Lightwave Logic, Inc.

Summary

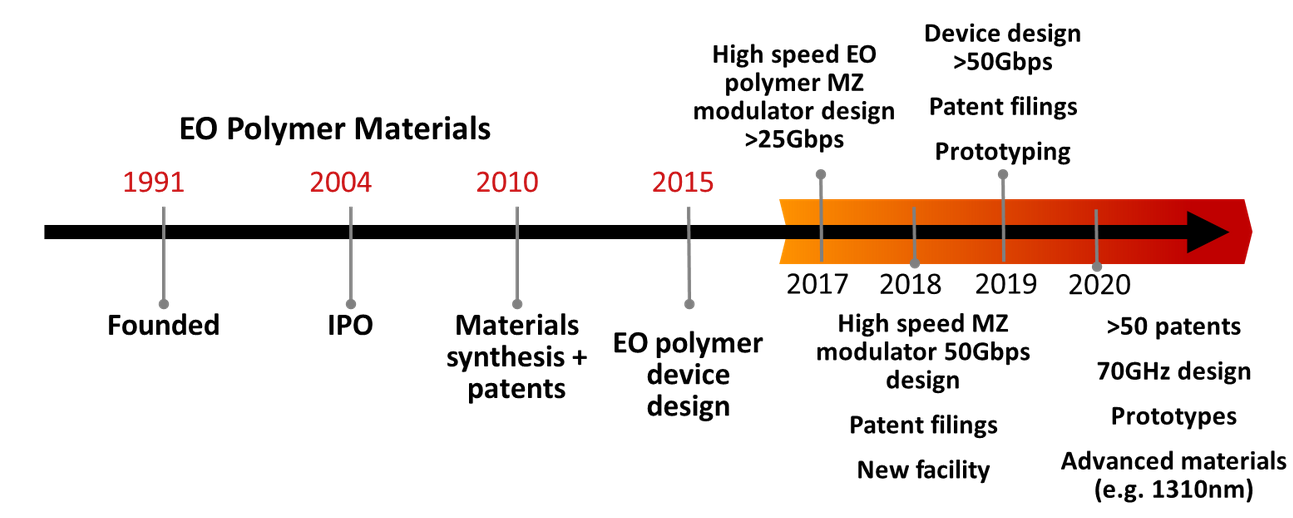

- Lightwave Logic, Inc. is a technology platform company established 1991, incorporated 1997 and got listed on NASDAQ in 2021.

- The company is still at a developing stage and yet to generate any revenue. The products are testing and at prototype stage.

- Total number of shares (basic) of the company stands at 111,887,124, and that of diluted is 111,887,124 as on June 30, 2022. Of the total stock of the company, 0.47% shares are held by the insiders, 22.54% by institutional investors. There are a total of 151 institutions holding the shares of Lightwave Inc.

- During this quarter ended June 30, 2022, Lightwave has reported no sales, which was the case for the same quarter of the previous year as well. Loss from operation of the company is $3.76 million, which was $3.45 million the previous period. Net loss of the company stands at $3.80 million, which was $4.53 million in the previous period due to higher commitment fee of $1.08 million.

- Net loss of the past year is $18,631,381, and $6,715,564 a year earlier; earning per share (EPS) negative $0.18, and $0.07 a year earlier.

- The company is continuing its research on two types of devices – elector-optic modulators, and polymer photonic integrated circuits (P2ICTM).

- Its first prototype product is The Ridge Waveguide Modulator.

Brief Company Overview

Lightwave Logic, Inc. (Nasdaq: LWLG) is a developing-stage company established in 1991. The company is trying to working on developing a platform leveraging its proprietary engineered electro-optic (EO) polymers to transmit data at higher speeds with less power. But although it has gathered about 71 patents since its first one in 2008, the revenue of the company stands zero as of today except for a small $2,500 revenue in 2014.1

Lightwave Logic, Inc. (Nasdaq: LWLG) is a developing-stage company established in 1991. The company is trying to working on developing a platform leveraging its proprietary engineered electro-optic (EO) polymers to transmit data at higher speeds with less power. But although it has gathered about 71 patents since its first one in 2008, the revenue of the company stands zero as of today except for a small $2,500 revenue in 2014.1

Lightwave was incorporated in 1997 as an Eastern Idaho Internet Services, Inc., and in 2004 acquired PSI-TEC Corporation. In 2006 they changed their name to Third-Order Nanotechnologies, Inc and became Lightwave Logic in 2008.

Total number of shares (basic) of the company stands at 111,887,124, and that of diluted is 111,887,124 as on June 30, 2022. Of the total stock of the company, 0.47% shares are held by the insiders, 22.54% by institutional investors. There are a total of 151 institutions holding the shares of Lightwave Inc. Top institutional holders include Blackrock Inc., Vanguard Group, Inc. (The), State Street Corporation, and Geode Capital Management, LLC.2 The company got listed on NASDAQ on September 01, 2021.

Financial Analysis

Q2’22 Results

During this quarter ended June 30, 2022, Lightwave has reported no sales, which was the case for the same quarter of the previous year as well. Research and development (R&D) cost for these two periods are reported to be $2.78 million and $2.79 million, respectively. General and administrative is reported $987,137 and $658,738 for the two periods, respectively. Thus, loss from operation of the company is $3.76 million, which was $3.45 million the previous period.

Lightwave has reported interest income during Q2’22 of $13,398, which was $105 the previous period. After further adding commitment fee of $47,644 to the loss from operation, net loss of the company stands at $3.80 million, which was $4.53 million in the previous period due to higher commitment fee of $1.08 million. Thus, reported earnings per share (EPS) for this quarter is negative 0.03, which was $0.04 the previous period due to lower number of outstanding shares.

Total current assets of the company reported on June 30, 2022 is $25.61 million which was $23.66 million a year earlier. The increase is due to improved cash position as well as increase in other current assets. Property, plant and equipment of the company stands at $2.09 million, which was $2.17 million a year earlier. The company has total current liability of $723,968, down from $1,585,973 a year earlier. Lightwave has deferred and operating lease liabilities on its balance sheet, totalling $323,919 on June 30, 2022, and $438,330 a year earlier.

Lightwave has 1,000,000 authorized preferred stocks of $0.001 par value, but none issued. Common stocks authorized is 250,000,000 and issued 111,887,124 shares as on June 30, 2022. Accumulated deficit of the company stands at $96,961,240 on June 30, 2022.

Net cash used in operating activities of the company during the SIX months period ended June 30, 2022 is $5,245,275, which was $2,991,879 during the same period a year earlier. Net cash used in investing activities $414,565, which was $654,699 during the previous period. Cash inflow from financing activities is $7,056,977 this period, and $14,253,507 the previous. Together with the opening cash balance, which is a result of higher cash inflows from financing activities of the previous period, of $23,432,612, cash position during at the end of this period stands at $24,829,749.

Analysis of the Past Year

In the past year ended on December 31, 2021, the results are somewhat similar to that of Q2’22 since the company had no sales during that period as well. Numbers of this period briefly are – R&D $12,476,040, and $4,590,545 a year earlier; loss from operations $16,996,443, and $6,599,974 a year earlier; Paycheck Protection Program loan forgiveness $419,700, and $0 a year earlier; interest income $13,826, and $776 a year earlier; net loss $18,631,381, and $6,715,564 a year earlier; earning per share (EPS) negative $0.18, and $0.07 a year earlier.

Lightwave has reported $23,664,920 in its current assets on December 31, 2021, which was $3,873,775 in the previous year. Property, plant and equipment of the company in 2021 was $2,179,075, which was $1,873,549 a year earlier. Current liabilities of the company at the end of 2021 period was $1,585,973, which was $933,032 a year earlier. Shares of common stock outstanding on December 31, 2021 was 110,555,459. Accumulated deficit of the company was $89,602,881 and $70,971,500, respectively.

Lightwave has reported net cash of $10,038,626 used in operating activities during 2021, which was $4,873,863 a year earlier. Net cash used in investing activities $1,116,179, which was $217,984 during the previous year. Cash inflow from financing activities is $31,280,827 this year, and $6,162,093 the previous.

Commitment on Leases

On October 30, 2017, Lightwave entered into a lease agreement to lease approximately 13,420 square feet of office, laboratory and research and development space located in Colorado for the Company’s principal executive offices and research and development facility. The term of the lease is sixty-one (61) months, beginning on November 1, 2017 and ending on November 30, 2022. During January 2022, the term was extended for an additional twenty-four (24) months. Base rent for the first year of the lease term is approximately $168,824, with an increase in annual base rent of approximately 3% in each subsequent year of the lease term. As specified in the lease, the Company paid the landlord ![]() all base rent for the period November 1, 2017 and ending on October 31, 2019, in the sum of $347,045; and (ii) the estimated amount of tenant’s proportionate share of operating expenses for the same period in the sum of $186,293.3

all base rent for the period November 1, 2017 and ending on October 31, 2019, in the sum of $347,045; and (ii) the estimated amount of tenant’s proportionate share of operating expenses for the same period in the sum of $186,293.3

Company Overview

Lightwave Logic (Nasdaq:LWLG) is a technology platform company, leveraging its proprietary technology platform to develop electro-optic polymers which increase the efficiency of internet infrastructure by converting data into optical signals, allowing more data to be transmitted at significantly higher speeds and with less power than existing solutions.

Lightwave Logic, Inc. was established in 1991 and headquartered in Englewood, Colorado, USA. The company has zero revenue for at least past five years of its operation. The products the company is trying to develop are still under research.

What and Why is Polymer Phonics4

Polymers are widely used today in photonics. However, these are optical polymers, not electro-optic polymers. Optical polymers are excellent for passive optics such as lenses, adhesives between lenses, and more recently, waveguides. Put simply, passive optical polymers take light from one place to another, analogous to wiring or printed circuit boards for electronics.

Electro-optics (EO) are also not new but much has changed recently. Lightwave Logic believes that polymer photonics are coming to the forefront of discussion again now for a variety of reasons, most notably the need for more robust performance characteristics. A few decades ago, there was a push for EO polymers that did not result in widespread commercialization. Lithium niobate, established and proven, took precedence in the market which was dominated by telecom demands. Its performance was adequate at the time even though it did not have the performance advantages of polymers.

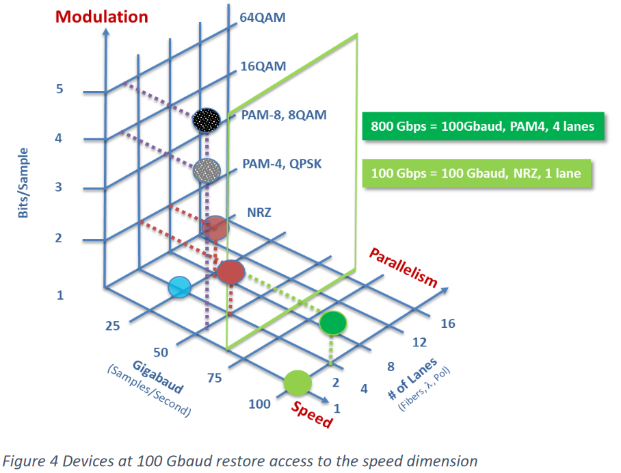

Today, the market is driven by datacom. The main source of discomfort for both datacom and telecom operators is lack of performance, specifically as it relates to very high speeds and very low power consumption.

Product Pipeline

Lightwave Logic, Inc. is developing proprietary photonic devices based on electro-optical polymer systems. According to the company reports, current legacy technology is based on inorganic crystalline materials, which has allowed for the proliferation of data over fiber optic cables. However, there are inherent molecular deficiencies that have prevented this technology from scaling down in price and up in functionality, especially in terms of $/Gbps. This is primarily due to a closed valence structure that does not allow for the molecular improvements. The valence or valency of an element is a measure of its combining power with other atoms when it forms chemical compounds or molecules. Also, the physical properties of a crystal do not allow for its implementation into highly miniaturize slot structures that are in simple terms the pathways that light travels through in the device.5

The company defends its research and development with this paragraph – “organic polymer materials on the other hand, have free electrons that allow for limitless potential to combine with other molecular structures, which allows for multiple options and combinations to improving performance characteristics. Importantly, because they can be applied to optical structures in thin-film liquid form, it is possible to imbue electro-optic ability to highly miniaturized slot structures. Organic polymer materials are also vastly cheaper to manufacture in comparison to growing exotic crystals that are prone to contamination and further must be sliced into thin wafers. Our Company believes that the combination of less expensive manufacturing cost, ease of application, and better scalability, together with a lower cost of ownership due to marked less heat dissipation (requiring less cooling), will create enormous demand for our products”.

The company is continuing its research on two types of devices – elector-optic modulators, and polymer photonic integrated circuits (P2ICTM).

Electro-optic Modulators are devices that convert data from electric signals into optical signals which can then be transmitted over high-speed fiber-optic cables. Modulators are key components that are used in fiber optic telecommunications, data communications, and data centers networks etc., to convey the high data flows that have been driven by applications such as pictures, video streaming, movies etc., that are being transmitted through the Internet.

Polymer Photonic Integrated Circuits (P2ICTM) is a photonic device that integrates several photonic functions on a single chip. One type of integration is to combine several instances of the same photonic functions such as a plurality of modulators to create a 4-channel polymer PIC. In this case, the number of photonic components would increase by a factor of 4. Another type is to combine different types of devices including from different technology bases such as the combination of a semiconductor laser with a polymer modulator. P2IC™ platform of Lightwave encompasses both these types of architecture. The company believes that their technology can enable the ultra-miniaturization needed to increase the number of photonic functions residing on a semiconductor chip to create a progression like what was seen in the computer integrated circuits, commonly referred to as Moore’s Law.

The Ridge Waveguide Modulator

This is the first prototype of the company’s photonic devices that is the company started producing 2016. This modulator can fabricate waveguide within a layer of the integrated photonics platform. In 2017, the company a bandwidth suitable for 25Gbps data rates. In July 2017, the company advanced their high-speed modulation performance to satisfy 28Gbps data rates for QSFP28 standards and 100Gbps data center applications.6 The company reports that it achieved another breakthrough in September, 2017 that will allow 50Gbps modulation in fiber-optic communications.

Recent Development

- A breakthrough peer-reviewed paper result has been presented at European Conference on Optical Communications (ECOC) on September 22, 2022 where Lightwave Logic together with Polariton Technologies demonstrated of a 250GHz super high bandwidth electro-optical-electrical (EOE) link through a collaboration with ETH Zurich.7

- ^ https://seekingalpha.com/article/4446965-lightwave-logic-recent-500-percent-plus-runup-is-without-substance

- ^ https://finance.yahoo.com/quote/LWLG/holders?p=LWLG

- ^ For more details see – 10-K Filing 2021, p.F-11

- ^ This section is from: https://www.lightwavelogic.com/technology/why-polymer-photonics-now/

- ^ 10-K Filing 2021, p.3

- ^ 10-K Filing 2021, p.4

- ^ https://www.prnewswire.com/news-releases/lightwave-logic-and-polariton-technologies-announce-world-record-performance-for-250-ghz-optical-link-301630744.html