One 97 Communications Limited (Paytm)

Summary

- The company launched Paytm in 2009, as a “mobile-first” digital payments platform to enable cashless payments for Indians, giving them the power to make payments from their mobile phones.

- One 97 Communications has a full suite of payment services for both consumers and merchants

- One97 Communications is all set to come out with an initial public offer (IPO) on November 8. The proposed Rs 18,300-crore IPO will make it one of India’s 50 most valuable companies.

Company Overview

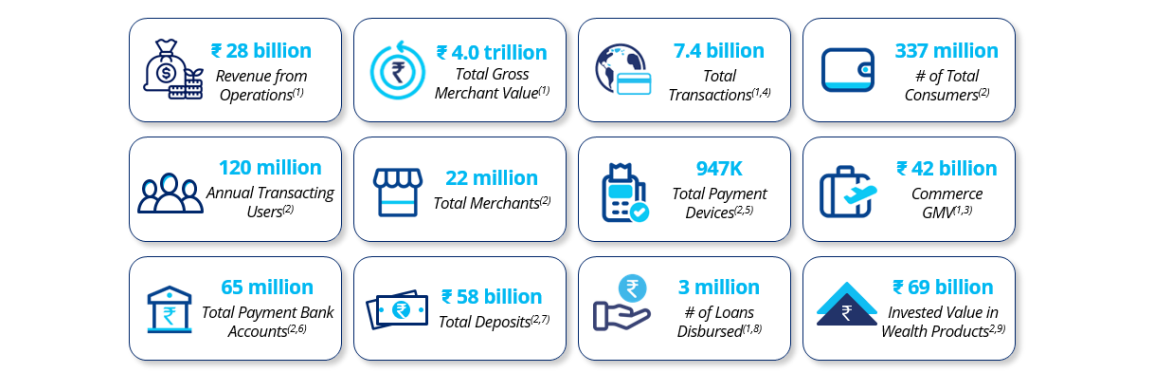

One 97 Communications Limited (NSE:PAYTM) is India’s leading digital ecosystem for consumers and merchants as One 97 Communications has built the largest payments platform in India based on the number of consumers, number of merchants, number of transactions and revenue as of March 31, 2021 according to RedSeer. The company offered payment services, commerce and cloud services, and financial services to 337 million registered consumers and over 21.8 million registered merchants, as of June 30, 2021. The company's two-sided (consumer and merchant) ecosystem enables commerce, and provides access to financial services through its financial institution partners, by leveraging technology to improve the lives of its consumers and help its merchants grow their businesses. In FY 2019, FY 2020 and FY 2021, and in the three months ended June 30, 2020 and 2021, revenue from its payment and financial services accounted for ₹16,955 million, ₹19,068 million, ₹21,092 million, ₹4,298 million and ₹6,894 million, respectively, i.e., 52.5%, 58.1%, 75.3%, 78.0% and 77.4%, respectively, of its revenue from operations.1

The company launched Paytm in 2009, as a “mobile-first” digital payments platform to enable cashless payments for Indians, giving them the power to make payments from their mobile phones. Starting with bill payments and mobile top-ups as the first use cases , and Paytm Wallet as the first Paytm Payment Instrument, One 97 Communications has built the largest payments platform in India based on the number of consumers, number of merchants, number of transactions and revenue as of March 31, 2021 according to RedSeer. One 97 Communications has also been able to leverage its core payments platform to build an ecosystem with innovative offerings in commerce and cloud, and financial services. Paytm is available across the country with “Paytm karo” (i.e. “use Paytm”) evolving into a verb for hundreds of millions of Indian consumers, shopkeepers, merchants and small businesses, according to RedSeer. As per the Kantar BrandZ India 2020 Report, the "Paytm" brand is India's most valuable payments brand, with a brand value of US$ 6.3 billion, and Paytm remains the easiest way to transact across multiple methods.

The Paytm app is a payments-led super-app , through which the company offer its consumers innovative and intuitive digital products and services. The company offer its consumers a wide selection of payment options on the Paytm app, which include ![]() Paytm Payment Instruments, which allow them to use digital wallets, sub-wallets, bank accounts, buy-now-pay-later and wealth management accounts and (ii) major third-party instruments, such as debit and credit cards and net banking. On its app, the company enable its consumers to transact at in-store merchants, pay their bills, make mobile top-ups, transfer money digitally, create and manage their Paytm Payment Instruments, check linked account balances, service city challans and municipal payments, buy travel and entertainment tickets, play games online, access digital banking services, borrow money, buy insurance, make investments and more.

Paytm Payment Instruments, which allow them to use digital wallets, sub-wallets, bank accounts, buy-now-pay-later and wealth management accounts and (ii) major third-party instruments, such as debit and credit cards and net banking. On its app, the company enable its consumers to transact at in-store merchants, pay their bills, make mobile top-ups, transfer money digitally, create and manage their Paytm Payment Instruments, check linked account balances, service city challans and municipal payments, buy travel and entertainment tickets, play games online, access digital banking services, borrow money, buy insurance, make investments and more.

The company help its merchants grow their business by giving them solutions that allow them to accept payments, acquire and retain consumers, improve their business operations and access financial services. Merchants can use in-store and online payment solutions to accept payments through Paytm Payment Instruments as well as major third-party payment methods. To help them acquire and retain customers, and create demand, the company offer them services like selling tickets to customers, advertising, mini-app listings, channel and loyalty solutions. In addition to helping its merchant ecosystem facilitate more commerce, the company also provide software and cloud services that allow large, medium and small merchants to improve their business operations and access important financial tools such as banking, wealth and credit facilities.

The company's ecosystem served 337 million registered consumers and 21.8 million registered merchants as of June 30, 2021. The company's payments platform is at the core of its ecosystem. Making payments (bill payments, in-store or money transfer) is, in most cases, the first use case for a consumer on Paytm. Leveraging the large scale, reach, and deep and high frequency engagement by consumers and merchants on its payments platform, One 97 Communications has been able to add new payments offerings, as well as expand into commerce and cloud services and financial services. Each of its offerings increases the scope of its ecosystem for consumers and merchants, enhancing the value of its ecosystem.

Services

Recharge & pay bills

- Mobile Recharge

- Mobile Bill Payment

- Datacard Recharge

- Datacard Bill Payment

- Dth Recharge

- Electricity Bill Payment

- Landline Bill Payment

- Broadband Bill Payment

- Gas Bill Payment

- Water Bill Payment

- Metro Card Recharge

- Municipal Recharge

- Toll Recharge

- Credit Bill Payment

- Cabletv Recharge

- Devotion

- Rental Bill Payment

- Fastag Recharge

Pay Loan EMI, Insurance Premiums & Education Fee

- Pay Loan EMI

- Pay Insurance Premium

Book Travel & Entertainment

- Movie Ticket Booking

- Bus Ticket Booking

- Flight Tickets Booking

- Train Ticket Booking

- Events Booking

- Upcoming Movies

Investments & Miscellaneous

- Mutual Fund Investments

- Miscellaneous

Industry Overview

With a Gross Domestic Product, of approximately US$2.7 trillion in 2020, India is the sixth largest economy according to World Economic Outlook database. Since 2015, India has witnessed an average real GDP growth rate of more than 7% per year and has consistently been one of the fastest growing large economies.

Evolving Digital landscape in India

Technology is playing an important role by increasing reach and accessibility for merchants and consumers. The revolution of mobile and cloud technology, combined with growing incomes and higher consumption rates in India, is at a digital tipping point.

Over the last decade, India added 500 million+ new smartphone users. With higher affordability, reducing smartphone costs (average smartphone cost being less than US$ 150) and availability of greater variety of value smartphones, the number of smartphone users expected to reach 800-850 million in FY 2026, representing more than 55% of total population and 80% of internet users.

In FY 2021, 650 - 700 million Indians had access to the internet and the number is expected to increase to over 950-1,000 million by FY 2026 representing more than 70% of the total population, this is primarily driven by increasing smartphone penetration, reducing data cost, new technology innovations and Government’s push towards digitization. As per TRAI, the data usage per data subscriber rose to 141 GB in 2020 from 3 GB in 2014 whereas, data cost declined from INR 269 / GB to INR 10.9/ GBin 2020.

Digitization Changing the Way People Transact in India

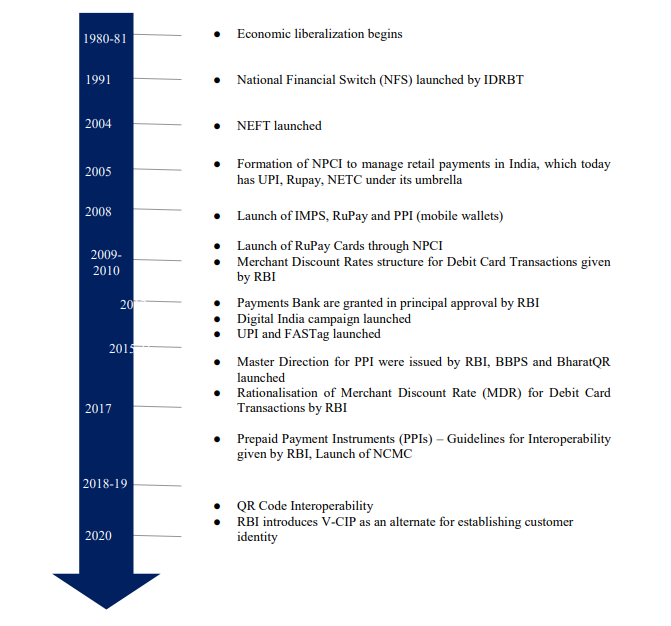

Indian payment system has evolved significantly in since 1980. For a long time cheque clearing systems dominated the payment landscape in India. The cheque clearing system underwent significant transition from Magnetic Ink Character Recognition (MICR) in 1980’s to the cheque truncation system first introduced in 2008.

In 2004, Real-Time Gross Settlement (RTGS), was launched. RTGS is mainly used for higher value transfers that require immediate clearance. In 2005, National Electronic Funds Transfer (NEFT) was introduced enabling transfer of fund between any two NEFT-enabled bank accounts on one to one basis and in 2010 Immediate Payment Service (IMPS) was launched.

Evolution of Indian Payment System

Emergence of Digital Payments

Digital payments have been growing steadily over time, however India continues to be cash driven economy. In FY 2021, digital payments market size by value stood at approximately US$ 20 trillion with 43 billion transactions during the year.

Consumers are rapidly switching to digital payments as it provides simple, safe and convenient ways to transfer money across accounts. Similarly, for merchants, acceptance of payments in digital form has increased significantly. Moreover, merchants have taken up digitization beyond merely accepting digital payments, digitization is helping them in other aspects of their business like credit, invoicing, maintaining ledger/accost, bookkeeping etc. helping their business to grow further.

Several factors, including government initiatives and reforms, improving technology, increasing reach and awareness, digital payments are expected to more than double from US$ 20 trillion in FY 2021 to US$ 40-50 trillion by FY 2026.

Mobile payments

Money transfer between consumers and merchants using wallets or UPI, is becoming highly ubiquitous in India, and has led to a surge in mobile payments over the last few years. Mobile payments increased approximately 16 times from 1.6 billion in FY 2017 to 26 billion in FY 2021.

In India, there are approximately 65 million merchants of which 45 million have access to internet. Merchants including medium and small enterprises are rapidly adopting new age payment technology in order to offer hassle free shopping experience to their customers. Digital payment mode at merchants typically include QR code, Point of Sale (POS) machines and payment gateway.

Business Segments

The company offer products and services across “payment services”, “commerce and cloud services” and “financial services”. The company's products and services are carefully developed to address large markets, and in areas where the consumers and merchants are underserved.

Payment Services

One 97 Communications has a full suite of payment services for both consumers and merchants which enables them to make and receive payments in a convenient, seamless and secure manner both online and in-store. According to RedSeer, One 97 Communications is the largest payments platform in India with a GMV of ₹4,033 billion in FY 2021. One 97 Communications has an overall mobile payments transaction volume market share of approximately 40%, and wallet payments transaction market share of 65% – 70% in India as of FY 2021, according to RedSeer.

One 97 Communications has driven innovation in the Indian payments landscape, designing and building products for Indian consumers and merchants, and creating new market segments. The company launched a wallet product, Paytm Wallet in 2014, which saw wide-spread acceptance amongst Indians, many of whom were making digital and mobile payments for the first time. The company launched QR in 2015, which the company upgraded to All-in-One QR in January 2020, which is the only source QR code that gives merchants the power to seamlessly accept payments from Paytm Payment Instruments, third party and all UPI instruments directly into their bank account. In 2020, the company launched Paytm Soundbox, an IoT enabled payment acceptance device, providing real time audio confirmation for payment completion.

Given the comprehensive nature of its payments platform, the company believe that One 97 Communications has better ability to monetize the payments business because One 97 Communications is not dependent on one or few payment methods where monetization potential is low or zero. Some of the payment instruments like credit cards and payment methods like in-store devices have a much higher monetization potential that the more widely used payment forms.

Using its extensive payment offerings, consumers can make online bill payments, mobile top-ups and money transfers using the Paytm app, make online payments on third party apps and in-store payments through QR codes and devices. Consumers can use a wide selection of instruments, both third party and Paytm Payment Instruments. The company believe that the company offer a differentiated value proposition and experience for its consumers because of a wide selection of use cases, multiple payments instruments, and a large number of merchant end points.

Merchants, large or small, organized or unorganized, in metros or small towns, can access its full suite of payment products and services ![]() in-store, using its Paytm QR code, Soundbox or POS devices; and (ii) online, using the Paytm all-in-one payment gateway infrastructure or through Paytm Wallet. The company's services power merchants to accept payments through its Paytm Payment Instruments or major third-party instruments.

in-store, using its Paytm QR code, Soundbox or POS devices; and (ii) online, using the Paytm all-in-one payment gateway infrastructure or through Paytm Wallet. The company's services power merchants to accept payments through its Paytm Payment Instruments or major third-party instruments.

The company also offer its merchants, Business Payments, a single platform solution to help manage their cash flows and their payables including ![]() vendor payments, such as rent payments, invoices, and utility bill payments, (ii) customer cashbacks, refunds, and channel partner incentives, and (iii) employee salaries, reimbursements and tax benefits.

vendor payments, such as rent payments, invoices, and utility bill payments, (ii) customer cashbacks, refunds, and channel partner incentives, and (iii) employee salaries, reimbursements and tax benefits.

Commerce and Cloud Services

The company's commerce and cloud services offerings provides a lifestyle destination for consumers to avail lifestyle commerce services such as ticketing, travel, entertainment, gaming, food delivery, ride hailing and more. Easy access to such services within the Paytm App environment, through its native offerings or through its mini-apps partners, plays a critical role in user engagement and retention, and enhances its brand.

Through its wide suite of commerce and cloud service offerings, merchants can connect with consumers to increase demand for their products and services, and improve their business operations. The company help its merchants conduct targeted outreach to its consumers to offer services such as ticketing (for entertainment and travel), commerce, deals, loyalty services, mini apps and advertising. The company also provide its merchants software and cloud services for various aspects of their business, such as billing, ledger, vendor management, customer promotions, catalogue and inventory management. The company's feature-rich Paytm for Business app provides merchants a comprehensive set of business management tools, including real time bank settlement and analytics, reconciliation services, banking services, access to financial services, and business growth insight tools to measure their business performance. The company also provide software and cloud services to enterprises, telecom companies, and digital and fintech platforms to track and enhance customer engagement, build payment systems, and unlock customer insights

In FY 2020, the company processed a total Commerce GMV of ₹142.2 billion, and in aggregate generated over ₹11 billion of revenues (in FY 2021 and in the first quarter of FY 2022, the company processed a total Commerce GMV of ₹42.4 billion and ₹9.0 billion, and in aggregate generated over ₹6.9 billion and ₹2.0 billion of revenue, respectively).

Financial Services

Financial Services is its set of innovative financial inclusion offerings including mobile banking, lending, insurance, and wealth management for consumers and merchants. The company's reach, size and scale of payment services places it at the center of payments flows between consumers and merchants. This affords it opportunities to distribute and/or develop financial products that can be the source of payments (such as deposits or lending) and destination of payments (such as wealth management). Since most of its financial services businesses were launched recently between 2019 and 2021, financial services contributed a relatively small percentage of its revenue.

Financial Highlights

Summary of financial Information (Restated Consolidated) For the year/period ended

| Particulars | (₹ in million) | ||||

| 30-Jun-21 | 30-Jun-20 | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | |

| Total Assets | 94,590 | 102,777 | 91,513 | 103,031 | 87,668 |

| Total Revenue | 9,480 | 6,494 | 31,868 | 35,407 | 35,797 |

| Profit After Tax | -3,819 | -2,844 | -17,010 | -29,424 | -42,309 |

IPO

Paytm to become one of top 50 most valued listed companies

Oct 30, 2021; Paytm IPO: Paytm's parent One97 Communications is all set to come out with an initial public offer (IPO) on November 8. The proposed Rs 18,300-crore IPO will make it one of India’s 50 most valuable companies. Paytm IPO is India’s largest so far, surpassing Coal India’s public issue at Rs 15,745 crore that was raised in October 2010. 2

Note that according to a report by Redseer management consulting company, Paytm is currently India’s leading digital ecosystem for consumers and merchants, with over 3.37 crore registered consumers and over 2.18 crore registered merchants as of June 30, 2021.

At the upper end of the price band of Rs 2,150 apiece, Paytm will have a post-money valuation of Rs 1,39,378.84 crore, which will propel it to the 36th position in terms of market capitalization among listed companies. Paytm’s market cap will be more than some of the established companies such as Hindustan Zinc, NTPC, Divi’s Laboratories, Power Grid Corp., Indian Oil Corp. (IOC), Vedanta, Pidilite Industries, SBI Life Insurance, Grasim Industries, Bajaj Auto, L&T Infotech, Mahindra & Mahindra (M&M), Hindalco Industries, Coal India, Zomato, SBI Cards and DLF Ltd.

Paytm IPO details:

Paytm IPO opening date: The current Rs 18,300-crore IPO will be open for subscription next month on November 8. The subscription will close on November 10.

Paytm IPO price band: One97 Communications has fixed the price band for the IPO at Rs 2,080-2,150 per share. The three-day public share sale will comprise a fresh issue of Rs 8,300 crore and an offer for sale of Rs 10,000 crore. In the present issue, the company has announced that 75% will be reserved for Qualified Institutional Buyers (QIBs), 15% for non-institutional investors (NIIs) and the remaining 10% for retail investors.

The OFS consists sale of up to Rs 402.65 crore by Vijay Shekhar Sharma, up to Rs 4,704.43 crore by Antfin (Netherlands) Holdings, up to Rs 784.82 crore by Alibaba.com Singapore E-Commerce and up to Rs 75.02 crore by Elevation CapitalV FII Holdings.

Further, Elevation Capital V Ltd will offer up to Rs 64.01 crore, Saif III Mauritius Rs 1,327.65 crore, Saif Partners Rs 563.63 crore, SVF Partners Rs 1,689.03 crore and International Holdings Rs 301.77 crore, as per the IPO document.

Paytm IPO apply: Investors who wish to subscribe to Paytm’s IPO can bid in the lot of six equity shares and multiples thereof. At the upper price band, they will have to shell out Rs 12,900 to get a single lot of One 97 Communications. The shares will be listed on both BSE and NSE.

For the unversed, Morgan Stanley India Company, Goldman Sachs (India) Securities, Axis Capital, ICICI Securities, J.P. Morgan India, Citigroup Global Markets India and HDFC Bank are the book running lead managers to the IPO. Link Intime India is the registrar of the issue.

The proceeds from the fresh issue will be used towards (1) Growing and strengthening its Paytm ecosystem, including through acquisition of consumers and merchants and providing them with greater access to technology and financial services, (2) Investing in new business initiatives, acquisitions and strategic partnerships and, (3) For general corporate purposes, according to the information in the RHP.

Out of the total proceeds of the IPO, Rs 4,300 crore will be used to grow and strengthen Paytm’s ecosystem; it will offer easy access to technology and financial services to acquire new clients and business partners, and retain existing customers and merchants.

Paytm Financials:

Paytm’s losses narrowed in June on the back of lower marketing expenses and payment processing charges. It clocked sales of Rs 3,186.80 crore in June compared to Rs 3,540.70 crore in June 2020. Net losses narrowed to Rs 1,701 crore from Rs 2,942.4 crore in the period under consideration. Total borrowings stood at Rs 476 crore in June compared to Rs 544.90 crore in June 2020.

It is worth adding that the anchor portion of the issue is likely to open on November 3, 2021. The share allotment is likely to take place on November 15, 2021, and the shares are expected to be listed on the bourses on November 18, 2021.

Listing

Paytm operator One97 Communications debuts with 9% discount at Rs 1,9503

Paytm operator One 97 Communications had a moderate listing on the bourses on November 18 as it fell 9 percent on debut. The stock opened at Rs 1,950 on the National Stock Exchange and the listing price on the BSE was Rs 1,955, against issue price of Rs 2,150.

The leading digital payments platform's initial public offering saw a tepid response from investors as it was subscribed 1.89 times. Net net qualified institutional investors supported the issue during November 8-10, subscribing for shares 2.79 times the portion set aside for them.

Retail investors also aided the offer to some extent by bidding for shares 1.66 times the reserved portion but non-institutional investors had put in bids for only 24 percent of the reserved portion.

Paytm launched the largest public issue in India, raising Rs 18,300 crore that comprised a fresh issue of Rs 8,300 crore and an offer for sale of Rs 10,000 crore by several shareholders, including the founder and investors. The net proceeds from fresh issuance will be utilised for strengthening the Paytm ecosystem, and investing in new business initiatives, acquisitions and strategic partnerships.

One 97 Communications, India's leading digital ecosystem for consumers and merchants, reported a consolidated loss of Rs 1,701 crore for the year ended March 2021, against the loss of Rs 2,942.4 crore in FY20, and a loss of Rs 4,230.9 crore in FY19. Total income during the year FY21 declined to Rs 3,186.8 crore, from Rs 3,540.7 crore in FY20 and Rs 3,579.7 crore in FY19.

On a quarterly basis, the consolidated loss in Q1FY22 widened to Rs 381.9 crore, from a loss of Rs 284.4 crore in the corresponding period last fiscal. However, revenue increased sharply to Rs 948 crore from Rs 649.4 crore over the same quarters.

The company launched Paytm in 2009 and has built the largest payments platform in India based on the number of consumers, number of merchants, number of transactions and revenue as of March 2021. Its ecosystem served 33.7 crore registered consumers and 2.18 crore registered merchants as of June 2021.

According to RedSeer, it is the largest payments platform in India with a GMV of Rs 4,03,300 crore in FY21. It has an overall mobile payments transaction volume market share of approximately 40 percent, and wallet payments transaction market share of 65-70 percent in India as of FY21.

All analysts had given a thumbs up to the IPO given the expected strong growth in mobile payments, and substantial growth in user base and gross merchandise value (GMV) since its inception within the Fintech sector.

"At the upper end of the price band, Paytm is valued at 49.7x its FY21 revenues. While valuations may appear to be expensive, Paytm has become synonymous with digital payments through mobile and is the market leader in the mobile payment space. Patym is well positioned to benefit from the exponential 5x growth in mobile payments between FY2021 – FY2026 and hence believe that the valuations are justified. We recommend investors to subscribe to the issue," says Angel One.

Canara Bank Securities also recommended a subscription for long term to the issue. "The company exhibits substantial growth in user base and GMV since its inception within the Fintech sector. Moreover, the business is scalable due to the high convenience of digital banking. However, the issue is available at P/B (price-to-book value) of 49.74x for FY21 which is expensive," it reasoned.

Research house Macquarie has initiated with an underperform rating on One 97 Communications as it believes PayTM’s business model lacks focus and direction.

It has kept a target price of Rs 1,200.

Competition and regulation will drive down unit economics and/or growth prospects in the medium term and unless PayTM lends, it can’t make significant money by merely being a distributor, said research house.

The key game changer could be an ability to monetise UPI, which could completely swing the investment case, it added.

References

- ^ https://static.paytmmoney.com/data/forms/ipo/Paytm_DRHP.pdf

- ^ https://www.timesnownews.com/business-economy/companies/article/paytm-ipo-paytm-to-join-top-50-most-valued-listed-companies/827835

- ^ https://www.moneycontrol.com/news/business/ipo/paytm-operator-one97-communications-sees-a-tepid-debut-stock-opens-at-rs-1950-7733641.html