Premier Cement Mills Limited

Summary

- Premier Cement Mills Limited (PCML) was incorporated on 15 October, 2001 as a private limited company under The Companies Act 1994.

- It is one of the leading cement manufacturing companies in the country with annual capacity of 2.4 million Metric Tons per annum.

- Revenue of the company has increased to BDT 12,810 million from BDT 10,461 million in 2019-20 which is a growth of 22.46%. It has led to a 28.04% increase in gross profit from BDT 1,503 million in 2019-20 to BDT 1,924 million. The company has reported BDT 653 million of net profit in 2020-21 which was BDT 271 million in 2020.

- PMCL has a subsidiary viz. Premier Power Generation Limited (PPGL) which supplies power only to PMCL.

- The company mainly produces 2 types of cement- Ordinary Portland cement and Portland Composite Cement and the products names are Portland Cement (PC): CEM I, Strength Class 52.5N; Portland Composite Cement (PCC): CEM II, Strength Class 42.5N and Portland Pozzalana Cement.

Company Overview

Premier Cement Mills Limited (DSE:PREMIERCEM; CSE:PREMIERCEM) is one of the leading cement manufacturers in Bangladesh, with the motto “Aamra Promane Bissashi (We believe in Outcomes)”, listed in both DSE (Dhaka Stock Exchange) and CSE (Chittagong Stock Exchange). The company has an annual capacity of 2.4 million Metric Tons per annum. The journey of the company started in 2001.

Premier Cement Mills Limited (DSE:PREMIERCEM; CSE:PREMIERCEM) is one of the leading cement manufacturers in Bangladesh, with the motto “Aamra Promane Bissashi (We believe in Outcomes)”, listed in both DSE (Dhaka Stock Exchange) and CSE (Chittagong Stock Exchange). The company has an annual capacity of 2.4 million Metric Tons per annum. The journey of the company started in 2001.

Corporate Structure

PCML has 500,000,000 authorised shares of BDT 10 each and the number of issued share is 105,450,000. Each of the managing director and the chairman of the company own more than 10% share. The general investors own 36% of the shares. PCML is the owner of 4,80,000 shares out of 5,00,000 shares i.e. 96% shares of Premier Power Generation Limited which is engaged in Producing electricity dedicatedly for Premier Cement Mills Limited. It is the owner of 7,000,000 shares out of 37,500,000 shares i.e. 18.67% shares of National Cement Mills Limited, associate of the company. These companies are not listed in any of the exchange in Bangladesh.1

Share Market Insights

Premier Cement Mills Limited has got listed in both Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited simultaneously in 2013. Each share traded at BDT 46.5 as on 26 June, 2022. It has seen a 34.51% decline in past one year of trading.

Its trading code is PREMIERCEM. The number of outstanding share is 105,450,000 and market capitalisation is BDT 4,966.695 million as on 26 June, 2022. In November of 2021, it has declared 200% cash dividend with EPS of BDT 6.18.

Financial Analysis

The accounting period of Premier Cement Mills Limited starts on July 1 and ends on 30th June. In 2020-21, the revenue of the company has increased to BDT 12,810 million from BDT 10,461 million in 2019-20 which is a growth of 22.46%. It has led to a 28.04% increase in gross profit from BDT 1,503 million in 2019-20 to BDT 1,924 million. The company has reported BDT 653 million of net profit in 2020-21 which was BDT 271 million in 2020. In 2019-20, the net income of the company has declined 56% and increased 141% in 2020-21. Due to the emergence of covid-19 pandemic, the government of Bangladesh imposed lockdown from 26 March 2020 to 30 May 2020 in order to stop the spread of the virus which directly affected the business performance. The company was able to use only 18.96 percent production capacity in the fourth quarter in the previous fiscal year. It was the key reason of the severe drop in the net profit of the company in 2019-20.

Though the EBIT of the company has increased by 35% that was mainly contributed by high gross profit in the year of 2020-21, one of its most contributing head in the income statement named other income has experienced large drop. The section includes income from interest earned from associate, given loans, leasing and so on, that has seen a severe drop of 96.9% in 2020-21. The reasons behind are the decrease of per bag cement carrying rate income and the forgone interest income charged to the borrower, Rupsha Edible Oil Refinery Ltd during the year. Administrative expenses increased by BDT 9.11 million in the financial year 2020-21. Mainly due to the increase of renewal, legal & professional fee is BDT 0.85 million, and BIWTA expenses increased by BDT 2.93 million. But still the high gross profit has made sure the EBIT growth to be positive.

The only subsidiary of PCML, Premier Power Generation Limited (PPGL), has generated net profit of BDT 37 million in 2020-21 and has total assets of BDT 480 million. More than 69% of the total assets is covered by current assets of PPGL. The property, plant and equipment was revalued at BDT 195 million which is BDT 26 million higher than before. However, the revenue has decreased by 9.5% in 2020-21. It has entered into a contract of lease liability of 1.4 million in 2020-21 which has increased its finance cost in the same period. The debt ratio of PPGL is only 1.55%.

The equity of the company has seen a growth of 60.49% which was contributed by the revaluation of property, plant & equipment which is around BDT 3,085 million before tax. It has also increased the assets size of the company. The debt to capital and debt to assets ratio has decreased as the company has repaid BDT 674.67 million of long term loan. The increased demand of cash and bank has led to 30% increase in the short term bank loan. Also, the inventory policy of the company left the company with more than BDT 400 million of inventory compared to that in the previous year. This has affected the current ratio of the company.

Ratio analysis of Premier Cement Mills Limited (stand-alone)

| Particulars | 2020-21 | 2019-20 | 2018-19 | 2017-18 | 2016-17 |

| Debt to Equity ratio | 2.31 | 3.38 | 2.92 | 2.15 | 1.55 |

| Current ratio | 0.54 | 0.59 | 0.84 | 0.78 | 0.94 |

| Total Asset Turnover | 0.53 | 0.52 | 0.75 | 0.84 | 0.96 |

| Sales growth | 22.46% | -12.82% | 19.40% | 8.29% | 10.4% |

| Gross Profit Margin | 14.68% | 13.86% | 13.92% | 14.72% | 16.41% |

| EBIT Margin | 10.64% | 9.47% | 10.41% | 9.67% | 9.46% |

| Net profit margin | 4.81% | 2.16% | 4.82% | 4.08% | 5.29% |

| Return on equity (ROE) | 7.69% | 4.60% | 12.10% | 9.59% | 12.04% |

| Dividend yield Ratio | 2.70% | 1.64% | 1.42% | 1.29% | 2.21% |

| Price Earnings (P/E) Ratio | 12.71 | 28.46 | 12.81 | 18.24 | 19.40 |

| Debt Coverage | 3.3% | 4.1% | 4.3% | 7.5% | 6.2% |

Business Overview

Business Model

The company was established in 2001. The main purpose of the company is to become the market leader in the sector with satisfactory services and competitive prices. It has 6.2% of market share in the industry. The company has generated BDT 12,313 million revenue from the local sales, BDT 204 million revenue from the export and BDT 292 million revenue from the empty bag sales. The revenue from the export increased by 118% that is the result of loss of revenue because of the pandemic in 2020. As on 2021, total number of employees is 3,110 which is 5.87% less than that of in the previous year. This happened mainly because of the pandemic which halted the operation of the company.

The company mainly produces 2 types of cement- Ordinary Portland cement and Portland Composite Cement and the products names are Portland Cement (PC): CEM I, Strength Class 52.5N; Portland Composite Cement (PCC): CEM II, Strength Class 42.5N and Portland Pozzalana Cement. Portland cement, also known as OPC, or "ordinary Portland cement," is the most widely used form of cement in the worldwide since it is a necessary component of most non-specialty grouts, concrete, mortar, and other building materials. It is created by grinding Portland cement clinker (more than 90%), a small quantity of calcium sulfate (which regulates the set time), and up to 5% minor ingredients into a fine powder.

The company mainly produces 2 types of cement- Ordinary Portland cement and Portland Composite Cement and the products names are Portland Cement (PC): CEM I, Strength Class 52.5N; Portland Composite Cement (PCC): CEM II, Strength Class 42.5N and Portland Pozzalana Cement. Portland cement, also known as OPC, or "ordinary Portland cement," is the most widely used form of cement in the worldwide since it is a necessary component of most non-specialty grouts, concrete, mortar, and other building materials. It is created by grinding Portland cement clinker (more than 90%), a small quantity of calcium sulfate (which regulates the set time), and up to 5% minor ingredients into a fine powder.

The value proposition of the company is to provide high quality products and services to ensure customer satisfaction. The company import high quality raw materials from Vietnam, China, Japan, Oman, Thailand, India and other countries. In each and every stage of production the company performs quality testing procedures. Measures are taken immediately if any discrepancy is found. Energy Dispersive X-ray Fluorescence is used in this process where the lab test is performed for the quality testing. The company has distribution fleet consisting of 259 dedicated covered vans, 84 open Trucks, 66 bulk carriers and 22 lighter vessels to ensure the door to door as well as quick delivery of cement.

When it comes to the need for cement in the cement business, there are primarily three major seasons. These are what they are: January through April/May is the peak season; June through September is the dull season and from October to December is the off season. The peak season in the cement business is from January through April, often even into May, when there is a very strong demand for cement on the market. Since there is little to no rain in Bangladesh according to the country's climate, this is the perfect time to begin work on building construction and other infrastructure development projects. Due to the strong demand for cement at this time of year, Premier Cement's goods are more expensive than they are for the rest of the year. The range of price of cement is BDT 485 to BDT 550.

To create brand awareness and brand association with the brand they basically use different kinds of promotional activities like-leaflet, mini leaflet, banner, poster, and electronic media, Mesban, Mason and Engineer Meeting, Newspaper Advertising etc. Among promotional activities Cash++ and Eid 2 Eid offer are most popular in which they give discount based on scratch card and gift items based on raffle draw.

Strategies

To make the company eligible for more export and increasing the capacity of production, an important strategic choice made by the company in 2021. The company installed and commissioned the most environmental friendly and cost effective & latest Technology-Vertical Roller Machine (VRM). After the completion of the project the production capacity will be increased by 11,040 MT per day. Along with that, the company has-

- Planted 1 lakh sapling across the country

- Installed new technology for dust collection

- Installed power saving light (LED Light) across whole factory

- Installed 2 units of solar home systems

- Been using solar power.

- Provided training to educate employees regarding environmental issue.

- Promoted employee participation in the company’s CSR initiatives in Environment protection and conservation.

- Installed of energy-control equipment to optimize energy utilization at head office and factory

Industry Overview

Bangladesh's cement sector has had some of the strongest development in recent years, with an average annual growth rate of 11.5 percent over the last decade. But still, Bangladesh has one of the lowest per capita cement consumption rates in the world, with 187 kg, compared to the global average of 563 kg. According to an IDLC research, with Bangladesh's economic progress, yearly per capita cement consumption has climbed from 45 to 200 kg during the previous two decades while EBL Securities reported that 60 percent of cement produced is utilized during the winter. The peak season for cement sales typically runs from November to April. It also has reported that Bangladesh cement industry is getting concentrated as approximately 81% of the total market share is held by top ten manufacturers. Among the top 10 cement market players in Bangladesh, 8 are local and 2 are multinationals.

The public sector accounts for 45 percent of overall consumption, with real estate businesses accounting for 30 percent and individuals accounting for 25 percent.

Growth Drivers

The key growth drivers that boost the demand of cement in Bangladesh is urbanisation. Around 39% population of the country live in urban area. According to Statista, the urbanisation growth in Bangladesh was 38.18% in 2020.2 The capital city has to accommodate more than 600,000 people each year which means the demand is around 120,000 household needs against the supply of only 25,000 units. Also, the population growth rate is another growth driver for the country. Another important driver of rising cement consumption in the nation is the real estate industry. However, the industry fell short of expectations because to increasing loan rates, higher land prices, and higher registration and associated fees.3 According to an IDLC report, 90% of Bangladesh’s cement is exported to India. Bangladeshi cement is becoming more popular in India due to its inexpensive transportation costs, competitive pricing, and export quality. According to a Simnet report from September 2020, the Bashundhara Group of Bangladesh planned to boost its capacity by spending 117.7 million dollars in order to sell to India's Seven Sister States. The cement industry employs 60,000 people directly and employs about one million people indirectly.4 From 2020 to 2025, the construction market in Bangladesh is anticipated to expand at an annual pace of 8%. This will bring an organic growth to the cement industry. Cement is exported from Bangladesh to India, Myanmar, Sri Lanka, Nepal, and the Maldives. Northeastern provinces such as Assam and Tripura provide the largest market for Bangladeshi cement producers owing to their isolation from India's industrial centers. In recent years, exports have increased by double digits.

Impact of Covid-19

According to a research by IDLC, manufacturers were only able to use 10% of their entire capacity during the lockout, resulting in a loss of BDT 3,000 crore. In addition to raw material shortages, stagnant real estate activity, and lost sales during the peak season, the businesses were also confronted with a number of other difficulties. The following picture shows the market growth of the industry from 2015 to 2020.

Clinker is one of the most vital raw ingredients in the manufacture of cement. And limestone, the primary component in clinker production, cannot be sourced from Bangladesh. There are just two producers of clinker in Bangladesh at now, the first of which is the state-owned Chhatak Cement Factory Limited, which has a pretty small production capacity. The other is Lafarge Surma Cement Limited, which generates around 10 percent of Bangladesh's total clinker demand. Imports include hefty taxes, import duties, and foreign currency concerns. During the 2019-2020 fiscal year, cement businesses imported 18.6 million tonnes of raw materials. Once primarily dependent on China for raw materials, Bangladeshi manufacturers now import the majority of their supplies from Thailand, Vietnam, Malaysia, and Indonesia. Pandemic has halted the import which was the one of primary reasons of the fall. Cement market sales plummeted to 30% of their pre-Covid levels in April. In May and June, sales hit 40 percent and 50 percent of the pre-Covid level, respectively. Beyond the closure, COVID-19 may have a lasting effect on demand. In the next two to three years, demand may stagnate before increasing to pre-Covid levels.5 The situation was exacerbated by the fact that the shutdown occurred during the peak demand months of March and April. Due to mandatory factory shutdowns, producers were unable to satisfy the peak demand.

Government mega-projects, with the exception of those of the highest importance, such as the Rooppur Nuclear Power Plant, were halted. These megaprojects account for 35% of the country's cement usage. Again, Currently, cement factories have a total yearly output capacity of 58 million tons, whereas the domestic market is just 33 million tons. This indicates that the cement sector has a 43 percent excess of production capacity relative to overall demand. Still many companies are investing to maximise the capacity due to the export opportunities. In the 2019-2020 fiscal year, exports decreased since ports were closed for the holidays, impeding trade. Even while this reduction may be seen as a one-time occurrence, there are more grounds to anticipate exports will shrink in the long term. The future potential for cement shipments to the northeastern states of India may be jeopardized by competition from Indian enterprises granted transit privileges. In addition, Bangladeshi cement exporters pay significant shipping expenses, which discourage exports.

Despite the disturbance created by the pandemic, the cement sector in Bangladesh has recovered and is positive about the future. The restart of government megaprojects and real estate operations boosted sales. As a consequence of increasing remittances and the return of expatriates with their funds, there has also been an increase in building in rural regions. All of these factors have contributed to the cement industry's V-shaped revival.

CSR Activities

- Provided 7 ventilators to Chattogram Maa O Shishu Hospital.

- Took the responsibly of its 2000 employees and provided them their job security as well as all other benefits.

- Provided safety equipment’s (Mask, PPE, Hand Gloves and Sanitizer) to the authority of Chittagong Customs and Narayanganj Police.

- Distributed emergency relief among the construction workers.

- Provided Safety equipment to our employees.

- Maintained Social distance at the work place.

- Provided ventilator to the Sylhet MAG Osmani medical College hospital.

- Always ensured medical services for all our staffs.

- Provided High flow nasal cannula to the Bangabandhu Sheikh Mujib Medical University Hospital

Company History

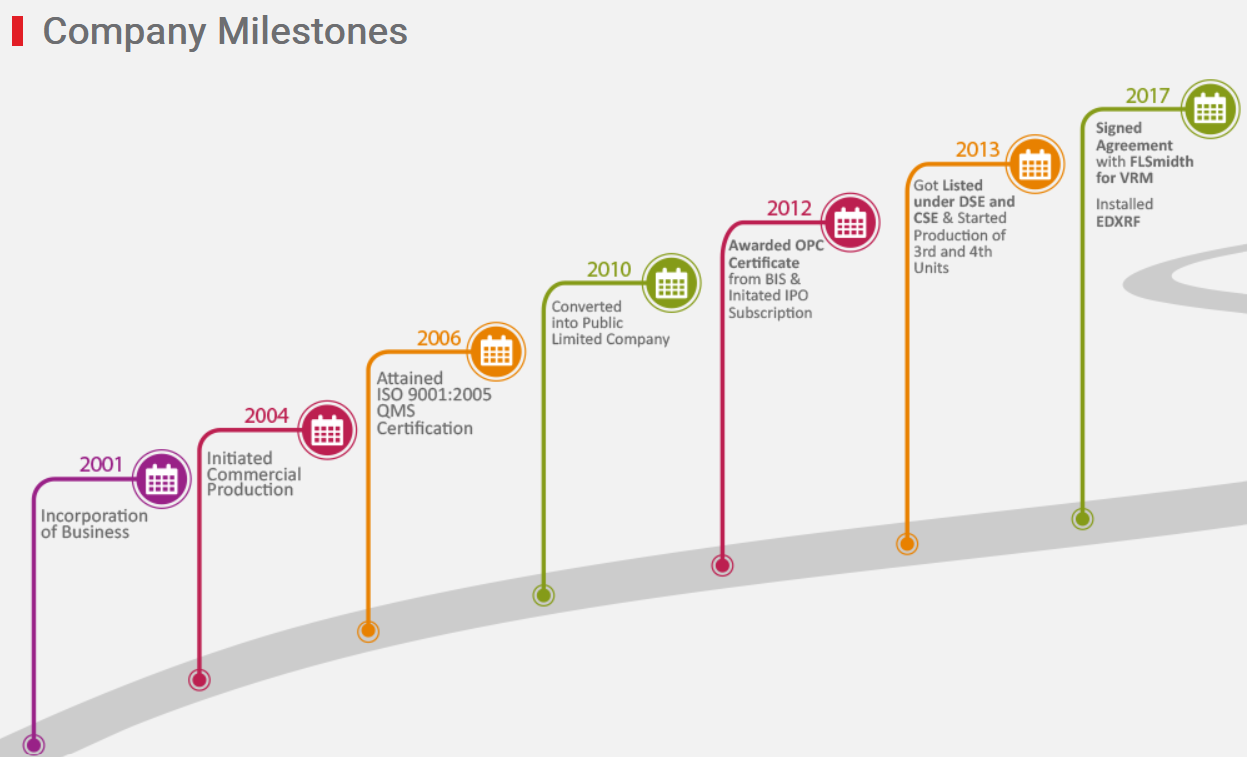

History of the company can be traced back to 15 October, 2001 when the company was incorporated as a private limited company under The Companies Act 1994. The company has started the production of its first unit on 12 March, 2004. The company has achieved “ISO 9001:2000 Quality Management System Certificate” on 10 May, 2006. On 2008, the company has exported its manufactured cement for the first time. On 16 April, 2010, the company has converted into public limited company. Then on 24 October, 2011, it has submitted application to BSEC (Bangladesh Securities and Exchange Commission) to begin the process of being listed on the stocks market. The company went through the process of IPO subscription and lottery. On 3 February, and 4 February, 2013, respectively, the company got listed in CSE and DSE. On 3 March of the same year, the company stock started trading on the stock markets.

In the meantime, the company has started its 2nd, 3rd, and 4th plants, respectively, one in 2011 and twos in 2013. The company has signed an agreement with FL Smidth=Denmark for installation of a Vertical Roller Mill (VRM), which will increase the production capacity from 2.4 million metric tons per annum to 5.16 million tons. In 2020, the company has launched two new routes to export to India – one through a river route to India’s north-eastern state of Tripura and another through a new road from Narayanganj, Bangladesh to Karimganj, India. In 2021, the company goes into VRM trial production.

Factory Locations

The factory is located at West Muktarpur, Munshiganj. On the front side of the factory land is the Dhaka-Munshiganj road and on the rear side is the river Shitalakhya which meets with the river Dhaleshwari and further downstream, both the rivers fall into the mighty Meghna. Thus the factory site has marvelous accessibility both by land and river. The company uses the most sophisticated cement plant namely FLS SMIDTH of Denmark, Packer from HAVER & BOECKER GmbH Germany and machineries maintaining EUROPEAN standards and qualities. The factory of the associated company, National Cement Mills Limited (NCML) is located at Issa Nagar, Karnafully, Chottogram.

Objective, Mission and Vision

Corporate Objectives

- To promote comprehensively on current areas of success.

- To build a strong brand image.

- To give more emphasis on customer’s satisfaction.

- To give more emphasis on employee’s satisfaction.

- To earn reasonable profits.

- To capture the target market share.

- To serve consistently the changing needs of customers for their convenience.

- To be the leading cement manufacturer in Bangladesh

Vision

Work towards the development of society through sustainable growth and excellence in performance.

Mission

To become a market leader in the cement industry by satisfying the customers through excellence in production, competitive pricing and adding value for their stakeholders

- ^ See Financial Statements 2020-21, p.52. for more information, Available at: https://www.premiercement.com/upload/investor/1639546162275.pdf

- ^ https://www.statista.com/statistics/455782/urbanization-in-bangladesh/

- ^ http://www.eblsecurities.com/AM_Resources/AM_ResearchReports/SectorReport/Bangladesh%20Cement%20Industry%20Review%20-%20June,%202020_Final.pdf

- ^ https://businessinspection.com.bd/cement-industry-of-bangladesh/

- ^ https://www.lightcastlebd.com/insights/2020/10/bangladesh-cement-industry-optimistic-despite-challenges/