Page Industries Ltd

Summary

- Page Industries Limited is the exclusive licensee of JOCKEY International Inc. (USA) for manufacture, distribution and marketing of the JOCKEY® brand in India, Sri Lanka, Bangladesh, Nepal and the UAE.

- Page Industries is also the exclusive licensee of Speedo International Ltd. for the manufacture, marketing and distribution of the Speedo brand in India.

- Jockey brand is present in 80,000+ stores across 2,800+ cities and towns.

- Speedo brand is available in 1,300+ stores, 34 EBOs and 15 Large Format Stores spread across 230+ cities.

Company Overview

Page Industries Limited (NSE:PAGEIND) located in Bangalore, India is the exclusive licensee of JOCKEY International Inc. (USA) for manufacture, distribution and marketing of the JOCKEY® brand in India, Sri Lanka, Bangladesh, Nepal, UAE, Oman and Qatar. Page Industries is also the exclusive licensee of Speedo International Ltd. for the manufacture, marketing and distribution of the Speedo brand in India.1

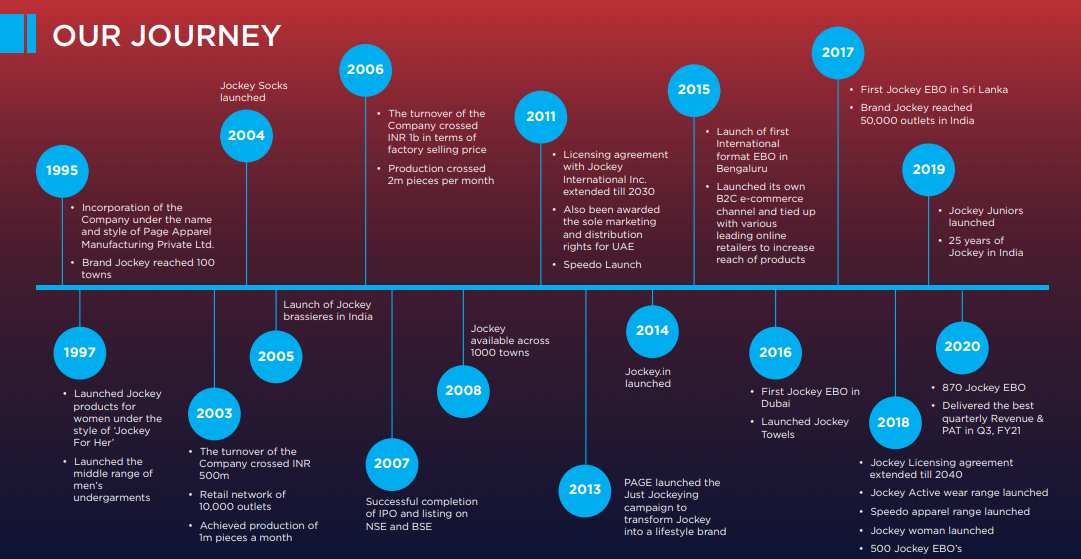

The Company was set up in 1994 with the key objective of bringing the world renowned brand "JOCKEY®" to India. Its promoters are the Genomal family, who have been associated with JOCKEY International Inc. for 50 years as their sole licensee in the Philippines.

The company commenced operations in the year 1995 with the manufacturing, distribution and marketing of Jockey® products. Page Industries became a public company in March 2007 and is quoted in the Bombay Stock Exchange and the National Stock Exchange of India

Brands

JOCKEY

JOCKEY is the company’s flagship brand and a market leader in the innerwear category. Page Industries and Brand Jockey have pioneered the innerwear industry on many fronts. The company has established the premium segment in the innerwear category in India through brand Jockey. The introduction of high quality products coupled with an organized and extensive network of distributors pan India has created a paradigm shift in the way consumers perceive innerwear in its country. JOCKEY was also the first innerwear brand in India to set up Exclusive Brand Outlets across the country.

Jockey brand is distributed across 2,800+ cities and towns. The products are sold through Exclusive Brand Outlets (EBO), Large Format Stores (LFS) and Multi Brand Outlets (MBO), as well as online. Across the above channels, the brand is present in 80,000+ stores.

During the year 2020-21, the Company through its authorised franchisees opened 200 EBOs, taking the total number of EBOs to 930 which includes 46 ‘Jockey Woman’ EBOs catering exclusively to its women customers. These outlets are spread throughout India covering even Tier II and Tier III cities. This is an indicator of the growth potential of the Jockey brand in such cities.

Apart from the domestic EBOs, the Company has six operational EBOs outside India, four in UAE (with another two stores in progress) and two in Sri Lanka. The company is confident of leveraging opportunities in these new markets.

The online retail business has also showed significant growth both through www.jockey.in as well as with its key e-commerce partners.

SPEEDO

Speedo International Limited appointed Page Industries as their sole licensee for the manufacturing, marketing and distribution of the Speedo brand in India. The vision of Speedo is to “inspire people to swim; with Speedo.” The mission of Page Industries is to be the number one swimwear brand in the country in terms of both market share and profitability.

Swimwear industry witnessed a significant impact owing to the COVID-19 lockdowns, during most of the entire financial year 2020-21. Restrictions are still in place for swimming pools in many apartment complexes and pools in clubs, hotels and schools. The Speedo brand has achieved a turnover of Rs 26 million in the financial year 2020-21 as against previous year sales of Rs 354 million. As on 31st March 2021, Speedo brand is available in 1,300+ stores, 34 EBOs and 15 Large Format Stores spread across 230+ cities.

Studies on the swimming market in India by global marketing research firm, AC Nielsen, commissioned by it, shows a promising and fast evolving market for both swimwear and swim equipment. Your Directors are confident that the Speedo business would experience healthy growth in the years to come as Speedo becomes a dominant brand in the premium swimwear market.

Plant Locations

- Hongasandra, Begur Hobli, Bangalore

- Anekal, Bangalore

- Hongasandra,Bangalore

- Bommanahalli, Begur Hobli, Bangalore

- Bommsandra Industrial Area, Bangalore

- HobliKasaba, Hassan

- Bangalore South Taluk,Bangalore

- Anekal Hobli, Bangalore

- Khill E Mohalla fort, Mysore

- Gowribidanur,Chikkaballapura Dist

- Palladam Road,Tirupur

- Hindiskere Gate,Tiptur

- K R Pete Taluk, Mandya

Industry Overview

The Indian textile industry is one of the largest in the world with a large unmatched raw material base and manufacturing strength across the value chain. It is the 2nd largest manufacturer and exporter in the world, after China. The share of textile and clothing in India’s total export stands at a significant 12 % (2018-19). India has a share of 5 % of the global trade in textiles and apparel. The textile industry contributes to 7% of industry output in value terms, 2% of India’s GDP and to 12% of the country’s export earnings. The textile industry is one of the largest sources of employment generation in the country with over 45 million people employed directly, and another 60 million people in allied sectors, including a large number of women and rural population.2

Indian Apparel Market

The overall apparel segment size in FY 2020 was estimated to be USD 67 bn. The market is projected to grow at 10 percent and reach USD 107 bn by FY 2025. This growth is expected to be driven by factors such as increased purchasing power driving growth in primary discretionary spend, better access and availability of products, acute brand consciousness, increasing urbanization and increasing digitization.

The branded apparel sector will witness a growth of 13.4 percent CAGR over the next five years as against the 10 percent CAGR projected for total apparel sector.

Women’s Innerwear

Women’s innerwear category is currently estimated to be around USD 4.4 bn and is expected to grow at a CAGR of 14 percent and nearly double by FY 2025 (USD 8.5 bn).

As compared with Men’s innerwear, Women’s innerwear market has more choice of offerings with multiple width (types) and depth (sizes, colours, styles) combinations and this is expected to drive this segment. This segment is also expected to be driven by changing consumers preference from ‘Foundation’ to ‘function plus fashion plus comfort’. Rising popularity of the fashion range is also expected to drive the growth of this segment.

Indian consumer spends on apparel, especially innerwear is significantly lower when compared with other Asian peers, suggesting a significant opportunity for growth, primarily driven by rising per capita incomes and thereby spend on such products.

Kids Wear

The kids wear market in India is currently about USD 14 bn (FY 2020) and is expected to grow at a CAGR of 10.5 percent and grow to nearly USD 23 bn by FY 2025. Uniforms, t-shirts/shirts and bottom wear are the three biggest categories contributing at 37 percent, 24 percent and 18 percent of the overall kids wear market as on FY 2020. Kids denims is showing the fastest growth rate of 13 percent among all the other product categories (FY 2020 - FY 2025).

The share of online retail market is currently 4.5 percent of the overall apparel market. The share of online retail market in the overall apparel market is expected to increase in future but it won’t affect the share of brick & mortar retail and both the channels will continue to co-exist. The online market has grown manifold in recent years and witnessed the emergence of strong vertical players with widespread geographical reach. However, the large retail houses will also be able to translate the legacy and trust enjoyed by these brands when they move from offline toward online models.

The online apparel retail market in FY 2020 was USD 2.9 bn. Men (50 percent) and women (44 percent) segment contribute to bulk of online apparel market with kids contributing only 6 percent of the market. High share of men’s segment in online apparel market is driven by high penetration of casual wear categories.

Online apparel market is dominated by western wear contributing to 60 percent of share of the market. High share of western wear in online apparel market is driven by high penetration of international and casual wear brands on online platform. Also, online fashion portals have focused on private label in the casual wear category further driving the penetration of casual wear category. These online fashion portals started with catering largely to the younger age audience, but it is increasingly finding acceleration and is expected to be adopted by consumer cohorts across all age groups. Online western wear market is dominated by men which is similar to the trend witnessed in overall fashion category.

Expansion

To meet the growing market demand, Page Industries is geared up to augment its production capacity. The company's installed capacity across various units is spread over 2.20 million sft. across 15 manufacturing units and 5 finished goods warehouses.

The Company is adding 1 lakh sft in Hassan, Karnataka for raw material storage, raw material quality and elastic preparatory processes. The facility is expected to be commissioned in the second half of FY22

In Odisha, IDCO has allotted 28.8 acres of land in Ramdaspur Village in Cuttack District. The Company will set up a manufacturing facility for Men’s innerwearModern Classic vertical. The facility shall be a state-ofthe-art campus with Central Stores, Elastics, Socks and Cut to pack manufacturing operations. The project has been awarded to renowned contractors to build and meet IGBC certification. Ground levelling activity has been progressing well and the project is expected to be completed by March’23.

Financial Highlights

For the financial year ended 31st March 2021 the revenue from operations of the Company decreased from Rs 29,455 million to Rs 28,330 million a de-growth of 3.8%. The profit before tax for the year under review stood at Rs 4,534 million as against Rs 4,620 million of last year. The profit for the year stood at Rs 3,406 million as against Rs 3,432 million of the previous year.

Further to the outbreak of COVID19 pandemic and its rapid expansion, government was constrained to resort to extraordinary restrictive measures, such as strict lockdowns which were extended to the entire country since March 2020. In view of these restrictive measures including lock-downs, its manufacturing facilities and offices had been temporarily shut down, adversely impacting the revenue and business operations of the Company. As a responsible corporate citizen with a deep sense of empathy, the company had taken all measures to ensure that all of its employees were retained, despite adverse business environment. The company has taken every measure to ensure that all workers and staffs were paid wages and salaries well on-time, significantly mitigating the adverse impact of the pandemic on its workforce.

During the year 2020-21, your Directors have declared interim dividends on 12th November 2020 (Interim dividend of Rs 100 per share) and 10th February 2021 (Interim dividend of Rs 150 per share) on an equity share value of Rs 10 each amounting to Rs 2,789 million. In total, two interim dividends have been declared and paid. The Board has not recommended any final dividend.

Financial Highlights for FY21

27 May 2021; Page Industries, India’s leading apparel manufacturer, announced its financial results for the quarter and full year ended 31 March 2021 3

- Revenue at Rs. 28,330 million; down 4% YoY. Although, sales were severely impacted due to the covid-19 pandemic during Q1’21, the company witnessed a steady recovery with a strong pick-up in sales momentum Q2’21 onwards leading to Q3’21 and Q4’21 reporting best quarterly performance in the history of the Company.

- The operating cost was reduced by 16% to Rs. 4,787 million.

- EBITDA and PAT margins are steady at 19% and 12% respectively.

- The cash & cash equivalent continued to be strong at Rs. 4,347 million. The company continue to have a strong balance sheet, debt-free and with ROCE at 55%.

Commenting on the results, Managing Director, Mr. Sunder Genomal said, “This has been an unprecedented year for all of it. However, I am pleased to say that during this time, the company were able to handle the operational challenges and come out as a stronger and more resilient organization.

Although the year started on a challenging note, the company were quick to implement its business continuity plans resulting in one of the best quarter performances for the company in its history. The company witnessed a strong demand pick-up across all its product categories. Page Industries has added 180 Exclusive Brand Outlets during the year and continue to strengthen its distribution channels.

The company's focus continues to be on strengthening its management team with the best talent and invest in digital transformation, technology and innovation in product design and development, marketing and brand building. There is also renewed focus in becoming more efficient and optimal in all aspects of the business, while at the same time taking care to eliminate any wasteful spend or activity.

Given its strong and proven business model, wide product portfolio, efficient financial management and a very loyal customer base, the company continue to remain very confident of its medium to long term prospects.”

References

.