Pan American Silver

Summary

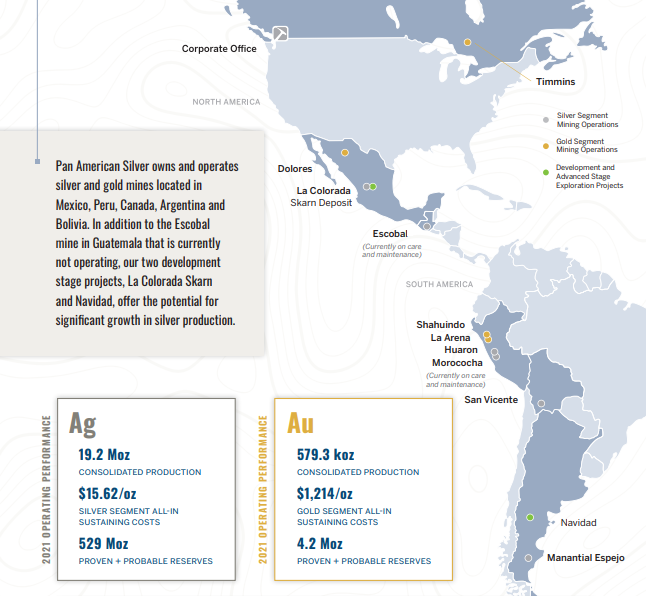

- Pan American Silver own and operate silver and gold mines located throughout the Americas.

- Pan American engages in silver and gold mining and related activities, including exploration, mine development, extraction, processing, refining and reclamation.

- The company's 2021 production for silver was 19.2 million ounces and gold 579.3 thousand ounces.

Pan American Silver (Nasdaq: PASS, TSX: PASS, OTC: PAASF) own and operate silver and gold mines located throughout the Americas.

Recent Developments

Pan American Silver Reports Large Increase to the Mineral Resource Estimate for its La Colorada Skarn Deposit1

September 14, 2022; Pan American Silver announced an updated mineral resource estimate for its 100% owned La Colorada Skarn deposit in Zacatecas, Mexico. The estimated indicated mineral resource totals 95.9 million tonnes containing 94.4 million ounces of silver, 2.7 million tonnes of zinc and 1.2 million tonnes of lead. In addition, the estimated inferred mineral resource now totals 147.8 million tonnes containing 132.9 million ounces of silver, 3.4 million tonnes of zinc and 1.5 million tonnes of lead. The updated mineral resource estimate is a significant increase relative to its previous mineral resource estimate released on August 4, 2020.

The mineral resource estimate is based on a US$45 per tonne unit cut-off value and an underground sub-level cave (SLC) mining method followed by processing through a selective flotation beneficiation plant that generates zinc and lead concentrates.

Financial Highlights

Q2 2022 results

August 10, 2022; Pan American Silver reports reported unaudited results for the quarter ended June 30, 20222

Consolidated Q2 2022 Highlights:

- Silver production of 4.5 million ounces and gold production of 128.3 thousand ounces.

- Revenue was $340.5 million, inclusive of a negative $9.3 million adjustment on open concentrate shipments, largely related to the decline in metal prices towards the end of Q2 2022. Revenue in Q2 2022 excluded inventory build-ups of 34.2 thousand ounces of silver and 8.5 thousand ounces of gold.

- Net loss of $173.6 million ($0.83 basic loss per share), impacted by a pre-tax impairment charge of $99.1 million recorded for Dolores and $62.8 million in net realizable value (NRV) inventory adjustments, primarily at Dolores.

- Adjusted loss of $6.5 million ($0.03 basic adjusted loss per share) excludes the impact from the Dolores impairment and the heap inventory write-down.

- Operations generated $20.8 million of cash flow, net of $42.4 million in tax payments and a $19.5 million build-up in working capital.

- Silver Segment Cash Costs and All-in Sustaining Costs ("AISC") per silver ounce were $12.10 and $17.30, respectively. Excluding NRV inventory adjustments, Silver Segment AISC was $15.90 per ounce.

- Gold Segment Cash Costs and AISC per gold ounce were $1,132 and $2,051, respectively. Excluding NRV inventory adjustments, Gold Segment AISC was $1,540 per ounce.

- As at June 30, 2022, Pan American had working capital of $513.9 million, inclusive of cash and short-term investment balances of $241.3 million; a long-term investment in Maverix Metals Inc. ("Maverix") with a fair value of $112.5 million; and $500.0 million available under its sustainability-linked credit facility. Total debt of $63.2 million was related to lease liabilities and construction loans.

- A cash dividend of $0.11 per common share has been declared, payable on or about September 2, 2022, to holders of record of Pan American’s common shares as of the close on August 22, 2022. Aligned with the Company’s dividend policy, the dividend is comprised of a base dividend of $0.10 per common share and a variable dividend component of $0.01 per common share. The dividends are eligible dividends for Canadian income tax purposes.

Business Overview

Pan American engages in silver and gold mining and related activities, including exploration, mine development, extraction, processing, refining and reclamation. The Company owns and operates silver and gold mines located in Peru, Mexico, Argentina, Bolivia, and Canada. The company also own the Escobal mine in Guatemala that is currently not operating. In addition, the Company is exploring for new silver deposits and opportunities throughout the Americas.

Silver production of 19.2 million ounces- Consolidated 2021 silver production of 19.2 million ounces was 1.9 million ounces more than the company produced in 2020, due to the impact of the coronavirus disease (COVID-19) related mine suspensions in 2020.

Gold production of 579.3 thousand ounces - Consolidated 2021 gold production of 579.3 thousand ounces was 56.8 thousand ounces more than the company produced in 2020. This is largely the result of higher gold production at Dolores from mine sequencing in 2021, and the impact in 2020 of the COVID-19 related mine suspensions.

Operations

Pan American Silver has a diversified portfolio of mining and exploration assets located throughout the Americas.3

| Project | Location | Type of Project | Products | Ownership | Type of Mine |

| Timmins | Ontario, Canada | Producing Mine | Gold | 100% | Underground |

| La Colorada Skarn | Zacatecas, Mexico | Advanced Exploration Project | Silver | 100% | Underground |

| Escobal | Santa Rosa, Guatemala | On Care and Maintenance | Silver, Gold, Lead, Zinc | 100% | Underground |

| La Arena | La Libertad, Peru | Producing Mine | Gold | 100% | Open-pit |

| Huaron | Pasco, Peru | Producing Mine | Silver, Zinc, Copper, Lead | 100% | Underground |

| San Vicente | Potosí, Bolivia | Producing Mine | Silver, Zinc, Copper, Lead | 95% | Underground |

| Navidad | Chubut, Argentina | On Care and Maintenance | Silver | 100% | Open-pit |

| La Colorada | Zacatecas, Mexico | Producing Mine | Silver, Lead, Zinc | 100% | Underground |

| Dolores | Chihuahua, Mexico | Producing Mine | Gold, Silver | 100% | Open-pit |

| Shahuindo | Cajamarca, Peru | Producing Mine | Gold | 100% | Open-pit |

| La Arena II | La Libertad, PeruLa Libertad, Peru | Advanced Exploration Project | Copper, Gold | 100% | Open-pit |

| Morococha | Yauli, Peru | On Care and Maintenance | Copper, Lead, Silver, Zinc | 92.30% | Underground |

| Manantial Espejo | Santa Cruz, Argentina | Producing Mine | Gold, Silver | 100% | Underground |

Company History

| Year | Detail |

| 2021 | Amended and extended $500 million corporate credit facility into a sustainability-linked revolving credit facility, aligning ESG performance to cost of capital. The ILO 169 consultation process for the Escobal mine in Guatemala commenced, led by Guatemala’s Ministry of Energy and Mines. |

| 2020 | Managed the impact of the COVID-19 pandemic and related government restrictions, which required the temporary transition of most of mines to care and maintenance. Fully repaid amounts drawn on corporate credit facility. Doubled the quarterly dividend. Reported an inferred mineral resource estimate for the La Colorada skarn discovery. Became a signatory to the United Nations Global Compact. |

| 2019 | Completed the acquisition of Tahoe Resources Inc., adding the Shahuindo, La Arena, Timmins West and Bell Creek mines to the portfolio, as well as the Escobal mine (currently suspended). |

| 2018 | Made a major exploration discovery at the La Colorada mine. Announced the proposed acquisition of Tahoe Resources Inc. Substantially completed active reclamation at the Alamo Dorado site. |

| 2017 | Completed the acquisition of the Joaquin and COSE projects in Santa Cruz, Argentina. Completed the La Colorada and Dolores mine expansion projects. Acquired an interest in New Pacific Metals Corp., providing exposure to the Silver Sand project in Bolivia. Concluded mining at Alamo Dorado and transitioned the mine into the reclamation phase. |

| 2015 | Approved the expansion of the Dolores mine. |

| 2012 | Acquired Minefinders Corporation Ltd. and its flagship Dolores mine in Mexico. Divested the Quiruvilca mine. |

| 2010 | Completed the acquisition of Aquiline Resources. Began paying a cash dividend. |

| 2009 | Launched a friendly offer to acquire Aquiline Resources Inc. and its Navidad project in Argentina. Published Pan American’s first Sustainability Report. |

| 2008 | Commenced production at Manantial Espejo. Substantially completed expansion of San Vicente mine. |

| 2007 | Increased interest in San Vicente to 95% and commenced mine expansion. Advanced Manantial Espejo’s construction. |

| 2006 | Completed construction of Alamo Dorado and increased ownership of Manantial Espejo to 100%. |

| 2004 | Acquired the Morococha mine in Peru. |

| 2003 | Acquired the Alamo Dorado project in Mexico. |

| 2002 | Acquired a 50% interest in the Manantial Espejo project in Argentina. |

| 2000 | Acquired the Huaron mine in Peru. |

| 1999 | Entered into a joint venture agreement with Bolivian state mining company, COMIBOL, in connection with the San Vicente mine in Bolivia. |

| 1998 | Acquired the La Colorada mine in Mexico. |

| 1995 | Acquired first producing mine, Quiruvilca, in Peru and listed on Nasdaq. |

| 1994 | Ross Beaty founded the company, taking over Pan American Minerals Corp., a TSX listed company. |