variety of banking services. Illinois lawyer Abraham Lincoln opens a bank account there two years later with an initial deposit of $310. |

| 1854 | Junius S. Morgan, patriarch of the Morgan banking family, moves to London and joins the private banking firm George Peabody & Co. |

| 1857 | A financial panic causes 18 New York City banks to close on a single day and ushers in a severe economic depression. Most banks suspend “specie payments” but Chemical Bank continues to redeem banknotes in gold coin, helping to stabilize the financial markets and earning it the nickname “Old Bullion.” |

| 1862-1864 | New banking laws passed during the Civil War authorize the U.S. government to create a uniform national currency, ease borrowing to pay its war expenses, and set up a new system of nationally chartered banks. The Legal Tender Act of 1862, and The National Bank Act of 1863 are passed. |

| 1863 | The First National Bank of Chicago opens for business, becoming the eighth nationally chartered bank under the new National Banking Act. JPMorgan Chase Bank continues to operate under this charter #8 to this day. |

| 1863 | The New York Guaranty and Indemnity Company is founded in New York. This institution, which evolves into Guaranty Trust Company of New York, later merges with J.P. Morgan & Co. in 1959. |

| 1871 | J. Pierpont Morgan partners with Philadelphia banker Anthony Drexel to form Drexel, Morgan & Co., a private merchant banking house in New York City. |

| 1877 | Chase National Bank is founded by John Thompson, a noted New York City banker and financial publisher. |

| 1889 | The Great Seattle Fire and founding of Washington Mutual. |

| 1892 | Drexel, Morgan & Co. finances the consolidation of Thomas Edison’s electric companies with the Thomson-Houston Electric Company to form General Electric Company, one of the most important industrial combinations of the late 19th century. |

| 1901 | United States Steel is organized |

| 1904 | Morgan finances the Panama Canal |

| 1911 | Morgan finances the Houston Ship Channel |

| 1913 | J. Pierpont Morgan dies while traveling in Rome on March 31, 1913. His son, J.P. (Jack) Morgan, Jr. becomes J.P. Morgan & Co.'s senior partner. |

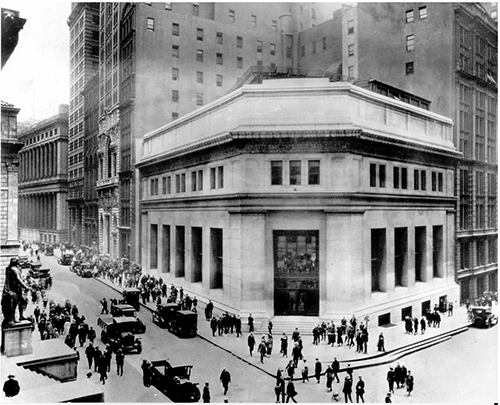

| 1914 | Construction begins in 1912 on a new J.P. Morgan & Co. headquarters at the firm’s historic site at 23 Wall Street. |

| 1920 | Chase National Bank and Guaranty Trust Company set up affiliates to do securities underwriting and open new branches in Europe, Asia and Latin America. Chase National merges with Equitable Trust Company in 1930, combining their extensive overseas branch networks and making Chase the world’s largest bank. |

| 1933 | The National Bank of Detroit, forerunner of NBD Bancorp, opens in Detroit amidst a nationwide financial collapse. As depositors lose confidence in banks’ solvency, the federal government declares a bank holiday – closing all banks to give the financial system time to stabilize. |

| 1940 | J.P. Morgan & Co., a private partnership since its inception, incorporates and sells shares to the public, becoming J.P. Morgan & Co. |

| 1941 | National Bank of Detroit is the first JPMC heritage bank to open a drive-in banking window. |

| 1947 | Chase National Bank establishes a branch in Japan and the first post-war U.S. bank branch in Germany. |

| 1955 | Chase National Bank merges with The Bank of The Manhattan Company to form Chase Manhattan Bank. |

| 1958 | Chase launches the first credit card in New York. |

| 1959 | J.P. Morgan & Co. Incorporated merges with Guaranty Trust Company of New York forming Morgan Guaranty Trust Company of New York. |

| 1960 | Chase Manhattan introduces the Octagon logo. Chase also unveils a new advertising campaign around the same time. The “You Have a Friend at Chase” campaign runs from January 1960 through 1975 and becomes one of the first to feature the bank’s new logo |

| 1961 | Chase Manhattan, First National Bank of Chicago and National Bank of Detroit each install computer equipment for the electronic processing of checks. Only two years after Chase Manhattan Bank installs one of the first computers in New York, an IBM 650 Data Processing System, the bank builds an automated check-processing center. |

| 1966 | City National Bank & Trust Company in Columbus, Ohio, (Bank One’s main predecessor) establishes a national credit card program, becoming the first bank outside of California to introduce the BankAmericard, the precursor to Visa. In 1969, Manufacturers Hanover and Chemical Bank are among the founding issuers of the Master Charge Plan, today’s Master Card. |

| 1969 | Chemical Bank installs the nation’s first cash dispensing machine – the precursor to the ATM – in a Rockville Center branch on Long Island, inaugurating 24-hour banking in the New York metropolitan area. |

| 1969 | Morgan Guaranty, Chase Manhattan, Manufacturers Hanover, Chemical, and First National Bank of Chicago all reorganize to form holding companies, corporate entities that own the capital stock of their lead banks. |

| 1973 | Opens door to Russia and China. |

| 1985 | The New York Cash Exchange (NYCE), the first automatic teller network in the New York metropolitan area, gives customers access to more than 800 ATMs in 650 locations in the tri-state area. |

| 1989 | In a relaxation of the Glass-Steagall banking laws separating commercial and investment bank activities, the U.S. Federal Reserve grants J.P. Morgan & Co. the right to underwrite and deal in corporate debt securities. |

| 1991 | Chemical Banking Corporation merges with Manufacturers Hanover Corporation, reported in the press as a "merger of equals." |

| 1995 | First Chicago Corporation merges with NBD Bancorp. The new firm, First Chicago NBD, is the largest banking company in the Midwest and the seventh largest bank holding company in the U.S. |

| 1995 | Chemical launches Online Banking which allows customers to consolidate all of their accounts and access them from their home computers. Two years later, NBD Bank, Bank One and Chase each introduce online banking services. |

| 1996 | Chase Manhattan Corporation merges into Chemical Banking Corporation in one of the largest consolidations in U.S. banking history. |

| 1998 | Banc One Corporation merges with First Chicago NBD. The new firm, retaining the name Bank One Corporation, chooses Chicago as its headquarters and becomes the fourth largest bank in the U.S. and the world's largest Visa credit card issuer. |

| 2000 | J.P. Morgan & Co. Incorporated merges with The Chase Manhattan Corporation. The new firm is named J.P. Morgan Chase & Co. |

| 2004 | J.P. Morgan Chase & Co. merges with Bank One Corporation. The new firm, with its corporate headquarters based in New York and its retail division based in Chicago, retains the name JPMorgan Chase & Co. |

| 2008 | JPMorgan Chase & Co. acquires Bear Stearns and Washington Mutual |

| 2010 | J.P. Morgan acquires full ownership of the firm's U.K. joint venture, J.P. Morgan Cazenove, with origins dating to 1823. |

| 2010 | J.P. Morgan leads General Motors in its historic initial public offering (IPO), serving as joint bookrunner and co-representative of the underwriters in the $23.1 billion sale, the world’s largest IPO at the time. |

| 2015 | The company announces Chase Pay |

| 2018 | JPMorgan Chase announces plans to replace its headquarters building at 270 Park Avenue with a new resource efficient skyscraper. The new world-class office tower, will house all NYC midtown employees. |

| 2018 | Launches AdvancingCities - a $500 million, five-year initiative to invest in solutions that bolster the long-term viability of the world's cities and communities that have not benefited from economic growth. |

- ^ https://www.jpmorganchase.com/news-stories/jp-morgan-wealth-management-introduces-quickdeposit-for-investments

- ^ https://www.cnbc.com/2023/01/12/jpmorgan-chase-shutters-student-financial-aid-website-frank.html

- ^ https://www.jpmorganchase.com/ir/news/2023/jpmc-declares-preferred-stock-dividends-01-13

- ^ jpmorganchase.com/ir/news/2023/jpmc-elects-alicia-boler-davis-to-its-board-of-directors

- ^ https://www.jpmorganchase.com/ir/news/2022/jpmc-to-redeem-all-2-9-billion-of-its-fixed-to-floating-rate-non-cumulative-preferred-stock-series-i

- ^ https://jpmorganchaseco.gcs-web.com/static-files/1293b833-c774-4377-ab22-abb3d15e01c8