Pfizer Ltd

Summary

- The Company has a portfolio of over 150 products across 15 therapeutic areas with annual sales of over Rs. 2,000 crores.

- Its top brands include Prevenar 13, Lyrica, Corex – DX, Dolonex, Enbrel, Becosules, Gelusil and Folvite among others

Company Overview

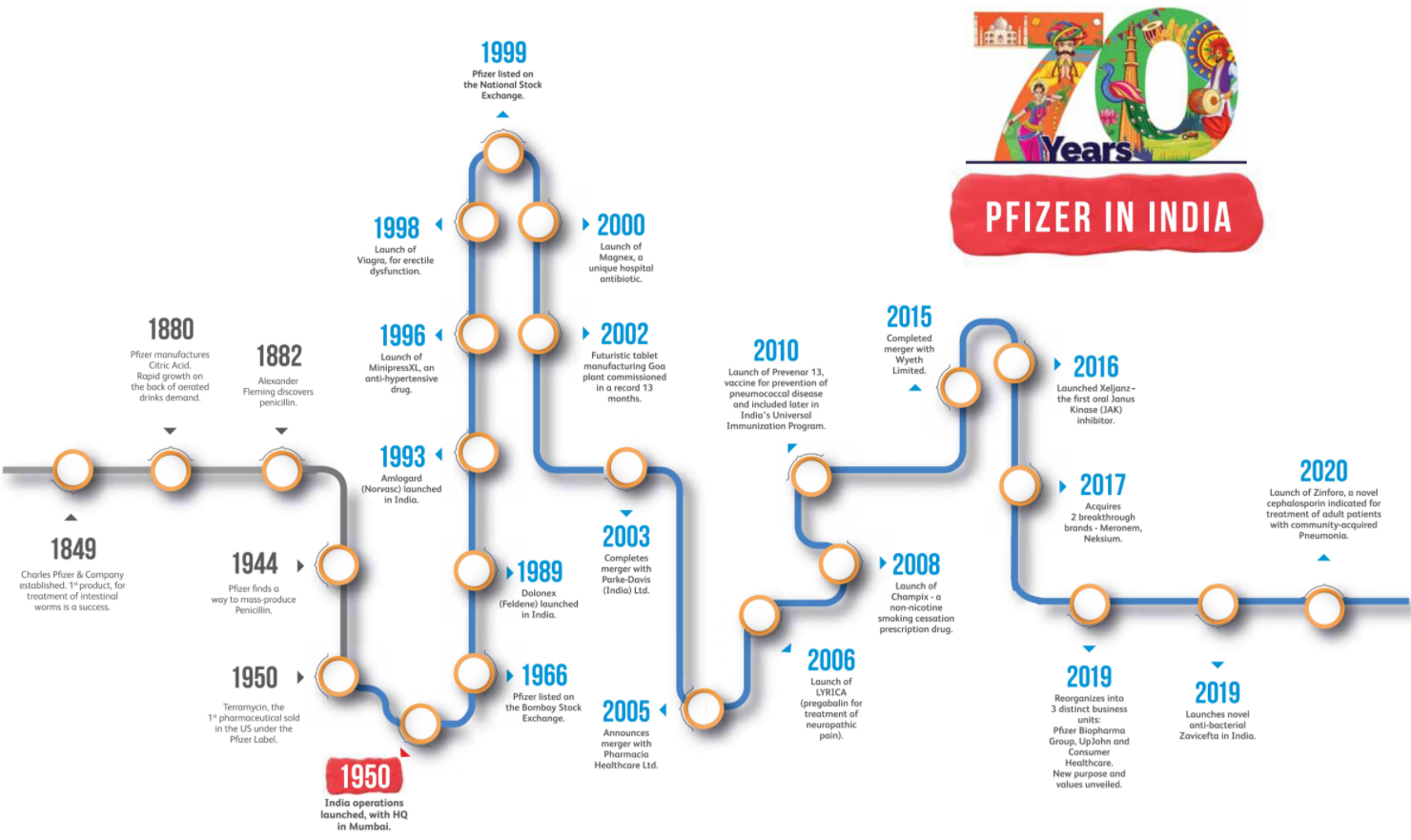

Pfizer Limited (NSE: PFIZER) was listed on the Indian stock exchange in 1966. Today, the company has over one lac shareholders in India. With annual sales of over Rs. 2,000 crores, it is the fourth largest multinational pharmaceutical company in India. The Company has a portfolio of over 150 products across 15 therapeutic areas. 1

Its top brands include Prevenar 13, Lyrica, Corex – DX, Dolonex, Enbrel, Becosules, Gelusil and Folvite among others. In addition to its commercial operations, Pfizer Limited also operates a state-of-the-art, award-winning manufacturing facility in Goa that produces more than a billion tablets annually.

The Company employs 2,631 colleagues, and is committed to providing therapies to prevent and treat some of the most critical diseases that impact public health in India today.

Plant Location

- Verna, Goa

- Thane Belapur Road, Navi Mumbai

Industry Overview

According to the Indian Economic Survey 2021, the domestic pharmaceutical market is expected to grow three times in the next decade to US$ 42 billion in 2021 and US$ 65 billion by 2024 and may reach ~US$ 120-130 billion by 2030. 2

The Union Budget 2021 puts a spotlight on health and well-being. Doubling up healthcare spending and allocating a sizable outlay for developing capacities of primary, secondary and tertiary healthcare systems and promoting new and existing institutions to concentrate on emerging diseases over the next 6 years, is a welcome move. The focus is now on overall well-being of the people including preventive and curative health with a larger emphasis on immunization. Allocating Rs 35,000 crore for COVID-19 vaccine and the assurance that any additional spending required would be provided for vaccination, is a welcome step. However, much needs to be done to improve national healthcare spending as a percentage of GDP.

Indian Pharmaceutical Industry

Market Overview

The Indian pharma market (IPM) grew at 4.3% over the April 2020 - March 2021 period, with a turnover of Rs 1,56,797 Crore. The growth was primarily driven by price, which contributed 4.3% to the total, followed by new products at 3.6% and volume at -3.6%. Multinational companies hold about 20% share in the market and have grown at 2.6%.

Therapeutic Growth

Cardiac has overtaken anti-infectives to emerge as the top therapy. Antivirals have registered highest growth of 161% due to pandemic. The acute care segment is growing at a meager 2% due to low patient volume during the pandemic. Anti-infective, being the most impacted, declined by 12%. Within the acute therapeutic areas, vitamins, minerals & supplements (VMS) was least impacted. Chronic segment has also suffered due to the pandemic as growth slipped to 8.4% (Mar’21 MAT) from 11.7% (Mar’20 MAT). Both cardiac and cardiovascular and neuroscience (CNS) therapies posted double-digit growths.

COVID-19 Impact on Pharmaceutical Industry

IPM grew faster in March 2021 due to the base effect of lockdown beginning March 25, 2020. IPM growth declined to 4.3% in 2021 as compared to 10.5% growth last year. Loss in potential sales is estimated at approximately Rs 8,000 Crore.

The impact was higher as the lockdown period overlapped with monsoon season which typically are growth drivers for acute therapeutic areas. With limited face-to-face detailing, new launches were either delayed or saw lower uptake but are now picking up. Vitamins has shown strong recovery driven by consumer awareness and their role in immunity building for COVID-19. The respiratory therapeutic area has shown lower growth levels. A research indicates lockdown linked drop in asthma attacks mainly due to lower levels of air pollution, fewer cold and flu infections. Limited access to healthcare professionals in Tier 1 Cities due to stricter lockdown, reverse migration, lower inter-district travel for medicine purchase and increased focus on rural markets are potential drivers for rural growth. Going forward, health systems needs to be mindful of increasing co-morbidities/ new diagnosis in COVID-19 recovered patients.

Business Overview

The company collectively addresses 15 therapy areas with a portfolio of over 150 products that include therapeutics and vaccines.

Vaccine

Vaccine: The company’s Vaccine business focuses on a pneumococcal conjugate vaccine - Prevenar 13. This vaccine provides broad coverage against the most prevalent 13 serotypes of streptococcus pneumoniae. Prevenar 13 is now ranked 16th in the Indian Pharma Industry (March 2021). Prevenar 13 is truly the only vaccine for all age groups, as the Drugs Controller General of India in May 2021 has granted approval for 18-49 years age group in addition to the pediatric, adolescent and 50 plus age group.

The company continues to enjoy a leadership position in the pneumococcal vaccines market with a share of 55.4%. It is committed towards creating awareness, education and make vaccines available so that more individuals can be protected against devastating pneumococcal infections.

Inflammation and Immunology

The Inflammation and Immunology vertical makes available medicines to patients suffering from chronic diseases related to immune system like Rheumatoid Arthritis, Psoriasis, Psoriatic Arthritis, Ankylosing Spondylitis and Internal Bowel Diseases. These advance therapies include drugs made from protein-cytokine, and oral therapies that manage inflammation and pain. The goal of this team is to transform the management of chronic inflammatory diseases, many of which are not well managed by existing treatment options that provide only symptomatic relief.

Internal Medicine

In 2019-20, the company’s Internal Medicine (IM) team framed a new mission for the next five years and developed a strategic roadmap – “To deliver sustainable, market-beating growth through differentiated go-to-market strategies (GTM)”. The key shift in GTM was to create two distinct market segments: Core market, focused on specialists in the urban geographies and Multiplier market, focused on general/family physicians in the extra-urban rural geographies.

During the year under review, this shift in GTM enabled the company to significantly maximize its presence in specialties like cardiologists, gynecologists, chest physicians, orthopedics etc. in the core geographies and increased reach and penetration in the rural and extra-urban geographies, leading to consistent market beating growth for key brands. The company also deployed innovative digital channels to improve trade engagement (retail, semi-stockist, stockist) across core and multiplier markets and ensure availability of key medicines for the patients, especially during lockdown.

Respiratory Portfolio

The company has presence in the Respiratory portfolio with Cough, Oral Corticosteroids and Smoking Cessation therapies. The flagship brand Corex Dx has maintained leadership position in the dry cough Respiratory Portfolio Market with 18.1% value market share. One of the major initiatives taken during the year was ‘cough the right way’ –a campaign that aimed to create awareness and educate patients on good practices to be followed to avoid spread of infections. As part of future growth strategy, the company continues to focus on building brands in the productive cough segment with line extensions of Corex LS and Corex LS Junior.

During the year, there has been continued focus on the smoking cessation drug Champix with launch of #BreakTheStick campaign. The campaign was initiated by the company in November 2020 with the aim to create an ecosystem to support smokers looking to quit smoking, while also enabling more primary care physicians to address smoking cessation successfully. A detailed omnichannel programme aided outreach to over 1,00,000 consumers, with 14,000 engaging on the micrositequittoday.in for a deeper understanding of the therapy, and over 330 smokers going through with an actual online consultation. The HCP engagement arm of the programme, designed for primary care physicians and chest physicians, empowered over 2500 doctors through more than 25 Key Opinion Leader (KOL) advisory and certification programs.

Vitamins Portfolio

The company’s flagship brand Becosules continues to lead and shape the B-complex vitamins market with growth of 32%. With a legacy of more than 60 years, the brand is still growing faster than the market with an Evolution Index (EI) of 103, which has resulted in moving its market share to 75.1%. Continuous focus on expanding the prescriber base, increasing consumer demand and innovative channel initiatives have been the key pillars to strengthen brand’s leadership.

With Becosules getting the over the counter (OTC) brand status coupled with the new GTM model helped the company to expand its retail reach. The company also drove aggressive retail engagement and connect at approximately 50,000 chemist outlets and build consumer awareness to help them Boost Immunity with Becosules.

Neuroscience and Cardiovascular

The company’s Neuroscience portfolio represents multiple brands that are leaders in their respective segments. Pacitane (Trihexyphenidyl) leads in its therapeutic category with 68% market share with 13% growth over last year. Ativan (Lorazepam) is the second largest anxiolytic brand in the Benzodiazepine Tranquilizer market growing at 14.6%.

The Cardiovascular (CV) team operates in the antihypertensive segment with its brands Minipress XL and Targit Range. Minipress, the leading brand in the market, for uncontrolled hypertension has maintained its market share at 43.9% with growth of 8% and EI of 101. The company continued its engagement activities in the area of uncontrolled hypertension through medico-marketing initiatives with physicians, nephrologists and cardiologists.

Eliquis

Eliquis® (Apixaban) a Factor Xa Inhibitor Anticoagulant is a leading oral Anticoagulant, predominantly prescribed by cardiologists, cardio like physicians and orthopedic surgeons. Eliquis is the leader in the Novel Oral Anti-Coagulants (NOAC) Market, with an EI of 125 and it grew by 69% over last year same period as per MAT Mar 2021.

During the year under review, the team has bought in extraordinary reach and penetration for the brand through the new go-to-market strategies. As per this new structure, Eliquis is now promoted by two teams under one leadership, allowing for increased reach amongst consulting physicians and orthopedic surgeons while sharpening focus and coverage amongst cardiologists. This co-marketing strategy has also helped maximize geographic penetration beyond metro and tier 1 cities which enables the company to improve lives of more patients across the country than ever before.

Women’s Healthcare

The company’s portfolio in Women’s Healthcare comprises many of the segment’s iconic brands, supporting important life-stages like pregnancy, menopause, reproductive health including contraception. Brands like Folvite, Autrin, Premarin and Ovral L continue to maintain their leadership position in the represented market and the consolidated portfolio continues to grow faster than the market average. Shift in go-to-market strategies and enhanced focus on gynecologists accelerated the prescription growth and now three brands in the portfolio – Folvite, Autrin and Folvite MB feature amongst the top 100 IPM brands prescribed by gynecologists.

Gastric portfolio

The company has presence in gastroenterology segment with brands like Neksium, Gelusil and Mucaine. The focus of its Esomeprazole Proton Pump Inhibitor (PPI) - Neksium, has been on delivering excellence by driving strong in-clinic focus at key specialties including gastroenterologists and orthopedicians. The company launched Gastroesophageal Reflux Disease (GERD) Clinic, Pfizer’s first ever annual initiative to reach more than 10,000 HCPs and drive GERD awareness. The company has intensified focus on nursing homes and small hospitals that have helped sustain momentum. Neksium D, launched in 2019, continues to build growth for the brand and has been positioned to drive differentiation by targeting patients with symptoms related to Refractory GERD.

Pain and inflammation portfolio

The company has a pronounced presence in the pain and inflammation category with brands Dolonex (Piroxicam) and Wysolone (Prednisolone). Both are legacy brands with more than 40 years of presence in India and are leaders in their respective categories, having impacted lives of more than 10 million patients in the Country. Dolonex DT and Wysolone both have a strong EI of 101 and 112 respectively indicating that they are growing faster than the market. The company has continued its engagement activities in osteoarthritis (OA) and low back pain (LBP) through medico-marketing initiatives with orthopedicians and physicians on treating OA and LBP.

The portfolio expanded in December 2020, with the introduction of Dolonex E (Etoricoxib) for the treatment of osteoarthritis. The company plans to further expand the portfolio to provide a range of solutions for management of osteoarthritis.

Hospitals

The company’s Hospitals business unit focuses on institutions such as hospitals and nursing homes with an advanced anti-infectives and sterile injectables portfolio.

Pfizer’s original breakthrough innovative and patented drug Zavicefta 2gm/0.5gm (ceftazidime-avibactam) has recorded an exponential growth driven by increased uptake across more number of hospitals. This novel drug is indicated for the management of hospital-acquired pneumonia including ventilator-associated pneumonia (HAP/VAP), complicated intra-abdominal infection (cIAI) and complicated urinary infection (cUTI) in adults. The emergence and spread of carbapenemase-producing pathogens are a concern and has highlighted the urgent need for new antimicrobial agents.

Financial Highlights

financial results for the quarter and year ended March 31, 2021.

Pfizer Limited announced its Audited results for the quarter and year ended March 31, 2021. 3

Revenues

Revenue from operations for the quarter ended March 31, 2021 stood at ₹535 crore as compared to ₹502 crore in the same period last year, a growth of 6.5%.

Revenue from operations for the year ended March 31, 2021 is ₹2,239 crore as compared to ₹2,152 crore in the same period last year, showing a 4% growth.

In India, the COVID-19 pandemic continued to develop rapidly into 2021, with a significant rise in the number of cases. The current year sales, primarily for Hospitals and Vaccines businesses, have been impacted due to the pandemic.

The Company has monitored the impact of COVID-19 on all aspects of its business. The management has exercised due care, in concluding significant accounting judgements and estimates, recoverability of receivables, assessment for impairment of goodwill, intangible assets, inventory based on the information available as on date, while preparing the financial results as of and for the year ended March 31, 2021.

While business-critical functions continued to be fully operational to ensure there are no interruptions in the delivery of its medicines to the hospitals and patients, rest of the colleagues worked from home. Several measures have been put in place for communications, technology and productivity improvements to help employees cope with this change.

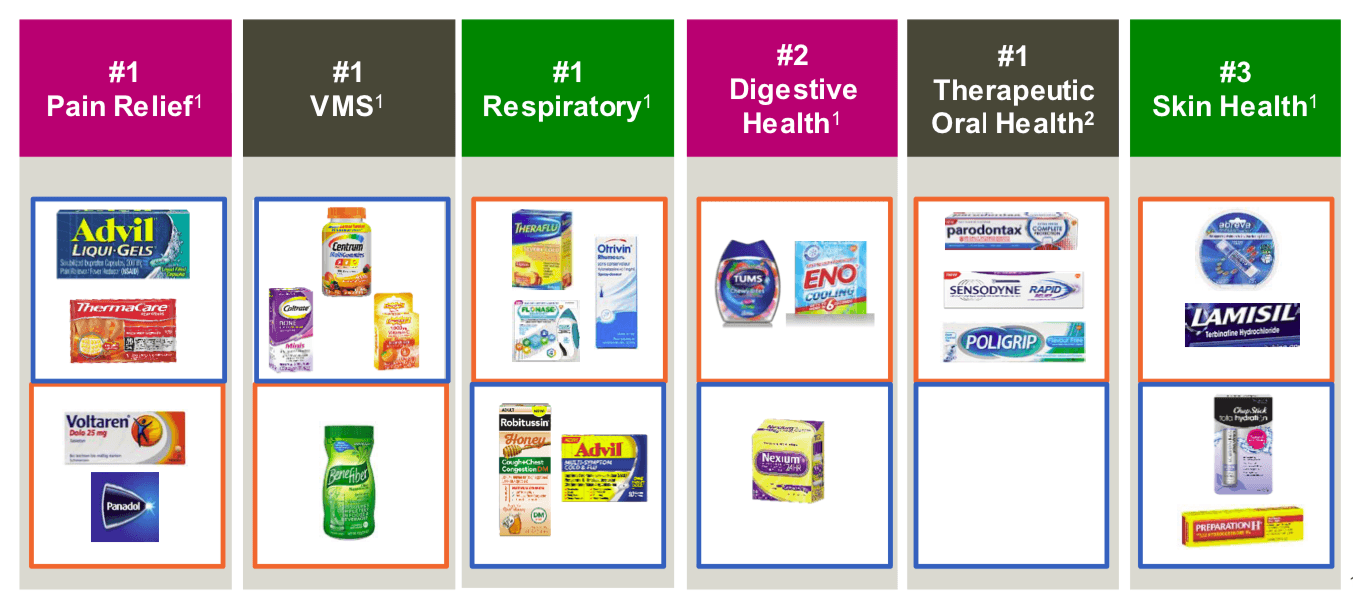

Consumer Healthcare business

During the current quarter, the Company completed the wind down activities for its Consumer Healthcare business consisting of two brands – Anacin and Anne French. The compensation of ₹27.5 crore derived based on the fair value of Pfizer Consumer Healthcare Products as determined by the independent valuers along with the incremental wind down cost of ₹11.6 crore will be received by the Company.

Profits before other income and tax

Profit from operations (before other income and tax) for the quarter ended March 31, 2021 registered a growth of 23% to ₹98 crore as against ₹80 crore in the same period last year.

Profit from operations (before other income and tax) for the year ended March 31, 2021 registered a growth of 28% to ₹603 crore as against ₹469 crore in the same period last year.

Net profit for the year

Net Profit after tax for the quarter ended March 31, 2021 is ₹100 crore as against ₹103 crore in the same period last year

Net Profit after tax for the year ended March 31, 2021 is ₹497 crore as against ₹509 crore in the same period last year

Quarter and Year ending March 2020 had Prior year tax reversals ₹44 crore, thereby resulting in the lower net profit during the period / year when compared with same period last year

Dividend

The Board of Directors of the Company has recommended a normal dividend of Rs 30/- per equity share of Rs 10/- each (300%) and a special dividend of Rs 5/- per equity share of Rs 10/- each (50%), aggregating to total dividend of Rs 35/- per equity share of Rs 10/- each (350%) for the year ended March 31, 2021.