Oil India Ltd

Company Overview

The story of Oil India Limited (NSE:OIL) traces and symbolises the development and growth of the Indian petroleum industry. From the discovery of crude oil in the far east of India at Digboi, Assam in 1889 to its present status as a fully integrated upstream petroleum company, OIL has come far, crossing many milestones. 1

On February 18, 1959, Oil India Private Limited was incorporated to expand and develop the newly discovered oil fields of Naharkatiya and Moran in the Indian North East. In 1961, it became a joint venture company between the Indian Government and Burmah Oil Company Limited, UK.

In 1981, OIL became a wholly-owned Government of India enterprise. Today, OIL is a premier Indian National Oil Company engaged in the business of exploration, development and production of crude oil and natural gas, transportation of crude oil and production of LPG. OIL also provides various E&P related services and holds 26% equity in Numaligarh Refinery Limited.

The Authorized share capital of the Company is Rs. 2000 Crores. The Issued, Subscribed and Paid share capital of the company is Rs. 1084.41 Crore. At present, The Government of India, the Promoter of the Company is holding 56.66% of the total Issued & Paid-up Capital of the Company. The balance 43.34%of the Equity capital is held by Public and others including Bodies Corporate, Mutual Funds, Banks,FPIs, Resident Individuals etc. Oil India LimitedOIL has over 1 lakh sq km of PEL/ML areas for its exploration and production activities, most of it in the Indian North East, which accounts for its entire crude oil production and majority of gas production. Rajasthan is the other producing area of OIL, contributing 10 per cent of its total gas production.

Additionally, OIL’s exploration activities are spread over onshore areas of Ganga Valley and Mahanadi. OIL also has participating interest in NELP exploration blocks in Mahanadi Offshore, Mumbai Deepwater, Krishna Godavari Deepwater, etc. as well as various overseas projects in Libya, Gabon, USA, Nigeria and Sudan.

In a recent CRISIL-India Today survey, OIL was adjudged as one of the five best major PSUs and one of three best energy sector PSUs in the country.

Business Overview

Drilling And Work Over

OIL currently owns and operates 13 drilling rigs and 14 work-over rigs, besides charter hiring drilling rigs based on operational requirement. 2

Over 1,000 wells covering over 3.5 million metres, varying in depth from 1,000 – 5,000 metres, have been drilled in various surface and sub-surface environments, including high underground pressures and temperature conditions.

To minimise land acquisition time, OIL has resorted to cluster well drilling to develop its oil and gas fields, which has resulted in protection of green belts surrounding OIL's operational areas.

OIL’s all round excellence in performance is attributed in part to efficient well drilling by the rig building team and proper maintenance of equipment at the company's well-equipped Workshop, which has achieved a peak performance level of over 20,000 m/rig year.

Wireline Logging Services

The process of recording formation parameters against depth for locating reservoirs, their contents and the ability to produce oil, gas or water after interpretation is known as ‘Well Logging’.

OIL’s Well Logging Department (WLD) was set up in 1978 under the directive of the Ministry of Petroleum & Chemicals, to develop self reliance and save foreign exchange being paid to service contractors. This in-house setup, equipped with basic logging equipment, started its logging operations from 1979 by recording a Cement Bond Log (CBL) in Well Jorajan # 12.

The WLD now provides around 75% of OIL’s total logging requirements. The balance 25% is supplemented by service contractors since the WLD has not invested in specialised logging equipment, which is extremely expensive and not cost-effective. Log interpretation, which was earlier outsourced, is now executed by OIL’s personnel. The WLD uses RS6000 workstation and software ‘ULTRA’, procured from Halliburton Energy Services, USA for log interpretation.

The WLD has recorded continuous awards as the best engineering installation in OIL’s internal safety competitions from 1994 till date, besides a continuous accident free record for several years. The WLD won the first prizes in the North-eastern Oil Mines Safety Competition as the Best Engineering Installation and for the Best Safety Performance.

The WLD has constantly stretched its manpower and equipment to their limits to serve OIL’s internal projects. In the onshore Bay Exploration Project at Orissa, it provided the entire logging services for 4 wells in 1987-88. Similarly, in the Rajasthan Project in 1988, the WLD provided logging services for the first well, followed by 3 drilling and 4 work-over wells at Kumchai in Arunachal Pradesh in 1992-93 and in Simen Chapori # 1 under BVEP in 2002. The WLD is also providing Cased Hole logging and perforating services to the Rajasthan Project.

The WLD currently provides self-designed, essential logging services as desired by the management. However, specialised logging services such as those for offshore, horizontal and multilateral wells will be outsourced in the future as well.

Pipelines

OIL's 1157 Km fully automated trunk pipeline with a capacity of 8 MMTPA, which transports the combined crude oil production of OIL and ONGCL in North-East to the refineries in this region and imported crude from Barauni to Bongaigaon Refinery (delivered from ex Haldia port through IOCL pipeline), has become a lifeline of national importance. Commissioned in 1962, the crude oil pipeline traverses 78 river crossings through the states of Assam, West Bengal and Bihar. The network of 10 pumping stations and 17 repeater stations is a specimen of exemplary maintenance work by OIL personnel. OIL has the distinction of running the crude oil fuelled prime mover engines & the pumps in its Pump Stations for over 200,000 hours.3

The 600 KM pipeline segment between Bongaigaon and Barauni has been re-engineered to enable oil flow in either direction and is now transporting RAVVA / Imported crude from Barauni to Bongaigaon.

The Company has recently undertaken a major project to replace all vintage equipments such as pumps, its prime movers along with all related auxiliaries in order to upgrade and optimize the Naharkatiya-Barauni pipeline system and meet all safety standards. With the induction of technology in all fronts, this pipeline will become one of the technically updated pipelines in the country.

Supervisory Control & Data Acquisition (SCADA) system to constantly monitor movement of crude oil through the pipeline is in use since its very inception. The trunk communication system uses Optical Fibre Cable technology for voice and data communication. OIL has also leased some of the spare dark fibre and bandwidth to other companies, generating revenue from the same.

In 2009, OIL commissioned a 660 km long Numaligarh - Siliguri product pipeline. This product pipeline is continuously evacuating refined products from Numaligarh Refinery to the markets in other states. The Duliajan - Numaligarh Gas Pipeline (DNPL) where OIL has 23% equity stake has also been operating since 2010. This line feeds natural gas to Numaligarh Refinery for their captive use and, in future may transport gas beyond Numaligarh to other cities in Assam. OIL thus has the distinct experience of operating and maintaining pipelines to transport hydrocarbon like crude oil, natural gas and petroleum products.

Harnessing Hydrocarbons

With privileged inheritance of tremendous knowledge, skill and entrepreneurship of the early oilmen who discovered and developed the Digboi oilfield, OIL has grown from strength to strength in the areas of systematic development and production of oil & gas fields.4

The Company has built up in-house expertise in advanced well stimulation and servicing techniques, design & operation of modern surface production facilities, artificial lift techniques and other enhanced oil recovery methods. It is the first company in India to start Reservoir Pressure Maintenance by Down Dip Water Injection and Crestal Gas Injection, thereby achieving remarkable recovery factor of more than 50% in some of the reservoirs.

The drilling of High Pressure High Temperature (HPHT) exploratory wells in Krishna Godavari(KG) basin involves high risk & high cost operations with exposure levels among the highest in the completion sector. The risks and demanding performance requirements for HPHT completions dictate special engineering considerations and investments. To ensure that completion equipment will perform safely and productively in specific HPHT environment, OIL along with the industry experts has defined a set of operational parameters and performance rating requirements for the equipment which shall endure the rigours of HPHT well tests.

The Company produces both Associated and Non-associated gas from its fields in Assam & Arunachal Pradesh and Non-associated gas from its gas fields in Rajasthan. The Company has been supplying its gas to consumers in different industrial sectors like Fertilizer, Power, Refinery, Petrochemical, Tea processing, domestic use etc.

From the perspective of OIL, the demand for natural gas has increased manifold over the years. Gas supply to Numaligarh Refinery Limited (NRL), with a committed quantity of 1 MMSCMD was started in February, 2011. Brahmaputra Crackers and Polymer Limited (BCPL), located at Lepetkata, Dibrugarh is a dream project of the people of Assam. OIL has started supplying natural gas to M/s Brahmaputra Cracker and Polymer Ltd. (BCPL) from FY 15-16.

To cater to the increasing demand, OIL has built up its gas collection and distribution infrastructure by constructing various pipelines and installations. Some of the major facilities like Central Gas Gathering Station and Offtake Point, gas pipelines have been constructed under this project.

In 1982, the Company set up an LPG recovery plant to process 2.20 MMSCMD of gas using the Turbo Expander Technology for the first time in Asia.

The 30 years old Recovery Plant, which is currently under replacement, along with a LPG Bottling Plant maintains excellent track records through consistence production without major breakdown. OIL today has the complete technical know-how to install, operate and maintain LPG Recovery and Bottling Plants.

International Business

OIL started aggressively pursuing acquisition of overseas E&P properties from the year 2005, with Government of India facilitating the process through the mechanism of Empowered Committee of Secretaries for faster clearance of such acquisition proposals. Currently the Company has established its presence in Libya, Gabon, Nigeria, Yemen, Venezuela, USA, Bangladesh, Myanmar, Mozambique and Russia. In 2013 OIL made commercial discovery of crude oil in Gabon where the Company is the Operator.5

OIL entered the arena of unconventional shale oil by acquiring 20% Participating Interest in Carrizo Oil and Gas Inc's liquid rich shale asset in Colorado, USA.

This helped OIL strategically for acquiring knowledge to develop similar opportunity in the country. Some recent overseas acquisitions of OIL include participation and winning two shallow-Offshoreblocks in Bangladesh bidding round-2012, acquisition of discovered gas assets in Mozambique during FY-14, acquisition of two Offshore exploratory blocks in Myanmar and acquisition of 50% stake in a producing asset in Russia.

OIL has also recently acquired stakes in two major producing assets from Rosneft Oil Company, the National Oil Company of Russian Federation. OIL led consortium of Indian Oil Corporation Limited and Bharat PetroResources Limited, successfully completed the acquisition of 29.9% and 23.9% stakes in LLC Taas-Yuryakh Neftegazodobycha and JSC Vankorneft respectively. With these acquisitions, crude oil production from Russia for OIL would be around 1.7 MMT.

These acquisitions, reflecting the Company's strategy for judicious mix of exploration and discovered/producing assets, are in line with the Government's stated objective of acquiring equity oil overseas.

Research and Development

OIL's R&D Mission is to provide knowledge-based, competent and techno-economically feasible solution in the areas of Exploration, Drilling, Production, Transportation of crude oil and natural gas, Pollution Monitoring & Control and Alternate source of Energy, through laboratory services of highest quality and by adopting state-of-the-art technology and caring for the environment.6

OIL accords utmost importance to up-gradation of technologies and expertise in various areas of its activities through its own Research & Development Centre at Duliajan, Assam.

The R&D Centre is accredited by National Accreditation Board of Testing & Calibration Laboratories (NABL), Govt. of India for ISO/IEC 17025:2005, and is recognized by the Department of Scientific & Industrial Research under the Ministry of Science & Technology, Govt. of India. It is the first laboratory of any E&P company in India to achieve this accreditation. The R&D Department is carrying out studies in the highly specialized areas of petroleum geochemistry, oilfield chemicals, drilling and workover fluids, enhanced oil recovery, well stimulation, pollution control, petroleum biotechnology, etc.

The Company has entered into collaborative projects with reputed academic institutions of higher learning – IIT (Bombay), IIT (Madras), IIT (Guwahati), IIT (Roorkee), Indian School of Mines, Dhanbad, Gauhati University and the North Eastern Hill University, Shillong. In addition, it has research tie-ups with reputed agencies such as The Energy and Resources Institute (TERI), Institute of Reservoir Studies (IRS, ONGC), National Geophysical Research Institute (NGRI), Indian Institute of Petroleum (IIP) and CSIR - Central Electrochemical Research Institute.

The Company is determined to further strengthen its R & D efforts towards providing appropriate techno-economical solution of the problems faced in the areas of exploration, drilling, production and transportation of crude oil and natural gas.

The Company has also Established Centre of Excellence for Energy Studies (CoEES), a centre for integrated study of various domains in the upstream petroleum sector specially covering both Exploration and Reservoir activities.

The vision of CoEES is to be a centre of innovation and development for enabling OIL to match with the global oil majors in terms of technical capability and business performance. To meet the above vision, the Company has procured top notch facilities in terms of software, hardwares, laboratory facilities and expertise for building an environment that fosters innovation and creativity. It is equipped with world class technologies encompassing the conventional oil and gas sector, unconventional hydrocarbon and other energy spectrum.

CoEES activities are aligned to match OIL's vision and strategy. Broadly the areas taken up by the centre are Basin Modelling, EOR / IOR, Unconventional Hydrocarbon / Alternate Energy Resources, Environmental Studies, and industry academia collaboration. A few projects are being taken up on the above areas in the initial phase and some of which are in collaboration with the premier institutions in India and abroad. The analytical laboratory has already started functioning after setting up of a few state-of-the-art equipment and facilities.

Industry Overview

Amid global trade war, tariff-related uncertainties, the global economy grew at a slower pace in 2019 in comparison to that in 2018. The Covid-19 crisis has further impacted the slowdown in 2020. Global economic uncertainty and trade tensions impacted oil demand. Despite the global downturn, India managed to stay afloat in FY 2019-20, still remaining one of the fastest growing major economies in the world. FY 2019-20 saw a lot of emphasis on policy initiatives including, reduction in market rates, reduction in Corporate taxes, consolidation of Public Sector Banks and incentives for new manufacturing units to attract global supply chains. With continued policy initiatives, India's Ease of Doing Business rankings, improved significantly. While outbreak of Covid-19 would make growth environment challenging in first half of FY 2020-21, various support measures announced by the government would help provide the desired support. 7

India, today is one of the fastest growing economies and among the largest and growing consumers of energy in the world. In FY 2019-20, the petroleum product consumption was 214 MMT. Covid-19 and ensuing lockdown had a strong downward pull in the month of March, 2020 denting the overall growth which the industry had sustained till the month of February 2020. Slowdown in demand and outbreak of Covid-19 pandemic pushed the crude prices lower. Brent and West Texas Intermediate (WTI) touched a low of USS 17.68/bbl and USS 17.99/bbl on 31.03.2020 and 25.03.2020 respectively, though the prices have improved thereafter. Lower global demand and enough supply is keeping oil prices in check. The Government of India is deeply committed towards driving the country to become energy independent and reduce India's energy imports by 10% by 2022. The Government has taken several steps to promote this vision further through encouraging foreign investment and global participation, in both the renewable and non-renewable energy sector in India. Till March, 2020, three rounds of bidding for exploration acreage under the Open Acreage Licensing Policy (OALP) and two rounds of bidding under the Discovered Small Fields (DSF) policy had attracted investments in exploration and production of crude oil and natural gas.

Nations worldwide are in pursuit of cleaner and greener energy to reduce the carbon footprint. Gas is the ideal transition fuel in the energy mix for the foreseeable future. In India, the government has set a target of raising the share of natural gas in primary energy basket to 15 per cent by 2030 from current 6.2 per cent with strong demand from Fertilizer, Power, Refining and other industrial sectors and the rapidly emerging City Gas Distribution sector. Connecting gas sources to consumption hubs is a key to achieving this. Plans for expansion of national natural gas pipeline network from the present 16,200 km to 27,000 km announced in the Budget 2020-21 will lead to boosting use of environment-friendly fuel.

Opportunities and Threats/Risksand Concerns

It's an undeniable fact that Covid-19 pandemic has brought in huge uncertainties and adversities on various sectors. The macro-economic factors that caused a slowdown in FY 2019- 20 will continue in FY 2020-21, with the first quarter of 2020- 21 completely dominated by the pandemic and the consequent lockdowns. Volatility in oil and gas prices and lower interest rates will continue to impact the Company's balance sheet by adversely affecting revenue, dividends and other incomes from various domestic and overseas projects. Despite volatility in economic environment, the Company strives to improve, evolve and grow consistently, contributing to energy security of the country.

The Company's stronghold on Assam Arakan Basin in North- East India provides a strong opportunity for its growth. Further the Company, through Govt. of India‘s Open Acreage Licensing Policy (OALP) and Discovered Small Fields (DSF) under Hydrocarbon Exploration Licensing Policy (HELP), acquired 24 Exploration Blocks which will further strengthen exploration activities of the Company. The Company has become the first operator to commence the exploration activities in OALP blocks for both 2D & 3D Seismic in Rajasthan and has completed Minimum Work Program of seismic acquisition in North Bank OALP block. The Company has also been awarded 4 Geographical areas under City Gas Distribution (CGD) bidding rounds in consortium with other companies. The Company is building on its strength in mature asset operatorship to achieve global performance on its core technical areas. Enhanced Oil Recovery (EOR) is another essential approach to ensure sustainable and growing production, especially when there is declining trend of current production profile within the current understanding of fields under exploration.

Financial Overview

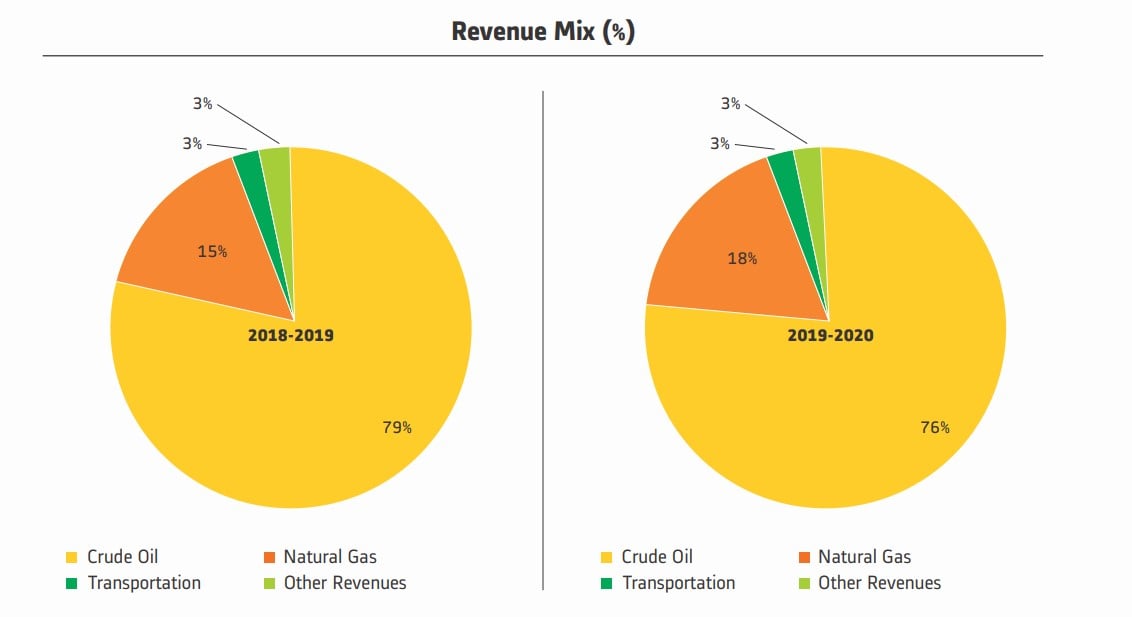

During the year, the Company has earned total revenue of Rs. 13,648.71 crore as against Rs 1517.00 crore in the previous year (2018-19). The Profit Before Tax (PBT) in the year 2019-20 was Rs. 2,120.10 crore against PBT of Rs. 3,916.22 crore in the previous year. The reduction in PBT is mainly attributed to 11.31% fall in crude Oil revenue due to lower price realization of USD 60.75/bbl in 2019-20 from USD 68.50/bbl in 2018-19 and impairment provisions in respect of overseas investment in view Of sharp fall in Oil prices. Natural Gas revenue increased by 7.79% due to higher price realization in 2019-20 of USD 3.46/mmbtu from USD 3.21 / rnmbtu in 2018-19. The Profit After Tax (PAT) was Rs. 2, 584.06 crore in the financial year 2019-20 against Rs_ 2, 590.14 crore in the previous year. During the year, the Company has adopted the new concessional corporate tax rate regime of 25.17%, as new Section 115 BAA Of Income TaxAct.

Crude Oil

During the year 2019-20, crude oil production was 3.133 MMT (Inclusive of Company's share of 0.013 MMTfrom Kharsang JV and 0.013 MMT from Dirok JV) as against the production of 3.323 MMT in the previous year. The crude oil sale was 3.055 MMT as compared to 3.233 MMT in the previous year.

Heavy Oil was discovered in Baghewala PML of Rajasthan in the year 1991. Previous efforts of the Company for commercializing the discovery were not successful. Cyclic Steam Stimulation (CSS) was successfully implemented for the first time in India during the last year on a pilot scale initially in one well. The same has been implemented during the year in anothertwo wells at Baghewala field.

Natural Gas

During the year 2019-20, natural gas production was 2801 MMSCM (inclusive of 133 MMSCM as Company's share from Dirok JV) as against the production of 2865 MMSCM in the previous year. The sale of natural gas was 2403 MMSCM against 2508 MMSCM in the previous year.

Liquefied Petroleum Gas (LPG)

During the year 2019 - 20, LPG production was 28990 metric tons against 33730 metric tons in the year 2018-19. The sale of LPG was 28962.68 metric tons against 33693.84 metric tons in the previous financial year.

Pipeline Operations

During the year 2019-20, crude oil pipeline transported 5.72 MMT of crude oil as against 6.53 MMT in the previous year. The Naharkatia - Bongaigaon sector transported 3.04 MMT of crude oil for the Company and 0.98 MMT of crude oil for ONGC. The Barauni - Bongaigaon sector transported 1.70 MMT of imported crude oil for Bongaigaon Refinery. The Company also transported 1.33 MMT of petroleum products through Numaligarh-Siliguri Product Pipeline. The total revenue earned from transportation business was Rs. 327.50 crore in the financial year 2019-20 against Rs. 365.34 crore in the year 2018-19.

Renewable Energy

The Company has renewable energy facilities of 188.10 MW (excluding projects for captive utilization) as on 3f March, 2020. This comprises ofl 74.10 MW of wind energy projects and 14 MW of solar energy projects. In addition, solar plants ofO.779 MW are being used for captive utilization of electrical energy. The company generated revenue of Rs. 138.00 crore from renewable energy projects (wind as well as solar plants) during 2019-20.

Exploration Activities and Discoveries

The company has been awarded 12 blocks under OALP round - 11 & Ill. Earlierthe Company was awarded 9 blocks under OALP round-I and 2 blocks under Discovered Small Field round- 11. The strategy of the company is to consolidate its position as the leading Operator in northeast and carry out exploration in Category 11 & Ill basins in line with the Government of India's vision to intensify exploration in Indian sedimentary basins and increase domestic oil and gas production.

The company had carried out 1,389.45 LKM of 2D & 263.00 sq km of 3D seismic survey in the nominated acreages and OALP Blocks during 2019-20. The company is the first operator to commence exploration activities in OALP blocks in the country by starting 2D & 3D seismic acquisition in OALP blocks in Rajasthan. The company has also initiated seismic campaign in OALP blocks located in North-east.

The company drilled 11 (eleven) exploratory wells in the PML areas in Assam and Rajasthan. During the year, the company made 1 (one) gas discovery in a HPHT well in KG basin. During the year, the company has achieved Reserve Replacement Ratio (RRR) of 1.15.

Oil and Gas Reserves

Domestic

The company has strong oil and gas country. The particulars of oil and 31.03.2020 are furnished below:

| Reserves | 1P | 2P | 3P |

| Oil + Condensate Reserves (MMT) | 29.8339 | 74.6865 | 99.2493 |

| Balance Recoverable Gas (BCM) * | 83.8025 | 132.2588 | 172.3012 |

| O+OEG (MMTOE) | 103.3024 | 189.9547 | 247.9506 |

Overseas

The oil & gas reserves position proportionate to the Company's participating interest in 06 (Six) overseas producing and discovered assets viz. Niobrara Shale Oil (USA), License-61 (Russia), Vankorneft (Russia), TaasYuryakh (Russia), Carabobo (Venezuela) and Area-I (Mozambique) as on 31 March, 2020 is asunder:

| Particulars | 1P | 2P | 3P |

| Oil+Condensate (MMT) | 14.9682 | 34.4426 | 55.6638 |

| Gas Reserves (MMTOE) | 12.8933 | 22.3771 | 26.4563 |

| OTOEG (MMTOE) | 27.8615 | 56.8197 | 82.1201 |

Recent developments

OIL India Q2 profit drops 42% to Rs 381.75 crore on blowout expense. 8

Oil India Ltd, the nation's second-biggest state oil producer, on November 9 reported 42 percent drop in September quarter net profit largely on account of lower oil prices and one-time expense it incurred on controlling a blowout in Assam.

Net profit in July-September at Rs 381.75 crore was lower than Rs 661.53 crore net profit in the same period a year back, the company said in a stock exchange filing.

OIL said a blowout occurred in a producing well (Baghjan#5) in Tinsukia district of Assam on May 27 and the well caught fire on June 9. "To control the blowout, all necessary remedial actions (have) been undertaken by the company," it said adding the total losses/damages arising out of the blowout can be assessed on successful control of the blowout.

The company is currently trying to control the blowout. "However, as on September 30, 2020 an amount of Rs 227.51 crore has been incurred to control the blowout and the same has been shown as an exceptional item in the statement of profit and loss," it said.

Out of Rs 227.51 crore, Rs 134.12 crore has been booked during September quarter. Turnover fell 32 percent to Rs 2,175.87 crore in the second quarter of the current fiscal.

A fall in international oil prices led to revenue from the sale of crude oil slump by 32 percent and segment pre-tax profit more than halved to Rs 432.27 crore. Lower natural gas prices also saw revenues from its sales slump 41 percent and pre-tax profit drop to Rs 51.70 crore from Rs 176.93 crore in July-September 2019.

References.

- ^ https://www.oil-india.com/Profile

- ^ https://www.oil-india.com/Drilling-and-work-over

- ^ https://www.oil-india.com/4Pipelines

- ^ https://www.oil-india.com/1Harnessing-hydrocarbons1

- ^ https://www.oil-india.com/3International-business

- ^ https://www.oil-india.com/Research-and-development

- ^ https://www.oil-india.com/Document/Financial/OIL_Annual_Report_2019_20_new.pdf

- ^ https://www.moneycontrol.com/news/business/earnings/oil-india-q2-profit-drops-42-to-rs-381-75-crore-on-blowout-expense-6094111.html