Wells Fargo & Co.

Summary

- Wells Fargo & Co. is a diversified financial services company.

- It is one of the largest banks in the United States, with over $1.9 trillion in assets as of 2022.

- It serves one in three U.S. households and more than 10% of small businesses in the U.S.

Wells Fargo & Co. (NYSE: WFC) is a diversified financial services company. It is one of the largest banks in the United States, with over $1.9 trillion in assets as of 2022. The company provides a wide range of financial products and services to individuals, businesses, and institutions. It serves one in three U.S. households and more than 10% of small businesses in the U.S., and is a leading middle market banking provider in the U.S. The company provide a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance.

Recent Developments

Wells Fargo Sells Private Equity Fund Investments1

09/29/2023; Wells Fargo & Company announced that it has sold to a group of leading investors approximately $2 billion of private equity investments in certain Norwest Equity Partners (NEP) and Norwest Mezzanine Partners (NMP) funds. Wells Fargo was previously the sole institutional limited partner in these funds. The buyer group for Wells Fargo’s positions included AlpInvest Partners (a subsidiary of Carlyle), Atalaya Capital Management, Lexington Partners, and Pantheon.

Lazard Ltd served as financial advisor to Wells Fargo in connection with the transaction. Separately, Wells Fargo will continue its relationship and investments with Norwest Venture Partners, a venture capital and growth equity investment firm.

In 2022, the company generated $13.2 billion of net income and diluted earnings per common share (EPS) of $3.14, compared with $21.5 billion of net income and diluted EPS of $4.95 in 2021.

Financial Highlights

Third Quarter 2023 Results2

Wells Fargo third quarter results were solid with net income of $5.8 billion and revenue of $20.9 billion. The company's revenue growth from a year ago included both higher net interest income and noninterest income as the company benefited from higher rates and the investments Wells Fargo is making in its businesses. Expenses declined from a year ago due to lower operating losses. While the economy has continued to be resilient, Wells Fargo is seeing the impact of the slowing economy with loan balances declining and charge-offs continuing to deteriorate modestly.

Company Overview

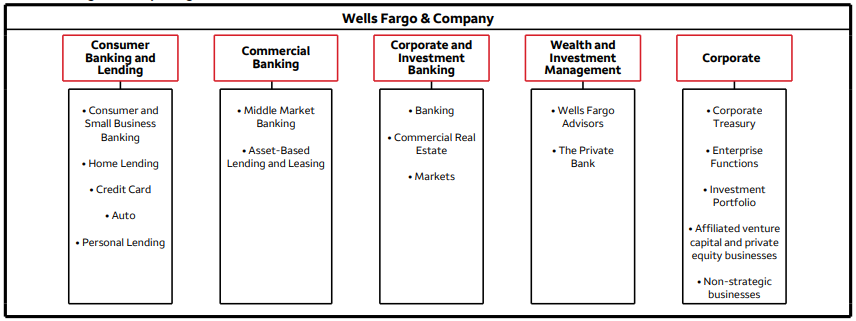

Wells Fargo & Company is a leading financial services company that has approximately $1.9 trillion in assets, proudly serves one in three U.S. households and more than 10% of small businesses in the U.S., and is a leading middle market banking provider i n the U.S. The company provide a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through its four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.3

Company History

Wells Fargo & Co. was founded in 1852 by Henry Wells and William G. Fargo to provide banking and express services to California, which was growing rapidly due to the California Gold Rush. Wells Fargo quickly became one of the most successful and well-known companies in the United States, playing a vital role in the development of the American West.4

Wells Fargo's stagecoaches and Pony Express riders were familiar sights on the frontier, transporting gold, mail, and other valuables. The company also played a major role in the Civil War, transporting gold and other valuables for the Union government.

After the war, Wells Fargo expanded its operations to include railroads, insurance, and investment banking. In the 20th century, Wells Fargo continued to grow and diversify, acquiring a number of other banks and financial institutions, and expanding its global presence. Today, Wells Fargo is one of the largest banks in the United States, with over 7,000 branches in 35 states.

References

- ^ https://newsroom.wf.com/English/news-releases/news-release-details/2023/Wells-Fargo-Sells-Private-Equity-Fund-Investments/default.aspx

- ^ https://www08.wellsfargomedia.com/assets/pdf/about/investor-relations/earnings/third-quarter-2023-earnings.pdf

- ^ https://fintel.io/doc/sec-wells-fargo-company-mn-72971-10k-2023-february-21-19410-9962

- ^ https://www.wellsfargohistory.com/timeline-of-innovation/