Mahindra & Mahindra Financial Services Ltd

Company Overview

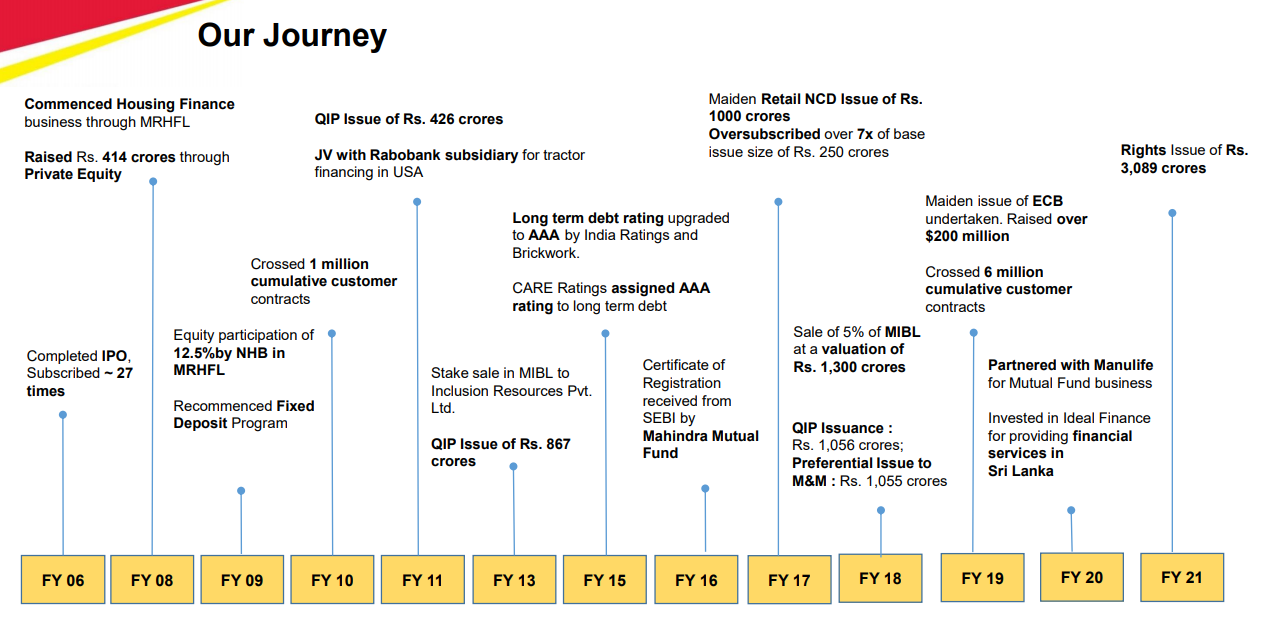

Mahindra & Mahindra Financial Services Ltd (NSE: M&MFIN) began as a captive financier of Mahindra Utility Vehicles in the early 90s. From Mahindra UVs to tractors to non-Mahindra products, the company has diversified into a financial services provider with a whole suite of financial solutions tailored to the under-served customer in under-penetrated rural markets. 1

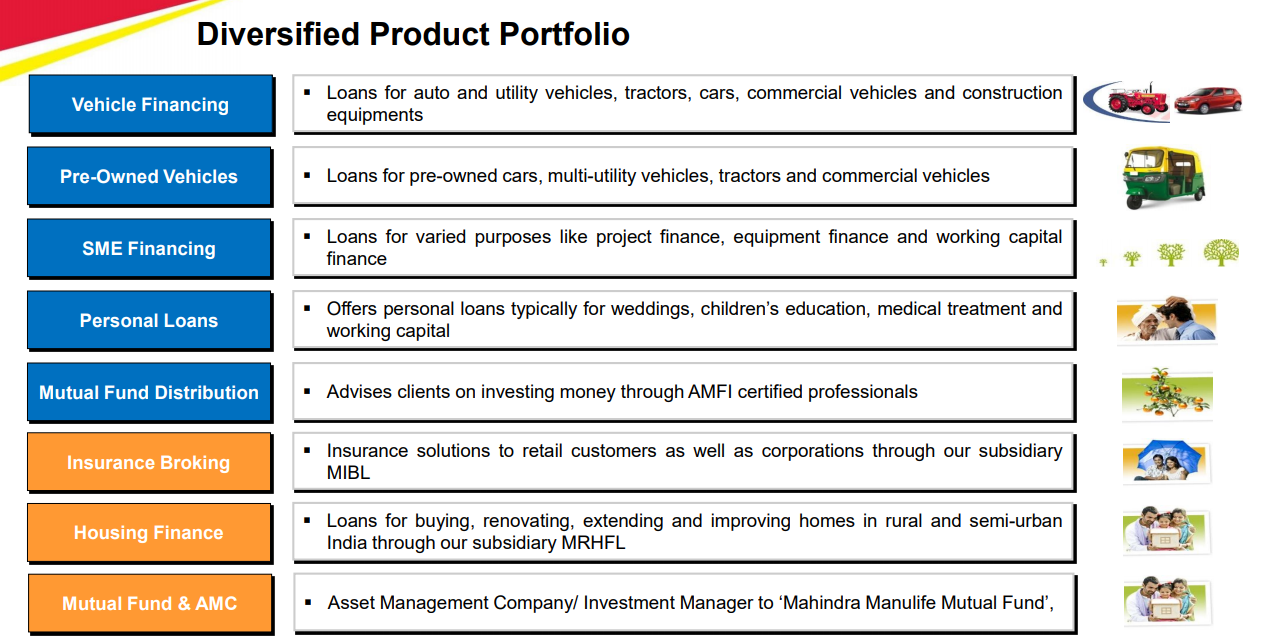

The company's product portfolio consists of vehicle finance, which includes financing of passenger vehicles, utility vehicles, tractors, commercial vehicles, construction equipment; and pre-owned vehicles and SME finance, which includes project finance, equipment finance, working capital finance and bill discounting services to SMEs. The company also undertakes mutual fund distribution, fixed deposits and personal loans tailor-made to suit its unique customer set.

With over 33,000 employees, Mahindra Finance has a presence in every state in India and a footprint in 85% of its districts. It has a network of over network 1380 offices, serving customers in more than 3, 80,000 villages– that’s one in every two villages in the country. And has assets under management (AUM) of over Rs. 81,500 crores.

Since inception, Mahindra Finance has served as a positive change agent catering to the financial needs of millions in rural and semi-urban India. Its deep connection with the customers and their evolving needs has been the key to its growth and success. The company has thus pioneered several innovative financial solutions tailor-made to the earning patterns of the unique “Earn and Pay” segment that it serves.

The company's endeavour to stay deeply connected with the customer begins with its recruitment strategy. The company consciously recruit employees at the local level, rather than appoint them from cities and depute them to rural branches.

The company's employees speak the local language, are connected to the land, its people, and understand the local challenges. This connect also helps it anticipate market needs and business trends and enables it to respond with the right combination of products and solutions.

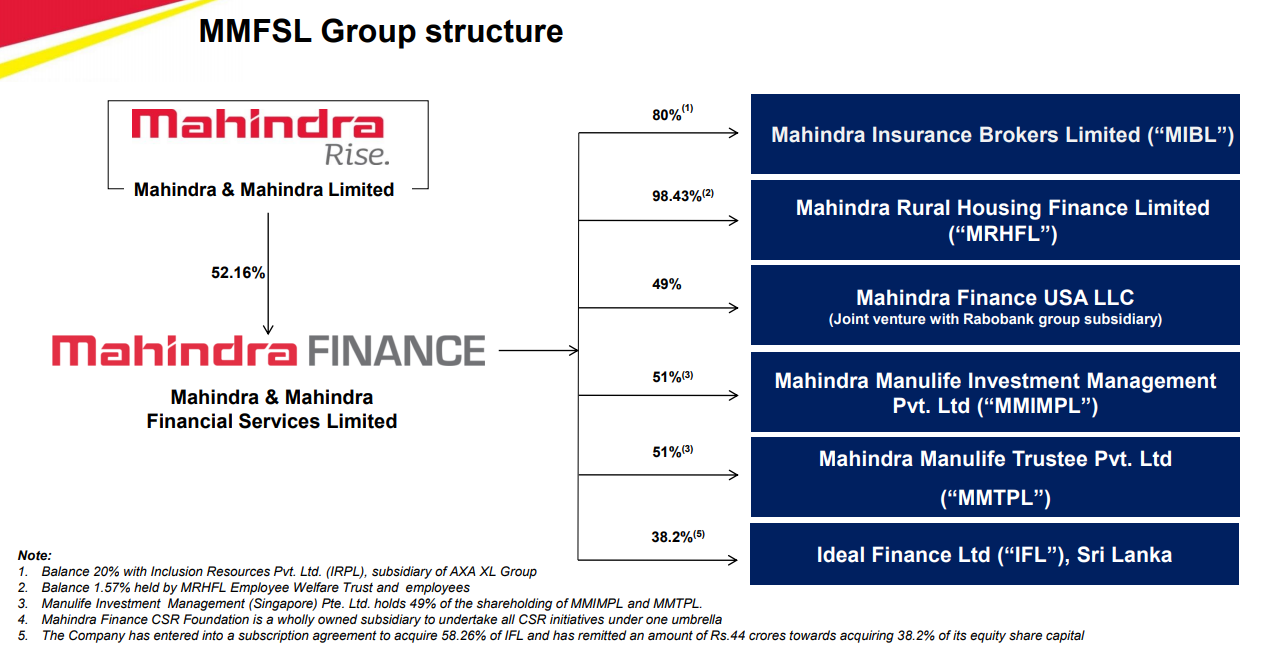

Through its subsidiary, Mahindra Insurance Brokers Limited (MIBL), the company provide life and non-life insurance products through tie-ups with various leading insurance companies. Another one of its subsidiaries Mahindra Rural Housing Finance, provides loans for home construction, extension, purchase and improvement to customers in rural and semi-urban India. Mahindra Asset Management Company, offers a variety of mutual fund schemes, with a special focus in rural and semi urban areas. Interestingly, its Mutual Fund schemes have been launched with Hindi names, so that investors in rural areas understand the objectives of the schemes better.

Mahindra Finance is the only Non-Banking Financial Company from India to be listed on Dow Jones Sustainability Index in Emerging Market Category. Mahindra Finance has been ranked in Top 20 India's Best Workplaces to Work in BFSI, 2019 by Great Place to Work® Institute India. M&MFIN has also been recognized as Aon Best Employer 2019 and ranked 49th amongst Top 100 Indian companies for Sustainability & CSR under Responsible Business Rankings 2019 by Futurescape

Industry Overview

Indian Financial Services Industry

India has a diversified financial sector undergoing rapid expansion with many new entities entering the market along with the existing financial services firms. The sector comprises commercial banks, insurance companies, NBFCs, housing finance companies, co-operatives, pension funds, mutual funds and other smaller financial entities. The RBI’s continued focus on financial inclusion has expanded the target market to semi-urban and rural areas. NBFCs, especially those catering to the urban and rural poor namely Non-Banking Financial Company Micro Finance Institutions (NBFC-MFIs) and asset finance companies, have a complementary role in the financial inclusion agenda of the country. After the COVID-19 impact gradually tapers off, the financial services sector is poised to grow eventually on the back of strong fundamentals, adequate liquidity in the economy, significant government and regulatory support, and the increasing pace of digital adoption. In fact, digital transactions will play a larger role in the financial eco-system than hitherto witnessed. 2

NBFCs

Over the past few years, NBFCs have undergone a significant transformation and today they form an important component of India’s financial system. Playing a critical role in the development of infrastructure, transport and employment generation, NBFCs are changing the business loan landscape in the country. Most NBFCs, leverage alternative and tech-driven credit appraisal methodologies to assess the credit worthiness of prospective borrowers.

This difference in approach allows them to meet loan requirements of individuals and businesses left traditionally underserved by banks. With the introduction of e-KYC, making borrowing an instant and hassle-free experience, NBFCs are already offering the right financial products to consumers and small businesses in a customised manner. The use of technology to optimise business processes also keeps cost overheads to a minimum, enabling credit to be availed at highly competitive interest rates.

The NBFC sector has been stung by a crisis set off by the shock collapse of non-bank lender group in 2018. The situation further worsened with another Housing Finance Company (HFC) defaulting in loan repayment in 2019.

According to Care Ratings, NBFCs’ borrowing profile has changed significantly from capital market instruments to bank borrowings. Banks lending to NBFCs registered a growth of 34.7% from September 2018 to January 2020.

India Ratings and Research (Ind-Ra) expects consolidation within the NBFC space leading to players with market leadership, operations in niche business segments, proven track record and limited overlap with banks in borrower profile, gaining the market share. Managing asset quality is likely to gain prominence over loan growth in 2020-21, as the major asset classes funded by non-banks face strong headwinds. Ind-Ra expects NBFCs to grow their portfolio at 8-10% in 2020-21, and the growth would be driven by retail-focused NBFCs with a long track record and an established franchise. The slowdown in auto sales, cash flow challenges for small businesses and sluggishness in real estate sector would keep the collection and recovery teams active.

Automobile Industry

The Indian automotive industry is seeing significant transformation with respect to its sustainable growth and profitability. Currently, the industry is witnessing five megatrends that are expected to transform the industry in a significant way. Rapidly evolving customer needs, the disruptive impact of technology, the dynamic regulatory environment, changing mobility patterns and global interconnectedness are all impacting the way auto companies are doing business today, globally as well as in India.

Production: According to Society of Indian Automobile Manufacturers (SIAM), the industry produced a total of 14,47,345 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers and quadricycles in March 2020, as against 21,80,203 in March 2019, a de-growth of 33.61%.

Production: The industry produced a total of 2,63,62,284 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers and quadricycles in April-March 2020 as against 3,09,14,874 in AprilMarch 2019, a decline of 14.73%.

India's automobile industry faced weak consumer sentiment in 2019-20 with sales in most segments declining. The outlook for 2020-21 looks challenging with the outbreak of COVID-19 and the resultant lockdown. Apart from the challenges revolving around the uncertainties caused by COVID-19, the domestic automobile industry will also struggle to clear inventory of Bharat Stage IV (BS-IV) vehicles in post lockdown era. According to the Federation of Automobile Dealers Association, there is a BS-IV inventory worth Rs. 63.5 billion, the majority of which are two-wheelers.

Tractor Industry

Easy credit availability, fund access, and high usage of tractors in farming operations have led India to be one of the largest markets for tractors, globally. To retain its status of global leader in the agricultural tractor industry, the GOI is actively involved in the credit and subsidy process. Domestic sales de-grew by ~10% in 2019-20 after three years of robust growth where the industry grew by 22%, 22% and 8% in 2016-17, 2017- 18 and 2018-19 respectively owing to poor commercial demand. According to CRISIL Research, domestic tractor demand is expected to be resilient in 2020-21 and will pick up in 2021-22.

Already reeling under subdued consumer sentiment, domes tic sales were fur ther hit by supply chain disruptions due to the COVID-19 outbreak. This adversely impacted production at manufacturing facilities in India in February. Since then, substantial progress has been made in developing alternate sources for procuring components. The business was hugely impacted by the lockdown just before the start of festive days in large parts of the country. In compliance with the regulations, the anticipated retail surge and billing totally stopped in all states.

The Government of India has undertaken timely initiatives for the farming community in the form of specific relief packages. Hopefully, this will help bring in momentum for tractor sales, after the lockdown ends. In fact, just as the automotive sector will move to the new BS-VI emission norms from April 1, the tractor industry is also gearing up to adopt the BS TR-Tractor EM-Emission (TREM) IV norms (for tractors over 50 HP) by October this year.

The proposed switchover to BS TREM IV is likely to impact ~15% of current industry volumes in the near term, while the rest of the industry (tractors below 50 HP) will migrate to the new norms by October 2023. The phased approach of transition to new norms will, however, give OEMs an opportunity to test the response of the Indian tractor consumer, tweak their product portfolios in the medium term and also gradually manage incremental product costs over the next couple of years.

Housing Finance

The affordable housing finance industry received a muchneeded growth impetus from the ‘Housing for All by 2022’ scheme of the GOI. Sustained support from the government has allowed the industry to thrive in India. According to ICRA, India’s mortgage market has been steadily growing at a CAGR of ~15% over the past 8 years. In 2018-19, the mortgage market touched Rs. 19.9 trillion. Despite steady growth in the formal mortgage market, India’s mortgage to GDP ratio remains lowest among the key G20 countries, at just about 10%.

India's housing finance market grew to ~Rs. 21.8 lakh crore in 2018-19 witnessing a CAGR of 18.6% during 2018-19, comprising both SCBs and HFCs. The housing finance industry has exhibited remarkable resilience over the past two broad economic cycles.

HFCs experienced moderation in credit grow th and muted profitability as market confidence in the sector waned post H1 2018-19 and the share of HFCs in the housing finance market stagnated. The stress faced by the NBFC sector led to a sharp deceleration of growth in the credit extended by HFCs, as some major HFCs had to temporarily withhold disbursements to maintain essential liquidity.

CARE Ratings has stated that the grow th in the housing finance companies loan book is expected to remain subdued due to funding challenges and lowered consumption due to a slowdown in GDP grow th. Most HFCs are looking to conserve liquidity and correcting asset and liability management through sell downs and slowing disbursements. Further, moderation in the loan book grow th of non-banks has curtailed the grow th of interest margins. Overall, the growth is expected to remain under pressure as the benefits of the relief measures initiated by the GOI and state governments on the liquidity front are yet to fully unfold. The slowdown in the real estate sector coupled with higher risk perception of refinancing developers could impact the asset quality of players in the sector.

Lower ef fective interest rates: Pradhan Mantri Awaas Yojana (PMAY) subsidy and tax incentives have led to lower effective interest rates for the affordable housing sector borrowers. This will perpetuate demand for housing in 2019-20 and beyond.

Others: Urbanisation in India is very high. However, as compared to other countries, mortgage penetration in India is very low. With nuclearisation of families and two-thirds of the population in India being below 35 years of age, encouraging demand for housing can be expected in the coming years.

Infrastructure and Real Estate

Given the current market conditions, developers are calibrating strategies to meet market requirements and their focus has shifted on right-sizing and right-pricing which has supported pick-up in sales velocity. Buoyed by change in sentiments and signs of possible long-term recovery, large listed players have increased their pace of project launches. The rate of execution of ongoing projects has been simultaneously maintained, given the increasing home buyer preference for completed inventory.

With a number of initiatives and policies coming up, 2020 is expected to be the year of emerging micro-markets, with huge demand for quality homes, along with the transparency in the real estate deals and improved accountability of builders. According to an industry report, the real estate sector will be at the centre of rapid economic and social development, which will further transform the economy. These emerging trends are supposed to create a highly competitive environment for the developers. CREDAI and IBEF reports predict that the sector will reach US$ 1 trillion by 2030, from US$ 120 billion in 2017, and contribute 13% to the country’s GDP by 2025. Moreover, the housing sector’s contribution to the GDP is expected to almost double to more than 11% by 2020.

Emerging technologies in the construction sector have made the large players implement new and innovative techniques that ensure fast and quality delivery within the stipulated time. The technological innovations such as Robotics and Cognitive Automation, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT) is supposed to impact transformation of Indian realty sector. These technology innovations will further pave the way for effective planning in construction project management, leading to leaner construction, optimised cost value, better quality, and value engineered products.

The transparency in policies and the ease to do business have attracted many foreign investors to enter the real estate market and capture a substantial share. Now, with the increase in NRI investments, the real estate sector is expected to grow substantially.

Mutual Fund Industry

Average Assets Under Management (AAUM) of India's mutual fund industry for the month of March 2020 stood at Rs. 24,70,882 crore. The AUM of the Indian mutual fund industry has grown from Rs. 6.14 trillion as on 31st March, 2010 to Rs. 22.23 trillion as on 31st March, 2020 more than 3½ fold increase in a span of 10 years. The industry AUM stood at Rs. 22.26 trillion (Rs. 22.26 lakh crore) as on 31st March, 2020.

The total number of accounts (or folios as per mutual fund parlance) as on 31st March, 2020 stood at 8.97 crore (89.7 million), while the number of folios under equity, hybrid and solution-oriented schemes, wherein the maximum investment is from retail segment stood at 7.94 crore (79.4 million). This is 70th consecutive month witnessing rise in the number of folios.

Going forward, it is expected that the industry would witness robust growth as the sector is yet to tap its full potential. Besides, several measures taken by Securities and Exchange Board of India (SEBI), the regulator, will help increase the penetration of mutual funds. Some of the factors that will drive the growth in 2020 include the untapped potential, rising investor awareness about mutual funds as an investment alternative, and consistent promotion campaign by the Association of Mutual Funds in India (AMFI).

Financial Overview

- Consolidated income for the year increased by 15% to Rs. 11,996.5 Crores as compared to Rs. 10,430.9 Crores in 2018-19

- Consolidated income from operations for the year was Rs. 11,883.0 Crores as compared to Rs. 10,371.7 Crores in 2018-19, a growth of 15%

- Consolidated profit before tax for the year was Rs. 1,602.0 Crores as compared to Rs. 2,840.8 Crores in 2018-19

- Consolidated profit after tax and non-controlling interest for the year was Rs. 1,075.1 Crores as compared to Rs. 1,827.3 Crores in 2018-19

During the year under review, the total value of assets financed was Rs. 42,388.2 Crores as against Rs. 46,210.3 Crores during the corresponding period last year, a decline of 8.3% over the same period in the previous year. While the Company has gained market share in many of the product lines, however in view of declining sales of vehicles, tractors, etc., the disbursements have been lower. The outbreak of COVID-19 pandemic has resulted in further slowdown in economic activities across the country, which even otherwise was on a slow pace. The impact of the pandemic led to closure of all the Company’s branch offices, business and recovery touch points and completely halted the field operations from the last week of March 2020. As an organization, the company has been strictly adhering to social distancing norms and lockdown announcements in accordance with the directives issued by the Central, State Government and Local Administration Guidelines.

The SME lending faced significant head winds during the year due to the weak economic environment and in particular the slowdown in the auto segment. The lockdown in March caused significant disruption in business and consequently, the AUM as of March 2020 declined by 2% in comparison to March 2019. To counter the effects of the slowdown, the company focused on strengthening its systems to reduce risk and enhance customer centricity. The Company developed a robust early warning system (EWS) and forged tie-ups with few fintechs to strengthen its credit assessment capabilities and monitor the customers better. The company also strengthened its product offerings and broadened its tie-ups with more OEMs. It is expected that with these measures, the company would be able to grow its book significantly once the economic activity picks up.

The overall disbursement stood at Rs. 42,388.2 Crores as compared to Rs. 46,210.3 Crores in the previous year. Total Income grew by 16% at Rs. 10,245.1 Crores for the year ended 31st March, 2020 as compared to Rs. 8,809.8 Crores for the previous year. Profit Before Tax (PBT) declined by 44% at Rs. 1,343.8 Crores as compared to Rs. 2,382.4 Crores for the previous year. Profit Af ter Tax (PAT) declined by 42% at Rs. 906.4 Crores as compared to Rs. 1,557.1 Crores in the previous year.

During the year under review, the Assets Under Management stood at Rs. 77,160 Crores as at 31st March, 2020 as against Rs. 68,948 Crores as at 31st March, 2019, a growth of 12%.

As on 31st March, 2020, the amount of Assets Under Management outstanding through the Company’s Distribution Services on MFP, aggregate of institutional and retail segment, was Rs. 1,384.93 Crores and the number of clients stood at 60,628.

The company has an extensive pan-India distribution network with 1,322 offices spanning across 27 States and 7 Union Territories as of 31st March, 2020, which is one of the largest amongst Non-Banking Financial Companies. The company’s widespread office network reduces its reliance on any one region in the country and allows it to apply best practices developed in one region to other regions. The geographic diversification also mitigates some of the regional, climatic and cyclical risks, such as heavy monsoons or droughts. In addition, the Company’s extensive office network benefits from a de-centralized approval system, which allows each office to grow its business organically as well as leverage its customer relationships by of fering distribution of insurance products and mutual funds. The company services multiple products through each of its offices, which reduces operating costs and improves total sales. The company believes that the challenges inherent in developing an effective office network in rural and semiurban areas have facilitated in catering to the diverse financial requirements of its customers by identifying and understanding the needs and aspirations of the people.

Q4FYF21 Result

Mahindra Finance Q4 consolidated net down 8% to Rs 219 cr, income down 3% 3

Mahindra and Mahindra Financial Services Ltd posted an eight per cent drop in consolidated net profit at Rs 219 crore in fourth quarter March 2021 (Q4FYF21). It had posted consolidated net profit of Rs 239 crore in Janaury-March 2020 (Q4FY20).

The net profit for FY21 declined by 28 per cent to Rs 780 crore from Rs 1,086 crore in FY20, the finance company said in a statement.

Its board of Directors has recommended a 40 per cent dividend of (Re 0.80 per share on equity share of Rs two each), subject to shareholders approval.

The total income in Q4FY21 was down three per cent at Rs 3,038 crore from Rs 3,140 crore in Q4FY20. The impairment on financial instruments rose to Rs 910.08 crore in Q4FY21 from Rs 821.9 crore in Q4FY20.

The company, a financer for automotive and tractors, saw loan assets contracting to Rs 64,608 crore in March 2021, from Rs 68,089 crore in March 2020. The disbursements were down 41 per cent to Rs 19,001 crore in FY21 from Rs Rs.32,381 crore in FY20.

Its gross non-performing assets (GNPAs) rose to 9.0 per cent in March 2021 from 8.4 per cent in March 2020.

The impact of Covid-19 on the global economy and how governments, businesses and consumers respond is uncertain. This uncertainty is reflected in the Company’s assessment of impairment loss allowance on its loans, it added.