United States Steel Corp

Summary

- United States Steel Corporation (U. S. Steel) was established in 1901 and currently is 24th largest steel-maker in the world.1

- The company has approximately 24,540 employees as of December 31, 2021.

United States Steel Corporation reported net sales of $4,338 million for the 4th quarter of 2022, which was $5,622 million for the same period a year earlier. Net earnings for fourth quarter of 2022 is $174 million.

Net sales for the twelve months ended December 31, 2022 compared to the same period in 2021 were $21,065 million and $20,275 million, respectively. Net income of the company is reported to be $2,524 million, down from a profit of $4,174 million a year earlier. Basic Earnings per share (EPS) of the company during 2022 is $10.22, which was $15.77 a year earlier.

U. S. Steel has four reportable segments: North American Flat-Rolled (Flat-Rolled), Mini Mill, U. S. Steel Europe (USSE), and Tubular Products (Tubular).

United States Steel Corporation announced on February 02, 2023 that its Board of Directors declared a dividend of $0.05 per share of U. S. Steel Common Stock.

Brief Company Overview

![]() United States Steel Corporation (NYSE:X) was established in 1901 by Andrew Carnegie, J.P. Morgan, Charles Schwab, and Elbert H. Gary. U. S. Steel produces and sells steel products, including flat-rolled and tubular products, in North America and Europe. Operations in the United States also include iron ore and coke production facilities and real estate operations. Operations in Europe also include coke production facilities. The company has supplied steel for many famous structures in the United States such as, San Francisco-Oakland Bay Bridge, Willis Tower and Hancock Tower in Chicago, United Nations Building in New York City, Chicago Picasso, “Three Sisters” bridges in Pittsburgh and others. U. S. Steel supplies customers through out the world primarily in the automotive, construction, consumer (packaging and appliance), electrical, industrial equipment, service center/distribution, structural tubing and energy (oil country tubular goods (OCTG) and line pipe) markets. According to the world steel Association’s latest published statistics, in 2020 U. S. Steel was the third largest steel producer in the United States and the thirty eighth largest steel producer in the world.

United States Steel Corporation (NYSE:X) was established in 1901 by Andrew Carnegie, J.P. Morgan, Charles Schwab, and Elbert H. Gary. U. S. Steel produces and sells steel products, including flat-rolled and tubular products, in North America and Europe. Operations in the United States also include iron ore and coke production facilities and real estate operations. Operations in Europe also include coke production facilities. The company has supplied steel for many famous structures in the United States such as, San Francisco-Oakland Bay Bridge, Willis Tower and Hancock Tower in Chicago, United Nations Building in New York City, Chicago Picasso, “Three Sisters” bridges in Pittsburgh and others. U. S. Steel supplies customers through out the world primarily in the automotive, construction, consumer (packaging and appliance), electrical, industrial equipment, service center/distribution, structural tubing and energy (oil country tubular goods (OCTG) and line pipe) markets. According to the world steel Association’s latest published statistics, in 2020 U. S. Steel was the third largest steel producer in the United States and the thirty eighth largest steel producer in the world.

The company has four reportable segments - North American Flat-Rolled (Flat-Rolled), Mini Mill, U. S. Steel Europe (USSE), and Tubular Products (Tubular). The company also has its Real Estate and Railroad Business. The company provides solution for industries like appliances, automotive, construction, electrical, energy, industrial, mining, and packaging. Specific products of the company include Advanced High-Strength Steel, Ultra High-Strength Steel, Coated Sheet, Cold-Rolled Coil, Dent Resistant, High-Strength Low-Alloy Steel, Hot-Rolled Coil, Mild Steels, and Tin. The company has annual raw steelmaking capability of 22.4 million net tons.

U. S. Steel is helmed by David Boyd Burritt as President, CEO & Director. The company has approximately 24,540 employees as of December 31, 2021. Return on Equity (TTM) and Return on Assets (TTM) of the company as on February 2, 2023 is 36.89% and 15.21%, respectively.2

Acquisitions and Disposition

Big River Steel Acquisition

On January 15, 2021, U. S. Steel purchased the remaining equity interest in Big River Steel for approximately $625 million in cash net of $36 million and $62 million in cash and restricted cash received, respectively, and the assumption of liabilities of approximately $50 million. There were acquisition related costs of approximately $9 million during the twelve months ended December31, 2021. Prior to the closing of the acquisition on January 15, 2021, U. S. Steel accounted for its 49.9% equity interest in Big River Steel under the equity method as control and risk of loss were shared among the joint venture members.

Transtar Disposition

On July 28, 2021, U. S. Steel completed the sale of 100 percent of its equity interests in its wholly-owned short-line railroad, Transtar, LLC (Transtar) to an affiliate of Fortress Transportation and Infrastructure Investors, LLC. The Company received net cash proceeds of $627 million, subject to certain customary adjustments as set forth in the Membership Interest Purchase Agreement, and recognized a pretax gain of approximately $506 million in 2021. In connection with the closing of the transaction, the Company entered into certain ancillary agreements including a railway services agreement, providing for continued rail services for its Gary and Mon Valley Works facilities, and a transition services agreement. Because Transtar does not represent a significant component of U. S. Steel's business and does not constitute a reportable business segment.

USS-UPI, LLC (UPI)

On February 29, 2020, U. S. Steel purchased the remaining 50% ownership interest in USS-POSCO Industries, (now USS-UPI, LLC, (UPI)) for $3 million, net of cash received of $2 million. There was an assumption of accounts payable owed to U. S. Steel for prior sales of steel substrate of $135 million associated with the purchase that was reflected as a reduction in receivables from related parties on the Company's Consolidated Balance Sheet as of December 31, 2020.

Financial Highlights

Q4'22 Performance Highlights

United States Steel Corporation reported net sales of $4,338 million for the 4th quarter of 2022, which was $5,622 million for the same period a year earlier.

Net earnings for fourth quarter of 2022 is $174 million, or $0.68 per diluted share. Adjusted net earnings was $226 million, or $0.87 per diluted share and excluded the impact of a one-time signing bonus related to the United Steelworkers labor agreement and other one-time items detailed in the reconciliation of adjusted net earnings table. This compares to fourth quarter 2021 net earnings of $1.07 billion, or $3.75 per diluted share. Adjusted net earnings for the fourth quarter 2021 was $1.43 billion, or $5.01 per diluted share.

The revenue of the company went down because of a lower average realized price per ton of its products. For example, the company has realized $1,086 net per ton of its products of flat-rolled segment for the fourth quarter of 2022, which was $1,432 net per ton for the same period a year before. The comparison is $786 to $1,490 for mini mill segment; $957 to $1,075 for U. S. Steel Europe segment for the same period. However, the company has realized average price of $3,616 for Tubular products, which was $1,968 for the earlier year. But this segment constitute only 4.11% of total shipments of the company. The company has shipped lower quantity of its products for the fourth quarter of 2022 as well. It has shipped 3,369 thousand tons of steel in total for this period, and 3,746 for the previous.

Annual Performance Highlights, 2022

Revenue is generated primarily from contracts to produce, ship and deliver steel products, and to a lesser extent, raw materials sales such as iron ore pellets and coke by-products and rail road services. Net sales for the twelve months ended December 31, 2022 compared to the same period in 2021 were $21,065 million and $20,275 million, respectively. For the Flat-Rolled segment the increase in sales primarily resulted from higher average realized prices ($89 per ton) primarily from higher value-added products, partially offset by decreased shipments (645 thousand tons) across most products. For the Mini Mill segment the decrease in sales primarily resulted from lower average realized prices ($180 per ton) primarily from lower value-added products partially offset by increased shipments (57 thousand tons), including the partial period of the Company's controlling interest in Big River Steel in January of 2021. For the USSE segment the consistent sales primarily resulted from higher average realized prices ($124 per net ton) across most products, offset by decreased shipments (543 thousand tons) across most products. For the Tubular segment the increase in sales primarily resulted from higher average realized prices ($1,282 per net ton) and increased shipments (79 thousand tons). Earnings before interest and taxes of the company is reported $3,160 million in 2022, down from a profit of $4,946 in 2021. Net income of the company is reported to be $2,524 million, down from a profit of $4,174 million a year earlier. Basic Earnings per share (EPS) of the company during 2022 is $10.22, which was $15.77 a year earlier. Quarterly dividends were declared by U. S. Steel in 2022 in the amount of five cents per share. Quarterly dividends on common stock were one cent per share in the first, second and third quarters and five cents per share in the fourth quarter in 2021.

Selling, general and administrative expenses were $422 million in 2022 and $426 million in 2021. Depreciation, depletion and amortization expenses were $791 million in both years ended December 31, 2022 and December 31, 2021. Earnings from investees were $243 million in 2022 versus earnings from investees of $170 million in 2021. The increase in 2022 from the prior year is primarily due to current year earnings from our PRO-TEC joint venture from higher realized prices.

The company reported cash balance of $3,504 million on December 31, 2022, which was $2,522 million a year earlier. Total current assets reported for the years are $7,866 million, and $7,152 million, respectively. Property, plant and equipment on December 31, 2022 is $8,492 million, which was $7,254 million the previous year. Total assets reported is $19,458 million, and $17,816 million for the years, respectively. Current liabilities of the company on December 31, 2022 is $3,959 million, and $3,852 million a year earlier. Long-term debts of the company has increased from $3,863 million to $3,914 million. U. S. Steel has 400,000,000 authorized share with par value of $1, and issued stocks are 282,487,412. Total shareholders equity has increased from $9,010 million to $10,218 million during the year.

Net cash provided by operating activities in 2022 is $3,505 million, down from $4,090 million. Net cash used in investing activities is $1,679 million, up from $840 million used in a year earlier. Net cash used in financing activities in 2022 is $868 million.

Business Overview

U. S. Steel has four reportable segments: North American Flat-Rolled (Flat-Rolled), Mini Mill, U. S. Steel Europe (USSE), and Tubular Products (Tubular). The Mini Mill segment reflects the full ownership of Big River Steel after January 15, 2021, and a new mill under construction in Osceola, Arkansas. Prior to the acquisition, the minority interest equity earnings of Big River Steel were included in the Other category. The Tubular segment includes the electric arc furnace at our Fairfield Tubular Operations in Fairfield, Alabama. The Other category includes results of our real estate business, the previously held equity method investment in Big River Steel, and our former railroad business.

Business Segments

Flat-Rolled

The Flat-Rolled segment includes the operating results of U. S. Steel’s integrated steel plants and equity investees in North America involved in the production of slabs, strip mill plates, sheets and tin mill products, as well as all iron ore and coke production facilities in the United States. These operations primarily serve North American customers in the automotive, appliance, construction, container, transportation and service center markets.

During 2021 Flat-Rolled had aggregate annual raw steel production capability of 17.0 million tons produced at the company's different production sites - Gary Works, Mon Valley Works, Great Lakes Works and Granite City Works facilities. In December 2021, U. S. Steel permanently idled the steelmaking operations at Great Lakes Works, which reduced the Company's overall annual raw steel production capability by 3.8 million net tons. Raw steel production was 9.9 million tons in 2021, 9.3 million tons in 2020 and 11.4 million tons in 2019. Raw steel production averaged 58 percent of capability in 2021, 55 percent of capability in 2020 and 67 percent of capability in 2019.

Mini Mill

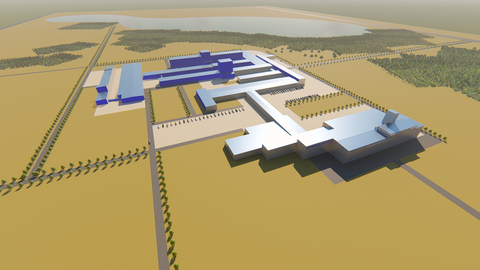

The Mini Mill segment includes the operating results of U. S. Steel's Big River Steel facility in North America and a new mill under construction in Osceola, Arkansas. The Mini Mill segment produces hot-rolled, cold-rolled and coated sheets and electrical. This operation primarily serves North American customers in the automotive, appliance, construction, container, transportation and service center markets.

Mini Mill has aggregate annual raw steel production capability of 3.3 million tons produced at the Big River Steel facility. Raw steel production was 2.7 million tons in 2021. Raw steel production averaged 81 percent of capability in 2021.

European Operations

The USSE segment includes the operating results of U. S. Steel Košice (USSK), U. S. Steel’s integrated steel plant and coke production facilities in Slovakia, and its subsidiaries. USSE conducts its business mainly in Central and Western Europe and primarily serves customers in the European transportation (including automotive), construction, container, appliance, electrical, service center, conversion and oil, gas and petrochemical markets. USSE produces and sells slabs, strip mill plate, sheet, tin mill products and spiral welded pipe.

USSE has annual raw steel production capability of 5.0 million tons. USSE’s raw steel production was 4.9 million tons in 2021, 3.4 million tons in 2020, and 3.9 million tons in 2019. USSE’s raw steel production averaged 99 percent of capability in 2021, 67 percent of capability in 2020 and 78 percent of capability in 2019.

Tubular

The Tubular segment includes the operating results of U. S. Steel’s tubular production facilities and an equity investee in the United States. These operations produce and sell seamless and electric resistance welded (ERW) steel casing and tubing (commonly known as OCTG), and standard and line pipe and mechanical tubing and primarily serve customers in the oil, gas and petrochemical markets.

The Tubular segment has annual raw steel production capability of 900 thousand tons. Raw steel production was 464 thousand tons in 2021 and 16 thousand tons in 2020. Raw steel production averaged 52 percent of capability in 2021 and 7 percent of capability in 2020. Tubular has total production capability of 1.9 million tons. In 2020, Tubular indefinitely idled the Lone Star Tubular Operations and Lorain Tubular Operations thereby effectively reducing on-line tubular production capacity by 790 thousand and 380 thousand tons, respectively. U. S. Steel Tubular Products, Inc. (USSTP), a wholly owned subsidiary of U. S. Steel, designs and develops a range of premium and semi-premium connections to address customer needs.

Products

Solutions offered by the company -

- Appliances

- Automotive

- Construction

- Electrical

- Energy

- Industrial

- Mining

- Packaging

- Sustainable steel

Products offered by the company -

- Advanced high-strength steel

- Coated sheet

- Ultra high-strength steel

- Cold-rolled coil

- Dent-resistant

- High-strength low-alloy steel

- Hot-rolled coil

- Mild steels

- Tin

Risk Factors of Operation

- Adverse effect on customer demand and results of operation due to cyclical nature of the industry.

- Import of the products at a lower rate due to lack of tariff control and global overcapacity.

- Unsuccessful investments in new technologies and products.

- Complexity related to occasional acquisitions, and divestitures in integrating and separating the businesses.

- Operational footprint, unplanned equipment outages and other unforeseen disruptions may adversely impact the results of operations or result in idle facility costs or impairment charges.

- Increased customer demand for low-carbon products.

- Limited availability, or volatility in prices of raw materials, scrap and energy may constrain operating levels and reduce profit margins.

- Dependence of U. S. Steel on the third parties for transportation services. It may result into high costs due to unavailability of services.

- Substantial expenditures for capital investments, debt service obligations, operating leases and maintenance.

- Foreign currency risk.

- Compliance with existing and new environmental regulations, environmental permitting and approval requirements may result in delays or other adverse impacts on planned projects, and results of operations and cash flows.

- Reducing greenhouse gas (GHG) emissions from steelmaking operations to meet corporate targets or comply with new regulations as well as stakeholder expectations and mitigate potential physical impacts of climate change could significantly increase costs to manufacture future materials or reduce the amount of materials being manufactured.

Company History

The US Steel Corporation was established in 1901 and is headquartered in Pittsburgh, Pennsylvania. Creation of United States Steel in 1901 was from the merger of several different steel companies including Carnegie Steel, Federal Steel [founded by John Morgan in 1898], American Steel & Wire and others. Charles Schwab was appointed by Carnegie to run Carnegie Steel. Elbert H Gary around this time was president of Federal Steel; and it was Carnegie, Morgan, Schwab and Gary who were instrumental in the subsequent creation of U.S. Steel.3

| Year | Particular |

|---|---|

| 1901 | United States Steel Corporation founded. |

| 1901-1910 | Acquisition of Bessemer Steamship Co (Great Lakes iron ore); Purchase of the Clairton Steel Company; Purchase of Tennessee Coal, Iron and Railroad Company; Acquisition of the Columbia Steel Company. |

| 1949 | Plans announced for construction of Fairless steelworks, Pa. |

| 1964 | Creation of new division - Pittsburgh Chemical Company. |

| 1979 | Restructuring - closure of 13 loss-making steel plants. |

| 1982 | Acquisition of Marathon Oil. |

| 1984-1986 | Buys US properties and oil reserves of Husky Oil Ltd; Acquisition of Texas Oil & Gas Corporation. |

| 1986 | JV with POSCO to modernize USX Pittsburg plant (California). |

| 1986 | Change of name to USX Corporation. (Name change to USX was in recognition of United States Steel's involvement at this point in steel, energy and other non-steel business) |

| 1990 | Cost-cutting consolidation of Texas Oil and Marathon Oil. |

| 2001 | USX split into 2: United States Steel Corp & Marathon Oil (In the reorganization of USX in 2001, the United States Steel Corporation took on the same name in which it had been founded 100 years earlier). |

| 2003 | Purchase of bankrupt steelmaker Sartid in Serbia. |

| 2014 | US Steel Corporation removed from S&P 500 index on 1st July. |

| 2017 | Finalizes restructuring and sale of U. S. Steel Canada. |

| 2019 | The steel producer buys a minority stake in Big River Steel. |

| 2020 | Acquires Remaining 50% Ownership Interest in USS-POSCO Industries (UPI). |

| 2020 | Buys remaining 50.1% stake in Big River Steel LLC for $774 million. |

| 2021 | Abandons $1.1 billion investment project in the Mon Valley; Sells Transtar LLC to Fortress Transportation and Infrastructure Investors LLC; Executes MOU With Equinor for Hydrogen and CCS; Commences site selection process for new 3 mt flat-rolled minimill in USA. |

| 2022 | Pays $1.5 million fine for pollution violations at Edgar Thomson Works. Edgar Thomson is a steelmaking unit at the Mon Valley Works. The $1.5m fine arose for alleged environmental violations, including apparent failures to properly maintain pollution control equipment. |

Recent Developments

- United States Steel Corporation announced on February 02, 2023 that its Board of Directors declared a dividend of $0.05 per share of U. S. Steel Common Stock.