Robi Axiata Limited

Summary

- Robi Axiata Limited is a telecommunication operator in Bangladesh

- It merged with Airtel on 16 November, 2016 to become the second largest operator in the country

- The company recently has come to public on 24 December, 2020

- The company raised BDT 5.237 billion from the initial public offering at BDT 10 per share in the secondary markets.

- The company achieved a year-on-year subscriber growth rate of 3.9%, revenue growth of 1.1%, and profit growth of more than 100% in 2020.

Company Overview

Robi Axiata Limited (DSE:ROBI; CSE:ROBI) is a public limited company in telecommunications sector of Bangladesh. The company is the second largest mobile network operator after Grameenphone with 50.9 million subscribers as of December, 20201.

As a mobile network operator, Robi competes with Grameenphone, Banglalink, and Teletalk. The company has emerged as the second largest operator in the country by merging with another competitor – Airtel. Robi merged with Airtel Bangladesh and has started commercial operation of the merged company under the name Robi Axiata Limited (Robi) on 16 November, 2016. The merger transaction was the biggest one ever in Bangladesh.

The core value of the company is a firm commitment to “Exceptional Performance and Uncompromising Integrity (UI-EP)” in creating value for customers by keeping them at the center. The company strives to keep pace with the evolving digital landscape of Bangladesh and provide customer centric digital services. It has four guiding principles – be agile, inspire to innovate, collaborate to deliver, and do digital.

Robi Axiata Limited started its journey in Bangladesh in 1997 as Telecom Malaysia International (Bangladesh). The company had the brand name “Aktel” until 2010, when it has changed the name to “Robi”. The company has made its share market debut on 24 December, 2020 in the two bourses – Dhaka Stock Exchange (DSE) and Chattogram Stock Exchange (CSE). The initial public offering of Robi has been the largest ever in Bangladesh. The ownership of the company (after merger) currently belongs to Axiata Group Berhad Malaysia (61.82%), Bharti Airtel of India (28.18%), and general public (10%).

The Merger in 2016

With a mission to long-term sustainability in the telecommunications sector of Bangladesh and faster rollout of mobile services nationwide, Robi and Airtel engaged in a merger speculation in 2015. The company started merger talks in August, 2015 and got approval from BTRC (Bangladesh Telecommunications Regulatory Commission) on 29 September, 2015. The merger took place on 16 November, 2016 for a fee of BDT 1 billion and a further charge of BDT 5.07 billion for spectrum fees. Below figure shows different milestones for the merger -

During the time of merger, Airtel had 7.94 million subscribers and Robi had 23.2 million subscribers. After the merger, the company had approximately 3.22 million subscribers, making it the second largest operator in the country, exceeded by Grameenphone (54.5 million subscribers) and followed by Banglalink (29 million subscribers) at that time2. Robi still remains the second largest operator with approximately 50 million subscribers. The main points of the merger are as follow –

- The merger bid started in August, 2015

- The merger took place on 16 November, 2016

- Robi (together with Airtel) became the second largest operator in Bangladesh

- The government has charged Robi BDT 1 billion as merger fee and 5.07 billion as spectrum fee

- The prefixes of Robi and Airtel are 018 and 016 have started operating under the same umbrella after the merger. However, Robi would continue the Airtel branding only for two years after the merger3.

The Stock Market Debut in 2020

Robi Axiata Limited has made its share market debut on 24 December, 2020. The company has 523.7 million shares, of which it has offloaded 10% shares to public. The company raised BDT 5.237 billion from the initial public offering at BDT 10 per share in the secondary markets. Since the telecommunications market in Bangladesh is of oligopolistic nature and Robi is the second largest telecommunications operator after Grameenphone to go public, there was a public hype about the IPO. The company followed fixed price method and called for subscription. The share would be allocated based on a lottery system. There was 5.74 times more subscription than the allocated number of shares. The company issued 136.1 million shares to employees to raise BDT 1.361 billion under Employee Share Purchase Plan (ESPP)4. The rest of the shares were issued publicly.

At the time of Robi’s floatation to the stock market, the company had an earnings per share (EPS) of BDT 0.04; profit plunged 77 percent year-on-year in the third quarter of 2020, which must be attributable to the lockdown due to Covid-19; and yearly revenue and net profit were BDT 74.81 billion and BDT 200 million, respectively, in 20195. Below are the facts and figures of Robi’s IPO debut –

- Bangladesh Securities and Exchange Commission (BSEC) approved the IPO on 23 September, 2020

- 52.37 million shares offered at BDT 10 per share to raise 5.237 billion

- Fixed price system is followed; shares are allocated based on lottery results

- It is the biggest public offering so far in Bangladesh

- The IPO experienced oversubscription of about 5.74 times

Business Overview

The business of Robi is manifested by its introduction of 4.5G services nationwide with a coverage of 97.4% of the total population. The company regularly rolls out different competitive offers and packages to their customers. It has conducted a trial run of 5G on its network as the first company in Bangladesh on July 25, 2018. The business strategy of the company is firmly rooted in expanding its network, subscribers, and introducing newer digital services.

In 2020, Robi has achieved a subscriber growth rate of 3.9%, year on year. The company had its 99% of the 4G sites operational and experienced a year-on-year 4G user growth of 72.8% in 2020. Despite the pandemic, the company has managed to experience a revenue growth of 1.1%, year on year, in 2020. The performance of the business in 2020 has been stellar compared to 2019 in terms of net profit. The company has made a net profit of BDT 1,574 million compared to BDT 169 million a year earlier. It claims that the growth has been due to operational efficiency6. However, a close inspection of the income statement shows that the company experienced a revenue growth of BDT 811 million, and decreased administrative expenses and operating expenses by BDT 1,182 million and BDT 956 million, respectively, in 2020. These factors have contributed to the huge increase in profits. The earnings per share (EPS) has increased from BDT 0.04 in 2019 to 0.33 in 2020.

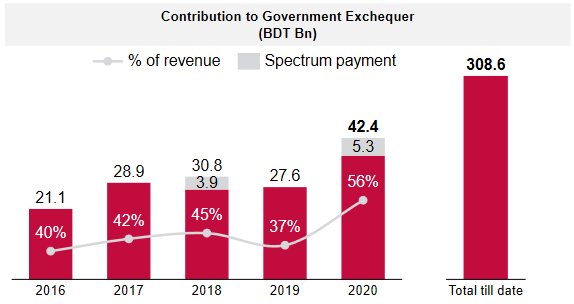

The company has made contribution to the government of Bangladesh by payments in the form of tax, VAT, revenue sharing, and duties. As the revenue and profits of the company is growing, so is the payment to the government.

Earnings before interest, tax, depreciation and amortization (EBITDA) of the company has grown from BDT 28.8 billion to BDT 32.2 billion, a growth rate of 11.8%, in 2020. The company has increased its property, plant and equipment investment in 2020, which has given it a growth in capital expenditure (Capex) of 47.6% (from BDT 14.2 billion to BDT 21.0 billion). Due to high capex deployment, free cash flow to firm has experienced a negative growth of 23% (from BDT 14.6 billion to BDT 11.2 billion in 2020).

Robi Axiata Limited financials, 31 March, 2021

In the first quarter of 2021, the company has earned BDT 328 million which is about 75% higher than the quarter a year earlier. Revenue did not grow compared to the first quarter of the last year but the increase in profit is due to the lower income tax paid. Earnings per share (EPS) of the company has also increased from the first quarter of last year by BDT 0.02 to BDT 0.06. Net asset value (NAV) per share is BDT 12.66, and net operating cash flow per share (NOCFPS) is BDT 1.68 per share.

Recent developments

- RedDot Digital has unveiled a private equity fund named R-Ventures on 1 July, 2021. The fund is worth BDT 150 million and will work as an alternative investment vehicle (AIF). RedDot Digital is a fully-owned subsidiary of Robi Axiata Limited.

- Managing Director and Chief Executive Officer (CEO) of Robi Axiata Limited has confirmed his resignation from the position on 4 August, 2021. He will not renew the contract that ends on 31 October, 2021. He was appointed CEO of the company on April, 2014.7

- ^ https://www.robi.com.bd/en/corporate/company-profile

- ^ https://www.thedailystar.net/business/telecom/robi-airtel-complete-merger-1315822

- ^ https://www.thedailystar.net/business/telecom/robi-airtel-complete-merger-1315822

- ^ https://thefinancialexpress.com.bd/stock/bangladesh/bsec-cautious-about-robis-ipo-approval-1595737069

- ^ https://www.thedailystar.net/business/news/robis-stock-market-debut-thursday-2015225

- ^ https://webapi.robi.com.bd/uploads/files/shares/Page/20210216_Robi_%20IR_Q42020_Final.pdf

- ^ https://www.thedailystar.net/business/organisation-news/news/robi-md-ceo-mahtab-uddin-ahmed-resigns-2145401