The Ramco Cements Limited

Summary

- The Ramco Cements Limited is the flagship company of the Ramco Group, a well-known business group of South India.

- The main product of the company is Portland cement, manufactured in eight state-of-the art production facilities with a current total production capacity of 16.45 MTPA.

- Capex at Jayanthipuram Plant with III Line of with a clinkerisation capacity of 1.5 Million Tons Per Annum (MTPA) under progress costing Rs 910 crores.

- the Company had expanded its Kolaghat grinding unit with another line of grinding capacity of 1.05 MTPA at a cost of Rs 386 crores.

Company Overview

The Ramco Cements Limited (NSE: RAMCOCEM) is the flagship company of the Ramco Group, a well-known business group of South India. It is headquartered at Chennai. The main product of the company is Portland cement, manufactured in eight state-of-the art production facilities that includes Integrated Cement plants and Grinding units with a current total production capacity of 16.45 MTPA (out of which Satellite Grinding units capacity alone is 4 MTPA). The company is the fifth largest cement producer in the country. Ramco Grade is the most popular cement brand in South India. The company also produces Ready Mix Concrete and Dry Mortar products, and operates one of the largest wind farms in the country.1

Plants and Facilities

Integrated cement plants

| Plant | Cement capacity (MTPA) | Captive power (TPP) |

| Ramasamy ,Tamil Nadu | 2 | 25 MW |

| Alathiyur, Tamil Nadu | 3.05 | 42 MW |

| Govindapuram Village, Tamil Nadu | 3.5 | 66 MW |

| Jayanthipuram, Andhra Pradesh | 3.65 | 60 MW |

Upcoming Integrated Cement Plant

- Kalavatala, Kolimigundla Mandal, Kurnool District, Andhra Pradesh

Grinding Units

| Plant | Capacity (MTPA) | Captive power (TPP) |

| Uthiramerur, Tamil Nadu | 0.5 | Uses green power of 4.95 MW from the Company’s windfarms |

| Valapady, Tamil Nadu | 1.6 | Uses green power of 9.90 MW from the Company’s windfarms |

| Gobburupalam, Andhra Pradesh | 2 | Uses 3.70 MW of gas power from Andhra Pradesh Gas Power Corporation Limited |

| Kharagpur, West Bengal | 0.2 | |

| Kolaghat, West Bengal | 2 | |

| Haridaspur, Odisha | 0.9 |

Packing Plant

- Kumarapuram, Kanyakumari District, Tamil Nadu

Readymix Concrete Plant

- Chennai, Tamil Nadu

Dry Mortar Plant

- Sriperumbudur, Tamil Nadu

R&D Centre

- Chennai, Tamil Nadu

Wind Farms

The installed capacity of the wind farm of the Company was 125.95 MW as on 31-03-2021

- Thandayarkulam, Tamil Nadu

- Veeranam, Tamil Nadu

- Muthunaickenpatti, Tamil Nadu

- Pushpathur, Tamil Nadu

- Udumalpet, Tamil Nadu

- Vani Vilas Sagar, Karnataka

- GIM II Hills, Karnataka

Products

Cement

- Ramco Supergrade

- Ramco Supercrete

- Ramco Superfine EFC

- Ramco Super Steel

- Ramco Super Fast

- Ramco Super Coast

- Karthic Super Plus

- Ramco Samudra

Ordinary Portland Cement (OPC)

- OPC 53

- OPC 43

- OPC 53 INFRA

- OPC 43 INFRA

Dry mix products

- Ramco Super Fine

- Ramco Tile Fix

- Ramco Ready Mix Plasters

- Ramco Self Curing Plasters

- Ramco Block Fix

- Ramco Tile Grout

Ready mix concrete

- Ramco Super Concrete

Industry Overview

According to the Cement Manufacturers Association, the total installed capacity in Indian cement sector is ~545 million tons per annum (MTPA) and it is the fourth-largest revenue contributor to the exchequer. The Indian cement sector accounts for over 7% of the global installed capacity and is the second-largest in the World after China. Covid-19 pandemic has had a severe hit on the cement sector leading to a demand contraction of about 10-13% in FY 2020-21, following lockdown measures taken by the Indian government to curb the spread of global pandemic in the country. This also negatively impacted capacity utilization levels of the domestic manufacturers.2

The demand offtake was particularly tepid in metros/tier 1 cities. Diversion of Government funds towards health and public welfare led to lower capex in cement projects weighed on demand growth as Government-led projects account for 35-40% of total demand. Recovery post opening up of businesses was slower owing to weak business sentiment and labour availability issues. The only relief was the rural demand which showed good offtake led by reverse migration and steady farm incomes even amidst lockdown. Overall impact on cement volume is expected to be 2% decline as a swift recovery in last quarter of FY 2020-21 compensated for the 31% decline in volume witnessed in the first quarter of the fiscal. Infrastructure push by the Government, a pick-up in real-estate demand and industry consolidation resulted in increase in pan-India cement prices in March 2021.

The cement industry is set to hit a decadal high volume growth of 20% in FY 2021-22 aided by an expected revival in demand from the infrastructure and urban housing sectors in line with ~26% increase in budgetary allocation for infrastructure in the Union Budget 2021-22. In addition to these sectors, rural demand is also expected to sustain on the back of higher rural incomes witnessed in FY 2020-21 and by positive farm sentiment. PMAY-G is expected to sustain momentum as it utilizes its potential to engage rural workforce and drive rural employment. Sufficient cash inflow in the rural economy could commensurate in rural infrastructure creation thus augmenting cement demand. PMAY-U has also witnessed pickup as against other housing segments owing to low ticket sizes and government incentives like inclusion of PMAY-U and infrastructure sector in the ‘Atmanirbhar Bharat 3.0’ package.

The increased sales volume will compensate the impact of rising power and fuel costs on cash accruals. Rising cost of diesel, pet coke and coal may push up cost as freight, power and fuel constitute ~55% of the total cost of sale of cement.

Return of volume growth to pre-pandemic levels to an expected 18-20% growth in cement demand, supported by rural demand, push for affordable housing, and recovery in infrastructure segment. Cement production capacity is forecast to increase by up to 20-22 MnT compared to 15-17 MnT in FY 2020-21. Most of this additional capacity is expected to be in the Eastern region. Capacity utilisation rates are also expected to recover from the low levels of FY 2020-21.

Due to the increasing demand in various sectors such as housing, commercial construction and industrial construction, cement industry is expected to reach 550-600 MTPA by 2025.

Business Overview

Cement Division

During the year ended 31 March 2021, the Company had sold 99.77 lakh tons of cement, compared to 112.03 lakh tons of the previous year. Due to the outbreak of COVID-19, Government had imposed lockdown since March 2020, which continued till first half of the year 2020-2021 with various levels of restrictions. The outbreak and the restrictions imposed on the movement of goods affected the construction industry, impacting the sale of cement for the year under review. The Company took various precautionary measures, with regard to safety of the employees and employees of the transporters and other contractors. The Company adhered to the various safety instructions issued by the State and Central Governments with regard to running of its factories and offices. These timely measures enabled the Company to resume its operations at the earliest possible periods. But for these steps, the impact of the COVID-19 on cement sales would have been higher.

During the year under ended March 31, 2021, the Company has exported 0.62 lakh tons of cement as against 2.30 lakh tons during the previous year. The export turnover of the Company for the year was Rs 23.22 crores as against Rs 113.71 crores of the previous year.

Ready Mix Concrete Division

The Division has produced 26,952 cu.m of concrete during the year, accounting for a revenue of Rs 11.92 crores (Net of duties and Taxes) as against 32,999 cu.m. of concrete accounting for a revenue of Rs 14.16 crores (Net of duties and Taxes) during the previous year.

Dry Mortar Division

The Division has produced 37,049 tons of Dry Mortar during the year as against 38,739 tons produced during the previous year. The Division has sold 36,694 tons of Dry Mortar accounting for a revenue of Rs 29.70 crores (Net of duties and Taxes) during the year as against 38,329 tons of Dry Mortar accounting for a revenue of Rs 30.59 crores (Net of duties and Taxes) during the previous year.

Wind Farm Division

The Division has generated 2,141 lakh units as compared to 2,268 lakh units in the previous year. Out of this, 2,062 lakh units were generated from the wind farms in Tamil Nadu and 79 lakh units from the wind farms in Karnataka. Out of the units generated in Tamil Nadu, 283 lakh units were meant for adjustment against the power consumed in the Company’s plants and balance 1,779 lakh units have been sold to Tamil Nadu Generation and Distribution Corporation Limited (TANGEDCO) for a value of Rs 53.30 crores.

The 79 lakh units generated during the period under review in Karnataka have been banked with Bangalore Electricity Supply Company Limited (BESCOM). Out of this, the company had sold 61 lakh units to third parties for a value of Rs 2.64 crores and the same had been realised. The balance 18 lakhs units lying in banking with BESCOM will be sold to third parties during subsequent periods.

The installed capacity of the wind farm of the Company was 125.95 MW as on 31-03-2021 comprising of 108 Wind Electric Generators.

The income during the year from the Division was Rs 56.42 crores as against Rs 58.07 crores of the previous year.

Power Plants

The Company’s thermal power plants aggregating to a capacity of 175 MW are located at its cement manufacturing plants. The power generated from the thermal power plants were used for self-consumption in the cement manufacturing.

New Projects

Cement Plants

In the Board’s Report for the year ended 31-03-2020, it was informed about the progress of establishment of Company’s Line III at the existing Jayanthipuram Plant with a clinkerisation capacity of 1.5 Million Tons Per Annum (MTPA). It was also informed that the plant will have a Waste Heat Recovery System to generate 27 MW of power. As against the project cost of Rs 740 crores as informed in the Board’s Report for the year ended 31-03-2020, the cost of the project now stands revised at Rs 910 crores. The increase in the cost of the project by Rs 170 crores is mainly due to, inclusion of additional features such as, slag hopper, clinker export system, larger sized limestone stacker reclaimers, belt conveyors, upgradation of interface automation, Intelligent Motor Control Centre and additional transformers.

Grinding Units

In the Board’s Report for the year ended 31-03-2020, it was informed that the Company had expanded its Kolaghat grinding unit with another line of grinding capacity of 1.05 MTPA at a cost of Rs 386 crores. It was also informed that the Mill was commissioned in September 2019 and subsequently during the year under review, the Railway Siding was commissioned in September 2020.

Financial Highlights

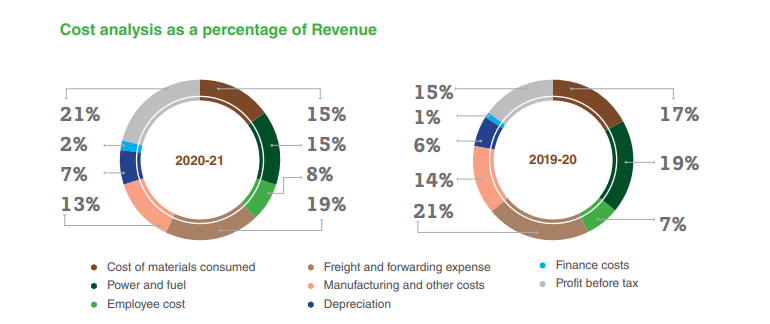

The company has sold 9.98 MnT of cement for the year ended 31 March 2021 as against 11.20 MnT during the previous year, with a de-growth in volume of 11%. There is a de-growth in volume in southern markets due to COVID-19 and prolonged monsoon. However, the volume has grown in the eastern markets. During the year, the average net realisable sale price of cement has improved by 10%. Though the volume de-growth for the year is 11%, the drop in net revenue is only 2% because of improvement in cement prices and improvement in sale of premium products during the year. The company’s strategy in offering its customers with right products for right applications has reinforced its market position with better market mix and premiumisation of its products.

During the current year, the Company saw a decline in the net generation of wind power from 22.68 Crore units to 21.41 Crore units, a reduction of 6% and thus revenue from wind power has declined by 3%. Other income has decreased mainly due to decrease in interest income.

During the year 2020-21, cost of materials consumed decreased by 11% compared to the previous year. The main reason is due to decrease in clinker production by 19% and cement production by 13%. Also there was a drop of 2% in the OPC production, which contributed for the reduction in raw materials cost. During the year, the company has used purchased clinker of 3.04 Lac tons for cement production to take care of the increased demand in the Eastern Market. But for this, cost of raw materials consumed would have been much lower. Cost of materials consumed for the year under review accounted for 15.44% of the revenue as against 17.04% in the previous year.

The employee cost for the year increased by 9% due to rise in headcount from 3,327 to 3,374, and increment in the annual salaries. The Company has also charged Rs 19.54 Crores towards fair value of the employee stock options granted to its eligible employees as per ESOS 2018, which is a non-cash item. The Company has capitalised an amount of Rs 34.19 Crores (PY: Rs 28.06 Crores) that are directly attributable towards commissioning of new projects. The employee cost for the year under review stood at 7.58% of the revenue, as against 6.81% in the previous year.

Finance costs have increased by 23% from Rs 71.35 Crores in FY 2019-20 to Rs 87.62 Crores in FY 2020-21 mainly due to increase in average borrowings compared to previous year. The weighted average cost of total borrowings for the current year stood at 6.10% as against 6.71% in the previous year. The total borrowings as at 31st March 2021 has increased marginally by Rs 77.63 Crores and stood at Rs 3,101.72 Crores.

The interest coverage ratio increased from 5.56 times in the previous year to 6.53 times in the current year due to improved operating margin. The Gross interest on the borrowings for the current year was Rs 187.87 Crores and out of which, Rs 100.25 Crores was capitalised as part of eligible qualifying assets. Finance costs accounted for 1.65% as against 1.32% in the previous year.

Profitability

EBIDTA grew by 35% from Rs 1,173.82 Crores in FY 2019-20 to Rs 1,582.60 Crores in FY 2020-21. The EBITDA margin for the current year stood at 29.84% as against 21.71% in the previous year. Blended EBITDA per ton is increased by 51% from Rs 1,048 per ton to Rs 1,586 per ton.

The company has achieved a Profit Before Tax of Rs 1,139.68 crores during the year and thus crossing the Rs 1,000 crores mark for the first time. Profit After Tax (PAT) increased by 27% from Rs 601.09 Crores to Rs 761.08 Crores led by improved prices and cost reduction. The PAT margin stood at 14.35% as against 11.12% in the previous year.

June 2021 Result

Ramco Cements Q1 net profit up 46% to Rs 172 crore on higher sales 3

The Ramco Cements Ltd on Tuesday reported a 46.10 per cent increase in consolidated net profit at Rs 171.67 crore for the quarter ended June, helped by growth in sales

The company had posted a net profit of Rs 117.50 crore during the April-June period of the previous fiscal, it said in a regulatory filing.

Total income was up 17.33 per cent to 1,239.99 crore during the quarter under review as against Rs 1,056.79 crore in the corresponding period of the previous fiscal.

Total expenses were at Rs 988.46 crore in Q1 FY 2021-22, up 9.91 per cent from Rs 899.29 crore earlier.