Weatherford International plc

Summary

- Weatherford International plc, an Irish public limited company, together with its subsidiaries providing equipment and services used in the drilling, evaluation, well construction, completion, production, intervention and responsible abandonment of wells in the oil and natural gas exploration and production industry as well as new energy platforms.

- It conducts operations in approximately 75 countries with 345 operating locations including manufacturing, research and development, service, and training facilities.

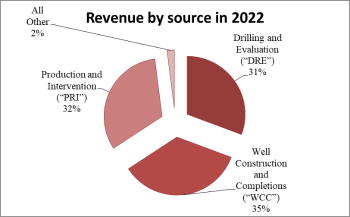

- WFRD offer services and technologies in relation to the well life cycle and have three reportable segments: (1)Drilling and Evaluation (2) Well Construction and Completions, and (3) Production and Intervention.

- In 2022, the company experienced growth in sales, with total sales reaching $4,331 million. This marked an increase of $686 million or 18.8% compared to the sales figure of $3,645 million in 2021.

- The company's gross profit for 2022 amounted to $1,311 million, reflecting a difference of $382 million or 41.1% from the gross profit of $929 million in the previous year, 2021.

- Additionally, the company's operating profit increased in 2022, totaling $412 million, which was higher by $296 million or 255.2% compared to the operating profit of $116 million in 2021.

- The net profit for the year 2022 was $26 million, representing an increase of $476 million compared to the net profit of $-450 million in 2021.

- Moreover, the diluted earnings per share (EPS) for 2022 were reported as $0.36, which showed an increase of $6.79 compared to the diluted EPS of $-6.43 in 2021.

Brief Company Overview

Weatherford International plc (NASDAQ:WFRD), an Irish public limited company, together with its subsidiaries providing equipment and services used in the drilling, evaluation, well construction, completion, production, intervention and responsible abandonment of wells in the oil and natural gas exploration and production industry as well as new energy platforms. Many of its businesses, including those of predecessor companies, have been operating for more than 50 years. WFRD conduct operations in approximately 75 countries, answering the challenges of the energy industry with 345 operating locations including manufacturing, research and development, service, and training facilities.

Weatherford International plc (NASDAQ:WFRD), an Irish public limited company, together with its subsidiaries providing equipment and services used in the drilling, evaluation, well construction, completion, production, intervention and responsible abandonment of wells in the oil and natural gas exploration and production industry as well as new energy platforms. Many of its businesses, including those of predecessor companies, have been operating for more than 50 years. WFRD conduct operations in approximately 75 countries, answering the challenges of the energy industry with 345 operating locations including manufacturing, research and development, service, and training facilities.

The company's subsidiaries include Weatherford Drilling International, specializing in drilling services; Weatherford Completion & Production Services, focusing on completion systems and production optimization; Weatherford Artificial Lift Systems, which designs and implements artificial lift solutions; and Weatherford Well Construction, providing technologies and services related to well construction. Weatherford's supply chain involves a complex network comprising sourcing raw materials, manufacturing, transportation, and global distribution of products and services. The company collaborates with various suppliers for materials like steel, polymers, and electronics. Key components of Weatherford's supply chain management include supplier management, manufacturing and assembly processes, distribution and logistics coordination, inventory management to meet customer demand, and technology integration using IoT devices and software for shipment tracking, equipment monitoring, and route optimization.

As of October 2023, the company's 52-week share price ranged from $100.93 to $38.61. The company's financial metrics are as follows: a trailing P/E (Price-to-Earnings) ratio of 20.86 times, a price-to-sales ratio (ttm) of 1.46 times, a profit margin of 7.01%, an operating margin of 16.60%, a return on assets (ttm) of 10.35%, and diluted earnings per share (ttm) of $4.77. The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2022 was approximately $1.5 billion based upon the closing price on the Nasdaq Global Select Market as of such date. The registrant had 70,890,321 ordinary shares outstanding as of February 1, 2023.

Recent Developments

- Launched a new MPD offering for the performance tier of the market providing comprehensive coverage across the market spectrum. This solution enhances pressure management, improves detection and visualization of kick/loss incidents while digitally capturing data for post job analyses and process improvement by leveraging industry-leading monitoring and modeling software capability.1

- Launched ForeSite® 5.0, which builds upon industry-leading production optimization platform. By integrating with Data Robot WFRD is now able to deliver operationalize Artificial Intelligence (AI) through machine learning (ML) models. These advanced and field tested ML models will be able to deliver failure prediction of artificial lift to deliver cost savings as well as improved production for customers. This AI foundation inForeSite® will also enable further collaborative development of machine learning models with our customers.2

- Launched CygNet 9.7, which advances WFRD’s CygNet platform to include greater flow measurement functionality for both gas and liquids. CygNet is the only IoT/SCADA platform offered by an energy services company for upstream and midstream customers, currently active on more than 350,000 wells and facilities.

- Within WFRD’s WCC segment, launched the Xpress XT Liner System with an API 19LH validation and pressure-balanced capability. With this launch, it is driving increased reliability of Liner hanger systems leading to reduced operational risk and superior well integrity.

- In Well Construction and Completions segment, it launched StringGuard™, a unique technology that enhances safety and operational efficiency by mitigating the risk of dropped strings in Tubular Running Services operations.3

- Signed a joint development agreement with Eavor, a revolutionary geothermal company, to develop whipstock and sidetrack technology for future projects in Germany and around the world that will reduce their overall costs. This agreement is designed to further bolster Weatherford’s geothermal offering and builds on an existing contract to provide liner hanger systems, cementation products, and open-hole/cased-hole wireline services to support the first commercial Eavor-loop™ in Germany.4

Recent Financing Activities

- Senior notes repayments and repurchases of $62 million in the first quarter of 2023, followed by issuance of notice to redeem the remaining $105 million of 11% senior unsecured notes due 2024.5

- Debt repayments of $159 million in the second quarter of 2023.

Financial Performance Highlights

Q2 2023 Highlights

In the second quarter of 2023, Weatherford International demonstrated significant growth in its financial performance. The company reported sales of $1,313 million, marking a substantial increase of $193 million or 17.23% compared to the second quarter of 2022, during which sales amounted to $1,120 million. The net profit for the second quarter of 2023 surged to $123 million, indicating a substantial increase of $95 million or 337.5% when compared to the net profit of $28 million in the second quarter of 2022. Furthermore, the company's diluted earnings per share (EPS) for the second quarter of 2023 exhibited a remarkable improvement. Weatherford International reported a diluted EPS of $1.66, reflecting a significant positive change of $1.27 or 325.64% compared to the diluted EPS of $0.39 in the second quarter of 2022.

Annual Performance Highlights

In 2022, the company experienced growth in sales, with total sales reaching $4,331 million. This marked an increase of $686 million or 18.8% compared to the sales figure of $3,645 million in 2021. The company's gross profit for 2022 amounted to $1,311 million, reflecting a difference of $382 million or 41.1% from the gross profit of $929 million in the previous year, 2021. Additionally, the company's operating profit increased in 2022, totaling $412 million, which was higher by $296 million or 255.2% compared to the operating profit of $116 million in 2021. The net profit for the year 2022 was $26 million, representing an increase of $476 million compared to the net profit of $-450 million in 2021. Moreover, the diluted earnings per share (EPS) for 2022 were reported as $0.36, which showed an increase of $6.79 compared to the diluted EPS of $-6.43 in 2021.

The year-over-year improvement was due to increased activity across all reporting segments. This activity increase was the result of increased customer demand, market share improvements, pricing improvements and operational focus. Revenues in 2022 reflect a 15% increase in service revenues and a 26% increase in product revenues. The revenue increase was led by the Drilling and Evaluation (“DRE”) and Production and Intervention (“PRI”) segments, and geographically, by improvements in Latin America, the Middle East/North Africa/Asia and the North America regions. Service and product quality excellence allowed us to benefit from a robust market with customers focusing on delivering energy supply with minimal disruption, globally. Imbalance across geographies driven by geopolitical conflicts, investment variances and supply disruptions caused a greater focus on energy security, globally. Company’s operational initiatives, put in place over the past couple of years, enabled us to regain share in a few product lines and geographies, as well as improve pricing through differentiation. Operating income of $412 million improved 255% in 2022 compared to 2021, due to reasons noted above.

Cash provided by operating activities in 2022 was $349 million. The primary sources of cash from operating activities were from higher operating income as well as effective working capital management, partially offset by interest payments. The primary sources of cash from operating activities were collections on accounts receivables, partially offset by interest payments.

Cash used in investing activities in 2022 was $54 million. The primary uses of cash from investing activities were capital expenditures of $132 million; partially offset by proceeds from the sale of assets of $82 million. The primary uses of cash from investing activities were for capital expenditures of $85 million and investments in marketable securities in Argentina of $39 million. The primary source of cash from investing activities was $41 million of proceeds from asset dispositions. The amount we spend for capital expenditures varies each year and is based on the types of contracts the company enter, its asset availability and expectations with respect to activity levels.

Cash used in financing activities in 2022 was $248 million. The primary uses of cash from financing activities were for repayments of long-term debt of$198 million, which included finance leases, a repurchase of $8 million of 2028 Senior Secured Notes and a $175 million early redemption of Exit Notes. Additionally, the entity paid dividends to non-controlling interests of $30 million. The remaining financing cash uses were primarily for financing fees paid on the Credit Agreement.

Business Overview

Weatherford operates in the oil and natural gas industry and provides various products and services for drilling, evaluation, completion, production, and intervention of oil and natural gas wells. Demand for its products and services is driven by many factors, including commodity prices, the number of oil and gas rigs and wells drilled, depth and drilling conditions of wells, number of well completions, age of existing wells, reservoir depletion, regulatory environment and the level of work over activity worldwide. WFRD offer services and technologies in relation to the well life cycle and have three reportable segments:

(1)Drilling and Evaluation

(2) Well Construction and Completions, and

(3) Production and Intervention.

All of its segments are enabled by a suite of digital monitoring, control and optimization solutions using advanced analytics to provide safe, reliable and efficient solutions throughout the well life cycle, including responsible abandonment.

Products and Services

Drilling and Evaluation (“DRE”) offers a suite of services including managed pressure drilling, drilling services, wire line and drilling fluids. DRE offerings range from early well planning to reservoir management through innovative tools and expert engineering to optimize reservoir access and productivity.

Managed Pressure Drilling helps to manage wellbore pressures to optimize drilling performance. WFRD incorporate various technologies, including rotating control devices and advanced automated control systems, as well as several drilling techniques, such as closed-loop drilling, air drilling, managed-pressure drilling and underbalanced drilling.

Drilling Services includes directional drilling, logging while drilling, measurement while drilling and rotary-steerable systems. WFRD provide a full range of down hole equipment, including high-temperature and high-pressure sensors, drilling reamers and circulation subs.

Wireline includes open-hole and cased-hole logging services that measure the geophysical properties of subsurface formations to determine production potential, locate resources and detect cement and casing integrity issues. WFRD also execute well intervention and remediation operations by conveying equipment via cable into existing wells.

Drilling Fluids provides fluids and chemicals essential to the drilling process.

Well Construction and Completions (“WCC”) offers products and services for well integrity assurance across the full life cycle of the well. The primary offerings are tubular running services, cementation products, completions, liner hangers and well services. WCC deploys conventional to advanced technologies, providing safe and efficient services in any environment during the well construction phase.

Tubular Running Services provides equipment, tubular handling, tubular management and tubular connection services for the drilling, completions and work over of various types of wells. It includes conventional rig services, automated rig systems, real-time torque-monitoring and remote viewing of the makeup and breakout verification process.

Cementation Products enable operators to centralize the casing throughout the wellbore and control the displacement of cement and other fluids for proper zonal isolation. Specialized equipment includes plugs, float and stage equipment and torque-and-drag reduction technology. WFRD’s cementation engineers analyze customer requirements and provide software enabled design input from pre-job planning to installation.

Completions offer customers a comprehensive line of completion tools, such as safety valves, production packers, down hole reservoir monitoring, flow control, isolation packers, multistage fracturing systems and sand-control technologies that set the stage for maximum production with minimal cost per barrel.

Liner Hangers suspend a casing string within a previous casing string thereby eliminating the need to run casing to the surface. The company offer a comprehensive liner-hanger portfolio, along with engineering and execution experience, for a wide range of applications that include high-temperature and high-pressure wells.

Well Services provides through tubing products and services which ensure consistent delivery of well solutions that extend the economic life of its customer’s assets.

Production and Intervention (“PRI”) offers production optimization technologies through the Company’s ability to design and deliver a complete production ecosystem ranging from boosting productivity to responsible abandonment for customers. The primary offerings are intervention services &drilling tools, artificial lift, digital solutions (previously production automation & software), sub-sea intervention and pressure pumping services in select markets. PRI utilizes a suite of reservoir stimulation designs, and engineering capabilities that isolate zones and unlock reserves in conventional and unconventional wells, deep water, and aging reservoirs.

Intervention Services & Drilling Tools provides re-entry, fishing and well abandonment services as well as patented bottom hole, tubular-handling equipment, pressure-control equipment and drill pipe and collars for various types of wells.

Artificial Lift provides pressure enabling methods to produce reservoir fluids from wells lacking sufficient reservoir pressure for natural flow. WFRD provides most forms of lift, including reciprocating rod lift systems, progressing cavity pumping, gas-lift systems, hydraulic-lift systems, plunger-lift systems and hybrid lift systems for special applications. It also offer related automation and control systems.

Digital Solutions (previously Production Automation & Software) provides software, automation and flow measurement solutions. For its customers’ drilling operations, the solutions deliver data aggregation, engineering, and optimization including performance analytics in real-time. For customers’ production operations, the solutions provide flow measurement, surveillance and control to deliver production optimization by integrating workflows and data for the well, surface facilities and the reservoir.

Sub-Sea Intervention provides electrical and hydraulic power transmission to subsea equipment in order to facilitate work overs in deep and ultra-deep water operations in select markets.

Pressure Pumping Services offers advanced chemistry-based solutions and associated pumping services for safe and effective production enhancements. In select international markets, WFRD provide pressure pumping and reservoir stimulation services, including acidizing, fracturing, cementing and coiled-tubing intervention.

Revenue: Revenues totaled $4.3 billion in 2022. The breakdown by segment revenues is as follows:

DRE revenues of $1.3 billion in 2022 increased 25% compared to 2021 due to higher demand and activity across all DRE product lines, and led primarily by managed pressure drilling and drilling services. Improvement in DRE was across all regions, and led primarily by the Latin America, North America and Middle East North Africa/Asia regions.

WCC revenues of $1.5 billion in 2022 increased 12% compared to 2021 due to higher demand and activity across all WCC product lines, and led primarily by cementation products. Improvement in WCC was across all regions and led primarily by the Middle East North Africa/Asia, Latin America and North America regions.

PRI revenues of $1.4 billion in 2022 increased 24% compared to 2021 due to higher demand and activity across all PRI product lines, and led primarily by artificial lift and pressure pumping. Improvement in PRI was across all regions.

Company History

1940–1989: Early Rise and Oil Bust Survival

Weatherford International's origins can be traced back to the 1940s when Jesse E. Hall Sr. founded the Weatherford Spring Company in Weatherford, Texas. Initially focused on providing oil drilling equipment and services, the company rapidly expanded its offerings and gained a global reputation for its casing cleaning and directional-drilling control services.

However, the 1980s brought challenging times as the oil industry faced a significant downturn. Weatherford, under the leadership of Eugene L. Butler, implemented strategic measures to survive the economic pressures. The company emphasized downsizing, quality services, and targeted specialization, enabling it to weather the storm amidst widespread industry setbacks.

1990–2000: Acquisitions and Mergers

At the dawn of the 1990s, Energy Ventures, Weatherford, and Enterra were three distinct entities, each growing through vertical integration and expansion. Energy Ventures (EV) had a history rooted in offshore oil and gas exploration. In 1981, it partnered with Northwest Energy to develop an oil field in Texas. Despite facing setbacks during the mid-1980s oil crisis, EV reemerged in 1987, embarking on an aggressive vertical integration strategy. Over the next 12 years, EV executed over 40 acquisitions, including Grant Oil Country Tubular and Prideco, solidifying its position in the drill pipe and tubulars market. In 1997, EV established a manufacturing plant in Canada and rebranded as EVI.

Enterra, a diversified energy service and manufacturing business, expanded globally and became a leader in technological research and development. In 1995, Weatherford, under the leadership of Phillip Burguieres, initiated a series of acquisitions, culminating in a significant merger in 1995. Weatherford and Enterra joined forces, creating Weatherford Enterra Inc., in the oil field services sector. The merger, approved by the Justice Department, formed a tax-free pooling of interests, resulting in the birth of a new entity that quickly became a key player in the industry. This consolidation of expertise and resources propelled the company to new heights, enabling it to offer a comprehensive range of products and services for the oil and gas industry.

2000s and Beyond: Adapting to Industry Dynamics

In the early 2000s, Weatherford International continued its growth trajectory, expanding its global footprint and diversifying its service offerings. The company made strategic acquisitions, enhancing its capabilities in drilling services, completion, production, and evaluation products. Weatherford's commitment to innovation led to the development of cutting-edge technologies, including directional drilling services that could navigate miles of bedrock with precision and tubular running services crucial for deep-water drilling projects.

2005 and Onwards: Strengthening Capabilities and Addressing Challenges

In 2005, Weatherford acquired Precision Drilling Corporation’s Precision Energy Services and International Contract Drilling divisions, further bolstering its position in the market. However, the company faced challenges, including scrutiny of its foreign subsidiary operations. To address these issues, Weatherford withdrew from activities in Sudan and refocused its efforts on compliance and ethical business practices.

Financial Restructuring and Resilience: 2019–2021

The company's journey was not without hurdles. In 2019, Weatherford International faced financial challenges, leading to a Chapter 11 bankruptcy filing in the Southern District of Texas. Despite these difficulties, Weatherford demonstrated resilience and determination. By December 2019, the company successfully completed its financial restructuring, reducing significant debt and securing substantial financing facilities. This strategic move provided Weatherford with a stronger financial foundation and enhanced liquidity.

Leadership Changes and Relisting: 2020–2021

In the midst of these transformations, Weatherford International underwent changes in leadership. In June 2020, the company announced several shifts in its executive team, including the resignation of CEO Mark A. McCollum and CFO Christian Garcia. Weatherford appointed Karl Blanchard as interim CEO and later announced Girish K. Saligram as the company's President and CEO in October 2020. Under Saligram's leadership, Weatherford embarked on a new chapter, marked by strategic initiatives and forward-looking vision.

In June 2021, Weatherford International achieved a significant milestone when Nasdaq approved the relisting of its ordinary shares under the ticker symbol "WFRD." This development underscored the company's stability and reaffirmed investor confidence in its future prospects.

References

- ^ https://www.marketscreener.com/quote/stock/WEATHERFORD-INTERNATIONAL-120797776/news/Weatherford-International-1Q-2023-Earnings-Presentation-43636850/

- ^ https://www.rogtecmagazine.com/weatherford-announces-second-quarter-2023-results-and-raises-full-year-outlook/

- ^ https://www.bloomberg.com/press-releases/2023-07-25/weatherford-announces-second-quarter-2023-results-and-raises-full-year-outlook

- ^ https://www.eavor.com/press-releases/2/

- ^ https://www.weatherford.com/investor-relations/investor-news-and-events/news/news-article/?ItemID=16351