Barclays

Summary

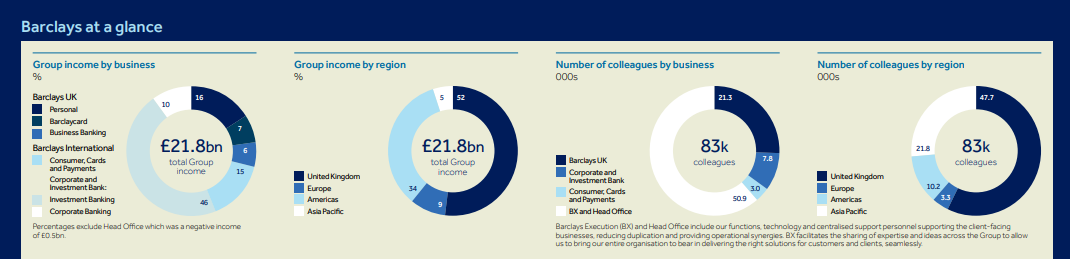

- Barclays operates as two divisions, Barclays UK and Barclays International, supported by service company, Barclays Execution Services.

- Barclays UK (BUK) consists of UK Personal Banking, UK Business Banking and Barclaycard Consumer UK businesses.

- Barclays International (BI) consists of Corporate and Investment Bank and Consumer, Cards and Payments businesses.

Company Overview

Barclays (NYSE:BCS, LSE:BARC) traces its ancestry back to two goldsmith bankers, John Freame and Thomas Gould, who were doing business in Lombard Street, London in 1690. In 1736, Freame’s son, Joseph took his brother-in-law, James Barclay on as a partner, and the name has remained a constant presence in the business ever since.

Barclays was built over centuries. The company's longevity is an extraordinary achievement, especially against the backdrop of multiple financial crises, international conflicts, and the agricultural, industrial and now technological revolutions.1

This story is best told through its rich archive of photographs, ledgers, letters, minute books, equipment and a range of, in some cases unexpected, curiosities housed in the Barclays Group Archives in Manchester, UK. The material in these archives is unique, irreplaceable and priceless. They don’t just tell the story of Barclays’ businesses around the world, they also communicate the strength and depth of the Values that have underpinned Barclays from the very beginning.

And it’s not just the story of a bank – it is the story of the communities that the company serve, as well as its colleagues, its buildings, and its products. The archives allow it to share those stories.

Business Overview

Barclays operates as two divisions, Barclays UK and Barclays International, supported by its service company, Barclays Execution Services.2

Barclays UK

Barclays UK (BUK) consists of its UK Personal Banking, UK Business Banking and Barclaycard Consumer UK businesses. These businesses are carried on by its UK ring-fenced bank (Barclays Bank UK PLC) and certain other entities within the Group.

UK Personal Banking offers retail solutions to help customers with their day-to-day banking needs. UK Business Banking serves business clients, from high growth start-ups to SMEs, with specialist advice for their business banking needs. Barclaycard Consumer UK is a leading credit card provider, offering flexible borrowing and payment solutions, while delivering a leading customer experience.

Barclays International

Barclays International (BI) consists of its Corporate and Investment Bank and Consumer, Cards and Payments businesses. These businesses are carried on by its non-ring-fenced bank (Barclays Bank PLC) and its subsidiaries, as well as by certain other entities within the Group.

With relentless focus on delivering for customers and clients around the world, Barclays International’s diversified business portfolio provides balance, resilience and exciting growth opportunities. The division has strong global market positions and continues to invest in people and technology in order to deliver sustainable improved returns. Barclays International offers customers and clients a range of products and services spanning consumer and wholesale banking.

Barclays Execution Services

Barclays Execution Services (BX) is the Group-wide service company providing technology, operations and functional services to businesses across the Group.

Financial Highlights

Barclays PLC Q3 2021 Results

The Group’s diversified business model delivered a record Group profit before tax of £6.9bn (Q320 YTD: £2.4bn), a return on tangible equity (RoTE) of 14.9% (Q320 YTD: 3.6%) and earnings per share (EPS) of 30.8p (Q320 YTD: 7.6p) 3

James E Staley, Chief Executive Officer, commented

“On top of a good first half, a strong third quarter performance means Barclays has delivered its highest Q3 YTD pre-tax profit on record in 2021, demonstrating the benefits of its diversified business model. The company continue to support its customers and clients through the COVID-19 pandemic, have achieved a double-digit RoTE in every quarter year to date, and expect to deliver a full year RoTE above 10%. While the CIB performance continues to be an area of strength for the Group, Barclays is also seeing evidence of a consumer recovery and the early signs of a more favourable rate environment. Against that backdrop, Barclays is focused on balancing cost efficiencies with further investment into high-returning growth opportunities. The company's CET1 ratio of 15.4% means Barclays is also in a strong position to balance this growth with a key priority of returning excess capital to shareholders.”

Highlight

- The Group’s diversified business model enabled Barclays to deliver a record profit before tax of £6,940m (Q320 YTD: £2,419m), RoTE of 14.9% (Q320 YTD: 3.6%) and EPS of 30.8p (Q320 YTD: 7.6p)

- Total income was stable at £16,780m (Q320 YTD: £16,825m). Barclays UK income increased 2%. Barclays International income decreased 2%, with CIB income down 1% and Consumer, Cards and Payments (CC&P) income down 6%. Excluding the impact of the 9% depreciation of average USD against GBP, total income was up, reflecting the Group’s diversified income streams

- Credit impairment net release of £622m (Q320 YTD: £4,346m charge). The net release included a reversal of £1.1bn in nondefault charges, primarily reflecting the improved macroeconomic outlook. Excluding this reversal, the charge was £0.5bn, reflecting reduced unsecured lending balances and low delinquency. Management judgements have been maintained in the quarter in respect of customers and clients considered to be potentially more vulnerable as government and other support schemes have started to reduce. The reduction in unsecured lending balances and growth in secured balances have contributed to a decrease in the Group’s loan coverage ratio to 1.7% (December 2020: 2.4%). Loan coverage ratios in unsecured and wholesale loan portfolios remained elevated compared to pre-COVID-19 pandemic levels

- Total operating expenses increased 6% to £10,709m, due to structural cost actions of £392m primarily relating to the real estate review in Q221, higher performance costs that reflect improved returns, and continued investment and business growth, partially offset by the benefit from the depreciation of average USD against GBP and efficiency savings. This resulted in a cost: income ratio of 64% (Q320 YTD: 60%)

- The effective tax rate was 15.5% (Q320 YTD: 18.2%). This reflects a £402m tax benefit recognised for the re-measurement of the Group’s UK deferred tax assets (DTAs) as a result of the UK corporation tax rate increase from 19% to 25% effective from 1 April 2023. The UK Government is reviewing the additional 8% surcharge tax that applies to banks’ profits and if the conclusion of that review is that the surcharge is reduced then the Group’s UK DTAs would be re-measured again and decreased, the exact timing of an enactment of a reduction in the surcharge is uncertain but would be expected to occur in H122

- Attributable profit was £5,258m (Q320 YTD: £1,306m)

- Following the completion of the £700m share buyback announced with FY20 results and the ongoing £500m share buyback announced with H121 results, the period end number of shares was 16,851m (December 2020: 17,359m)

- Total assets increased to £1,407bn (December 2020: £1,350bn) primarily due to a £37bn increase in cash at central banks, a £29bn increase in financial assets at fair value due to an increase in secured lending, a £18bn increase in cash collateral and settlement balances and a £17bn increase in trading portfolio assets due to increased activity, partially offset by a £44bn decrease in derivative assets driven by an increase in major interest rate curves

- Deposits at amortised cost increased £29bn to £510bn further strengthening the Group’s liquidity position and contributing to a loan: deposit ratio of 69% (December 2020: 71%)

- Tangible net asset value (TNAV) per share increased to 287p (December 2020: 269p) primarily reflecting 30.8p of EPS, partially offset by negative reserve movements

Barclays UK

Profit before tax increased to £1,957m (Q320 YTD: £264m). RoTE was 17.9% (Q320 YTD: 2.2%) reflecting materially lower credit impairment charges.

Total income increased 2% to £4,837m. Net interest income reduced 1% to £3,889m with a net interest margin (NIM) of 2.53% (Q320 YTD: 2.63%) as strong customer retention and improved margins in mortgages was more than offset by lower unsecured lending balances. Net fee, commission and other income increased 18% to £948m, returning back towards preCOVID-19 pandemic levels.

Credit impairment net release of £306m (Q320 YTD: £1,297m charge) driven by an improved macroeconomic outlook and lower unsecured lending balances due to customer repayments and lower delinquencies. As at 30 September 2021, 30 and 90 day arrears rates in UK cards were 1.0% (Q320: 1.7%) and 0.3% (Q320: 0.8%) respectively

Total operating expenses were stable at £3,187m (Q320 YTD: £3,172m) reflecting investment spend and higher operational and customer service costs primarily driven by increased volumes, offset by efficiency savings

Loans and advances to customers at amortised cost increased 2% to £208.6bn predominantly from £9.2bn of mortgage growth following a strong flow of new applications as well as strong customer retention, offset by a £2.3bn decrease in the Education, Social Housing and Local Authority (ESHLA) portfolio carrying value as interest rate yield curves have steepened, £1.7bn lower unsecured lending balances and £0.5bn lower Business Banking balances as repayment of government scheme lending takes effect

Customer deposits at amortised cost increased 7% to £256.8bn reflecting an increase of £13.6bn and £2.8bn in Personal Banking and Business Banking respectively, further strengthening the liquidity position and contributing to a loan: deposit ratio of 86% (December 2020: 89%)

RWAs decreased to £73.2bn (December 2020: £73.7bn) as growth in mortgages was more than offset by a reduction in unsecured lending and the ESHLA portfolio

Barclays International

Profit before tax increased 97% to £5,500m with a RoTE of 16.4% (Q320 YTD: 7.5%), reflecting a RoTE of 16.4% (Q320 YTD: 10.5%) in CIB and 16.2% (Q320 YTD: (10.6)%) in CC&P.

The 9% depreciation of average USD against GBP adversely impacted income and profits and positively impacted total operating expenses.

Total assets increased to £1,076bn (December 2020: £1,042bn) primarily due to a £30bn increase in financial assets at fair value, due to an increase in secured lending, a £18bn increase in cash collateral and settlements balances, and a £17bn increase in trading portfolio assets, due to increased activity, partially offset by a £45bn decrease in derivative assets driven by an increase in major interest rate curves

RWAs increased to £222.7bn (December 2020: £222.3bn)

Group capital and leverage

The CET1 ratio increased to 15.4% (December 2020: 15.1%)

The average UK leverage ratio decreased to 4.9% (December 2020: 5.0%). The average leverage exposure increased by £52.9bn to £1,199.8bn (December 2020: £1,146.9bn) largely driven by an increase in securities financing transactions (SFTs), potential future exposure (PFE) on derivatives and trading portfolio assets (TPAs)

The liquidity pool was £293bn (December 2020: £266bn) and the liquidity coverage ratio remained significantly above the 100% regulatory requirement at 161% (December 2020: 162%), equivalent to a surplus of £107bn (December 2020: £99bn). The increase in the pool is driven by deposit growth, borrowing from the Bank of England’s Term Funding Scheme with additional incentives for SMEs and a seasonal increase in short-term wholesale funding, which were partly offset by an increase in business funding consumption

Wholesale funding outstanding, excluding repurchase agreements, was £165.2bn (December 2020: £145.0bn). The Group issued £8.2bn equivalent of minimum requirement for own funds and eligible liabilities (MREL) instruments from Barclays PLC (the Parent company) during the year. The Group is well advanced in its MREL issuance plans relative to the estimated 1 January 2022 requirement

References

- ^ https://home.barclays/who-we-are/our-history/

- ^ https://home.barclays/content/dam/home-barclays/documents/investor-relations/reports-and-events/annual-reports/2020/Barclays-PLC-Annual-Report-2020.pdf

- ^ https://home.barclays/content/dam/home-barclays/documents/investor-relations/ResultAnnouncements/Q32021Results/20211021-BPLC-Q3-2021-RA.pdf