Valero Energy Corp

Summary

- Valero Energy Corporation engages in the refining and marketing of transportation fuels and petrochemical products.

- Valero's primary products are gasoline, diesel, jet fuel, petrochemicals, asphalt, and lubricants.

- Valero operates 15 refineries in the U.S., Canada, and the U.K., with a combined throughput capacity of approximately 3.2 million barrels per day.

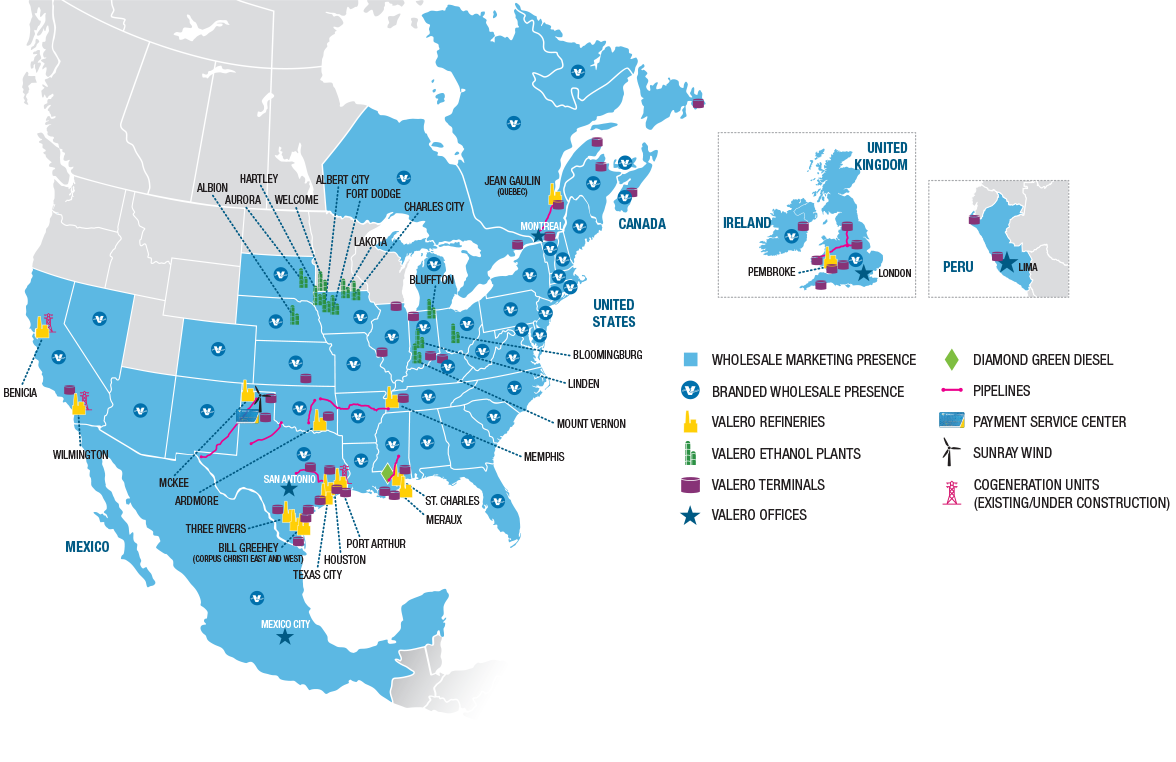

Valero Energy Corporation (NYSE: VLO, LSE: 0LK6) is a Fortune 500 company based in San Antonio, Texas, that primarily engages in the refining and marketing of transportation fuels and petrochemical products. It is the largest independent petroleum refiner in the United States and one of the largest producers of low-carbon transportation fuels. Valero operates 15 refineries in the U.S., Canada, and the U.K., with a combined throughput capacity of approximately 3.2 million barrels per day. The company also owns 12 ethanol plants in the U.S. Midwest with a combined production capacity of 1.6 billion gallons per year. In addition, Valero is a joint venture partner in Diamond Green Diesel, which produces renewable diesel from animal fats and used cooking oil.

Financial Highlights

Second Quarter 2023 Results

07/27/23; Valero Energy Corporation reported net income attributable to Valero stockholders of $1.9 billion, or $5.40 per share, for the second quarter of 2023, compared to $4.7 billion, or $11.57 per share, for the second quarter of 2022. Excluding the adjustments shown in the accompanying earnings release tables, adjusted net income attributable to Valero stockholders was $4.6 billion, or $11.36 per share, for the second quarter of 2022.1

Refining

The Refining segment reported operating income of $2.4 billion for the second quarter of 2023, compared to $6.2 billion for the second quarter of 2022. Adjusted operating income was $6.1 billion for the second quarter of 2022. Refining throughput volumes averaged 3.0 million barrels per day in the second quarter of 2023.

Renewable Diesel

The Renewable Diesel segment, which consists of the Diamond Green Diesel joint venture (DGD), reported $440 million of operating income for the second quarter of 2023, compared to $152 million for the second quarter of 2022. Segment sales volumes averaged 4.4 million gallons per day in the second quarter of 2023, which was 2.2 million gallons per day higher than the second quarter of 2022. The higher sales volumes were due to the impact of additional volumes from the startup of the DGD Port Arthur plant in the fourth quarter of 2022.

Ethanol

The Ethanol segment reported $127 million of operating income for the second quarter of 2023, compared to $101 million for the second quarter of 2022. Adjusted operating income for the second quarter of 2022 was $79 million. Ethanol production volumes averaged 4.4 million gallons per day in the second quarter of 2023, which was 582 thousand gallons per day higher than the second quarter of 2022.

Corporate and Other

General and administrative expenses were $209 million in the second quarter of 2023, compared to $233 million in the second quarter of 2022. The effective tax rate for the second quarter of 2023 was 22 percent.

Investing and Financing Activities

Net cash provided by operating activities was $1.5 billion in the second quarter of 2023. Included in this amount was a $1.2 billion unfavorable change in working capital and $242 million of adjusted net cash provided by operating activities associated with the other joint venture member’s share of DGD, excluding changes in DGD’s working capital. Excluding these items, adjusted net cash provided by operating activities was $2.5 billion in the second quarter of 2023.

Capital investments totaled $458 million in the second quarter of 2023, of which $382 million was for sustaining the business, including costs for turnarounds, catalysts and regulatory compliance. Excluding capital investments attributable to the other joint venture member’s share of DGD, capital investments attributable to Valero were $433 million.

Liquidity and Financial Position

Valero ended the second quarter of 2023 with $9.0 billion of total debt, $2.3 billion of finance lease obligations and $5.1 billion of cash and cash equivalents. The debt to capitalization ratio, net of cash and cash equivalents, was 18 percent as of June 30, 2023.

Company Overview

Valero Energy Corporation, through its subsidiaries, is a multinational manufacturer and marketer of petroleum-based and low-carbon liquid transportation fuels and petrochemical products, and sells its products primarily in the United States (“U.S.”), Canada, the United Kingdom (“U.K.”), Ireland and Latin America. Valero owns 15 petroleum refineries located in the U.S., Canada and the U.K. with a combined throughput capacity of approximately 3.2 million barrels per day. Valero is a joint venture member in Diamond Green Diesel Holdings LLC, which owns two renewable diesel plants located in the U.S. Gulf Coast region with a combined production capacity of approximately 1.2 billion gallons per year, and Valero owns 12 ethanol plants located in the U.S. Mid-Continent region with a combined production capacity of approximately 1.6 billion gallons per year. Valero manages its operations through its Refining, Renewable Diesel, and Ethanol segments.2

Operations

Valero manages its operations through its Refining, Renewable Diesel, and Ethanol segments.

Refineries

The company's 15 petroleum refineries are located in the U.S., Canada, and the U.K., and they have a combined feedstock throughput capacity of approximately 3.2 million BPD. The following table presents the locations of these refineries and their feedstock throughput capacities as of December 31, 2022.

The company sell refined petroleum products in both the wholesale rack and bulk markets. These sales include products that are manufactured in its refining operations, as well as products purchased or received on exchange from third parties. Most of its refineries have access to marine facilities, and they interconnect with common-carrier pipeline systems, allowing it to sell products in the U.S., Canada, the U.K., Ireland, Latin America, and other parts of the world.

| Refinery | Location | Throughput Capacity (BPD) |

| U.S.: | ||

| Benicia | California | 1,70,000 |

| Wilmington | California | 1,35,000 |

| Meraux | Louisiana | 1,35,000 |

| St. Charles | Louisiana | 3,40,000 |

| Ardmore | Oklahoma | 90,000 |

| Memphis | Tennessee | 1,95,000 |

| Corpus Christi | Texas | 3,70,000 |

| Houston | Texas | 2,55,000 |

| McKee | Texas | 2,00,000 |

| Port Arthur | Texas | 3,95,000 |

| Texas City | Texas | 2,60,000 |

| Three Rivers | Texas | 1,00,000 |

| Canada: | ||

| Quebec City | Quebec | 2,35,000 |

| U.K.: | ||

| Pembroke | Wales | 2,70,000 |

| Total | 31,50,000 |

Renewable Diesel

Diamond Green Diesel (DGD) owns two renewable diesel plants. The first DGD plant began operations in 2013 and is located next to its St. Charles Refinery (the DGD St. Charles Plant). The second DGD plant commenced operations in the fourth quarter of 2022 and is located next to its Port Arthur Refinery (the DGD Port Arthur Plant, and together with the DGD St. Charles Plant, the DGD Plants). The DGD Plants produce renewable diesel and renewable naphtha. Renewable diesel is a low-carbon liquid transportation fuel that is interchangeable with petroleum-based diesel. Renewable naphtha is used to produce renewable gasoline and renewable plastics. These products are produced from waste and renewable feedstocks using a pre-treatment process and an advanced hydroprocessing-isomerization process.

The DGD Plants receive waste and renewable feedstocks primarily by rail, trucks, ships, and barges owned by third parties. DGD is party to a raw material supply agreement with Darling under which Darling is obligated to offer to DGD a portion of its feedstock requirements at market pricing, but DGD is not obligated to purchase all or any part of its feedstock from Darling. Therefore, DGD pursues the most optimal feedstock supply available.

The DGD Port Arthur Plant, which has a production capacity of approximately 470 million gallons of renewable diesel and approximately 20 million gallons of renewable naphtha per year was commissioned and commenced operations in the fourth quarter of 2022. DGD’s combined renewable diesel and renewable naphtha production capacities increased to approximately 1.2 billion gallons and 50 million gallons, respectively, per year.

Ethanol

The company's ethanol business began in 2009 with the purchase of its first ethanol plants. Valero Energy has since grown the business by purchasing additional ethanol plants. The company's 12 ethanol plants are located in the Mid-Continent region of the U.S., and they have a combined ethanol production capacity of approximately 1.6 billion gallons per year. The company's ethanol plants are dry mill facilities that process corn to produce ethanol and various coproducts, including livestock feed (dry distillers grains, or DDGs, and syrup) and inedible corn oil.

The company sell its ethanol under term and spot contracts in bulk markets in the U.S. The company also export its ethanol into the global markets. The company distribute its ethanol primarily by rail (using some railcars owned by us), truck, ship, and barge. The company sell DDGs primarily to animal feed customers in the U.S., Mexico, and Asia, which are distributed primarily via rail, truck, ship, and barge.

| State | City | Ethanol Production Capacity | DDG Production Capacity | Corn Processing Capacity |

| Indiana | Bluffton | 135 | 3,55,000 | 47 |

| Linden | 135 | 3,55,000 | 47 | |

| Mount Vernon | 100 | 2,63,000 | 35 | |

| Iowa | Albert City | 135 | 3,55,000 | 47 |

| Charles City | 140 | 3,68,000 | 49 | |

| Fort Dodge | 140 | 3,68,000 | 49 | |

| Hartley | 140 | 3,68,000 | 49 | |

| Lakota | 110 | 2,89,000 | 38 | |

| Minnesota | Welcome | 140 | 3,68,000 | 49 |

| Nebraska | Albion | 135 | 3,55,000 | 47 |

| Ohio | Bloomingburg | 135 | 3,55,000 | 47 |

| South Dakota | Aurora | 140 | 3,68,000 | 49 |

| Total | 1,585 | 41,67,000 | 553 |

Company History

Valero Energy Corporation has founded in 1980.3

| Year | Milestone |

| 1980 | On January 1, Valero Energy Corporation is born as the corporate successor of Lo-Vaca Gathering Company. |

| 1984 | Valero officially commissions its first full-scale refinery in Corpus Christi, Texas |

| 197-1998 | Valero agrees to merge its natural gas-related service business with PG&E Corporation and spin off its refining assets into a new public corporation still known today as Valero Energy Corporation. |

| 2000 | Valero purchases Exxon’s Benicia Refinery in Northern California, and enters the West Coast refining market. |

| 2001 | Six more refineries into Valero’s portfolio: Ardmore, Oklahoma; Wilmington, California; Denver, Colorado; McKee (Sunray, Texas) and Three Rivers, Texas; and Lévis, Quebec |

| 2001 | Valero expands in Corpus Christi with the purchase of a second refinery (later named the Corpus Christi Refineries East Plant), and acquires two asphalt refineries on the West Coast. |

| 2003-2004 | Valero purchases its St. Charles Refinery from Orion Refining Corporation in South Louisiana, |

| 2003-2004 | Valero extends its international reach with the acquisition of El Paso Corporation’s Aruba Refinery plus related marine, bunkering and marketing operations. |

| 2005 | Acquisition of Premcor Inc. in an $8 billion transaction. The deal adds four refineries to the portfolio: Port Arthur, Texas; Memphis, Tennessee; Delaware City, Delaware; and Lima, Ohio |

| 2009-2010 | Valero purchases seven ethanol plants from VeraSun Energy Corporation. With this purchase, a new alternative energy subsidiary is formed, called Valero Renewable Fuels Company LLC. The ethanol plants are located in Albert City, Charles City, Fort Dodge and Hartley, Iowa; Welcome, Minnesota; Aurora, South Dakota; and Albion, Nebraska. |

| 2014 | Valero Renewables grows to 10 ethanol plants with the purchase of three more sites (Bloomingburg, Ohio; Linden, Indiana; and Jefferson, Wisconsin), and one additional site in Mount Vernon, Indiana in 2014. |

| 2011 | Valero enters the Western European refining market with the purchase of the Pembroke Refinery |

| 2011 | Valero also acquires its 15th refinery, plus related logistics assets, in Meraux, Louisiana. The refinery offers significant hydroprocessing capacity and synergies with the company’s St. Charles refinery in nearby Norco, Louisiana. |

| 2012 | In a joint venture called Diamond Green Diesel, Valero partners with Darling Ingredients Inc. to build a 10,000-barrel-per-day renewable diesel refinery near its St. Charles refinery to process recycled animal fat, used cooking oil and other feedstocks into renewable diesel fuel. |

| 2013 | Valero forms Valero Energy Partners LP, a publicly traded master limited partnership, to own, operate, develop and acquire crude oil and refined products pipelines, terminals and other transportation and logistics assets serving Valero refineries. |