Transocean Ltd

Summary

- Transocean Ltd. is the world’s largest offshore drilling contractor.

- The company provides services for drilling oil and gas wells and managing offshore drilling projects.

- Transocean owns operates a fleet of 37 mobile offshore drilling units, consisting of 28 ultra-deepwater floaters and nine harsh environment floaters.

Transocean Ltd. (NYSE: RIG, LSE: 0QOW) is the world’s largest offshore drilling contractor. The company provides services for drilling oil and gas wells and managing offshore drilling projects on behalf of oil and gas companies.

Transocean Ltd. operates a fleet of offshore drilling units, including ultra-deepwater drillships, semisubmersibles, and jack-up rigs. The company’s fleet operates around the world, including in the Gulf of Mexico, the North Sea, the Atlantic Ocean, the Indian Ocean, and the Pacific Ocean.

Transocean Ltd. was founded in 2007 as a result of the merger of Transocean Inc. and Aker Drilling ASA. The company is headquartered in Houston, Texas and has offices in over 30 countries.

Recent Developments

Transocean Ltd. $486 Million Contract for Deepwater Aquila1

September 14, 2023; Transocean Ltd. announced a three-year award for the newbuild ultra-deepwater drillship Deepwater Aquila with a national oil company for work offshore Brazil. The contract is expected to commence in the third quarter of 2024 and represents approximately $486 million in firm backlog, excluding a mobilization fee of approximately 90 times the contract dayrate.

Transocean has also agreed to acquire the outstanding interests in Liquila Ventures Ltd., a company formed to acquire the Deepwater Aquila, from its joint venture partners, Perestroika and Lime Rock Partners. Following this acquisition, Transocean will own and operate eight of the twelve ultra-deepwater, 1,400 short-ton hookload drillships in the world. The Deepwater Aquila is expected to be delivered from the shipyard in October 2023.

In connection with the execution of the drilling contract for the Deepwater Aquila and the acquisition of the outstanding interests in Liquila Ventures Ltd., Transocean is exploring various debt financing alternatives to partially fund the costs associated with acquiring the rig from the shipyard and preparing it for its contract in Brazil.

Transocean Ltd. $222 Million Ultra-Deepwater Drillship Contract2

August 30, 2023; Transocean Ltd. announced that Oil and Natural Gas Corporation Ltd awarded the Dhirubhai Deepwater KG1 a binding Notification of Award for work offshore India. The 21-month program is expected to commence in the first quarter of 2024 and will contribute an estimated $222 million in backlog, excluding a mobilization fee of $5 million.

Financial Highlights

Second Quarter 2023 Results

July 31, 2023; Transocean Ltd. reported a net loss attributable to controlling interest of $165 million, $0.22 per diluted share, for the three months ended June 30, 2023.3

Contract drilling revenues for the three months ended June 30, 2023, increased sequentially by $80 million to $729 million, primarily due to increased activity for rigs that returned to work after being idle in the first quarter, the commencement of operations of the newbuild Deepwater Titan and $19 million of revenues associated with the early termination of Transocean Endurance and Transocean Barents, partially offset by reduced activity for two rigs that were idle in the second quarter of 2023.

Contract intangible amortization represented a non-cash revenue reduction of $19 million. This compares with $18 million in the prior quarter.

Operating and maintenance expense was $484 million, compared with $409 million in the prior quarter. The sequential increase was primarily due to rigs that returned to work after being idle, the commencement of operations of the newbuild Deepwater Titan and higher costs associated with two rigs undergoing contract preparation.

Interest expense, net of amounts capitalized, was $168 million, compared with $249 million in the prior quarter. Interest expense included a non-cash loss of $46 million, compared with $133 million in the prior quarter, associated with the fair value adjustment of the bifurcated exchange feature embedded in its exchangeable bonds issued in September of 2022. Interest income was $11 million, compared with $19 million in the previous quarter.

The Effective Tax Rate(2) was 8.8%, up from (12.3)% in the prior quarter. The increase was primarily due to updates to its forecast to include losses on revaluation of its exchangeable bonds. The Effective Tax Rate excluding discrete items was 11.7% compared to (29.0)% in the previous quarter.

Cash provided by operating activities was $157 million during the second quarter of 2023, representing an increase of $204 million compared to the prior quarter. The sequential increase is primarily due to increased collections from customers, reduced payments for payroll-related items, and reduced payments for interest.

Second quarter 2023 capital expenditures of $76 million decreased primarily due to reduced spending for its newbuild rigs under construction. This compares with $81 million in the prior quarter.

Company Overview

The company provide, as its primary business, contract drilling services in a single operating segment, which involves contracting its mobile offshore drilling rigs, related equipment and work crews to drill oil and gas wells. The company specialize in technically demanding regions of the global offshore drilling business with a particular focus on ultra-deepwater and harsh environment drilling services.4

Drilling

The company provide contract drilling services using its fleet of mobile offshore drilling units, including both drillships and semisubmersibles, broadly referred to as floaters. Floaters are designed to operate in locations away from port for extended periods of time and have living quarters for the crews, a helicopter landing deck and storage space for drill pipe, riser and drilling supplies.

The company's operations are geographically dispersed in oil and gas exploration and development areas throughout the world. The company operate in a single, global offshore drilling market, as its drilling rigs are mobile assets and can be moved according to prevailing market conditions.

As of February 9, 2023, the drilling units in its fleet, including stacked and idle rigs, but excluding rigs under construction, were located in the U.S. Gulf of Mexico (nine units), Greece (seven units), the Norwegian North Sea (six units), Brazil (five units), Malaysia (three units), the United Kingdom (the “U.K.”) North Sea (three units), Angola (one unit), Canada (one unit), India (one unit) and Suriname (one unit).

Fleet

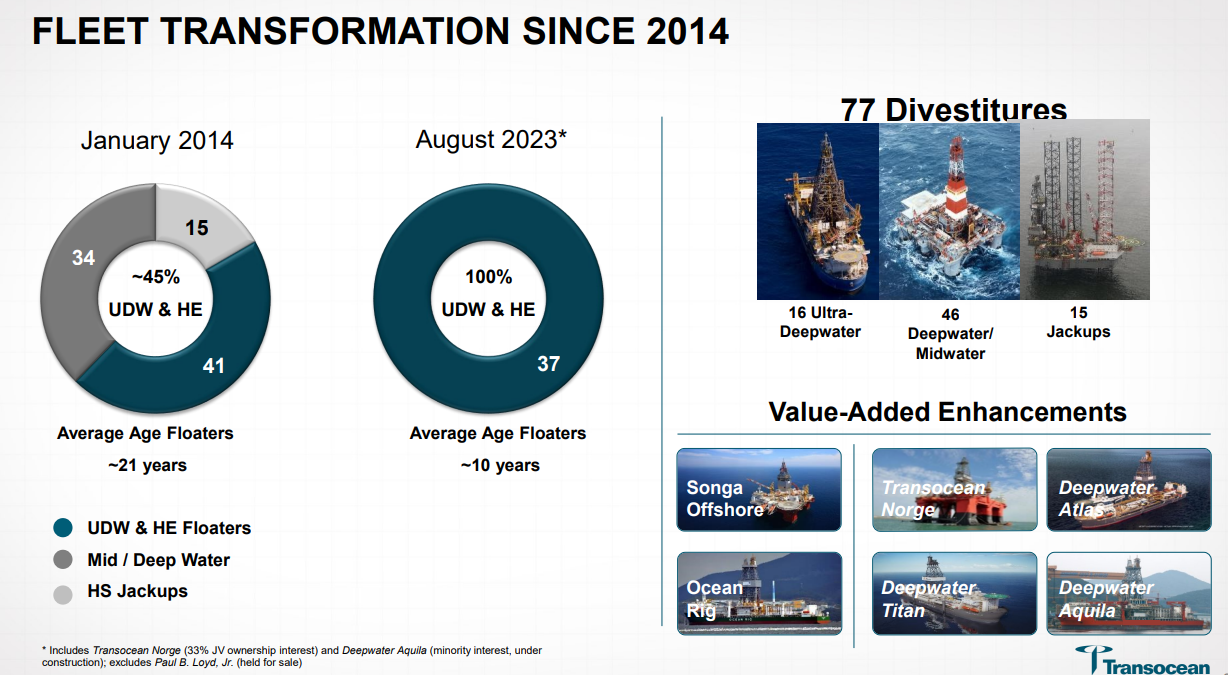

Transocean owns or has partial ownership interests in and operates a fleet of 37 mobile offshore drilling units, consisting of 28 ultra-deepwater floaters and nine harsh environment floaters. In addition, Transocean is constructing one ultra-deepwater drillship.5

Company History6

| Year | Milestone |

| 1926 | Transocean traces its roots to onshore drilling operations, where T.S. "Stoney" Stoneman began his career as a draftsman and then a landman before joining the Danciger Oil & Refining Company of Fort Worth, Texas in 1926. |

| 1950 | Southern Production Co., a subsidiary of Southern National Gas, purchased Danciger and later began work to form The Offshore Company. |

| 1963 | The Offshore Company acquired International Drilling Co. Ltd. of London, marking the beginning of operations in the United Kingdom. |

| 1981 | The Kuwait Petroleum Corporation (KPC) acquired Santa Fe. |

| 1982 | The Offshore Company became Sonat Offshore Drilling Inc. |

| 1984 | Schlumberger purchased Sedco. |

| 1987 | Sonat Offshore Drilling, Inc. acquired the offshore drilling fleet of Dixilyn-Field (a PanHandle Eastern Company.) |

| 1996 | In September, Sonat Offshore Deepwater Drilling Inc. acquired Transocean ASA. At this time the company name was changed to Transocean Offshore Deepwater Drilling Inc. and the logo was changed. |

| 1997 | In December, Reading & Bates and Falcon Drilling merged to become R&B Falcon Drilling. |

| 1998 | In December, R&B Falcon acquired Cliffs Drilling Company. |

| 1999 | Schlumberger spun off Sedco Forex, which merged with Transocean Offshore Inc. to become the world’s largest offshore drilling contractor: Transocean Sedco Forex. |

| 2001 | Transocean Sedco Forex Inc. and R&B Falcon Corporation combined to form the world's largest offshore drilling contractor. |

| 2001 | Global Marine and Santa Fe International merged to become GlobalSantaFe Corporation, the second largest drilling contractor. |

| 2007 | Transocean and GlobalSantaFe merged as the world's largest offshore drilling contractor. |

| 2011 | In October, Transocean acquired Aker Drilling ASA |

| 2018 | In May, Transocean Ltd. acquired Songa Offshore SE. The acquisition added seven floaters, four of which were high specification harsh environment. |

| 2018 | In December, Transocean Ltd. acquired Ocean Rig UDW. The acquisition added 11 floaters, including four 7th gen UDW drillships. |

References

- ^ https://www.deepwater.com/news/detail?ID=28056

- ^ https://www.deepwater.com/news/detail?ID=28026

- ^ https://www.deepwater.com/news/detail?ID=27996

- ^ https://fintel.io/doc/sec-transocean-ltd-1451505-10k-2023-february-23-19412-7247

- ^ https://www.deepwater.com/our-fleet

- ^ https://www.deepwater.com/about/our-history