Southern Copper Corporation

Summary

- Southern Copper is subsidiary of Grupo Mexico S.A.B. de C.V. the group own 88.91% in the company.

- It operations in Peru through SPCC Peru Branch in Mexico through Minera Mexico.

- Minera Mexico is largest mining company in Mexico.

Southern Copper Corporation (NYSE: SCCO, LSE: 0L8B) is a majority-owned, indirect subsidiary of Grupo Mexico S.A.B. de C.V. (“Grupo Mexico”). At December 31, 2018, Grupo Mexico through its wholly-owned subsidiary Americas Mining Corporation owned 88.91% of its capital stock.1

The company conduct its operations in Peru through a registered; The SPCC Peru Branch comprises substantially all of its assets and liabilities associated with its copper operations in Peru.

On April 1, 2005, the company acquired Minera Mexico, the largest mining company in Mexico. Minera Mexico is a holding company and all of its operations are conducted through subsidiaries that are grouped into three units: ![]() the La Caridad unit (ii) the Buenavista unit and (iii) the IMMSA unit. The company own 99.96% of Minera Mexico.

the La Caridad unit (ii) the Buenavista unit and (iii) the IMMSA unit. The company own 99.96% of Minera Mexico.

Financial Highlights

Third Quarter 2023 Results

The Company’s net sales were $2,505.6 million and $7,600.2 million in the three and nine months ended September 30, 2023, compared to $2,156.9 million and $7,227.6 million in the same period of 2022.2

In the third quarter of 2023, approximately 74.8% of its revenue came from the sale of copper; 13.7% from molybdenum; 4.2% from silver; 2.8% from zinc; and 4.6% from various other products, including gold, sulfuric acid, and other materials.

Mined copper production in the third quarter of 2023 decreased 1.9%, driven by lower production due to lower ore grades. Production at its Cuajone mine was down due to lower ore grades. Declines were also recorded at its Buenavista and IMMSA operations. The aforementioned was partially offset by higher production at its Toquepala (+12.6%) and La Caridad (+0.8%) mines in quarter-on-quarter terms, as a result of better ore grades.

Molybdenum production increased 12.6% in the third quarter of 2023 compared to the levels registered in the third quarter of 2022. This was attributable to higher production at its La Caridad (+37.8%), Toquepala (+14.7%) and Buenavista (+0.6%) mines, which was mainly driven by an increase in grades and recoveries. This effect was mainly offset by a reduction in production at its Cuajone (-28.8%) mine, which was largely driven by a drop in ore grades and recoveries.

Silver mine production decreased 10.0% in the third quarter of 2023 compared to the same period of 2022. This was attributable to lower production at its Cuajone (-23.5%), Buenavista (-18.3%), IMMSA (-7.5%) and La Caridad (-4.0%) operations in quarter-on-quarter terms. This was slightly offset by higher production at its Toquepala (+13.0%) mine.

Zinc production increased 9.4% in the third quarter of 2023 compared to the same period in 2022. This result was mainly attributable to a rise in mineral production at the Charcas and Santa Barbara units, which was partially offset by a decrease in production at the San Martin mine.

Full Year 2022 Results

Net profit in 2022 stood at $2,638.5 million, down 22.3% from 2021. The net profit margin in 2022 was 26.3%, versus 31.1% in 2021. Adjusted EBITDA in 2022 was $5,365.3 million, which reflected a decrease of 21.7% with regard to the figure in 2021. The adjusted EBITDA margin in 2022, in turn, was 53.4% vs 62.7% in 2021.

Overall copper production in 2022 fell 6.6% to 894,703 tons, impacted by the stoppage at Cuajone and by a reduction in ore grades. Molybdenum production stood at 26,240 tons in 2022, 13.3% below the print in 2021. This drop was driven by a decrease in production at its Toquepala mine due to lower ore grades. Mined zinc production fell 10.4%, which reflected lower production at the Charcas and Santa Barbara mines. Silver production decreased 2.1% in 2022, fueled by a decrease in production at its Peruvian operations and at the La Caridad mine. This reduction was partially offset by an uptick in production at its Buenavista and IMMSA mines.

Despite the challenges of 2022, Southern Copper has maintained its current capital investment program for the decade, which tops $15 billion and includes investments in the Buenavista Zinc, Pilares, El Pilar and El Arco projects in Mexico and the Tia Maria, Los Chancas and Michiquillay projects in Peru.

The company believe the company hold the world’s largest position of copper reserves. As of December 31, 2022, its copper mineral reserves, calculated at a copper price of $3.30 per pound, totaled 45,134 million tons of contained copper.

Company Overview

Southern Copper Corporation is one of the largest integrated copper producers in the world. The company's major production includes copper, molybdenum, zinc and silver. All of its mining, smelting and refining facilities are located in Peru and Mexico and the company conduct exploration activities in those countries and in Argentina, Chile and Ecuador. Southern Copper was incorporated in Delaware in 1952 and have conducted copper mining operations since 1960. Since 1996, its common stock has been listed on both the New York and Lima Stock Exchanges.3

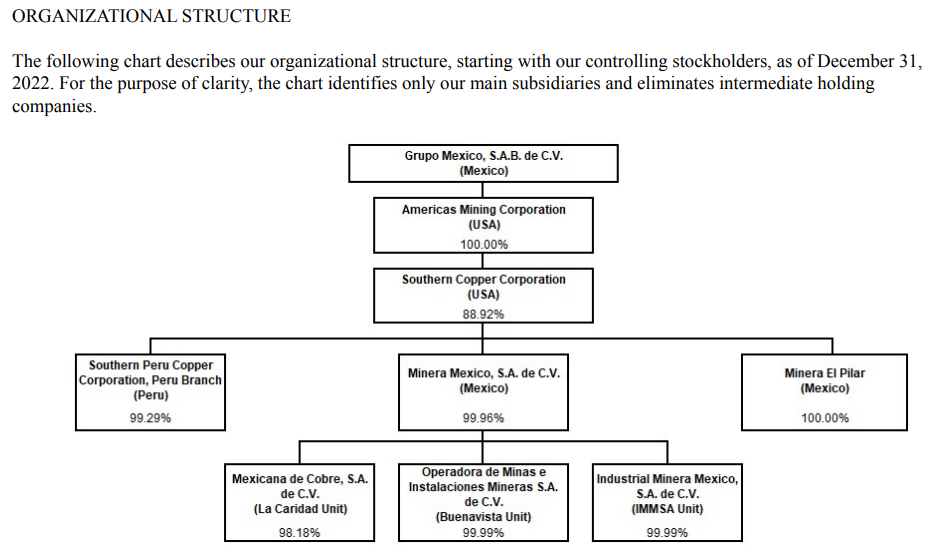

Southern Copper Corporation is majority-owned, indirect subsidiary of Grupo Mexico S.A.B. de C.V. (“Grupo Mexico”). As of December 31, 2022, Grupo Mexico, through its wholly-owned subsidiary Americas Mining Corporation, owned 88.9% of its capital stock. Grupo Mexico’s principal business is to act as a holding company for the shares of other corporations engaged in the mining, processing, purchase and sale of minerals and other products and in the provision of railway and other related services.

The company's Peruvian copper operations involve mining, milling and flotation of copper ore to produce copper concentrates and molybdenum concentrates; the smelting of copper concentrates to produce blister and anode copper; and the refining of anode copper to produce copper cathodes. As part of this production process, the company also produce significant amounts of molybdenum concentrate and sulfuric acid. The company's precious metals plant at the Ilo refinery produces refined silver, gold, and other materials. Additionally, the company produce refined copper using solvent extraction/electrowinning technology (“SX-EW”). The company operate the Toquepala and Cuajone open-pit mines high in the Andes Mountains, approximately 860 kilometers southeast of the city of Lima, Peru. The company also operate a smelter and refinery west of the Toquepala and Cuajone mines in the coastal city of Ilo, Peru.

The company's Mexican operations are conducted through its subsidiary, Minera Mexico, S.A. de C.V. (“Minera Mexico”), which the company acquired in 2005. Minera Mexico engages primarily in the mining and processing of copper, molybdenum, zinc, silver, gold and lead. Minera Mexico operates through subsidiaries that are grouped into three separate units. Mexicana de Cobre, S.A. de C.V. (together with its subsidiaries, the “La Caridad” unit) operates La Caridad, an open-pit copper mine, a copper ore concentrator, a SX-EW plant, a smelter, refinery and a rod plant. The La Caridad refinery has a precious metals plant that produces refined silver, gold and other materials. Operadora de Minas e Instalaciones Mineras, S.A de C.V. (the “Buenavista unit”) operates Buenavista, an open-pit copper mine, which is located on the site of one of the world’s largest copper ore deposits, two copper concentrators and two operating SX-EW plants. Industrial Minera Mexico, S.A. de C.V. (together with its subsidiaries, the “IMMSA unit”) operates five underground mines that produce zinc, lead, copper, silver and gold, and a zinc refinery.

Operations

| Facility Name | Location | Stage | Process | Nominal Capacity | 2022 Production | 2022 Capacity Use |

| PERUVIAN OPEN‑PIT SEGMENT | ||||||

| Mining Operations | ||||||

| Cuajone open‑pit mine | Cuajone (Peru) | Production | Copper ore milling and recovery, copper and molybdenum concentrate production | 90.0 ktpd—ore milled | 80.5 | 89.4 % |

Toquepala open‑pit mine; Concentrator I | Toquepala (Peru) | Production | Copper ore milling and recovery,copper and molybdenum concentrate production | 60.0 ktpd—ore milled | 60.9 | 101.5 % |

| Concentrator II | 60.0 ktpd—ore milled | 60.6 | 101.1 % | |||

| Toquepala SX‑EW plant | Toquepala (Peru) | Production | Leaching, solvent extraction and cathode electrowinning | 56.3 ktpy—refined | 26.5 | 47.0 % |

| Processing Operations | ||||||

| Ilo copper smelter | Ilo (Peru) | Production | Copper smelting, blister, anodes production | 1,200.0 ktpy—concentrate feed | 1,242.0 | 103.5 % |

| Ilo copper refinery | Ilo (Peru) | Production | Copper refining | 294.8 ktpy—refined cathodes | 289.7 | 98.3 % |

| Ilo acid plants | Ilo (Peru) | Production | Sulfuric acid | 1,354.93 ktpy—sulfuric acid | 1,210.2 | 89.3 % |

| Ilo precious metals refinery | Ilo (Peru) | Production | Slime recovery & processing, gold & silver refining | 460 tpy | 375.1 | 81.6 % |

| MEXICAN OPEN‑PIT SEGMENT | ||||||

| Mining Operations | ||||||

Buenavista open‑pit mine; Concentrator I | Sonora (Mexico) | Production | Copper ore milling & recovery,copper concentrate production | 84.0 ktpd—milling | 85.1 | 101.3 % |

| Concentrator II | 115.0 ktpd—milling | 118 | 102.6 % | |||

| Buenavista: SX‑EW plant I | Sonora (Mexico) | Production | Leaching, solvent extraction & refined cathode electrowinning | 11.0 ktpy—refined | — | — % |

| SX‑EW plant II | Sonora (Mexico) | Production | Leaching, solvent extraction & refined cathode electrowinning | 43.8 ktpy—refined | 24.2 | 55.3 % |

| SX‑EW plant III | Sonora (Mexico) | Production | Leaching, solvent extraction & refined cathode electrowinning | 120.0 ktpy—refined | 69 | 57.5 % |

| La Caridad open‑pit mine | Sonora (Mexico) | Production | Copper ore milling & recovery,copper & molybdenum concentrate production | 94.5 ktpd—milling | 93.5 | 98.9 % |

| La Caridad SX‑EW plant | Sonora (Mexico) | Production | Leaching, solvent extraction & cathode electrowinning | 21.9 ktpy—refined | 23.3 | 106.6 % |

| Processing Operations | ||||||

| La Caridad copper smelter | Sonora (Mexico) | Production | Concentrate smelting, anode production | 1,000 ktpy—concentrate feed | 1,052.0 | 105.2 % |

| La Caridad copper refinery | Sonora (Mexico) | Production | Copper refining | 300 ktpy copper cathode | 245.7 | 81.9 % |

| La Caridad copper rod plant | Sonora (Mexico) | Production | Copper rod production | 150 ktpy copper rod | 156.4 | 104.3 % |

| La Caridad precious metals refinery | Sonora (Mexico) | Production | Slime recovery & processing, gold & silver refining | 1.8 ktpy—slime | 1.1 | 58.8 % |

| La Caridad sulfuric acid plant | Sonora (Mexico) | Production | Sulfuric acid | 1,565.5 ktpy—sulfuric acid | 1,001.3 | 64.0 % |

| IMMSA SEGMENT | ||||||

| Underground mines | ||||||

| Charcas | San Luis Potosi (Mexico) | Production | Copper, zinc, lead milling, recovery & concentrate production | 1,460 ktpy—ore milled | 1,190.7 | 81.6 % |

| San Martin | Zacatecas (Mexico) | Production | Lead, zinc, copper & silver mining,milling recovery & concentrate production | 1,606 ktpy—ore milled | 1,413.2 | 88.0 % |

| Santa Barbara | Chihuahua (Mexico) | Production | Lead, copper and zinc mining & concentrates production | 2,190 ktpy—ore milled | 1,495.7 | 68.3 % |

| Santa Eulalia | Chihuahua (Mexico) | Suspended | Lead & zinc mining and milling recovery & concentrate production | 547.5 ktpy—ore milled | — | — % |

| Taxco | Guerrero (Mexico) | Suspended | Lead, zinc silver & gold mining recovery & concentrate production | 730 ktpy—ore milled | — | — % |

| Processing Operations | ||||||

| San Luis Potosi zinc refinery | San Luis Potosi (Mexico) | Production | Zinc concentrates refining | 105.0 ktpy zinc cathode | 99.9 | 95.1 % |

| San Luis Potosi sulfuric acid plant | San Luis Potosi (Mexico) | Production | Sulfuric acid | 180.0 ktpy sulfuric acid | 182.1 | 101.2 % |

Expansion and modernization Programs

Capital investments were $948.5 million for 2022. This is 6.3% higher than in 2021 and represented 36.2% of net income.

Mexican Projects

Buenavista Zinc, Sonora:

This project is located within the Buenavista deposit, where a new concentrator is being built. This facility has a production capacity of 100,000 tonnes of zinc and 20,000 tonnes of copper per year. Southern Copper has completed the engineering study and the project has all the necessary permits. When operating, this facility will double the Company’s zinc production capacity and will provide more than 2,000 operational jobs. The company expect to initiate operations in the second half of 2023. As of December 31, 2022, Southern Copper has invested most of the $416 million budget.

Pilares, Sonora:

Located six kilometers from La Caridad, this project consists of an open-pit mine operation with an annual production capacity of 35,000 tonnes of copper in concentrate. This project will significantly improve the overall mineral ore grade (combining the 0.78% expected from Pilares with 0.29% from La Caridad). The budget for Pilares is $159 million, most of which has already been invested. Pilares is currently operating and delivering copper mineral oxides to the SX-EW facilities of the Caridad operation. The company expect to produce mineral for the Caridad concentrator at full capacity in the second quarter of 2023.

El Pilar, Sonora:

This low-capital intensity copper greenfield project is strategically located in Sonora, Mexico, approximately 45 kilometers from its Buenavista mine. Its copper oxide mineralization contains estimated proven and probable reserves of 317 million tonnes of ore with an average copper grade of 0.249%. The company anticipate that El Pilar will operate as a conventional open-pit mine with an annual production capacity of 36,000 tonnes of copper cathodes. The budget for El Pilar is $310 million. The results from experimental pads in leaching process have confirmed adequate levels of copper recovery. The SX-EW plant EPCM project has been awarded to a contractor and has started. The company expect production to begin in 2024 and mine life is estimated at 13 years.

Lime plant - Sonora:

As part of its cost improvement projects, the company built a new lime plant with a production capacity of 600 metric tonnes per day, which will be the largest lime plant of Mexico. This facility will allow it to reduce its current lime cost at its Mexican operations by approximately 50%. The total budget for the plant is $65.5 million, of which the company had invested $62.6 million as of December 31, 2022. The furnace of the plant started operations in the second quarter of 2022, complying with the performance tests.

Peruvian Projects

Quebrada Honda dam expansion – Tacna:

This project aims to enlarge the main and lateral dams in Quebrada Honda and includes the relocation and repowering of some facilities due to dam growth and installations of facilities for water recovery, among other factors. As of December 31, 2022, the drainage works and removal of Eolic material for the main and lateral dam had been completed; complementary operational works are underway and are expected to be completed in the first quarter 2023. This project has a total budget of $174.4 million, of which Southern Copper has invested $153.6 million as of December 31, 2022.

Tia Maria - Arequipa:

This greenfield project, located in Arequipa, Peru, will use state of the art SX-EW technology with the highest international environmental standards to produce 120,000 tonnes of SX- EW copper cathodes per year. SX-EW facilities are the most environmentally friendly in the industry as they do not require a smelting process and therefore, do not release any emissions into the atmosphere. Tia Maria’s project budget is approximately $1.4 billion, of which $329.8 million had been invested as of December 31, 2022.

Company History

Southern Peru Copper Corporation (“SPCC”) was incorporated in the State of Delaware, United States.4

| Year | Milestone |

| 1952 | FOUNDING OF SCC Southern Peru Copper Corporation (“SPCC”) was incorporated in the State of Delaware, United States. |

| 1954 | TOQUEPALA MINE IN TACNA, PERU Exploitation of the Toquepala mine in Tacna, Peru A branch was established in Peru |

| 1965 | ASARCO MEXICANA S.A. DE CV The mining company ASARCO S.A. changed its name to ASARCO Mexicana S.A. de CV, by increasing the Mexican capital share to 51%. |

| 1968 | CONSTITUTION MEXICANA DE COBRE Mexicana de Cobre was established and began operations with explorations at La Caridad deposit in Nacozari, Sonora. |

| 1974 | LA CARIDAD CONSTRUCTION It was started the construction of La Caridad, one of the largest mining-metallurgical complexes in the world. |

| 1976 | INAUGURATION OF THE CUAJONE MINING COMPLEX The Cuajone mining complex was inaugurated and began operations in 1976, with a production capacity of 58,000 t/day of milling. |

| 1978 | INCORPORATION OF GRUPO INDUSTRIAL MINERA MEXICO S.A. DE C.V. Grupo Industrial Minera Mexico S.A. de C.V. was established with mexican capital. La Caridad Concentrator Plant began operations in 1979, with a grinding capacity of 72,000 t/day. |

| 1982 | NEW ZINC REFINERY IN SAN LUIS POTOSÍ Operations began at the new San Luis Potosí zinc refinery, designed to produce 105,000 MT per year. |

| 1985 | MOLY PLANT IN LA CARIDAD La Caridad molybdenum plant began operations in 1985, with a treatment capacity of 2,000 t/day. |

| 1986 | LA CARIDAD SMELTER PLANT BEGINS OPERATIONS The La Caridad smelter opened in July 1986 with a capacity of 493 t/day. |

| 1990 | CANANEA MINING OPERATION Grupo Industrial Minera Mexico S.A. de C.V. acquires the Cananea mining operation. |

| 1994 | ILO COPPER REFINERY SPCC acquired the Ilo Copper Refinery from the Peruvian goverment, which by then had a production capacity of 190,000 t/year. |

| 1995 | LA CARIDAD BEGAN ITS OPERATIONS The LESDE Plant in La Caridad began operations in 1995 with a capacity of 60 t/day, while the sulfuric acid plant in Ilo started operations with a design capacity of 140,600 t/year, with the aim of reducing gas emissions and provide acid for leaching operations. |

| 1998 | LA CARIDAD REFINERY EXPANSION La Caridad refinery expanded its capacity to 932 t/day and La Caridad wire rod plant began operations with a capacity of 300 t/day. |

| 2000 | LA CARIDAD WIRE ROD PLANT EXPANDED ITS CAPACITY In 2000, La Caridad wire rod plant expanded its production capacity to 150,000 t/year. |

| 2001 | LESDE II CANANEA PLANT EXPANDED ITS CAPACITY In 2001, the LESDE II Cananea plant expanded its production capacity to 54,800 tons/year. |

| 2003 | MODERNIZATION OF THE ILO SMELTER The Ilo Smelter modernization project began with the aim of improving efficiency in copper production to capture at least 92% of SO2 emissions and smelt 1.1 million tons of copper concentrate per year. |

| 2005 | SOUTHERN PERU COPPER CORPORATION MERGES WITH MINERA MEXICO In April Southern Peru Copper Corporation merges with Minera Mexico and subsidiaries, consolidating itself as the most important mining company in Mexico and Peru, |

| 2009 | LA CARIDAD TREATMENT PLANT Operations began at the by-product treatment plant in La Caridad metallurgical complex, and the modernization of the Agua Prieta Lime Plant was also completed, which meets Mexican environmental regulations. |

| 2014 | THE CONSTRUCTION OF THE SX-EW III PLANT IS COMPLETED Construction of the third SX-EW plant in Buenavista del Cobre with an annual nominal capacity of 120,000 tons of copper is completed. |

| 2018 | SCCO ACQUIRES MICHIQUILLAY MINING PROJECT The Company signs a contract for the acquisition of the Michiquillay copper project in Cajamarca, Peru, at a purchase price of $400 million |