Marathon Oil Corp.

Summary

- Marathon Oil Corporation is an independent exploration and production (E&P) company.

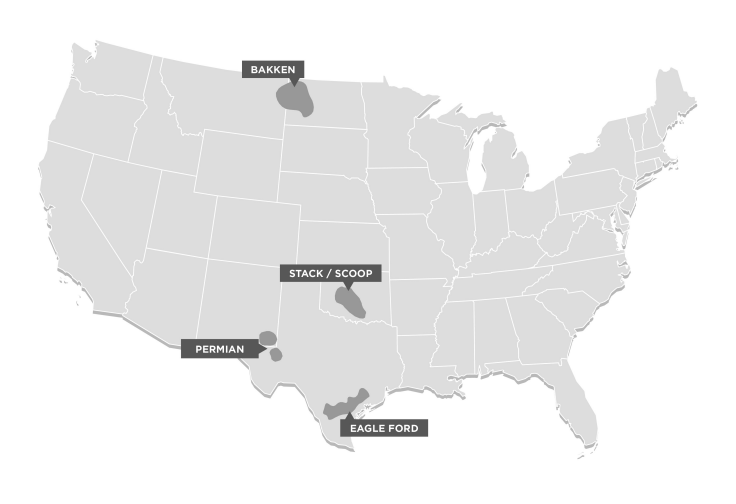

- Company focused on four of the most competitive resource plays in the U.S Eagle Ford, Bakken, Permian, STACK and SCOO.

- Marathon Oil to Further Develop Equatorial Guinea Gas Mega Hub

Marathon Oil Corporation (NYSE:MRO, LSE: 0JY9) is an independent exploration and production (E&P) company focused on four of the most competitive resource plays in the U.S.

Recent Developments

Marathon Oil to Further Develop Equatorial Guinea Gas Mega Hub1

March 30, 2023; Marathon Oil Corporation (NYSE: MRO), through its affiliated company Marathon E.G. Holding Limited, announced it has signed a Heads of Agreement (HOA) with the Republic of Equatorial Guinea (E.G.) and Noble Energy E.G. Ltd, a Chevron company, to progress the next phases (Phases II and III) in the development of the Equatorial Guinea Regional Gas Mega Hub (GMH).

Phase I of the GMH was successfully achieved with the tieback of the Alen Field to Punta Europa, which delivered first gas in February 2021. Alen gas is processed under the combination of a tolling and profit-sharing arrangement through Alba Plant LLC's onshore Liquified Petroleum Gas (LPG) plant (MRO 52% interest) and Equatorial Guinea LNG Holdings Ltd's LNG facility (E.G. LNG, MRO 56% interest).

The announced HOA builds on the success of Phase I, aligning all parties on necessary commercial principles to advance Phases II and III of the GMH.

More specifically, Phase II involves processing Alba Unit (MRO 64% interest) gas, from Jan. 1, 2024, under new contractual terms following the legacy Henry Hub-linked Alba sales and purchase agreement expiration at the end of this year. Phase II will materially increase MRO's exposure to global LNG pricing and is expected to improve the Company's E.G. earnings and cash flow significantly. Phase III of the GMH is expected to facilitate gas processing from the Aseng Field at Punta Europa facilities.

Financial Highlights

Second Quarter 2023 Results2

Marathon Oil Corporation (NYSE: MRO) reported second quarter 2023 net income of $287 million or $0.47 per diluted share, which includes the impact of certain items not typically represented in analysts' earnings estimates and that would otherwise affect comparability of results. Adjusted net income was $295 million or $0.48 per diluted share. Net operating cash flow was $1,076 million or $1,121 million before changes in working capital (adjusted CFO). Free cash flow was $442 million or $531 million before changes in working capital and including Equatorial Guinea (E.G.) distributions and other financing (adjusted FCF).

U.S. production averaged 356,000 net boed for second quarter 2023, an increase from 341,000 net boed during first quarter. Oil production averaged 181,000 net bopd for second quarter, an increase from 176,000 net bopd during first quarter. The Company brought a total of 80 gross Company-operated wells to sales during second quarter. U.S. unit production costs averaged $5.88 per boe during second quarter.

Marathon Oil's second quarter Eagle Ford production averaged 156,000 net boed, including 81,000 net bopd, with 49 gross Company-operated wells to sales. Bakken production averaged 109,000 net boed, including 68,000 net bopd, with 23 gross Company-operated wells to sales. Oklahoma production averaged 50,000 net boed, including 9,000 net bopd. Permian production averaged 40,000 net boed, including 21,000 net bopd, with eight gross Company-operated wells to sales.

INTERNATIONAL: E.G. production averaged 43,000 net boed for second quarter 2023, including 8,000 net bopd. Unit production costs averaged $5.72 per boe, and net income from equity method investees totaled $22 million during second quarter. Second quarter production, unit costs, and equity income were all negatively impacted by a triennial turnaround completed during the month of April. Second quarter cash distributions from equity method companies totaled $249 million, including $215 million of dividends and $34 million of distributions classified as return of capital.

CASH FLOW AND CAPEX: Net cash provided by operations was $1,076 million during second quarter or $1,121 million before changes in working capital. Second quarter cash additions to property, plant and equipment totaled $634 million, while capital expenditures (accrued) totaled $623 million.

BALANCE SHEET AND LIQUIDITY: Marathon Oil ended second quarter with $215 million in cash and cash equivalents. The Company redeemed $131MM of 8.125% Senior Notes in July, bringing year-to-date gross debt reduction to $200 million. This followed the successful April remarketing of $200 million of tax-exempt bonds at an interest rate of 4.05% that matures in 2026. At quarter end, Marathon Oil had $2.1 billion of available borrowing capacity on its revolving credit facility that matures in 2027. All three primary credit rating agencies continue to rate Marathon Oil as investment grade, with Fitch and Moody's reaffirming their credit rating in June 2023.

ADJUSTMENTS TO NET INCOME: The adjustments to net income for second quarter increased net income by $8 million, primarily due to a small unproved property impairment and the income impact associated with unrealized losses on derivative instruments.

Company Overview

Marathon Oil Corporation is an independent exploration and production company incorporated in 2001, focused on U.S. resource plays: Eagle Ford in Texas, Bakken in North Dakota, STACK and SCOOP in Oklahoma and Permian in New Mexico and Texas.3

United States Segment

Marathon Oil is engaged in oil and gas exploration, development and production activities in the U.S. The company's primary focus in the United States segment is concentrated within its four high-quality resource plays.

Eagle Ford – Marathon Oil has been operating in the South Texas Eagle Ford play since 2011, where its acreage is located in Karnes, Atascosa, Gonzales, Lavaca, DeWitt, Bee and Live Oak Counties. The company operate 32 central gathering and treating facilities across the play that support more than 1,600 producing wells. The company also own and operate the Sugarloaf gathering system, a 42-mile natural gas pipeline through the heart of its acreage in Karnes and Atascosa Counties. In addition, in the fourth quarter of 2022, the company acquired approximately 130,000 net proved and unproved acres, with an average 97% working interest, and approximately 700 existing wells from Ensign Natural Resources.

Bakken – Marathon Oil has been operating in the Williston Basin since 2006. The majority of its core acreage is within McKenzie, Mountrail and Dunn Counties in North Dakota targeting the Middle Bakken and Three Forks reservoirs.

Oklahoma – With a history in Oklahoma that dates back more than 100 years, its primary focus has been development in the STACK Meramec and SCOOP Woodford, while progressing delineation of other plays across its acreage. The company primarily hold net acreage with rights to the Woodford, Springer, Meramec, Osage and other prospect intervals, with a majority of this in the SCOOP and STACK.

Permian – Marathon Oil has been operating in the Northern Delaware basin, which is located within the greater Permian area, since closing on two major acquisitions in 2017. The company's focus has been to advance its position through execution of strategic acreage trades, progress early delineation and development of its acreage, improve its cost structure and secure midstream solutions. Marathon Oil has the majority of its acreage in Eddy and Lea counties primarily in the Wolfcamp and Bone Spring New Mexico plays.

International Segment

Marathon Oil is engaged in oil and gas exploration, development and production activities in E.G. The company include the results of its investments in a LPG processing plant and LNG and methanol production operations in E.G. in its International segment.

Equatorial Guinea – The company own a 63% and an 80% operated working interest in two separate production sharing contracts (Alba PSC and Block D PSC, respectively), which the company produce from the Alba field, located offshore E.G. These production sharing contracts were unitized in 2017 resulting in the Alba Unit in which the company own a 64% operated working interest.

Equatorial Guinea – Gas Processing – The following facilities located on Bioko Island, all accounted for as equity method investments, allow it to further monetize natural gas production from the Alba field.

The company own a 52% interest in Alba Plant LLC, which operates an onshore LPG processing plant. Alba field natural gas is processed by the LPG plant under a fixed-price long-term contract. The LPG plant extracts condensate and LPG from the natural gas stream and uses some of the remaining dry natural gas in its operations.

The company also own 56% of EGHoldings, which operates a 3.7 mmta LNG production facility. Under EGHoldings’ current sales and purchase agreement, which ends on December 31, 2023, the purchaser takes delivery of the LNG on Bioko Island, with pricing linked principally to the Henry Hub index. Marathon Oil is progressing new LNG agreements expected to begin on January 1, 2024, and its intention is to secure increased exposure to global LNG market prices. EGHoldings’ gross sales of LNG from this production facility totaled approximately 2 mmta in 2022.

The company also own 45% of AMPCO, which operates a methanol plant. AMPCO had gross sales totaling approximately 2,351 mtd in 2022. Methanol production is sold to customers in Europe and the U.S.