Agricultural Marketing Company Limited (Pran)

Summary

- Agricultural Marketing Company Ltd. (AMCL) is one of the largest food and beverage manufacturing company in the country operating since 1985 (PRAN group is formed in 1981).

- In the long history of operation of the company has furnished mainly two types of products to its portfolio – agro-commodity and various beverages. The main category of products include juice, drinks, mineral water, soft drinks, ice pops, mango bar and others.

- AMCL made revenue of BDT 2.948 million in FY 2020-21. It was a growth of 11.65% compared to the revenue of FY 2019-20.

- Total comprehensive income of the company is BDT 42.99 million for FY20-21, which was BDT 45.48 million a year earlier – a degrowth of 5.68%.

- Net Asset Value (NAV) per share has increased from BDT 81.99 in FY19-20 to BDT 84.17 in FY20-21. Earning per share of the company is thus BDT 5.37 in FY20-21 which was BDT 5.70 in the previous year.

Company overview

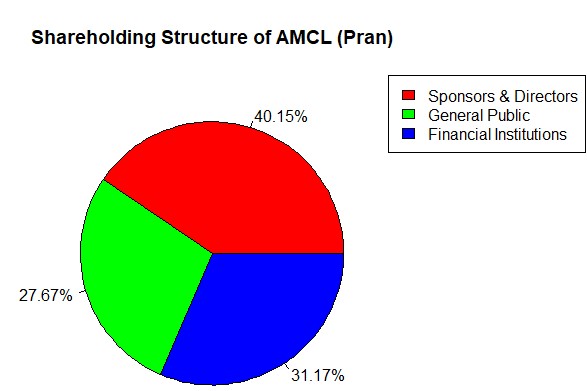

Agricultural Marketing Company Ltd. (DSE: AMCL(PRAN): CSE: AMCL(PRAN)) is a company operating in the FMCG industry in Bangladesh. It is one of the largest food and beverage manufacturing company in the country operating since 1985 (PRAN group is formed in 1981). AMCL is a subsidiary of PRAN group, although the shareholding structure is diluted as described in the chart that follows.1 The company is helmed by Ahsan Khan Chowdhury as chairman. Md. Eleash Mridha serves as the Managing Director of the company. The Board of the company has Mrs. Sabiha Amjad, Mrs. Uzma Chowdhury, CPA, and Mr. Md. Abdus Salam FCA as Directors. The company is headquartered at PRAN Centre, Ga-105/1, Middle Badda, Dhaka-1212, Bangladesh.

Financial analysis

AMCL has report revenue of BDT 2,948 million in FY20-21, which was BDT 2,641 million a year earlier. Revenue growth has been 11.61% during that period. After deducting the COGS (cost of goods sold), the company reported gross profit of BDT 556.33 million with a contribution margin (CM) of 18.88%. The CM of the company in the previous year was 18.70%. The operation has been, therefore, carried out with almost same pace as the previous year despite the fallout of the Covid-19 pandemic in the most recent year. The company has reported BDT 220.78 million in operating profits, which was BDT 197.95 million in the previous year – a growth of 11.53%. The operating profit of the company is consistent with the sales growth; therefore, the COGS and operating expenses has been in accordance with the casual operational procedures and no unusual costs have incurred during the period. The company reported BDT 88.75 in profits after financial expenses which was BDT 68.16 million a year earlier, a growth of 32%. This indicates that the company has incurred lesser financial expenses than the previous year. Examination of the figures reveals that, as opposed to the previous year, the company has incurred no interest on long-term loans as well as interest on WPPF; also, the company got interest subsidy of BDT 4 million due to Covid-19 in the outgoing year. The other income of the company has decreased during FY20-21 and came to negative. Reported other income in FY20-21 is negative BDT 0.203 million while it was BDT 4.11 million a year earlier. The company earned a substantial amount of BDT 1.567 million in other incomes from Dhaka International Trade Fair (DITF) in FY19-20, which was not held in the latest financial year due to Covid-19 pandemic. Also, the company lost about BDT 2.29 million in currency exchange in FY20-21 due to Covid-19 pandemic-induced weak trade position of Bangladesh, therefore, depreciation of Taka. Thereafter, although the company has reported BDT 84.34 million in net profit before taxes, which was BDT 45.58 million a year earlier, net profit after tax went down compared to the previous year due to imposition of AIT on export and CI of BDT 14.27 million in the current fiscal year. Thus, total comprehensive income of the company is BDT 42.99 million for FY20-21, which was BDT 45.48 million a year earlier – a degrowth of 5.68%. Earning per share of the company is thus BDT 5.37 in FY20-21 which was BDT 5.70 in the previous year.

Total non-current asset of the company has decreased from BDT 280.31 million to BDT 235.37 million in FY20-21. The asset base went down due to depreciation charge (see note 5 of Annual Report 2020-21). Reported total asset base of the company is thus BDT 1,375 million in FY20-21. Shareholder’s equity of the company stands at BDT 673.37 million which was BDT 655.95 million a year earlier. The company reports no long-term credit facility except a lease liability. But the company has a short-term credit facility of BDT 596.26 million, decreased to it from BDT 652.63 million. Net Asset Value (NAV) per share has increased from BDT 81.99 in FY19-20 to BDT 84.17 in FY20-21.

The company generated more cash from operation in the latest financial year amounting to BDT 169.80 million, which was BDT 124.18 million a year earlier. The company had taken short-term loan in the FY19-20 whereas it has repaid BDT 56.37 in short-term loan in FY20-21. The company paid dividend of BDT 24.97 million which was BDT 25.69 million a year earlier. The company used up more cash in the financing side compared to the previous year. Therefore, it ends up with a cash position of BDT 37.54 million which was BDT 78.18 million a year earlier.

| 2018-2019 | 2019-2020 | 2020-2021 | |

| Current Ratio | 1.37 | 1.56 | 1.63 |

| Total Asset Turnover | 1.99 | 1.88 | 2.12 |

| ROCE | 38% | 29% | 32% |

| Gross Profit Margin (GPM) | 19.19% | 18.71% | 18.87% |

| Net Profit Margin (NPM) | 2.07% | 1.73% | 1.46% |

| Return on Total Assets (ROA) | 4.12% | 3.25% | 3.09% |

| Total Debt to Equity | 141% | 114% | 104% |

| Debt to Total Assets | 59% | 53% | 51% |

| Basic EPS | 7.30 | 5.70 | 5.37 |

Share Market Insights

The company has been listed in DSE and CSE since 1996. The current market price is BDT 272.80 with 8,000,000 outstanding shares as on 17 July, 2022. The price is 27.66% higher than that of in the previous year. The code used for trading is AMCL(PRAN). For the financial year of 2020-21, the company declared dividend of BDT 11 per unit.

Business overview

Factories and distribution centers

AMCL owns its own factory and vehicles for manufacturing and distribution. The raw materials are collected from the representative in different sources. Then they are processed in different manufacturing sites in Habigonj industry park, Natore, Pran Agro ltd, Ghorashal and others. They also import different chemicals from Thailand and Hong Kong. It employs officers in its depo to distribute products and supervise the whole arrangement. AMCL has its own websites where distributors place demand orders and pay through the bank and those are delivered through the depos. It has 1 depo in each district. The distributors then distribute the products to the retailing store in their Thanas and Upazilas. So, it can be said that the business model is B2C. In case of export, the company individually deliver to the retailing stores. The stores individually place orders.

Key products of AMCL (PRAN)

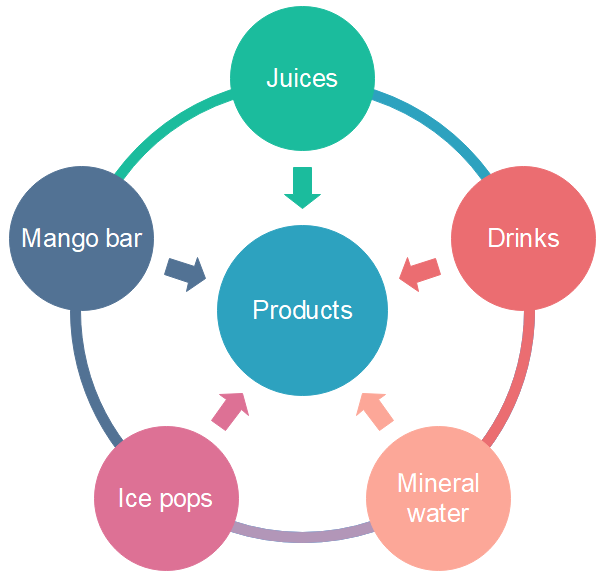

In the long history of operation of the company has furnished mainly two types of products to its portfolio – agro-commodity and various beverages. The main category of products include juice, drinks, mineral water, soft drinks, ice pops, mango bar and others.

Juices and drinks are bottled in tetra pack, glass bottle, pet bottle, and can bottle. The company now produces two types of drinks – one is flavored drink and another is soft drink.

Strategy and CSR activities

AMCL focuses on better environment, power markets, power brands, greenhouse gas emissions and sourcing. They have tried to reduce environmental impact and ensure their Sherice materials responsibly. Also, they have 16 Power markets which have the highest absolute growth potential for them and where they see the greatest ability to win. They are towards developing markets which have greater economic growth, rising middle classes and more opportunities to increase market penetration. AMCL invests heavily in their focused portfolio of 19 market-leading brands. They provide almost 80% of their revenue. They have tries to reduce their emissions through manufacturing process improvements, energy efficiency programs, investing in renewable technologies and procuring electricity from renewable shires. They have tried to use natural raw materials and their responsible focus on high-priority commodities, such as palm oil and latex.

Company history

The history of AMCL started with the formation of PRAN Group in 1981. It was established by retired Major General Amjad Khan Chowdhury. The group merged with RFL group the same year. After that, the group started a number of subsidiaries including AMCL. It also established a subsidiary in UAE in 2003. In 2008, the group established manufacturing line in India for complying with the laws. it exports to more than 115 countries all over the world.

AMCL was launched in 1985 as an agri-business venture with motives of:

- Serving small farmers by purchasing their produces at the right price.

- Marketing farm produce for profits.

- Growing specific crops with organizing contract growers.

- Exporting of agricultural products and services.

In May 1991, AMCL constructed a facility on 8 acres in Ghorasal, complete with bottling and canning equipment. Since 2011, the factory has developed significantly in all areas of food processing, including bottling, canning, pulping, pickling, concentrating, and the construction of Bangladesh's first Tetra-Pack facility and a contemporary Extrusion machine for snack foods. The company has been exporting to USA (NY), Australia, UAE, Saudi-Arabia, Qatar, India, Oman, Malaysia, Singapore, Somalia, France with full-fledged offices, warehouses and other supports.

Industry overview

In Bangladesh, the FMCG business is divided into three primary categories: (a) Foods and Beverages, (b) Personal Care, and (c) Household Care Industries. AMCL is under the food and allied industry which is also a subsection of FMCG industry. The COVID-19 epidemic left an indelible imprint on people's way of life. As a consequence of the outbreak, our economic growth has seen a significant slowdown, which has had a negative influence on the disposable cash of customer groups, causing a reduction in customer demands. Given the economic downturn and decreased demand, the expansion of the FMCG business has slowed. In addition, supply chain interruptions, difficulties in acquiring raw materials, and national limitations have contributed to the industry's issues. In addition, the rise in DMI import tax from 15% to 25% and the rising prices of major imported commodities owing to DMI deficiency in 2020 provide a hurdle to the manufacturers of beverages. In contrast to luxury products, the FMCG business has maintained reasonably steady despite the economic downturn. In their annual report, Unilever Consumer Care Limited revealed that the food segment of the FMCG market grew by just 2% in 2020. The fast-moving consumer goods (FMCG) business, which is valued USD 3.4 billion, is one of the largest industries in the nation. In the current fiscal year, the food and beverage sector is anticipated to recover substantially due to the return of mass vaccination distribution.

The emergence of different drinks sector in the Bangladesh is primarily attributable to a rise in per capita income, middle-class growing populations, and community-wide health awareness. As a result of the administration's heavy investments in road and highway construction, small enterprises and mom-and-pop stores have benefited from the fast expansion of distribution systems across the nation. Another significant section of AMCL production is biscuits. Wheat, palm oil, and sugar are the primary components used in biscuit production. Bangladesh is not a significant manufacturer of these goods. These raw ingredients are acquired from national merchants. To satisfy consumer needs, more than 80 percent of the wheat consumed in Bangladesh is imported. On the basis of increasing usage, the demand for essential components is anticipated to stay robust. However, as a result of the Russia-Ukraine war and the higher currency rate, the rising cost of acquiring raw materials has become a serious worry for the business. According to the Export Processing Bureau (EPB), Bangladesh exports six kinds of baked goods, including breads, cookies, and cakes, to the Middle East and other regions. The most often exported biscuits include crispbread, gingerbread, sweet cookies, waffle, wafer, bread rusk, and pastry. The finest of them are the sweet cookies and rusks. In the previous year, these commodities generated around BDT 4.6 billion in export revenue, which is anticipated to increase. AMCL (Pran) has around 2-3% market share of the market share. The size of the biscuit industry is around BDT 30 billion.

The urbanization is also playing major roles in growth of food industry as it increases the demand of packaged food. In 2021, the urbanization growth was 3.25% though for Covid 19, the rate has decreased much. The number of urban people is around 5 crores according to Bangladesh Bureau of Statistics. The urbanization has increased the demand of meat, sea foods, vegetable, fruit and egg, while reducing demand for grains and fats. This is increasing the demand of agricultural production and processed and frozen food. Frozen food industry of Bangladesh is enjoying 16% growth recently which will be around BDT 3000 crores by 2024. Bangladesh has more than 164 million people and it is growing at the rate of 1.01% each year. At least 48% expenditure of household us for food and beverages. So, the food and beverage industry will be see a decent growth in the upcoming years. Higher literacy rate is changing the life style of people in Bangladesh. They now prefer organic plant- based foods, branded products with more transparency and so on. Golden Harvest, ACI Foods, BD food, Pran, Square have created different brands like Radhuni, Bloop ice cream, Ruchi, ACI Pure, Fun and others. The growing consciousness about the nutrients of food has increased the demand of organic food and environment friendly companies. So, the companies are being committed to the society and environments where PRAN is globally compliant through ISO 9001:2008, ISO 14001:2004, ISO 22000:2005, Halal, and HACCP certificates, FuWang Foods has got ISO-9002 certification and so on.