Royal Bank Of Canada

Summary

- Royal Bank of Canada has 150 yeas of history.

- Royal Bank of Canada serves across Canada, the United States, and select global markets.

- It has 17 million clients in Canada, the U.S. and 34 other countries.

Company Overview

Royal Bank of Canada (NYSE:RY, TSX:RY) is a global financial institution with a purposedriven, principles-led approach to delivering leading performance. The company's success comes from the 86,000+ employees who leverage their imaginations and insights to bring its vision, values and strategy to life so the company can help its clients thrive and communities prosper. As Canada’s biggest bank, and one of the largest in the world based on market capitalization, RBC has a diversified business model with a focus on innovation and providing exceptional experiences to its 17 million clients in Canada, the U.S. and 34 other countries.

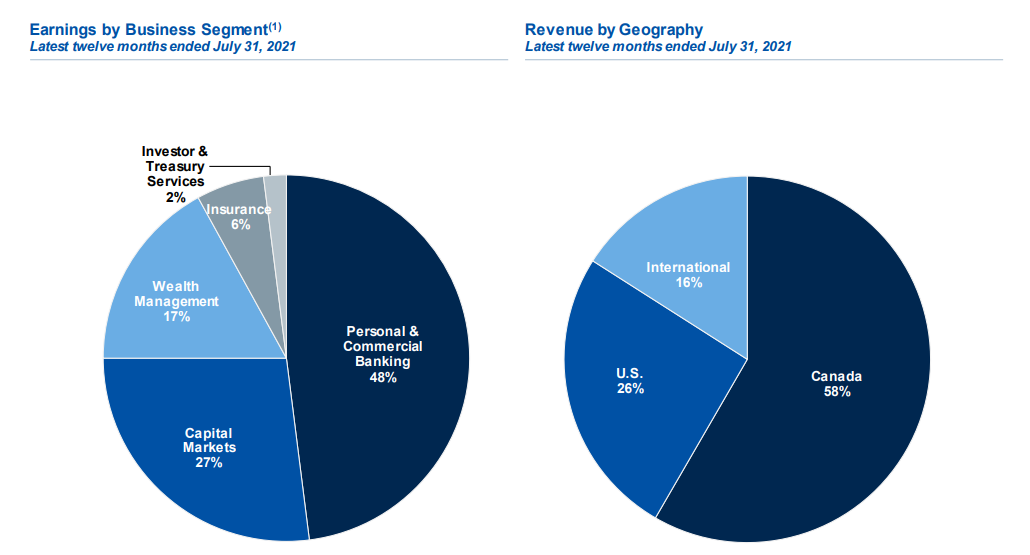

Business Segment

For more than 150 years, we’ve gone where its clients have gone – expanding across Canada, the United States, and to select global markets. Today, the company hold strong market positions in five business segments, with 17 million clients who continue to put their trust in RBC.1

Personal & Commercial Banking

Personal & Commercial Banking comprises its personal banking operations and certain retail investment businesses in Canada, the Caribbean and U.S. as well as its commercial and corporate banking operations in Canada and the Caribbean.

- RBC Royal Bank

- RBC InvestEase

- RBC Direct Investing

- RBC Bank

- RBC Royal Bank Caribbean

Wealth Management

Wealth Management serves affluent, high-net-worth and ultra-high-net-worth clients in Canada, the United States, and selected regions outside North America with a full suite of investment, trust and other wealth management solutions and businesses that provide asset management products and services through RBC distribution channels and third-party distributors.

- RBC Dominion Securities

- RBC Estate and Trust Services

- RBC Wealth Management, International

- RBC Phillips, Hager & North Investment Counsel

- RBC Global Asset Management

Investor & Treasury Services

Investor & Treasury Services serves the needs of institutional investing clients and provides custodial, advisory, financing and other services for clients to safeguard assets, maximize liquidity and manage risk in multiple jurisdictions around the world.

- RBC Investor & Treasury Services

Capital Markets

Capital Markets provides public and private companies, institutional investors, governments and central banks globally with a wide range of capital markets products and services across its two main business lines, Corporate and Investment Banking and Global Markets

- RBC Capital Markets

Insurance

Insurance offers a wide range of life, health, home, auto, travel, wealth and reinsurance advice and solutions, as well as creditor and business insurance services to individual, business and group clients.

Industry Overview

Measures to contain the COVID-19 pandemic have sharply curtailed economic activity in many countries, resulting in unprecedented declines in GDP and a substantial increase in unemployment starting in the spring of 2020. Significant fiscal and monetary policy stimulus has helped to support the partial recovery to date. However, a resurgence of virus spread and associated re-imposition of containment measures to varying degrees in some regions, along with the tapering off of certain elements of fiscal support has raised further uncertainty with regards to the timing and extent of recovery. Despite recent positive trial results, the ongoing evolution of the development and distribution of an effective vaccine also continues to raise uncertainty.2

Canada

The Canadian economy is expected to contract by 5.6% in calendar 2020 after the COVID-19 containment measures led to an unprecedented decline in economic activity in the first half of the calendar year. An easing in containment measures allowed for a sharp, but partial, rebound in activity over the summer. However, investment in the oil and gas sector fell sharply with drilling activity continuing to run below year-ago levels in Canada. This, along with activity in the accommodation and food services industries where social distancing remains more challenging, has lagged the broader recovery. The unemployment rate rose to a peak of 13.7% in May 2020 from pre-pandemic levels of under 6% and remained elevated at 8.9% as of October 2020. With the resurgence in the spread of COVID-19 in the latter part of the calendar year, the pace of recovery has slowed and the re-imposition of containment measures to varying degrees in some regions remains a significant risk to the economic outlook. Exceptional government income support has helped to offset lost wage income for households and, until reduced or terminated, will continue to do so with enhanced employment insurance payments and the new Canada Recovery Benefit program. Policy rates have fallen in calendar 2020 to low levels and the company expect the Bank of Canada (BoC) will maintain the overnight rate at the current low level for an extended period, as well as continue with the existing quantitative easing (QE) programs. Low rates, government support programs and the gradual winding down of measures to combat the spread of COVID-19 are expected to ultimately result in a partial recovery in the economy in 2021.

U.S.

The U.S. economy is expected to contract by 3.6% in calendar 2020. All components of aggregate demand besides government expenditure slumped in the second calendar quarter of 2020 amid widespread COVID-19 pandemic containment measures. Labour market conditions also deteriorated rapidly during the onset of the COVID-19 pandemic, with the unemployment rate hitting a peak of 14.7% in April 2020, markedly higher than February’s pre-pandemic rate of 3.5%. The initial rebound in the economy during the second half of the calendar year has been rapid, but partial, with the unemployment rate still well-above pre-pandemic levels at 6.9% in October 2020. Household spending has been supported by exceptional government income transfers and policy rate cuts. While some federal income support programs expired over the summer, the Federal Reserve (Fed) has committed to maintaining extraordinary policy support until the economic slack is fully absorbed and the labour market has recovered. Moving forward the company expect a more gradual recovery, and forecast real GDP will partially retrace the 2020 decline in calendar 2021.

Europe

Euro area GDP is expected to contract by 7.2% in calendar 2020, with divergence in country performance across the trading bloc. Similar to many other central banks, the European Central Bank (ECB) has held interest rates low and announced additional stimulus measures to combat the impact from the COVID-19 pandemic, including expanding its QE programs. The Bank of England (BoE) also responded to the COVID-19 pandemic with lower interest rates and expanding their QE programs. GDP in the U.K. is expected to decline by 11.5% in calendar 2020. A resurgence in the spread of COVID-19 in the fourth calendar quarter 2020, alongside the re-imposition of containment measures to varying degrees in some regions, is expected to limit the pace of recovery both in the U.K. and the Euro area after unprecedented declines over the first half of 2020. Uncertainty about Brexit will further weigh on growth in the U.K. In calendar 2021, GDP growth for both the Euro area and the U.K. is expected to rebound at a relatively modest pace.

Financial markets

Government bond yields remain at historically low levels due to subdued inflation and expectations that monetary policy will remain accommodative for an extended period. Monetary policy stimulus and massive government income support have been supporting equity markets broadly throughout the COVID-19 pandemic, with major indexes posting a full rebound to pre-pandemic levels in August 2020. Recent announcements of positive vaccine trial results have further boosted market sentiment. Oil prices have rebounded somewhat after falling sharply in the spring alongside a price war between Russia and Saudi Arabia and virus containment measures that weighed heavily on demand. The company continue to look for a gradual recovery in oil prices in 2021, as demand continues to bounce back.

Relief programs

In response to the COVID-19 pandemic, several government programs have been and continue to be developed to provide financial aid to individuals and businesses, which include wage replacement for individuals, wage subsidies and rent relief for businesses, and lending programs for businesses, which RBC is administering for its clients. To further support its clients in financial need, various temporary relief programs were launched beyond the available government programs.

Financial Highlights

Net income of $11,437 million decreased $1,434 million or 11% from a year ago (2019). Diluted EPS of $7.82 was down $0.93 or 11% and ROE of 14.2% was down 260 bps. The company's Common Equity Tier 1 (CET1) ratio was 12.5%, up 40 bps from a year ago.

Total revenue for year 2020 increased $1,179 million or 3% from last year, largely due to higher net interest income, underwriting and other advisory fees, investment management and custodial fees, and higher trading revenue. The impact of foreign exchange translation also increased total revenue by $172 million. These factors were partially offset by a decrease in other revenue and lower insurance premiums, investment and fee income (Insurance revenue).

Net interest income increased $1,086 million or 5%, primarily driven by volume growth in Canadian Banking and Wealth Management, and higher fixed income and equity trading revenue in Capital Markets. Higher funding and liquidity revenue within its Investor & Treasury Services business also contributed to the increase. These factors were partially offset by the impact of lower interest rates in Personal & Commercial Banking and Wealth Management. The impact associated with higher funding and liquidity revenue within its Investor & Treasury Services business was more than offset by lower related gains on non-trading derivatives in Other revenue.

NIM was down 6 bps compared to last year mainly due to lower spreads in Wealth Management primarily due to the impact of lower interest rates, as well as lower spreads in Canadian Banking primarily due to the impact of lower interest rates and competitive pricing pressures.

Insurance revenue decreased $349 million or 6%, mainly reflecting the change in fair value of investments backing policyholder liabilities, which is largely offset in PBCAE. This was partially offset by business growth primarily in longevity reinsurance and group annuities, both of which are largely offset in PBCAE.

Trading revenue increased $244 million or 25%, mainly due to higher fixed income trading in Europe, higher commodities trading in Canada, and higher equity trading in the U.S. and Europe. These factors were partially offset by lower equity trading in Canada and lower fixed income trading in the U.S.

Investment management and custodial fees increased $353 million or 6%, largely driven by higher average fee-based client assets reflecting net sales and market appreciation, partially offset by the impact of a favourable accounting adjustment in Canadian Wealth Management in the prior year.

Other revenue decreased $753 million or 47%, primarily reflecting lower gains on non-trading derivatives in its Investor & Treasury Services business, which were largely offset in Net interest income. A gain on the sale of the private debt business of BlueBay of $151 million in the prior year and lower income from cash sweep deposits, also contributed to the decrease. These factors were partially offset by the favourable impact of economic hedges.

Total trading revenue of $4,698 million, which is comprised of trading-related revenue recorded in Net interest income and Non-interest income, increased $1,437 million or 44% from last year, mainly due to higher fixed income trading across all regions and higher equity trading mainly in the U.S.

PCL on loans increased $2,340 million or 124% from the prior year, reflecting higher provisions primarily in Personal & Commercial Banking, Capital Markets and Wealth Management due to the impact of the COVID-19 pandemic. The PCL on loans ratio increased 32 bps. For further details on PC

Third Quarter 2021 Results

August 25, 2021; – Royal Bank of Canada (RY on TSX and NYSE) today reported net income of $4.3 billion for the quarter ended July 31, 2021, up $1.1 billion or 34% from the prior year. Diluted EPS was $2.97, up 35% over the same period. The company's results this quarter included releases of provisions on performing loans of $638 million mainly driven by improvements in its credit quality and macroeconomic outlook as compared to provisions of $280 million taken in the prior year due to the evolving impact of the COVID-19 pandemic. Earnings in Personal & Commercial Banking, Capital Markets and Wealth Management were up from last year, largely due to the favourable impact of lower provisions. Higher results in Insurance and Investor & Treasury Services also contributed to the increase.3

Pre-provision, pre-tax earnings5 of $5.0 billion were up 6% from a year ago, mainly reflecting strong client-driven growth in volumes and fee-based assets, constructive markets, record investment banking revenue and well-controlled discretionary expenses, partially offset by the impact of low interest rates, lower trading revenue and higher variable compensation on improved results. Compared to last quarter, net income was up $281 million with higher results in Personal & Commercial Banking, Capital Markets, Wealth Management, and Insurance. These results were partially offset by lower earnings in Investor & Treasury Services.

The PCL on loans ratio of (28) bps was down 23 bps from last quarter primarily due to lower provisions in Personal & Commercial Banking and Capital Markets. The PCL on impaired loans ratio of 8 bps decreased 3 bps from last quarter.

The company's capital position remained robust, with a Common Equity Tier 1 (CET1) ratio of 13.6% supporting strong client-driven volume growth and $1.5 billion in common share dividends paid.

Personal & Commercial Banking

Net income of $2,113 million increased $746 million or 55% from a year ago, primarily attributable to lower PCL. Pre-provision, pre-tax earnings 6 of $2,653 million were up 12% from a year ago, mainly reflecting strong average volume growth of 9% (+10% in deposits and +8% in loans) in Canadian Banking and higher average balances driving higher mutual fund distribution fees, partially offset by lower spreads. Also, the company generated positive operating leverage of 6.3% while continuing to invest in the business.

Compared to last quarter, net income increased $205 million or 11%, primarily due to lower PCL. The impact of three additional days in the current quarter and average volume growth of 2% in Canadian Banking also contributed to the increase. These factors were partially offset by lower spreads and higher staff-related costs.

Wealth Management

Net income of $738 million increased $176 million or 31% from a year ago, mainly due to higher average fee-based client assets reflecting market appreciation and net sales. Average volume growth and lower PCL also contributed to the increase. These factors were partially offset by higher variable compensation as well as the impact of lower spreads.

Compared to last quarter, net income increased $47 million or 7%, mainly due to higher average fee-based client assets reflecting market appreciation and net sales, and average volume growth. These factors were partially offset by higher variable compensation, lower transactional revenue mainly driven by client activity, and lower spreads.

Insurance

Net income of $234 million increased $18 million or 8% from a year ago, primarily due to the impact of new longevity reinsurance contracts, lower claims costs and the favourable impact of actuarial adjustments. These factors were partially offset by the impact of realized investment gains in the prior year.

Compared to last quarter, net income increased $47 million or 25%, primarily due to higher new longevity reinsurance contracts.

Investor & Treasury Services

Net income of $88 million increased $12 million or 16% from a year ago, primarily driven by higher funding and liquidity revenue as the prior year reflected unfavourable impacts from interest rate movements and a heightened impact from elevated enterprise liquidity. This was partially offset by lower client deposit revenue largely driven by margin compression, and higher technology-related costs.

Compared to last quarter, net income decreased $32 million or 27%, mainly driven by lower funding and liquidity revenue reflecting lower gains from the disposition of investment securities, higher technology-related costs, and a favourable sales tax adjustment in the prior quarter.

Capital Markets

Net income of $1,129 million increased $180 million or 19% from a year ago, primarily driven by lower PCL and record Corporate and Investment Banking revenue. These factors were partially offset by lower revenue in Global Markets as the prior year benefitted from elevated client activity.

Compared to last quarter, net income increased $58 million or 5% mainly due to lower PCL and lower compensation on decreased revenue. These factors were partially offset by lower equity and fixed income trading revenue across most regions driven by reduced client activity

Capital, Liquidity and Credit Quality

Capital – As at July 31, 2021, its CET1 ratio was 13.6%, up 80 bps from last quarter, primarily due to a decrease in risk-weighted assets (RWA) reflecting the impact of model parameter updates, as well as internal capital generation, partially offset by increases in RWA largely driven by business growth.

RWA decreased by $12.6 billion, mainly driven by the impact of model parameter updates to increase the threshold for determining small business clients subject to retail capital treatment, as permitted under regulatory capital requirements, and to recalibrate probability of default parameters for the remaining borrowers in its wholesale portfolio. These factors were partially offset by business growth primarily in wholesale lending, including loan underwriting commitments, residential mortgages and personal lending, and an increase in stressed value-at-risk multipliers reflecting the unwinding of temporary measures introduced by the Office of the Superintendent of Financial Institutions in response to the COVID-19 pandemic.

Liquidity – For the quarter ended July 31, 2021, the average Liquidity Coverage Ratio (LCR) was 125%, which translates into a surplus of approximately $69.2 billion, compared to 133% and a surplus of approximately $89.6 billion in the prior quarter. Average LCR decreased from the prior quarter primarily due to growth in retail and wholesale loans, partially offset by continued growth in client deposits.

The Net Stable Funding Ratio (NSFR) as at July 31, 2021 was 116%, which translates into a surplus of approximately $110.4 billion, compared to 118% and a surplus of approximately $119.0 billion in the prior quarter. NSFR decreased from the prior quarter primarily due to growth in retail and wholesale loans and an increase in on-balance sheet securities, partially offset by continued growth in client deposits.

Credit Quality

Total PCL was $(540) million. PCL on loans of $(492) million decreased $1,170 million from a year ago, due to lower provisions in Personal & Commercial Banking, Capital Markets and Wealth Management. The PCL on loans ratio of (28) bps decreased 68 bps. The PCL on impaired loans ratio of 8 bps decreased 15 bps.

PCL on performing loans was $(638) million, compared to $280 million in the prior year, reflecting releases of provisions in Personal & Commercial Banking, Capital Markets and Wealth Management in the current quarter mainly driven by improvements in its credit quality and macroeconomic outlook as compared to provisions taken in the prior year due to the evolving impact of the COVID-19 pandemic.

PCL on impaired loans of $146 million decreased $252 million, mainly due to lower provisions in Personal & Commercial Banking. Provisions taken in Capital Markets and Wealth Management in the prior year as compared to recoveries in the current quarter also contributed to the decrease.

Digitally Enabled Relationship Bank

Digital usage continued to grow with 90-day Active Mobile users increasing 10% from a year ago to 5.4 million, and mobile sessions up 27% from a year ago to 111.6 million. Digital adoption increased to 56.4%, and self-serve transactions decreased 100 bps from last year but remained high at 93.5%.