Torrent Pharmaceuticals Ltd

Summary

- Torrent Pharma, the flagship Company of Torrent Group is one of the leading pharma companies of the Country.

- Torrent Pharma widespread global presence in over 40 countries.

- The Company has cumulatively filed 818 patent applications for NCEs from these and earlier projects in all major markets of which, 497 patents were granted so far.

- The company's state-of-the art R & D Centre at Bhat near Ahmedabad is spread out over 125,000 Sq. mts. with a built-up area of 41,000 Sq. mts

Company Overview

Torrent Pharma, (NSE:TORNTPHARM) the flagship Company of Torrent Group is one of the leading pharma companies of the Country. The Company was a pioneer in initiating the concept of niche marketing in India and today is ranked amongst the leaders in therapeutic segment of cardiovascular (CV), central nervous system (CNS), gastro-intestinal (GI) and women healthcare (WHC). The Company also has significant presence in diabetology, pain management, gynaecology, oncology and anti-infective segments.1

Torrent Pharma's competitive advantage stems from the world-class manufacturing facilities, advanced R & D capabilities, extensive domestic network and a widespread global presence in over 40 countries.

The acquisition of Elder Pharma's Indian branded business in 2013, Dermaceutical business of Zyg Pharma in 2015, API plant of Glochem Industries in 2016, women healthcare brands from Novartis and Unichem's Indian branded business along with its Sikkim Plant in 2017 strengthened Torrent Pharma's position in the Indian Pharma market.

Torrent Pharma started international acquisitions in 2005 with 90 year old Heumann from Pfizer to enter the German market. Later on purchased ANDA of Minocycline from Ranbaxy for the US Market in 2015.

In January 2018, Torrent also acquired Bio-Pharm, Inc. (BPI) a generic pharmaceuticals and OTC Company, based in Levittown Pennsylvania, USA, which also included a US FDA registered manufacturing facility.

Torrent Group

The Torrent Group, founded by Late Mr. U. N. Mehta in 1959 and currently lead by Mr. Sudhir Mehta and Mr. Samir Mehta, is a driving force dedicated to transforming life.2

It was four decades ago that Mr. U. N. Mehta embarked on a journey called Torrent for a simple cause and a unique sense of purpose - ‘Happiness for All’. A medical representative with an exemplary vision, he ventured out on his own by making niche marketing as his core competency. And the rest, as they say, is history.

Torrent lives up to the literal meaning- ‘Rushing Stream’, especially in the way it conceives products and services, which transform life. Over the years, the Torrent Group has remained focused on Healthcare and Power - two crucial sectors without which modern life is unimaginable. The Torrent Group today is not just spreading care, hope and happiness across the world, it is also empowering the people and lighting up their lives.

The Group’s governance philosophy has always emphasized people and society over everything else, more particularly in times of distress and stands committed to doing all that it can during the time of national crisis. Recently, Torrent Group announced its support of Rs. 100 crores to strengthen the Government’s efforts to fight the COVID-19 pandemic and its fallout on poorer sections of its society. This contribution was made to the PM-CARES Fund and for various initiatives such as providing essential medicines to various Govt. hospitals free of cost, contributions to State Government relief funds, contributions to NGOs doing grassroots work to address the issues arising from the COVID-19 pandemic, provision of PPEs to healthcare workers and its own direct efforts to contain the impact of the COVID-19 pandemic on the vulnerable sections of society. In addition to the above, Torrent Group ensured that its employees (including thousands of contract and construction workers working under its contractors) were paid full wages for the entire duration of the lockdown and the entire cost of the same was borne by the Group.

Be it finding a cure for fatal diseases or ambitious power generation projects; or setting new standards in transmission and distribution; breakthrough pharma discoveries or 24X7 customer care initiatives - Torrent has a strong infrastructure in place to ensure that Torrent Pharmaceuticals is always at the centre of the movement towards a better life.

Milestones

| 1959 | Shri U. N. Mehta started Pharma operations. |

| 1971 | Trinity Laboratories renamed as Torrent Pharmaceuticals Limited. |

| 1980 | First manufacturing facility set up at Vatva in Ahmedabad |

| 1989 | Second manufacturing plant commissioned at Indrad |

| 1995 | Torrent Gujarat Biotech Limited plant commissioned. |

| 1996 | State-of-the-art R&D Centre commissioned |

| 1999 | First New Chemical Entity Patented by Torrent Research Center |

| 2001 | Torrent do Brasil Ltda. set up in Brazil |

| 2003 | Torrent Pharma Inc. set up in USA. |

| 2003 | Torrent Pharma Philippines Inc. set up. |

| 2004 | Restructuring of marketing divisions and addition of new division, Delta. |

| 2004 | Torrent Australasia Pty Ltd. incorporated in Australia |

| 2005 | New manufacturing unit at Baddi, Himachal Pradesh, set up to cater to domestic formulations market. |

| 2005 | Acquired Heumann Pharma GmbH & Co Generica KG, a Pfizer group company, in Germany. |

| 2007 | Construction of Sikkim Plant started |

| 2010 | Started construction of Dahej manufacturing facility |

| 2010 | Commissioned a subsidiary in United Kingdom and Romania |

| 2011 | Sikkim Plant commences operation |

| 2017 | Acquired Women Healthcare brands from Novartis |

| 2021 | Torrent Pharma Enters Into Voluntary Licensing Agreement with Lilly to manufacture and distribute Baricitinib for Covid-19 in India |

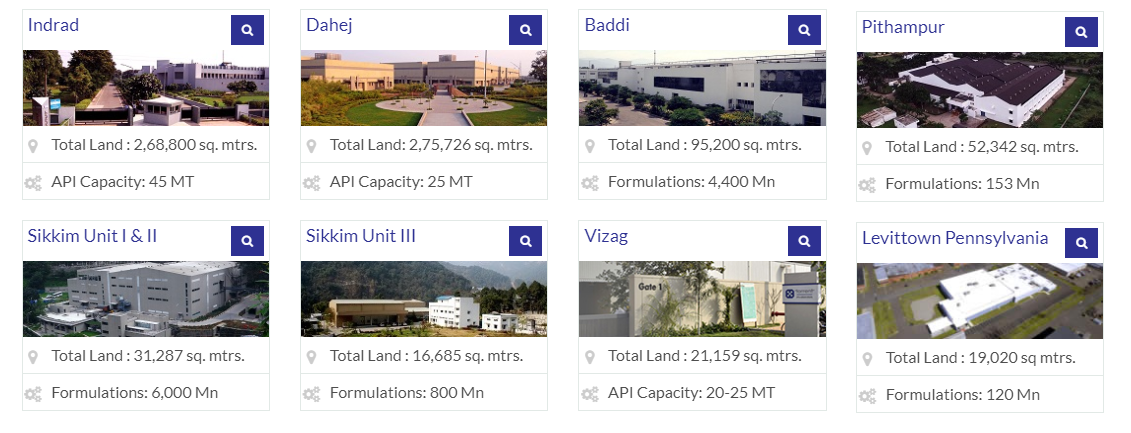

Manufacturing Facilities

Torrent Pharma has robust manufacturing technologies and manufacturing facilities.3

| Total Land | API Capacity/Formulations | |

| Indrad | 2,68,800 sq. mtrs | 45 MT |

| Dahej | 2,75,726 sq. mtrs. | 25MT |

| Baddi | 95,200 sq. mtrs | 4,400 Mn |

| Sikkim Unit I & II | 31,287 sq. mtrs. | 6,000 Mn |

| Sikkim Unit III | 16,685 sq. mtrs. | 800 Mn |

| Vizag | 21,159 sq. mtrs | 20-25 MT |

| Pithampur | 52,342 sq. mtrs. | 153 Mn |

| Levittown Pennsylvania | 19,020 sq mtrs. | 120 Mn |

Research & Development

The company's state-of-the art R & D Centre at Bhat near Ahmedabad has one of the most advanced infrastructures for both basic and applied research. Spread over a lush green campus and housed in an architecturally unique energy efficient structure, the R & D Centre is spread out over 125,000 Sq. mts. with a built-up area of 41,000 Sq. mts. It is managed by a dedicated staff, who work round the clock to take care of all its needs. It houses 999 inquisitive minds whose passion is to discover and develop medicines to help patients lead a longer and healthier life.4

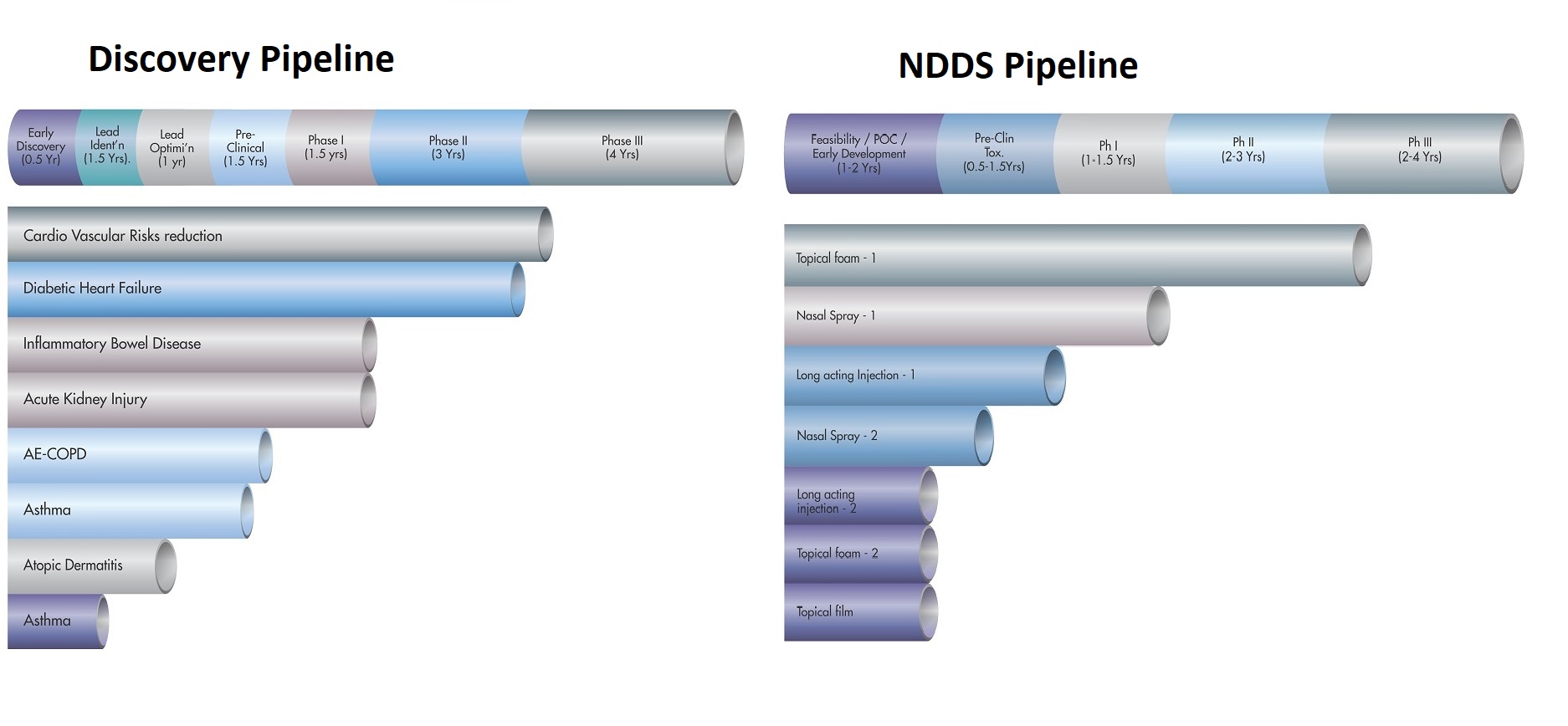

Discovery Research

The Company is currently developing several in-house New Chemical entities (NCE) in the areas of metabolic, cardiovascular, gastrointestinal, dermatological and respiratory disorders. The Company has cumulatively filed 818 patent applications for NCEs from these and earlier projects in all major markets of which, 497 patents were granted so far.

The most advanced discovery programme of the Company is a metabolic modulator NCE, 'omzotirome', for the treatment of diabetes. This program me is currently undergoing the pivotal phase-3 clinical trial in key markets where the Company has presence, with India gearing up to be the first to launch. The Company believes that this asset is uniquely positioned to address the consequences of Cardiometabolic-Based Chronic Disease (CMBCD), which is assuming alarming proportions in India and other emerging economies besides developed countries.

NDDS

Novel Drug Delivery Systems (NDDS) emerged from application of new technology platforms to design products with an aim to reposition existing drugs, if required through an alternate route of administration. The aim is to improve their performance with respect to efficacy, safety and patient compliance through enhanced bio-availability, dosage reduction, frequency and onset of action.

The Company’s pipeline includes several NDDS programmes, adapted for existing medications, which will give the Company an edge over its competitors through differentiation. The Company is currently focusing its R&D efforts on several innovative projects in the area of complex generics, with respect to oral solids, foams/ointments/creams and nasal delivery.

Foam-based topical product for psoriasis was launched successfully. Another product for the indication of acute pain management through nasal route of delivery was also launched. Nasal route of delivery is also being explored for management of vitamin B12 deficiency. The phase-3 trial has been completed and filed for marketing approval.

Business Overview

Torrent Pharma blazed a new trail in the Indian Pharmaceuticals industry by successfully implementing the concept of niche marketing. Torrent Pharmaceuticals was the pioneers in initiating the concept of niche marketing and today, is ranked amongst the leaders in therapeutic segment of cardiovascular (CV), central nervous system (CNS), gastro-intestinal (GI) and women healthcare (WHC). The Company also has significant presence in diabetology, pain management, gynaecology, oncology and anti-infective segments.5

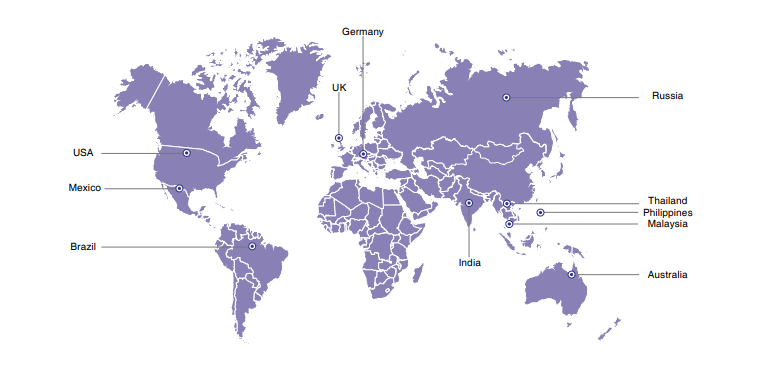

Torrent Pharma also has a strong international presence spread across 40 countries with operations in regulated and emerging markets like US, Europe, Brazil and Rest of the World. The Company operate through its wholly owned subsidiaries spread across 12 nations with major setups in Brazil, Germany and US.

India Business

Right from pioneering niche marketing in India to earning the sobriquet of 'The Company with the Most First Launches,' Torrent Pharma has established itself as a major player in the Indian Pharma arena. Torrent Pharmaceuticals has well segregated marketing divisions, strategically structured on specific therapeutic areas and enjoys dominance in therapeutic segment of cardiovascular (CV), central nervous system (CNS), gastro-intestinal (GI) and women healthcare (WHC). The company's vast field force of more than 3600 personnel cater to 1.70 Lakh Doctors across the country. Torrent Pharma has a strong domestic presence in India with modern manufacturing facilities and cutting edge R & D Center. Revenues in India was Rs. 3,739 Cr. in 2020 – 2021. Torrent Pharma reaches the target market segments through 22 sales divisions with a wide customer coverage through 5000+ stockists and 59000 retailers serviced through 22 distribution centres across India.

With Unichem's domestic business acquisition, Torrent has entered the list of top pharma firms in the Indian Pharma Market (IPM) and is ranked No 8 in the IPM.

US Business

The world’s largest market for pharmaceuticals, USA has always been on Torrent Pharma’s strategic radar. Torrent Pharma Inc., its subsidiary, serves the growing need of its products in the market and today Torrent Pharmaceuticals is ranked 10th amongst the US generic Indian Companies.

Torrent Pharmaceuticals has 88 ANDAs approval with 42 approvals in pipeline. The company aim to strengthen its position in the market by launching complex generics which include specialty oral solids (Oncology) and value added medicines 505(b)(2) in the coming times.

Torrent has strengthened the US presence through acquisition of Bio-Pharm, Inc. (BPI) a generic pharmaceuticals and OTC Company, based in Levittown Pennsylvania, USA, which includes, its first overseas US FDA registered manufacturing facility.

International Business

EUROPE

One of the most regulated and evolved Pharma markets worldwide, the EU has been a veritable learning ground for Torrent. Proven expertise in product development and a strong regulatory knowledge have helped in developing a highly robust product portfolio comprising of different TAs including CNS, CVS and GI among others. The company's wholly owned subsidiaries in Germany and UK, spearhead Torrent Pharma’s operations in the EU territory. Both the markets have shown impressive growth over the last 5 years.6

Germany

Torrent forayed into Germany in 2005 with acquisition of Heumann Pharma Generics, a Pfizer Group Company. Heumann’s broad product portfolio coupled with its low-cost manufacturing facilities provide a good strategic market position to it in one of the biggest pharmaceutical markets in the globe.

Today, Torrent enjoys 4th position in the market and is ranked No. 1 amongst the Indian players in the market.

UK

Torrent Pharma (UK) Ltd is one of the fastest growing generic pharmaceutical companies within the UK; the most mature generics market in Western Europe. Through robust supplies from Torrent Pharmaceuticals and several portfolio acquisition deals, Torrent Pharmaceuticals has built a robust pipeline of products and a current range of over 100 molecules.

Brazil

Torrent entered the Brazilian market 16 years ago. Currently, ranked 1st in covered market, it is ranked 15th in prescriptions exhibiting the 5th highest growth in branded products amongst the top 50 Pharmaceuticals companies in the Country. Torrent is also the biggest Indian Company in terms of sales in Brazil contributing to almost 65% of sales by Indian companies in Brazil. The company's strong relationship with Neurologists, Psychiatrists and Cardiologists have helped it accomplish the same.

Torrent Pharmaceuticals has 48 products approved at Anvisa with 22 of products in CNS segment, 16 in the Cardio Vascular and 10 in Oral Anti Diabetic/Obesity (OAD) segments.

In view of the high growth in the pure generic segment, Torrent Pharmaceuticals is building its product portfolio in the CV, CNS, OAD and other therapies. The company has 30 more products of branded generics and generics in the pipeline in Brazil.

Emerging markets is a mix of regulated and semi regulated markets comprising of Russia, CIS, South East Asia, Asia Pacific, Africa, Middle East, Central and Latin America. Torrent Pharma’s products in the Therapeutic areas of Diabetology, Cardiovascular and Central Nervous System are promoted and supported by its sales and support team of over 450 people.

African Countries

Zimbabwe

Torrent has the distinction of being one of the foremost Indian Company to get its products registered in this market and is also amongst the leading Indian company in the Zimbabwean market. With a rich portfolio of 35 products and a strong pipeline of 10 products under registration, Torrent Pharmaceuticals is well poised to extract the high potential offered by this market.

Kenya

Kenya being the gateway to East African Markets is a territory of strategic significance for Torrent. Having started its marketing operations in 1994, the past couple of years have witnessed consolidation of the marketing efforts. With 45-product registered and 12 more in the offing, its focus is on brand building.

Uganda

Strategic selection of products encompassing a wide range of therapeutic indications has found profound acceptance by the members of medical fraternity in this country. The aim is to intensify Torrent's focus on Cardio Vascular and CNS products, which has been its forte over the years. Present product portfolio entails an assortment of 33 products with 8 more in pipeline.

Nigeria

Extending its territorial fortification to Western Africa, Torrent made successful forays into Nigeria, which by far is one of the biggest markets in West Africa. Having already secured registrations for a handful of its specialized products, Torrent is all set to explore this attractive market with 30 products in pipeline.

South Africa

Having received SA MCC’s approval for the manufacturing facility of Oral Solids and about 15 product registrations, Torrent’s pathway is open to explore Africa’s sizeable and the most regulated market.

Asian Countries

Srilanka

Torrent's consistent sales growth over the past decade displays the confidence of medical fraternity in its brands. With over 55 products in the market and another 15 in the pipeline, the company remain committed towards providing a wide range of products to the Sri Lankan market. Torrent is well known in the island for its neuro-psychiatry, cardio vascular and gastro intestinal range.

Vietnam

Vietnam is one of the major market in the South East Asian arena for Torrent. Currently, 55 products are registered and 15 are in pipeline. The company started its operations in Vietnam in the year 1996, with representative office in Ho Chi Minh City, the commercial capital of Vietnam.

Torrent in Vietnam now has a mixed basket of products, with a focus on brand building to ensure long-term business & growth. In continuation of its Indian tradition, Torrent has earned a distinct image for itself in Vietnam in the field of cardiology & neuropsychiatry.

Myanmar

Torrent Pharma initiated the marketing operations in Myanmar in 1995. Torrent Pharmaceuticals has more than 50 products registered in the country with another 20 in the pipeline. Four distributors across the country distribute its registered products.

With strong product portfolio in cardiovascular and decent presence in neuropsychiatry, Torrent is poised to create a specialty-focussed platform in the country.

The company's focus is on strengthening the product basket, creating brand equity and launching new molecules in the market.

Philippines

Torrent’s first subsidiary in Asia has been in Philippines considering the marketing opportunities available in this densely populated island nation. Today, Torrent is amongst the top 20 companies in the country and is the No. 1 branded Generic Company in CNS segment.

Malaysia

Laboratories Torrent (Malaysia) Sdn Bhd , a subsidiary of Torrent Pharma in Malaysia , kicked off its operations in March 2012 to further strengthen presence in the South East Asian Market. The major focus areas are CNS and CV therapies. Today, Torrent is one of the fastest growing companies in the country.

MENA

The Middle East North Africa operations are spread across affluent markets like Bahrain, UAE and Yemen. Torrent Pharmaceuticals has about 40 registrations in these markets with a strong product portfolio in the pipeline. Torrent Pharma is expanding its operations in the MENA region and Torrent Pharmaceuticals has strategic tie-ups in Jordan, Qatar and Libya as well.

Australia

Torrent Pharma has created a distinct presence in the Pacific region with its subsidiary - Torrent Australasia Pvt Ltd (TAPL). Torrent Pharmaceuticals has received 5 product approvals in the regulated markets of the region.

Latin America

Mexico

Torrent entered Mexico Market in 2010, primarily with CNS products. Today Torrent Pharmaceuticals is the 6th ranked company in the covered market. Torrent Pharmaceuticals is active amongst highest growing companies in the CNS segment. Torrent Pharmaceuticals has 26 registered products out of which 11 products are being marketed. Torrent Pharmaceuticals has been growing through intensive CRM with the key specialists like Neurologists, Psychiatrists and Geriatricians.

In addition to continuing the consolidation in the CNS segment; the company aim to strengthen its business by launching new products in other therapeutic areas as well.

Rest of Latin America & Caribbean markets

Torrent aims to penetrate the Latin American market with its high quality products and extensive product portfolio. Strong economic performance in this region is expected to fuel its growth in the coming years. In addition, recent regulatory developments will create further market opportunities in these countries, particularly for generic producers in both the private and public sectors. With over 50 registrations in pipeline, Torrent is increasing its foothold in important markets like Venezuela, Colombia, Peru, Chile, Panama, Guatemala, Ecuador, Dominican Republic, Costa Rica, Honduras, Jamaica and Trinidad & Tobago

Russia & CIS

Torrent Pharma’s foray into the international markets began with operations in the erstwhile Soviet Union in 1983. In Russian Federation, Torrent has a wholly owned subsidiary and its own warehouse for closer reach to the customers. Torrent, through its own field force of over 65 sales professionals has strong presence across major cities in Russia.

With product registrations in Russia and CIS , Torrent has sizeable presence in therapeutic areas of Cardio Vascular, Neurology , Psychiatry and Gastroenterology.

Industry Overview

Global Pharma Market

Life science companies are facing unprecedented change. Their customers are changing, the nature of their products and sales models are changing, and they face new kinds of competitors. Budgetary pressures are affecting health care systems globally, payers are pushing back aggressively on prices and demanding evidence of value, and digitally empowered and increasingly informed patients are playing a more active role in their treatment. By 2025, many life science companies will have transitioned toward more patientcentric business models, offering products and services designed to improve outcomes and address the specific needs of empowered customers. The market will be characterised by mass customisation, enabled by continuous technological advancements and a host of new health care players.7

Global medicine spending is expected to grow more slowly, but projected to exceed $1.1 trillion in the next five years

The rise in spending is partly due to increased use, but is also driven by changes in the specialty and innovative product composition of new brands reaching the market. Other factors, such as pricing pressures and brand losses of exclusivity offset rises in spending. With these dynamics, spending growth is projected to slow in the next five years

Developed markets are expected to see an average CAGR between 1–4% through 2023-24, below the historical 3.3% CAGR from 2014–19. Developed markets are expected to see slowing brand growth despite increases in specialty medicine spending, as greater brand losses of exclusivity (LOE) offset higher new brand product spending, and price and volume growth both slow

Pharmerging markets are expected to show the most growth with a 5–8% CAGR through 2023-24. Most pharmerging market growth has been driven by access expansions, leading to greater volume use and adoption of more novel therapies

Brand LOEs are projected to have a $139 billion negative impact on brand sales from 2020–24, compared to the $107 billion impact seen from 2014–19

Future of Generics

Generic medicine is designed to be identical as branded drugs, marketed by private companies in dosage form, strength, safety, route of administration, performance characteristics, quality, and intended use. Generic drugs work in the same way as branded drugs in terms of clinical benefits. Generic drugs are manufactured after the expiration of the exclusive rights or patent of the branded drugs.

The global generic pharmaceuticals market is expected to grow from $233.66 billion in 2019-20 to $245.6 billion in 2020-21 at a compound annual growth rate (CAGR) of 5.1%.

Growth is mainly due to the companies resuming their operations and adapting to the new normal while recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities, resulting in operational challenges.

The Generic pharmaceuticals market is expected to reach $331.54 billion in 2024-25 at a CAGR of 7.8%.

The rising incidence of chronic diseases is one of the major drivers of the generic pharmaceuticals market. As more individuals are diagnosed with chronic diseases, they look for more medicines for the treatment. Branded drugs come at a premium price, while generic drugs are available at a lower cost having the same chemical composition of branded drugs. The low-cost and same chemical composition and strength of generic drugs make a patient buy generic drugs instead of branded drugs. If it is a chronic disease, the treatment goes for a longer period of time and hence, the sales of generic drugs also increase. For instance, according to the WHO (World Health Organisation), over the next 10 years, the deaths due to chronic disease is projected to increase by 17%. Also, in 2019-20, almost 3-quarters of all deaths in the world is due to chronic diseases.

The market of the generic drugs consists of both Branded Generics and Non Branded Generics. Branded Generic drugs are marketed under another the company’s brand name but they are bioequivalent to their generic counterparts. It is expected that the global Branded Generics market will be led China, India and Asia Pacific (excluding Japan). Drugs for cardiovascular diseases and diabetes, which account for major share of Branded Generics sales in the global market, are projected to remain at the top over the next 10 years.

Business Overview

Torrent Pharma is one of the front-runners in the Indian pharmaceuticals industry having presence in domestic as well as International markets. The Company has subsidiaries across the globe as under. The Company also has major commercial presence in other countries mainly covering Southeast Asia, Africa and the Middle East.

| Revenue (in crores) | 2020-21 | 2019-20 | Growth | ||

| Amount | Share | Amount | Share | % | |

| India | 3,739 | 47% | 3,517 | 44% | 6% |

| USA | 1,261 | 16% | 1,523 | 19% | -17% |

| Germany | 1,038 | 13% | 947 | 12% | 10% |

| Brazil | 630 | 8% | 715 | 9% | -12% |

| Other countries | 820 | 10% | 766 | 10% | 7% |

| CRAMS/others | 517 | 6% | 472 | 6% | 10% |

| Total | 8,005 | 100% | 7,939 | 100% | 1% |

Torrent’s four major pharma markets are India, US, Germany and Brazil. The Company’s strategic priorities in India and Brazil continue to focus on strengthening specialties, field force productivity and new product development. These markets remain a key priority for the Company and offer higher visibility and sustainability to the business. In the US and Germany, the Company continues to focus on its new product pipeline by developing complex products.

India

The Indian pharmaceutical market (IPM), which is valued at more than $20 billion has demonstrated its resilience in 2020-21 during the pandemic. Over the past several years, the IPM has exhibited a strong growth trajectory and is fundamentally poised to remain a double-digit growth market owing to several demand levers over the coming years. With rising prevalence of chronic diseases, a significant push towards increasing healthcare coverage towards a large set of the population coupled with government support and insurance coverage, volume growth in the IPM in all therapies is more than likely to sustain this momentum in the near term, and even increase over the medium term. Notwithstanding the therapy specific impact that the pandemic is likely to have in the coming year 2021-22, the IPM should grow at a significantly higher rate than the previous year.

The fiscal 2020-21 witnessed demand disruptions in several forms; lockdowns reduced patient footfalls, general infections remained low due to greater social distancing measures followed, and physician practice was impacted in the first half of the year. On the other hand, pandemic related drugs, including repurposed antivirals, multivitamins, immunity boosters and nutraceuticals saw a boost. In 2021-22, while the impact related to lockdowns may be much lower on an annual basis, the second wave of the pandemic is likely to affect overall demand in the first half of the year.

For the year ended 31st March 2021, India continues to be the largest business unit contributing 47% to the Torrent Pharma's revenues.

The Company is ranked 8th in the IPM and continues to grow faster than the market. It has the 5th position among combined chronic and sub-chronic therapy areas, with 16 brands featuring among the Top 500 brands of the IPM, 10 brands have revenue of over Rs 100 crores

In IPM, Cardiac is the major contributor followed by Anti Infective, Gastro-intestinal, Anti-diabetic and Vitamin Mineral Nutrients (VMN) segment. Torrent Pharma has strong presence in Cardiac, Gastro-intestinal, CNS, Vitamin Minerals Nutrients and Anti-diabetic, with Top 5 therapies contributing 85% to sales.

New introductions in key therapies have been a focus area for Torrent Pharma to drive higher than market growth and it has launched a significant number of new products in 2020-21. In addition to patent expiration launches, Torrent Pharma has launched several brand extensions with first-in-India combinations for unmet needs, and this will remain a focus for the coming years. Some important new introductions in key markets were - Dapagliflozin and Rivaroxaban in the CVD therapeutic area; Brivaracetam in the CNS segment; Obeticholic Acid within the Gatro-intestinal therapy along with strengthened presence in Pain Analgesic segment through NDDS Tapentadol Nasal Spray. Tapentadol NS is Torrent’s own patented and in-house developed nasal spray for severe pain management.

Brazil

Brazil is the largest pharmaceutical market in Latin America and the 10th largest in the world. The Brazilian pharma market is estimated to be around US$ 33.6 billion as of Dec-2019 and is expected to grow through a year-on-year growth of 6-9% over next 5 years, depending on expected improvements on macroeconomic parameters under government controls and its policies

Brazil’s economic scenario worsened due to the pandemic. GDP in 2019-20 declined by 4.1%. Inflation is expected to remain in the range of 4% to 5% in 2021. Apart from economic impact, Brazil is still facing difficulties in implementing reforms. In 2019-20, both tax and administrative reforms were included in Congress’ agenda but are still facing resistance. Main objective of tax reform is to simplify taxation rules by implementing GST (Goods and Service Tax) whereas administrative reform is to address the fiscal imbalances and high cost of the administrative structure. Economic challenges stemming from productivity and low investments remain to be addressed by the government also through privatisation of state-owned companies.

During the year, Brazilian operations registered revenue of Rs 630 crores (sales in local currency BRL 454 million, 11% growth in constant currency). Growth in rupee terms was negative due to depreciation of Brazilian currency, which depreciated by 30% against US dollars in 2020-21. In its focused business (Branded-Generic and Generic-Generic) the Company grew by 14% at constant currency. The Company intends to gain market share through specialty focus, enhancing field force productivity, new product filings and new launches. In parallel, it is preparing for entry into newer therapeutic segments.

Among the Indian companies, in terms of value Torrent Pharma ranks No. 1, with the second largest less than half of the size of Torrent (IQVIA dataset). Currently, Torrent has commercialised 24 Branded Generics and 20 Generic products. In its Branded Generic portfolio, the Company has 11 filings awaiting approval, 23 under preparation for filing in existing business and 17 in new business. In addition, the Company has been building its portfolio in the Generic segment with parallel filings and launches of its Branded Generic products.

USA

USA continues to be the largest pharmaceutical market, accounting for approximately 41% of global pharmaceutical spending. It recorded 4% CAGR for 2014-19 and is expected to grow at 3-6% CAGR to US $605-635 billion by 2023-24.

Growth will likely be principally driven by the development and launch of innovative specialty drugs but will be partially tempered by existing drug patent expiries and cost reduction initiatives by payers

Generic drugs play a vital role in facilitating access to lifesaving medicines and remain a public health priority for the U.S. Food and Drug administration (FDA). There are more than 10,000 FDA-approved Generic drugs and nine of every 10 prescriptions in the U.S. are filled by Generics. Generic drugs have saved the health care system close to $2.2 trillion dollars in the past decade.

Amid the challenges of a worldwide pandemic and rapidly advancing science, the FDA’s generic drug program continued steadfast efforts to help increase the availability of safe, effective, high-quality, more affordable drugs in the U.S.

In 2020, the FDA approved or tentatively approved 948 Generic drug applications (ANDAs). Among the total approvals were 50 original applications and 668 supplement submissions for drug products used as potential treatments and supportive therapies for patients with COVID-19. It also includes 72 first-time Generic drugs, and 30 Generics were approved under the Competitive Generic Therapy (CGT) pathway.

Torrent Pharma is ranked 11 among the US Generic Indian companies and has a market share of around 13% in its covered market. Revenues from the US business were Rs 1261 crores (sales US$ 166 million) during 2020-21 as compared to Rs 1,523 crores (sales US$ 207 million) in the previous year with a de-growth of 17%.

Germany

Top 5 European markets are Germany, France, Italy, UK and Spain. Medicine spending in top 5 European countries will increase from US$ 174 billion 2018-19 to US$ 210 to US$ 240 billion in 2024. CAGR from 2019-20 to 2023-24 is expected to be 3% to 6%.

Despite the COVID-19 disruptions, with continued support and industry resilience, the European pharma outlook for 2021 is positive. The presence of leading companies in the European region is also expected to boost the demand for pharmaceutical manufacturing.

Towards the end of 2019-20, European Commission published the Pharmaceutical Strategy for Europe with the aim to ensure equitable access to medicines throughout the region and support the industry’s competitiveness and innovation on the global pharmaceutical stage. This includes access to safe, effective, and high-quality medicines at an affordable price. The pharmaceutical strategy for Europe aims at creating a future-proof regulatory framework and supporting industry in promoting research and technologies that actually reach patients in order to fulfil their therapeutic needs, while addressing market failures. It will also take into account the weaknesses exposed by the pandemic and take appropriate actions to strengthen the system.

Germany is the 4th largest pharmaceutical market in the world and the largest in Western Europe. It is valued at around $52 billion and is expected to grow at a CAGR of 4% to 75 till 2020-24. Majority of the market is tender driven, which leads to a very competitive environment for the industry. Among the Generic players, Torrent Pharma holds 5th position with a market share of around 6.6% and is ranked first among Indian players in the German market. Revenues from Germany operations during 2020-21 were Rs 1,038 crores (sales in euro 119 milliom) with a growth of 10%.

Financial Highlights

The consolidated sales and operating income for the year ended 31 March 2021, increased to Rs 8,005 crores from Rs 7,939 crores in the previous year showing a growth of 1%. The consolidated operating profit for the year was Rs 2,537 crores as against Rs 2,284 crores in the previous year registering growth of 11%. The consolidated net profit stood at Rs 1,252 crores compared to Rs 1,025 crores in the previous year registering growth of 22%.

Torrent Pharma Q1 FY22 results

Revenues & profitability 8

- Revenue at Rs. 2,134 crores up by 4%

- Gross margins : 72.4%; EBITDA margins : 34%

- EBITDA at Rs. 717 crores was up by 8%

- Profit before tax at Rs. 484 crores was up by 20%.

- Net profit after tax at Rs. 330 crores was up 2.8%.

India

- India revenues at Rs 1,093 crores grew by 18%.

- As per AIOCD data, Torrent’s Q1 FY22 growth was 24% versus IPM growth of 37%. IPM growth during the quarter includes high contribution from Covid treatments and a low base last year

- Covid drugs: Torrent has launched baricitinib during the quarter and is currently conducting clinical trials for molnupiravir; more partnerships under evaluation to widen covid portfolio

- PCPM for the quarter was Rs 10 lakhs with an MR strength of 3,600

- Torrent has launched its Trade Generics division during the quarter.

United States

- US revenues at Rs 266 crores, were down by 29%.

- Constant currency sales were $36 million.

- Sales were lower due to price erosion in the base business and lack of new approvals pending re-inspection of facilities.

- As on June 30, 2021, 54 ANDAs were pending for approval with USFDA and 7 tentative approvals were received, including 1 tentative approval received during the quarter.

Brazil

- Brazil revenues at Rs 153 crores, were up by 9%

- Constant currency sales at R$ 108 million, was up by 14% versus covered market growth of 12%

- Growth was driven by growth momentum in boththe branded and generic segment. New products have contributed to 3% growth.

Germany

- Germany revenues at Rs 260 crores were up by 5%

- Constant currency sales were Euro 29 million with flat growth.

- Second wave of Covid and related lockdowns impacted the market growth during the quarter.

References

- ^ https://torrentpharma.com/index.php/site/info/aboutUs

- ^ https://torrentpharma.com/index.php/site/info/aboutgroup

- ^ https://torrentpharma.com/index.php/site/info/manufacturing

- ^ https://torrentpharma.com/index.php/site/info/rnd

- ^ https://torrentpharma.com/index.php/site/info/businessAreas

- ^ https://torrentpharma.com/index.php/site/info/business_international

- ^ https://torrentpharma.com/pdf/download/AR-2020-21.pdf

- ^ https://torrentpharma.com/pdf/investors/Press_Release_Torrent_Pharma_Results_21-22.pdf