NaturalShrimp, Inc.

Summary

- NaturalShrimp, Inc. is an aqua-tech company that produces shrimp free from antibiotics, probiotics, or toxic chemicals in La Coste, Texas and Webster City, Iowa using patented proprietary technology.

- The company employs only 25 full-time employees. It has 740.58 million shares outstanding.

- The company is in growth stage and does not have mentionable sales revenues. However, it has generated $36,336 in revenue in the first quarter of running financial year ended on June 30, 2022. During the year 2022, ended March 30, the company has generated revenue of $33,765, which was nil the year before.

- Net loss for the first quarter of FY23 stands at $2,200,176. Yearly net loss of the outgoing financial year is $86,297,748, which was $3,580,454 a year earlier. The huge shoot-up in net loss is due to recognition of Series F Preferred Stock as stock compensation.

- The company has paid dividend of $575,029 in 2022 and $317,870 a year earlier.

- On December 25, 2018, the company was awarded U.S. Patent “Recirculating Aquaculture System and Treatment Method for Aquatic Species” covering all indoor aquatic species that utilizes proprietary art. NaturalShrimp and F&T combinedly shared the award.

- As of March 31, 2022, NaturalShrimp has one 40,000 square feet production facility in La Coste, Texas, another three facilities totalling 344,000 square feet in Iowa. The company signed a joint venture agreement with Hydrenesis to build a 240,000 square feet production facility in Florida. Over the next five years, the company plans to increase construction of new regional production facilities each year.

Brief Overview

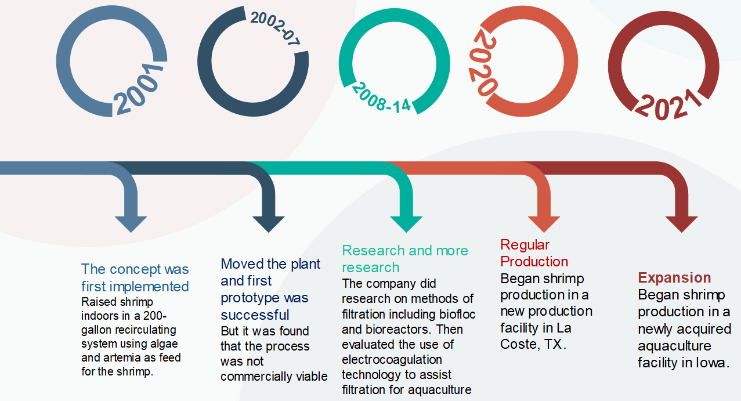

N aturalShrimp, Inc. (OTCQB: SHMP) is an aqua-tech company that produces shrimp free from antibiotics, probiotics, or toxic chemicals in La Coste, Texas and Webster City, Iowa using patented proprietary technology. NaturalShrimp started its journey back in 2001 when it deployed a research & development effort to build a system to organically cultivate shrimp without any dependency on seawater, which turned out to be economically infeasible until next several years whereby the company was able to cut out the costly part – dependency on too much algae and artemia, of the cultivation and brought out the products into market during 2008-2011 period.1

aturalShrimp, Inc. (OTCQB: SHMP) is an aqua-tech company that produces shrimp free from antibiotics, probiotics, or toxic chemicals in La Coste, Texas and Webster City, Iowa using patented proprietary technology. NaturalShrimp started its journey back in 2001 when it deployed a research & development effort to build a system to organically cultivate shrimp without any dependency on seawater, which turned out to be economically infeasible until next several years whereby the company was able to cut out the costly part – dependency on too much algae and artemia, of the cultivation and brought out the products into market during 2008-2011 period.1

The only product of the company is fresh shrimp, supplied all round the year. The company is headquartered at Dallas, TX, United States. Mr. Gerald Easterling is the Co-founder President, Chairman & CEO of the company. NaturalShrimp employs 25 full time employees.2 The company is listed on OTCQB market trading at $0.1450 on 03 October, 2022. Total number of outstanding shares of the company is 740.58 million.3

Financial Analysis

Q1 Results

NaturalShrimp is a growth-stage company that has a mixed financing condition. The company has issued debentures multiple times, has convertible preferred shares as well as common stocks in its liabilities and equities section of the balance sheet. As on June 30, 2022, the company has Series A convertible preferred stock of $0.0001 par value 5,000,000 shares issued and outstanding amounting to $500; common stock of $0.0001 par value 740,585,500 shares outstanding amounting to $74,097; Series E redeemable convertible preferred stock $0.0001 par value 2,140 shares outstanding amounting to $2,020,176; Series F redeemable convertible preferred stock $0.0001 par value 750,000 shares outstanding amounting $43,612,000; and convertible debenture amounting to $4,669079.

Total current asset position on June 30, 2022 is $2.8 million, fixed assets $15.80 million, and other assets $16.84 million. Total asset is $35.45 million on the same date. Current liabilities of the company on the end of first quarter of FY23 is $19.67 million total liabilities is $24.71 million and total liabilities and equities combined is $35.45 million.

The company has generated revenue of $36,336 in the first quarter of FY23, ended June 30, 2022 which was $0 during the same period a year earlier. Operating expenses of the company during the period is $2,923,140 which was $2,238,090 a year earlier. Thus, the company incurs an operating loss of $2,886,804 in the first three months of FY23, which was $2,238,090 during the same period of the previous year. After addition and subtraction of other expenses, incomes, and changes in fair value of derivative liability and warrant liability, net loss stands at $2,200,176 during this period as compared to $2,562,743 in that of a year earlier.

Analysis of Past Financial Year

Revenue and Net Income

NaturalShrimp has not generated any significant revenue since their inception.4 During the year 2022, ended March 30, the company has generated revenue of $33,765, which was nil the year before. However, the operating cost of the company during the latest financial year has been $54,474,975 which was $3,301,254 a year earlier – a growth of about 1,550%. The huge shoot-up is due to recognition of Series F Preferred Stock as stock compensation – an estimated amount of $43,612,000. The 750,000 preferred stocks were issued on March 1, 2022 to three executive officers of the company, 250,000 each. Other than stock compensation, the overall change in expenses is mainly due to the increase in salary, professional services, facility operations and other general and administrative expenses, as well as depreciation, and the amortization of the intangible assets.

After incurring all the other expenditure, the company reported a net loss of $86,297,748, which was $3,580,454 a year earlier. The company has further added to the loss amortization of beneficial conversion feature on preferred shares, accretion on Series D Preferred shares, redemption and exchange of Series D Preferred shares, and dividends to a net loss available for common stockholders of $96,352,775. The company has paid dividend of $575,029 in 2022 and $317,870 a year earlier.

Assets

The company has reported total current asset of $4,829,141 as on March 31, 2022, an increased figure from $811,134 a year earlier. Reported fixed assets during the year is $14,798,103, an increase from $12,236,557 a year earlier. Reporting of fixed asset is bumped up in quarterly reporting for the quarter ended 31 December, 2020. On March 31, 2020, the company has reported fixed assets of only $707,808. But it has entered into an Asset Purchase Agreement with VBF – a company that only entered the growth phase and didn’t work out any further5, and purchased $10,000,000 assets including land, buildings, autos and trucks, and machinery and equipment. The company purchased the fixed assets with cash of $5,000,000, and two deferred payment schemes – a 36-months payment scheme at 5% interest rate, and a 48-months payment scheme at 5% interest rate – both having the option of balloon payment at the end of the maturity period.

List of Bank Loans and Notes

On April 10, 2020, the company obtained a Paycheck Protection Program (PPP) loan of $103,200 under the CAREs Act, which was later forgiven as the company filed for it on April 16, 2021.

On January 10, 2017, the company has entered into a promissory note with Community National Bank for $245,000 at an annual rate of 5%. After some partial payment, modification of terms, and further paybacks, balance of the note stood at $214,452 on March 31, 2021. The company paid this loan in full on December, 2021.

On November 3, 2015, NaturalShrimp entered into a short-term note agreement with Community National Bank to the effect of $50,000. The balance on March 31, 2021 was $3,124 and the company paid it off in full in July of 2021.

During the asset acquisition of VBF, the company has entered into two Promissory Notes – A and B, which are payable in 36 months and 48 months, respectively. Total amount of borrowed is $5,000,000. The company settled the notes in full on December 23, 2021.

Outstanding notes payable of $119,604 on Balance Sheet of the company on March 31, 2022 is the balance of the promissory note issued to Ms. Williams on July 15, 2020 less current portion of $96,000 of it.

As on March 31, 2022, the company has a zero balance of bank loan and $119,604 of notes payable on its Statement of Financial Position.

List of Debentures

The company has these debentures issued and some converted6 – August 14, 2018 convertible 10% promissory note, converted into shares on March 31, 2019; September 14, 2018 convertible 12% promissory note, converted into shares during the first quarter of fiscal year 2021; March 1, 2019 convertible 10% promissory note, converted to shares on December 21, 2020; April 17, 2019 convertible 10% promissory note, converted to shares on September 14, 2020; February 26, 2021 convertible 12% note, settled through cash payment and conversion on April 16, 2021; December 15, 2021 secured promissory note at the rate of 12% per annum.

Stockholders’ Equity

NaturalShrimp has a series of preferred stock issued along with the common stock, stocks issued to the consultants as its shareholders’ equity. As of March 31, 2022 and March 31, 2021, the Company had 200,000,000 shares of preferred stock authorized with a par value of $0.0001 –5,000,000 shares of Series A preferred stock are authorized and outstanding; 5,000 shares of Series B preferred stock are authorized with 0 and 607 outstanding in the mentioned two financial years, respectively; 20,000 shares Series D preferred stock are authorized with 0 and 6,050 outstanding, respectively; 10,000 shares Series E preferred stock are authorized with 2,840 and 0 outstanding, respectively; and 750,000 shares Series F Redeemable Convertible Preferred stock are authorized with 750,000 and 0 shares outstanding, respectively.7

Common stocks of the company come from a securities purchase agreement, common stocks due to conversion of debentures, and common stocks issued to consultant. On April 14, 2021, the Company entered into a securities purchase agreement with an accredited investor, for the offering of ![]() $5,000,000 worth of common stock, par value $0.0001 per share, of the Company; at a per share purchase price of $0.55 per Share (ii) common stock purchase warrants to purchase up to an aggregate of 10,000,000 shares of Common Stock, which are exercisable for a period of five years after issuance at an initial exercise price of $0.75 per share, subject to certain adjustments, as provided in the Warrants; and (iii) 1,000,000 shares of Common Stock.8

$5,000,000 worth of common stock, par value $0.0001 per share, of the Company; at a per share purchase price of $0.55 per Share (ii) common stock purchase warrants to purchase up to an aggregate of 10,000,000 shares of Common Stock, which are exercisable for a period of five years after issuance at an initial exercise price of $0.75 per share, subject to certain adjustments, as provided in the Warrants; and (iii) 1,000,000 shares of Common Stock.8

During the three months ended December 31, 2021, three consultants were issued a total of approximately 430,000 shares of common stock, with a total fair value of approximately $158,000, based on the market price of $0.36 on the grant date.

Working Capital

The increase in current assets is due to the remainder of the receipt of the cash for the December 15, 2021 convertible debenture including the $1,500,000 in escrow, as well as an approximately $856,000 increase in prepaid expense. The increase in the prepaid expense is mainly due to approximately $965,000 related to work being done at the Iowa facilities. The increase in current liabilities is primarily due to the addition of the derivative related to the new convertible note, with a fair value of $13,101,000 as of the year end. Additionally, due to the derivative, the existing warrants were classified as a liability, with a fair value of $3,923,000 as of the current fiscal year end. Lastly, there also is an increase of approximately $1,839,000 in accounts payable and $427,000 in accrued interest mostly related to the new convertible debenture. The increases in liabilities are offset by the settlement of bank loans and lines of credit and non-current short-term notes and notes payable to related parties, as well as accrued expenses of approximately $316,000 related to the Vero Blue acquisition recognized in the gain on Vero Blue debt settlement.

Cash Position

The company has earned a net loss of $86,297,748 owing to its minimal sales that only started off in the past financial year. Due to that loss in the financial year 2022, the company has used $12,575,244 in operating activities during this financial year. Due to the asset acquisition process with VeroBlue Farms, Inc., the company has also paid cash in investing activities of $8,432,465. The company has generated cash inflows from financing activities. It received $17 million from issuance of common shares, $8.90 million from convertible debentures, $5 million from escrow settlement, and $1.34 million from Series E preferred stocks sale. Net cash inflow from financing activity is $22,585,954. Thus, at the end of the year, the company has $1,734,040 cash on hand.

Company Overview

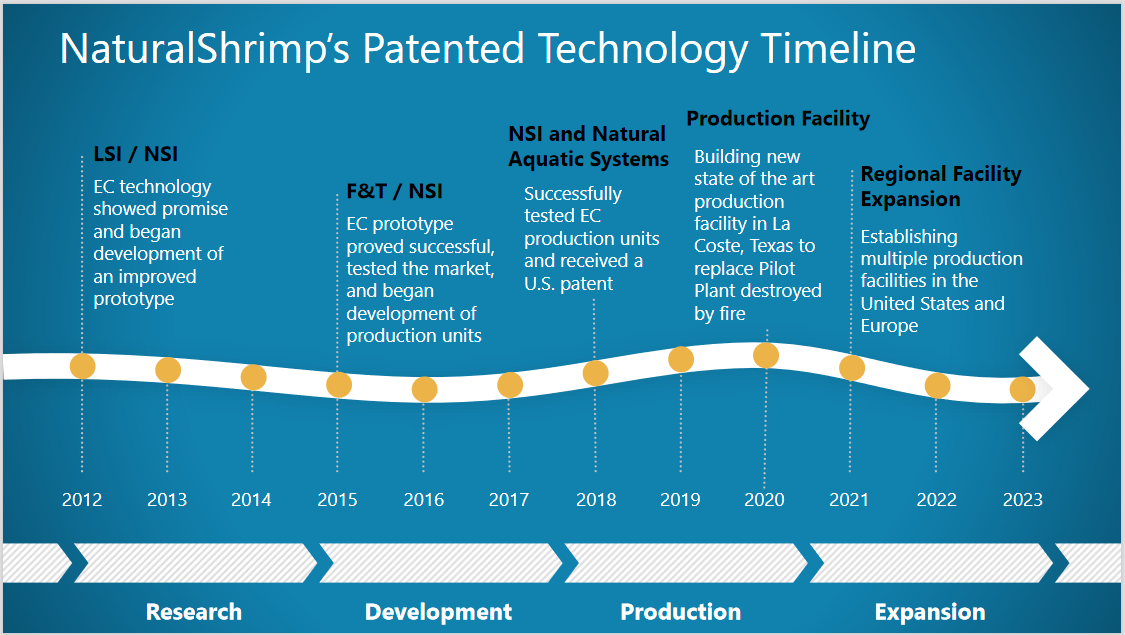

NaturalShrimp is a publicly-traded agro-tech company that strives to provide the freshest shrimp and seafood to the local markets everywhere. They have developed a system through intense and consistent research over the years which requires a small footprint and minimal power. The company has initially tested its concept in 2001 when it has raised shrimp indoors in a 200-gallon recirculating system using algae and artemia and feed for the shrimp. But when the company moved to a warehouse to test the development in a larger system, it found that the tested system was commercially inviable because of the large requirement algae and artemia. It then acquired 37 acres of land in La Coste, TX and constructed a greenhouse and a 30,000 square foot metal building with lined tanks and filtration equipment to evaluate using dry shrimp feed instead of algae and artemia on a commercial scale. During the years of 2008 through 2011, the company researched methods of filtration including biofloc and bioreactors; constructed 70,000 square feet joint venture biofloc in Spain; raised and sold tens of thousands of pounds of shrimp but could not achieve consistent production in high densities. NaturalShrimp then in the years 2012 to 2014, evaluated the use of electrocoagulation technology to assist filtration for acquaculture. It demonstrated the ability to control both ammonia and bacteria which resulted in much better growth and survival but the equipment needed refinement. Then during the years 2015 through 2017, the company has evaluated a clearwater system using refined electrocoagulation equipment that once again proved successful in maintaining water quality and great shrimp survival but the equipment required further refinements. In 2018, the company received U.S patent for using electrocoagulation for shrimp extended to include other aquatic species. In 2019, the company has renovated a pilot plant by replacing the lined tanks with fiberglass tans and acquiring additional electrocoagulation systems. In 2020, the company has begun shrimp production in a new production facility in La Coste, TX. And in 2021, the company has begun shrimp production in a newly acquired aquaculture facility in Iowa.

On October 16, 2015, NaturalShrimp collaborated with F&T Water Solutions LLC to form Natural Aquatic Systems (NAS) which would formalize the business relationship between the collaborators in jointly developing water technologies. On December 25, 2018, both parties were awarded U.S. Patent “Recirculating Aquaculture System and Treatment Method for Aquatic Species” covering all indoor aquatic species that utilizes proprietary art.

On December 15, 2020, NaturalShrimp has entered into an asset purchase agreement with VeroBlue Farms USA, Inc. for $10,000,000 in consideration. The purchase includes the tangible assets of VBF, the motor vehicles of Transport and the real property (together with all plants, buildings, structures, fixtures, fittings, systems, and other improvements located on such real property). VBF was a new company which did not continue its operation and therefore sold its facilities to NaturalShrimp. The facility was originally designed as an aquaculture facility. NaturalShrimp has begun a modification process to convert the plant to produce shrimp, which will allow them to scale faster without having to build new facilities. The three Iowa facilities contain the tanks and infrastructure that will be used to support the production of shrimp with the incorporation of the Company’s Electrocoagulation (EC) platform technology.

On May 19, 2021, the Company entered into a Patents Purchase Agreement with F&T. F&T owns 50% of the patent awarded to both the companies on December 25, 2018. NaturalShrimp purchased the 50% and 100% of the interest in a second patent that F&T owns for $2,000,000 in cash and 9,900,990 shares of the company’s common stock with a market value of $0.505 per share for a total fair value of $5,000,000, for a total acquisition price of $7,000,000. The Company paid the cash purchase price on May 20, 2021 and the closing of the Patents Agreement took place on May 25, 2021.

On August 25, 2021, the Company, through its 100% owned subsidiary NAS, entered into an Equipment Rights Agreements with Hydrenesis-Delta Systems, LLC and a Technology Rights Agreement, in a sub-license agreement with Hydrenesis Aquaculture LLC, The Equipment Rights involve specialized and proprietary equipment used to produce and control, dose, and infuse Hydrogas® and RLS® into both water and other chemical species, while the Technology sublicense pertains to the rights to Hydrogas® and RLS®. Both rights agreements are for a 10-years term – renewable.

NaturalShrimp was incorporated in the State of Nevada on July 3, 2008 under the name “Multiplayer Online Dragon, Inc.” Effective November 5, 2010, the company effected an 8-for-1 forward stock split, which increased outstanding common stock from 12,000,000 shares to 96,000,000 shares. On October 29, 2014, the company effected a 1-for-10 reverse stock split, which decreased outstanding common stock from 97,000,000 to 9,700,000 shares.

Industry Overview

The world population has been depending on shrimp production for meeting its demand of daily protein from sea-food sources. According to the USDA Foreign Agricultural Service, the world consumes approximately 9 billion pounds of shrimp annually with over 1.7 billion pounds consumed in the United States alone. Approximately 65% of the global supply of shrimp is caught by ocean trawlers and the other 35% is produced by open-air shrimp farms, mostly in developing countries.

The United States population is approximately 330 million people with an annual shrimp consumption of 1.7 billion pounds, of which less than 400 million pounds are domestically produced. In other words, of the total demand, 1.5 billion pounds are imported. Top shrimp exporting countries in the world remain the developing countries such as Ecuador, India, Vietnam, Indonesia, Argentina, Thailand, and China.9

Shrimps in the exporting countries are either caught using shrimp-catching boats or shrimp farming. Approximately 65% of the global supply of shrimp is caught by ocean trawlers and the other 35% is produced by open-air shrimp farms, mostly in developing countries. Allegedly, the shrimp farming processes are not free from antibiotics and usage of disinfectants.10

There is a scope in the United States for shrimp aquaculture since the country is yet to reduce its dependency on imports for shrimp consumption. NaturalShrimp is a first mover to that end.

Locations, Strategy, Market Segment

As of March 31, 2022, NaturalShrimp has one 40,000 square feet production facility in La Coste, Texas, another three facilities totalling 344,000 square feet in Iowa. The company signed a joint venture agreement with Hydrenesis to build a 240,000 square feet production facility in Florida. Over the next five years, the company plans to increase construction of new regional production facilities each year. With the existing facility in Texas, the company expects to produce 3,000 pounds of shrimp per week, and with the facilities in Iowa, the company expects the number to be 12,000 pounds of shrimp per week. Combined output per week in the first quarter of 2023 is expected to be 15,000 pounds.

With its homegrown shrimps, the company expects to be able to supply fresh, naturally grown, and quality shrimps each week. Thus, the distribution companies will be able to use their existing relationship with restaurants, supermarkets, country clubs, and retail stores to supply shrimps uninterruptedly.

The company targets two types of market – one is fresh and never frozen and the second one is the live market. Goal of the company is to establish production systems and distribution centers in regional areas of the United States, as well as international distribution networks through joint venture partnerships throughout the world. This should allow the Company to capture a significant portion of world shrimp sales by offering locally grown, environmentally friendly, fresh shrimp at competitive wholesale prices.

Recent Developments

- On September 28, 2022, NaturalShrimp, Inc. partnered up with US Foods – one of the leading food companies in America, with an exclusive grow out program for NaturalShrimp’s customers.11

- As part of its expansion plan, on February 17, 2022, NaturalShrimp Florida has signed a letter of agreement with the Jefferson County, Florida Board of County Commissioners to lease or convey a ten-acre tract of land for the development up to a 250,000 square foot inland shrimp production facility in Florida, and help to identify and pursue up to $25 million in available funding grants.12

- ^ https://naturalshrimp.com/about-our-company/

- ^ https://finance.yahoo.com/quote/SHMP/key-statistics?p=SHMP

- ^ 10-Q form of FY2022 first quarter, ended June 30, 2022

- ^ 10-K Filing 2022. p-34

- ^ 10-K filing 2022, p.F-12

- ^ For more details see 10-K filing 2022, p.F-15

- ^ More details available 10-K filing 2022, p.F-18

- ^ More information available at 10-K filing 2022, p.F-23

- ^ https://www.rodaint.com/vannamei-tips/global-shrimp-exports-exceed-20-billion-dollars-china-is-still-ecuadors-largest-target-market/

- ^ Bermúdez-Almada, M. C., and A. Espinosa-Plascencia. "The use of antibiotics in shrimp farming." Health and environment in aquaculture (2012): 199-214.

- ^ https://www.globenewswire.com/en/news-release/2022/09/28/2524328/0/en/NaturalShrimp-Partners-With-Leading-Foodservice-Distributor.html

- ^ https://www.globenewswire.com/en/news-release/2022/02/17/2387199/0/en/NaturalShrimp-Partners-with-Jefferson-County-Florida-for-New-Shrimp-Production-Facility-Property-and-to-Seek-25-Million-in-Available-Grants.html