Southern Company

Summary

- Southern Company is one of the largest energy providers in the United States and the largest wholesale provider in the Southeast.

- Southern Company also transmits and distributes electricity in four states: Alabama, Georgia, Mississippi, and Tennessee.

Southern Company is one of the largest energy providers in the United States and the largest wholesale provider in the Southeast. The company generates electricity through a variety of sources, including coal, natural gas, nuclear power, and renewable energy. Southern Company also transmits and distributes electricity to customers in four states: Alabama, Georgia, Mississippi, and Tennessee.

Southern Company is a publicly traded company with its headquarters in Atlanta, Georgia. The company has approximately 31,300 employees and serves more than 9 million customers.

Recent Developments

Southern Power acquires solar facilities in Texas and Wyoming.1

10/05/2023; Southern Power, a leading U.S. wholesale energy provider and subsidiary of Southern Company, recently acquired two solar facilities, continuing the growth of the company's clean generating assets and increasing its overall portfolio to more than 2,740 MW of solar generation.

The acquisition of the 200-megawatt Millers Branch Solar Facility in Haskell County, Texas, and the 150-megawatt South Cheyenne Solar Facility in Wyoming, is part of Southern Power's overall 5,280 MW renewable fleet, which now consists of 30 solar and 15 wind facilities operating or under construction.

Southern Power acquires South Cheyenne Solar Facility2

Sept. 25, 2023 -- Southern Power a subsidiary of Southern Company, announced the acquisition of its 30th solar project — the 150-megawatt (MW) South Cheyenne Solar Facility — from Qcells USA Corp.

The project, located in Wyoming, is Southern Power's first solar facility in the state and contributes to the company's growing renewable fleet of clean generating assets from California to Maine. Construction is underway, and the project is expected to achieve commercial operation in the first quarter of 2024.

South Cheyenne was developed by Qcells USA, which is also providing the engineering, procurement and construction of the project, as well as serving as the module supplier. The project is expected to create approximately 180 jobs during peak construction.

Southern Power acquires Millers Branch Solar Facility3

Sept. 21, 2023; Southern Power, subsidiary of Southern Company, announced the acquisition of its 29th solar project — Millers Branch Solar Facility — from EDF Renewables. The 200-megawatt (MW) facility is currently in the early stages of development and has the potential to expand up to 500 MW.

The project, located in Haskell County, Texas, contributes to the company's growing renewable fleet of clean generating assets from California to Maine. Southern Power will lead the continued development and construction of Millers Branch, which is expected to achieve commercial operation in the fourth quarter of 2025.

Once operational, the electricity and associated renewable energy credits generated by the 200 MW facility will be sold under a 20-year virtual power purchase agreement with Thermo Fisher Scientific, which uses the renewable energy certificates to drive progress toward its net zero-by-2050 commitment.

Financial Highlights

Second-Quarter 2023 Earnings4

Aug. 3, 2023 Southern Company reported second-quarter earnings of $838 million, or 77 cents per share, in 2023 compared with earnings of $1.1 billion, or $1.04 per share, in the second quarter of 2022. For the six months ended June 30, 2023, Southern Company reported earnings of $1.7 billion, or $1.56 per share, compared with $2.1 billion, or $2.01 per share, for the same period in 2022.

Excluding the items described under "Net Income – Excluding Items" in the table below, Southern Company earned $868 million, or 79 cents per share, during the second quarter of 2023, compared with $1.1 billion, or $1.07 per share, during the second quarter of 2022. For the six months ended June 30, 2023, excluding these items, Southern Company earned $1.7 billion, or $1.59 per share, compared with $2.2 billion, or $2.05 per share, for the same period in 2022.

Adjusted earnings drivers for the second quarter 2023, as compared with the same period in 2022, were increased depreciation and amortization, milder weather at the company's regulated electric utilities, changes in rates and pricing and higher interest expense, partially offset by lower income taxes and lower non-fuel operations and maintenance costs.

Second-quarter 2023 operating revenues were $5.7 billion, compared with $7.2 billion for the second quarter of 2022, a decrease of 20.2 percent. For the six months ended June 30, 2023, operating revenues were $12.2 billion, compared with $13.9 billion for the corresponding period in 2022, a decrease of 11.7 percent. These decreases were primarily due to lower fuel costs and milder weather in 2023.

Full Year 2022 Results

Consolidated net income attributable to Southern Company was $3.5 billion in 2022, an increase of $1.1 billion, or 47.3%, from 2021. The increase was primarily due to a $1.1 billion decrease in after-tax charges related to the construction of Plant Vogtle Units 3 and 4, increases in retail electric revenues associated with rates and pricing, warmer weather, primarily in the second quarter 2022, and sales growth, and increases in natural gas revenues from base rate increases and continued infrastructure replacement, partially offset by higher non-fuel operations and maintenance costs and higher interest expense.

Basic EPS was $3.28 in 2022 and $2.26 in 2021. Diluted EPS, which factors in additional shares related to stock-based compensation, was $3.26 in 2022 and $2.24 in 2021. EPS for 2022 and 2021 was negatively impacted by $0.04 and $0.01 per share, respectively, as a result of increases in the average shares outstanding.

Dividends paid per share of common stock were $2.70 in 2022 and $2.62 in 2021. In January 2023, Southern Company declared a quarterly dividend of 68 cents per share. For 2022, the dividend payout ratio was 82% compared to 116% for 2021.

Electricity Business

Retail electric revenues increased $3.3 billion, or 22.5%, in 2022 as compared to 2021. The significant factors driving this change are shown in the preceding table. The increase in rates and pricing in 2022 was primarily due to increases at Georgia Power resulting from higher contributions by commercial and industrial customers with variable demand-driven pricing,

In 2022, wholesale electric revenues increased $1.2 billion, or 48.3%, as compared to 2021 due to increases of $1.1 billion in energy revenues and $75 million in capacity revenues. Energy revenues increased $744 million at Southern Power primarily due to fuel and purchased power increases compared to 2021 and an increase in the volume of KWHs sold primarily associated with natural gas PPAs. Energy revenues increased $367 million at the traditional electric operating companies primarily due to higher natural gas and coal prices. The increase in capacity revenues was primarily due to a net increase in natural gas PPAs at Southern Power and increased opportunity sales at Alabama Power due to warmer weather

Gas Business

Operating revenues in 2022 were $6.0 billion, reflecting a $1.6 billion, or 36.1%, increase compared to 2021. Revenues at the natural gas distribution utilities increased in 2022 compared to 2021 due to rate increases at Nicor Gas, Atlanta Gas Light, and Chattanooga Gas and continued investment in infrastructure replacement.

Company Overview

Southern Company is a holding company that owns all of the common stock of three traditional electric operating companies, Southern Power, and Southern Company Gas and owns other direct and indirect subsidiaries. The primary businesses of the Southern Company system are electricity sales by the traditional electric operating companies and Southern Power and the distribution of natural gas by Southern Company Gas. Southern Company’s reportable segments are the sale of electricity by the traditional electric operating companies, the sale of electricity in the competitive wholesale market by Southern Power, and the sale of natural gas and other complementary products and services by Southern Company Gas.5

- The traditional electric operating companies – Alabama Power, Georgia Power, and Mississippi Power – are vertically integrated utilities providing electric service to retail customers in three Southeastern states in addition to wholesale customers in the Southeast.

- Southern Power develops, constructs, acquires, owns, and manages power generation assets, including renewable energy projects, and sells electricity at market-based rates in the wholesale market.

- Southern Company Gas is an energy services holding company whose primary business is the distribution of natural gas. Southern Company Gas owns natural gas distribution utilities in four states – Illinois, Georgia, Virginia, and Tennessee – and is also involved in several other complementary businesses.

Operating Companies

Electric Companies

- Alabama Power

- Georgia Power

- Mississippi Power

Natural Gas Companies

- Southern Company Gas

- Atlanta Gas Light

- Chattanooga Gas

- Nicor Gas

- Virginia Natural Gas

Other Companies

- Southern Nuclear

- Southern Power

- Power Secure

- Southern Telecom

- Southern Linc

Facilities

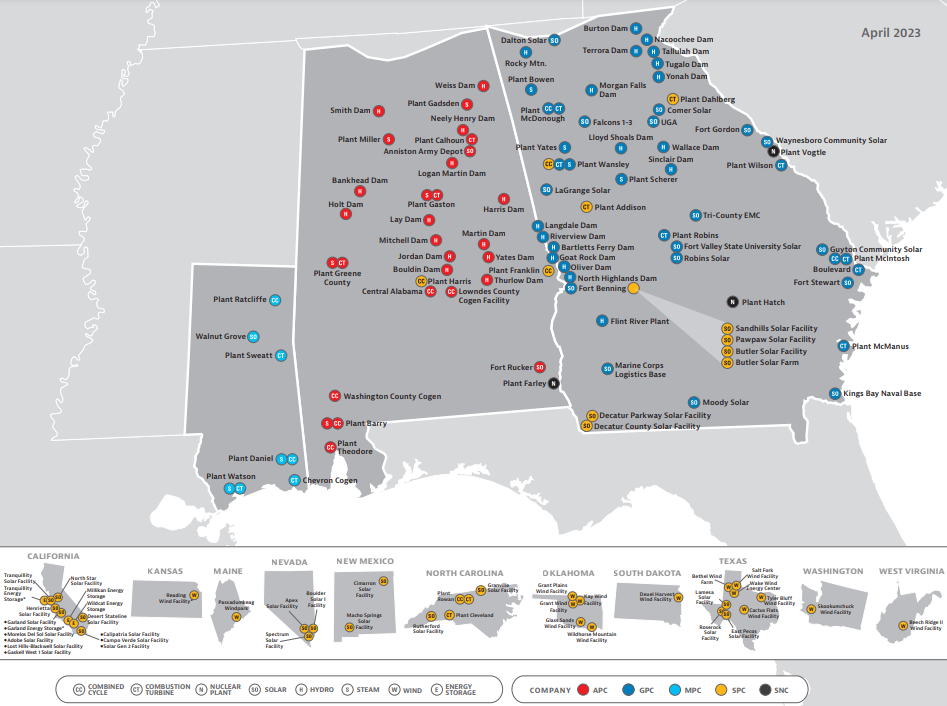

Southern Company Generation manages production, fleet operations, planning, engineering and fuel procurement for Southern Company's coal, oil, gas and hydro generating units at 103 power plants.

References

- ^ https://www.southerncompany.com/newsroom/clean-energy/southern-power-acquires-solar-facilities-in-texas-and-wyoming-as-part-of-growing-renewable-fleet.html

- ^ https://southerncompany.mediaroom.com/2023-09-25-Southern-Power-acquires-South-Cheyenne-Solar-Facility

- ^ https://southerncompany.mediaroom.com/2023-09-21-Southern-Power-acquires-Millers-Branch-Solar-Facility

- ^ https://southerncompany.mediaroom.com/2023-08-03-Southern-Company-reports-second-quarter-2023-earnings

- ^ https://fintel.io/doc/sec-southern-co-92122-10k-2023-february-16-19404-9699