Occidental Petroleum Corporation

Summary

- Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, North Africa, and Latin America.

- OXY generate revenue from three reporting segments: oil and gas, chemical and midstream and marketing.

- The Oil and Gas segment reflects the company's core business in hydrocarbon exploration and production, while the Chemical and Midstream and Marketing segments contribute to the company's overall financial performance by providing complementary services and products in various geographical regions.

- In 2022, the company experienced remarkable growth in sales, with total sales reaching $36,634 million. This marked an increase of $10,678 million or 41% compared to the sales figure of $25,956 million in 2021.

- The company's gross profit for 2022 amounted to $17,645 million, reflecting a difference of $9,795 million or 125% from the gross profit of $7,850 million in the previous year, 2021.

- Company's operating profit increased in 2022, totaling $13,665 million, which was higher by $8,000 million or 135% compared to the operating profit of $4,665 million in 2021. The net profit for the year 2022 was $11,704 million, representing an increase of $10,182 million or 669% compared to the net profit of $1,522 million in 2021.

- The diluted earnings per share (EPS) for 2022 were reported as $12.40, which showed an increase of $10.82 or 684% compared to the diluted EPS of $1.58 in 2021.

Brief Company Overview

Occidental Petroleum Corporation (NYSE:OXY) is an international energy company with assets in the United States, Middle East, Africa, and Latin America. It is one of the largest oil producers in the U.S., including production in the Permian and DJ basins, and offshore Gulf of Mexico. Its midstream and marketing segment provides flow assurance and provide majority revenue from oil and gas. OXY’s chemical subsidiary OxyChem manufactures the building blocks for life-enhancing products. Its Oxy Low Carbon Ventures (OLCV) subsidiary is advancing leading-edge technologies and business solutions that reduce emissions.1

Occidental Petroleum Corporation (NYSE:OXY) is an international energy company with assets in the United States, Middle East, Africa, and Latin America. It is one of the largest oil producers in the U.S., including production in the Permian and DJ basins, and offshore Gulf of Mexico. Its midstream and marketing segment provides flow assurance and provide majority revenue from oil and gas. OXY’s chemical subsidiary OxyChem manufactures the building blocks for life-enhancing products. Its Oxy Low Carbon Ventures (OLCV) subsidiary is advancing leading-edge technologies and business solutions that reduce emissions.1

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, North Africa, and Latin America. It operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. The company's Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas. Its Chemical segment manufactures and markets basic chemicals, including chlorine, caustic soda, chlorinated organics, potassium chemicals, ethylene dichloride, chlorinated isocyanurates, sodium silicates, and calcium chloride; and vinyls comprising vinyl chloride monomer, polyvinyl chloride, and ethylene. The Midstream and Marketing segment gathers, processes, transports, stores, purchases, and markets oil, condensate, NGLs, natural gas, carbon dioxide, and power. This segment also trades around its assets consisting of transportation and storage capacity; and invests in entities. Occidental Petroleum Corporation was founded in 1920 and is headquartered in Houston, Texas.2

As of September 2023, the company had a 52-week share price range of $55.51 to $76.11. The trailing P/E ratio of the company is 11.23 times, the price-to-sales ratio (ttm) is 2.07 times, the profit margin is 21.55%, the operating margin is 20.04%, the return on assets (ttm) is 7.83%, the return on equity is 23.74%, and the diluted earnings per share (ttm) is $5.92. The aggregate market value of the registrant’s Common Stock held by nonaffiliated of the registrant was approximately $59.82 billion computed by reference to the closing price on the New York Stock Exchange of $66.46 per share of Common Stock on October 19, 2023. As of January 31, 2023, there were 900,072,447 shares of Common Stock outstanding, par value $0.20 per share.

Recent Developments

- In February 2022, Occidental announced an authorization to repurchase up to $3.0 billion of Occidental's shares of common stock. The plan was completed in the fourth quarter of 2022.

- In 2022, Occidental purchased proved reserves of 10 MMboe primarily consisting of proved reserves in the Permian Basin.

- In July 2022, Occidental sold 10.0 million limited partner units of WES for proceeds of approximately $250 million, resulting in a gain of $62 million.

- In November 2022 and December 2022, Occidental acquired additional primarily producing assets in the Permian Basin for a combined net purchase price of approximately $400 million.

- In November 30, 2022 – Enbridge Inc and OLCV, a subsidiary of Occidental announced that the parties intend to work towards jointly developing a carbon dioxide (CO2) sequestration hub in the Corpus Christi area of the Texas Gulf Coast. Enbridge and OLCV signed a letter of intent to explore this joint project, which would provide a complete CO2 solution for area emitters through the development of a pipeline transportation system and sequestration facility.3

- For the twelve months ended December 31, 2022, Occidental repaid debt with a face value of more than $10.5 billion, reducing the face value of Occidental’s debt to less than $18.0 billion. The net book value of the full year repayments was $9.8 billion, which resulted in a gain of $149 million.

Recent Financing Activities

- In the first quarter of 2023, Occidental repurchased $752 million of common stock, accounting for over 25% of the $3.0 billion repurchase program.

- In the first quarter of 2023, Triggered the redemption of $647 million of preferred stock, initiating the next phase of shareholder return framework.

- In the second quarter of 2023, repurchased $425 million of common stock, with year-to-date purchases accounting for nearly 40% of the $3.0 billion repurchase program.4

- In the second quarter of 2023, triggered the redemption of $522 million of preferred stock, bringing year-to-date redemptions to nearly $1.2 billion or 12% of preferred equity.

Financial Performance Highlights

Q2 2023 Highlights

In the second quarter of 2023, the company reported sales of $6,702 million, reflecting a decrease of $3,974 million or 37% compared to the second quarter of 2022, which had sales of $10,676 million. The net profit for the second quarter of 2023 was $605 million, showing a reduction of $2,997 million or 83% when compared to the net profit of $3,602 million in the second quarter of 2022. Furthermore, the company's diluted earnings per share (EPS) for the second quarter of 2023 decreased to $0.63, a negative change of $2.84 or 82% compared to the diluted EPS of $3.47 in the second quarter of 2022.

Annual Performance Highlights

In 2022, the company experienced remarkable growth in sales, with total sales reaching $36,634 million. This marked an increase of $10,678 million or 41% compared to the sales figure of $25,956 million in 2021. The company's gross profit for 2022 amounted to $17,645 million, reflecting a difference of $9,795 million or 125% from the gross profit of $7,850 million in the previous year, 2021. Additionally, the company's operating profit increased in 2022, totaling $13,665 million, which was higher by $8,000 million or 135% compared to the operating profit of $4,665 million in 2021. The net profit for the year 2022 was $11,704 million, representing an increase of $10,182 million or 669% compared to the net profit of $1,522 million in 2021. Moreover, the diluted earnings per share (EPS) for 2022 were reported as $12.40, which showed an increase of $10.82 or 684% compared to the diluted EPS of $1.58 in 2021.

Occidental’s revenue are sensitive to fluctuations in oil, NGL and natural gas prices. Price and volume changes generally represent the majority of the change in the oil and gas and chemical segments sales. Midstream and marketing sales generally represent the margins earned by the marketing business at it strives to optimize the use of its transportation, storage and terminal commitments to provide access to domestic and international markets and, to a lesser extent, NGL and sulfur revenues from the gas processing business. The increase in net sales in 2022 compared to 2021 was primarily due to higher realized commodity prices in the oil and gas segment. Chemical sales increased primarily due to higher prices and volumes across all product lines. The increase in midstream and marketing sales was due to higher crude oil prices impacting the marketing businesses. Domestic oil and gas results, excluding significant items affecting comparability, increased in 2022 compared to 2021 primarily due to higher realized oil, NGL and natural gas prices and lower DD&A rates, partially offset by higher lease operating costs. International oil and gas results, excluding significant items affecting comparability, increased in 2022 compared to 2021 primarily due to higher oil prices. Price changes at current global prices and levels of production affect Occidental’s pre-tax annual income by approximately $200 million for a $1 per barrel change in oil prices and approximately $30 million for a $1 per barrel change in NGL prices. If domestic natural gas prices varied by $0.10 per Mcf, it would have an estimated annual effect on Occidental’s pre-tax income of approximately $30 million. These price-change sensitivities include the impact of PSC and similar contract volume changes on income. Marketing results are sensitive to price changes of oil, natural gas and, to a lesser degree, other commodities. A $0.25 change in the Midland-to-Gulf-Coast oil spreads impacts operating cash flows by approximately $65 million. Occidental’s results are also sensitive to fluctuations in chemical prices. A variation in chlorine and caustic soda prices of $10 per ton would have a pre-tax annual effect on income of approximately $10 million and $30 million, respectively. A variation in PVC prices of $0.01 per lb. would have a pre-tax annual effect on income of approximately $30 million. Historically, over time, product price changes have tracked raw material and feedstock product price changes, somewhat mitigating the effect of price changes on margins.

In 2022, cash provided by operating activities for Occidental demonstrated a notable increase, reaching $16.81 billion, compared to $10.43 billion in 2021. This significant uptick in operating cash flow was primarily attributed to the surge in commodity prices during the year, with average WTI and Brent prices soaring by 39% and 40%, respectively, and NYMEX natural gas prices experiencing a remarkable 76% increase. Furthermore, the chemical segment played a pivotal role in driving this growth, contributing substantially to operating cash flows, chiefly due to elevated prices of various chemical products, with caustic soda, in particular, commanding higher prices compared to the preceding year. This robust financial performance underscores Occidental's ability to capitalize on favorable market conditions and its diverse business operations across the energy and chemical sectors.

In 2022, Occidental reported a significant increase in cash flows used by investing activities, totaling $4.87 billion, marking a $3.6 billion increase compared to the previous year. This surge was primarily driven by heightened capital spending, especially in the Permian Basin, where the company saw increased activity. Occidental expanded its asset portfolio by acquiring primarily producing assets in the Permian Basin, with an approximate value of $400 million, and additional interests in emerging low-carbon businesses and net-zero pathways, amounting to approximately $350 million. To optimize its portfolio, Occidental also divested certain strategic assets in the Permian Basin, yielding around $190 million in proceeds. Additionally, in 2022, Occidental sold 10 million limited partner units of WES, generating approximately $250 million in proceeds, contributing to the overall changes in cash flows from investing activities.

Cash used by financing activities in 2022 amounted to $13.72 billion, marking a significant increase of $5.1 billion compared to the previous year. This increase was primarily attributed to debt tenders and repayments, as well as treasury share repurchase activity. More detailed information regarding Occidental's debt repayments can be found in Note 6 - Long-Term Debt in the Notes to Consolidated Financial Statements in Part II Item 8 of the Form 10-K. Moreover, the financing activities also included cash dividend payments of $1.2 billion on preferred and common stock, as well as $111 million associated with net interest rate swap settlements and collateral activity.

Business Overview

OXY generate revenue from three reporting segments: oil and gas, chemical and midstream and marketing. The Oil and Gas segment reflects the company's core business in hydrocarbon exploration and production, while the Chemical and Midstream and Marketing segments contribute to the company's overall financial performance by providing complementary services and products in various geographical regions. Segments include:

OIL AND GAS OPERATIONS

OXY primarily conducts its ongoing exploration and production activities in the United States, the Middle East and North Africa. Within the United States, Occidental has operations primarily in Texas, New Mexico and Colorado, as well as offshore in the Gulf of Mexico. Internationally, Occidental primarily conducts operations in the UAE, Oman and Algeria.

As a producer of oil, NGL and natural gas, Occidental competes with numerous other domestic and international public, private and government producers. Oil, NGL and natural gas are sensitive to prevailing global and local market conditions, as well as anticipated market conditions. Occidental’s strategy relies on producing hydrocarbons in a capital efficient manner through developing conventional and unconventional fields, and utilizing primary, secondary (waterflood) and tertiary (CO2 and steam flood) recovery techniques. The oil and gas segment maximizes efficiencies to deliver lower breakeven costs and generate excess free cash flow. The oil and gas segment strives to achieve low development and operating costs to maximize full-cycle value of the assets.

In 2022, in the United States, the company had reserves of 1,639 MMbbl of oil, 654 MMbbl of NGL, and 4,073 Bcf of natural gas. Internationally, they held 274 MMbbl of oil, 192 MMbbl of NGL, and 2,277 Bcf of natural gas. In total, Occidental had 1,913 MMbbl of oil, 846 MMbbl of NGL, and 6,350 Bcf of natural gas, amounting to 3,817 MMBoe in reserves. Their sales volumes for the same year included 185 MMbbl of oil, 83 MMbbl of NGL, and 445 Bcf of natural gas in the United States, and 41 MMbbl of oil, 12 MMbbl of NGL, and 164 Bcf of natural gas internationally, resulting in a total of 226 MMBoe in sales volumes. It's worth noting that natural gas volumes were converted to Boe using a conversion factor of six Mcf of gas per one barrel of oil, and the conversion to Boe may not equate to price equivalency. Reserves and sales volumes associated with Occidental's discontinued operations are excluded from the data.

CHEMICAL OPERATIONS

OxyChem operates manufacturing plants at 21 domestic sites across the United States and two international sites in Canada and Chile. OxyChem is among the top three producers of PVC in the United States and maintains a competitive edge by focusing on cost-effective production. Their product range includes basic chemicals such as chlorine, caustic soda, chlorinated organics, potassium chemicals, EDC, chlorinated isocyanurates, sodium silicates, and calcium chloride. They also produce vinyls, including VCM, PVC, and ethylene, which find applications in various industries such as water treatment, pharmaceuticals, pulp and paper, refrigerants, and construction materials. OxyChem's capacity and competitive strategy underscore its significance in the chemical industry.

MIDSTREAM AND MARKETING OPERATIONS

Occidental’s midstream and marketing operations primarily support and enhance its oil and gas and chemical businesses. The midstream and marketing segment strives to optimize the use of its gathering, processing, and transportation, storage and terminal commitments and to provide access to domestic and international markets. To generate returns, the segment evaluates opportunities across the value chain to provide services to Occidental subsidiaries, as well as third parties. The midstream and marketing segment operates or contracts for services on gathering systems, gas plants, cogeneration facilities and storage facilities and invests in entities that conduct similar activities, such as WES and DEL, which are accounted for as equity method investments. WES owns gathering systems, plants and pipelines and earns revenue from fee-based and service-based contracts with Occidental and third parties. DEL owns and operates a pipeline that connects its gas processing and compression plant in Qatar and its receiving facilities in the UAE, and uses its network of DEL-owned and other existing leased pipelines to supply natural gas across the UAE and to Oman. The midstream segment includes Al Hosn Gas, a processing facility in the UAE that removes sulfur from natural gas and processes the natural gas and sulfur for sale. The midstream and marketing segment also includes OLCV businesses.

Occidental Petroleum's midstream and marketing operations encompass a diverse range of locations and capacities. In Texas, New Mexico, and Colorado, the company and third parties operate natural gas and CO2 gathering, compression, and processing systems with a total capacity of 2.2 billion cubic feet per day (Bcf/d). Additionally, they hold an equity investment in gas processing facilities through WES in the Rocky Mountains and other regions, boasting a capacity of 5.0 Bcf/d. In the UAE, Occidental manages natural gas processing facilities for Al Hosn Gas with a capacity of 1.3 Bcf/d.

Their pipelines and gathering systems primarily focus on CO2 fields and pipeline systems that transport CO2 to oil and gas producing locations in Texas, New Mexico, and Colorado, with a capacity of 2.8 Bcf/d. They also have an equity investment in the DEL natural gas pipeline in Qatar, the UAE, and Oman, which has a capacity of 3.2 Bcf/d. In the United States, Occidental has an equity investment in WES for gathering and transportation, encompassing an extensive network of 14,712 miles of pipeline.

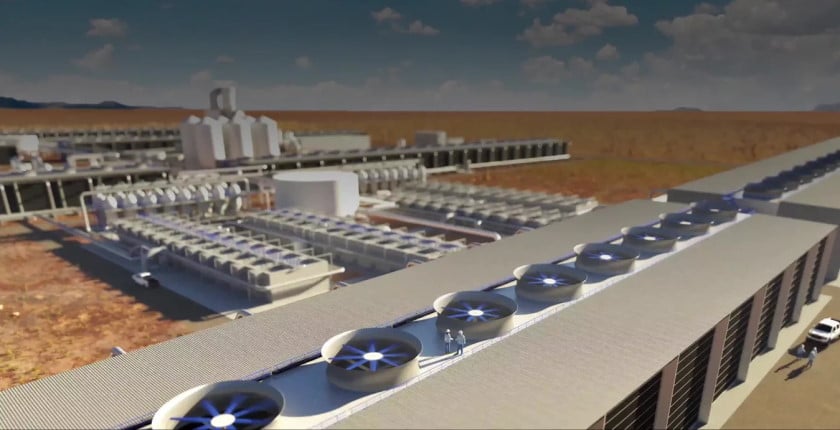

For power generation, Occidental operates power and steam generation facilities in Texas and Louisiana, generating 1,218 megawatts of electricity and 1.6 million pounds of steam per hour. Additionally, they own a solar generation facility in Texas with a capacity of 16.8 megawatts of electricity, and they have an equity investment in a zero-emission natural gas generation demonstration facility in Texas with a potential capacity of up to 50 megawatts of electricity. In Canada, Occidental has an equity investment in the development of Direct Air Capture (DAC) technology, designed to capture CO2 directly from the atmosphere.

Revenue of OXY

In 2022, Occidental Petroleum's revenue was generated across three primary segments as follows:

- Oil and Gas Segment: This segment was the primary revenue driver for Occidental, accounting for $27.17 billion in revenue. The revenue from the Oil and Gas segment was primarily derived from the sale of various products, including oil, natural gas liquids (NGL), and gas. The revenue was generated from both domestic (United States) and international markets. Oil sales constituted the majority of the revenue, with significant contributions from NGL and gas.

- Chemical Segment: The Chemical segment contributed $6.74 billion in revenue. This segment primarily involves the production and sale of various chemical products. Revenue is categorized based on the geographic areas where these chemicals are sold, encompassing both the United States and international markets.

Midstream and Marketing Segment: The Midstream and Marketing segment added $3.76 billion to Occidental's total revenue. The revenue in this segment is generally allocated based on the location of the sale, excluding net marketing revenue. It includes various activities related to gathering, processing, transportation, storage, and terminal services for oil and gas products.

Other Business Information

Occidental and its subsidiaries and their respective operations are subject to numerous laws and regulations relating to public and occupational health, safety and environmental protection, including those governing air and GHG emissions, water use and discharges, waste management and protection of wildlife and ecosystems. The requirements of these laws and regulations are becoming increasingly complex, stringent and expensive to implement. Costs of compliance with these laws and regulations are significant and can be unpredictable. These laws sometimes provide for strict liability for events that pose an impact or threat to public health and safety or to the environment, including for funding or performance of remediation and, in some cases, compensation for alleged personal injury, property damage, natural resource damages, punitive damages, civil penalties, injunctive relief and government oversight costs. Strict liability can render Occidental or its subsidiaries liable for damages without regard to their degree of care or fault. Some environmental laws provide for joint and several strict liability for remediation of spills and releases of hazardous substances or materials, and, as a result, Occidental or its subsidiaries could be liable for the actions of others.

Company History

Occidental Petroleum Corporation, often referred to as Oxy, has a rich history of transformation and expansion since its founding in 1920. Armand Hammer, a successful international businessman, played a pivotal role in the company's early development. Initially, Occidental was a small and unprofitable driller, and Hammer's interest in the company was primarily for tax purposes.5 However, the company's fortunes took a dramatic turn in 1957 when Hammer acquired a controlling stake. The discovery of a significant crude oil deposit in southern California shifted Occidental's trajectory, and Hammer decided to redirect the company's focus.

Under Hammer's leadership, Occidental made a series of successful discoveries, including a substantial natural gas deposit in northern California in 1961. These successes encouraged the company to expand its operations beyond the United States and into various industries. Occidental ventured into coal mining, chemical manufacturing, plastics, fertilizers, and meat processing. The company's diversification marked a significant departure from its original focus on oil and gas.

One notable milestone came in 1967 when Armand Hammer secured an oil concession from Libya, following a significant oil discovery in the country. This strategic move catapulted Occidental into the realm of major international oil companies. However, in the 1970s, in an effort to prevent the nationalization of its oil production by the Libyan government, Occidental made concessions that limited its earnings from Libya. As tensions between Libya and the United States escalated, the company ultimately suspended its operations in Libya in 1986.

To bolster its reserves of oil and natural gas, Occidental expanded its presence in the North Sea and acquired Midcon Corporation in 1986, which held one of the largest natural gas pipeline networks in the United States. This period also saw the consolidation of its chemical activities into Occidental Chemical Corporation (OxyChem) in 1987. Under Hammer's leadership, Occidental transitioned away from being exclusively reliant on energy ventures.

Following Armand Hammer's passing in 1990, Ray R. Irani assumed the role of president and chief executive officer. Over his two-decade tenure, Irani focused on reducing the company's debt and streamlining its operations to emphasize profitable oil and gas production. Occidental divested various non-core assets, including meatpacking, agricultural products, coal mining, and certain gas pipelines. In 1998, the company made a significant acquisition of natural gas deposits in the Elk Hills Field of southern California. Occidental also expanded its reach into the Permian Basin and pursued lucrative production and pipeline projects in the Persian Gulf, particularly in Oman and Qatar.

Throughout these transitions, chemicals remained an important component of Occidental's operations, generating a substantial portion of its revenue through OxyChem and other subsidiaries and joint ventures. Stephen I. Chazen succeeded Ray R. Irani as CEO in 2011, and Occidental continued to adapt and thrive in the dynamic energy and chemical industries.

In August 2019, Occidental made a landmark acquisition by purchasing Anadarko Petroleum for $57 billion, solidifying its position as a major player in the oil and gas sector. The company's growth trajectory continued into August 2023 when Occidental acquired all outstanding equity in Carbon Engineering, a direct air capture technology company, for $1.1 billion.

Occidental Petroleum Corporation's journey from its modest beginnings to becoming a global energy and chemical powerhouse is a testament to its ability to adapt, diversify, and seize opportunities in the ever-evolving energy industry. With its rich history of discoveries, expansions, and strategic shifts, Oxy stands as a prominent player in the energy sector and beyond.

References

- ^ https://www.oxy.com/news/news-releases/occidental-to-provide-oxy-low-carbon-ventures-olcv----investor-update-on-wednesday-march-23-2022/

- ^ https://finance.yahoo.com/quote/OXY/profile/

- ^ https://www.oxy.com/news/news-releases/enbridge-and-oxy-low-carbon-ventures-to-explore-the-development-of-a-co2-pipeline-transportation-and-sequestration-hub-near-corpus-christi-texas/

- ^ https://www.oxy.com/news/news-releases/occidental-announces-2nd-quarter-2023-results/

- ^ https://www.britannica.com/topic/Occidental-Petroleum-Corporation