Standard Chartered Plc

Summary

- Standard Chartered is a major international bank listed on the London and Hong Kong Stock Exchanges.

- The bank serves customers in 150 markets worldwide.

- The Standard Chartered Bank come into existence by merging the Charted bank of India, Australia and China and the Standard bank of British South Africa in 1969

Company Overview

Standard Chartered (LSE:STAN) is principally engaged in the business of retail and commercial banking and provides other financial services. With 85,000 employees and a presence in 59 markets, serves customers in 150 markets worldwide. Standard Chartered is listed on the London and Hong Kong Stock Exchanges.

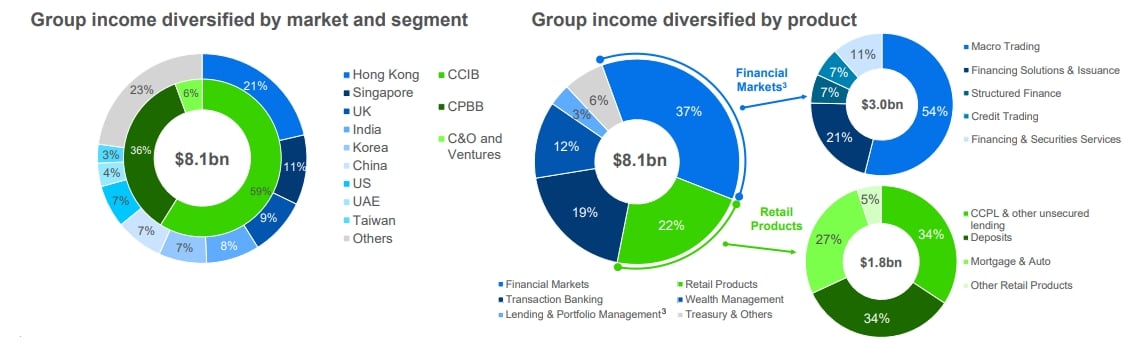

Standard Chartered provides banking and financial services. It operates in two segments

Corporate, Commercial and Institutional Banking

Providing banking, financial markets, corporate finance to Corporate, Commercial, and Institutional clients, providing solutions to more than 22,000 clients across 49 markets.

Consumer, Private and Business Banking

Consumer, Private and Business Banking serves more than 9 million individuals and small businesses.

Financial Highlights

First Half 2022 Results

Income up 8% to $8.2bn, up 10% at constant currency (ccy) and Net interest income up 12% at ccy. 2Q’22 income up 6% YoY, or up 11% at ccy excluding DVA and normalising for the 2021 IFRS9 interest rate adjustment. – 2Q’22 Net interest margin (NIM) up 6bps QoQ to 1.35%, from rising interest rates.1

Underlying profit before tax up 7% at ccy to $2.8bn; statutory profit before tax up 10% at ccy to $2.8bn. Earnings per share increased 5.1 cents or 9% to 63.4 cents

For the year ended 31 December 2021 Underlying Net interest income $6,807 compared to 6,882 in 2020 while Underlying operating income was $ 14,713 (14,765). Underlying Net profit for the year was $ 2,313 compared to $751 in 2020.

Business Segments

Corporate, Commercial and Institutional Banking

The bank cover 49 markets and serves more than 22,000 clients in some of the world’s fastest-growing economies. The Banks clients include governments, banks, investors, and local and large corporations operating or investing mainly in Asia, Africa and the Middle East.2

Underlying profit before tax of $3,124 million in 2021 up 57 per cent from last year, primarily driven by credit impairment releases, partially offset by lower income and higher expenses. Underlying operating income of $8,407 million was down 1 per cent mainly due to lower Cash Management income impacted by a low interest rate environment and lower Macro Trading income on the back of lower market volatility and tighter spreads, partially offset by strong performance in Credit Market and Trade

Consumer, Private and Business Banking

Consumer, Private and Business Banking serves more than 9 million individuals and small businesses. The bank’s services spanning across deposits, payments, financing products and Wealth Management. Private Banking offers a full range of investment, credit and wealth planning products to grow, and protect, the wealth of high-net-worth individuals.

Underlying profit before tax of $1,071 million in year 2021 was up 51 per cent driven by higher income and lower credit impairments. Underlying operating income of $5,733 million was up 1 per cent (flat constant currency). Asia was up 1 per cent and Africa and the Middle East was up 2 per cent.

Global Footprint

Asia

The bank present in all 10 ASEAN market. Standard Chartered is present in 21 markets across Asia, including some of the world’s fastest-growing economies. Hong Kong and Singapore are the highest income contributors.3

- Australia

- Bangladesh

- Brunei Darussalam

- Cambodia

- Chinese Mainland

- Hong Kong

- India

- Indonesia

- Japan

- Laos

- Macau

- Malaysia

- Myanmar

- Nepal

- Philippines

- Singapore

- South Korea

- Sri Lanka

- Taiwan

- Thailand

- Vietnam

Africa and Middle East

The bank present in 25 markets, of which the most sizeable by income are the United Arab Emirates (UAE), Nigeria and Kenya.

| Africa | Middle East |

| Angola | Bahrain |

| Botswana | Iraq |

| Cameroon | Jordan |

| Côte d’Ivoire | Lebanon |

| Egypt | Oman |

| Ghana | Pakistan |

| Kenya | Qatar |

| Mauritius | Saudi Arabia |

| Nigeria | United Arab Emirates |

| Sierra Leone | |

| South Africa | |

| Tanzania | |

| The Gambia | |

| Uganda | |

| Zambia | |

| Zimbabwe |

Europe and the Americas

The bank has presence in both North America and Latin America.

| Europe | Americas |

| France | Argentina |

| Germany | Brazil |

| Ireland | Colombia |

| Jersey | Falkland Islands |

| Poland | United States |

| Sweden | |

| Turkey | |

| United Kingdom | |

Company History

Standard Chartered Bank was Formed by in 1853 as the Charted bank of India, Australia and China and in 1862 the Standard bank of British South Africa Covering Africa.4

In 1969 it was decided to merging Asia and Africa business and the Standard Chartered Bank formed by merging the Charted bank of India, Australia and China and the Standard bank of British South Africa.

In 1986 a hostile takeover attempt by Lloyds failed. In 1987 Bank sold its South African business.

The bank acquired Grindlays Bank in year 2000 and Korea First Bank in year 2005.

In year 2006 The bank acquire 81% shareholding in the Union Bank of Pakistan and in 2007 it buy 49% share of an Indian brokerage firm (UTI Securities).

In 2008 the bank bought Cazenove Asia Limited. In 2010 the bank bought the African custody business from Barclays PLC